Did you know that over 52 million Americans have bad credit? This problem can close the doors to obtaining a loan, be it a small personal loan or a mortgage loan for buying your dream home, and even your career as many employers will use your credit score to evaluate your eligibility.

If you’ve experienced these problems, then it’s to solve them with the best apps for credit repair. They will help you to know the real status of your credit, identify and dispute negative and inaccurate items, and detect identity theft to boost your creditworthiness.

Come with us to check the ranking to start fixing and rebuilding your credit now.

The 5 Best Apps for Credit Repair in 2024: Download Now for Fixing Your Credit Score

Let’s make 2023 an amazing year for your credit score, just click on the name of your favorite credit repair app to start using it:

- Credit Score IQ: Best Overall Credit Repair App

- CreditFirm.net: Most Affordable Credit Repair App

- Credit Nerd: Best for Repairing Extremely Bad Credit

- Credit Score Hero: Best 7-Day Trial

- Identity IQ: Best for Identity Theft

Simply choose your favorite option from our ranking to start fixing and rebuilding your credit. Because the difference between having bad credit and an excellent credit score is just one click away - take action now to boost your creditworthiness in 2023.

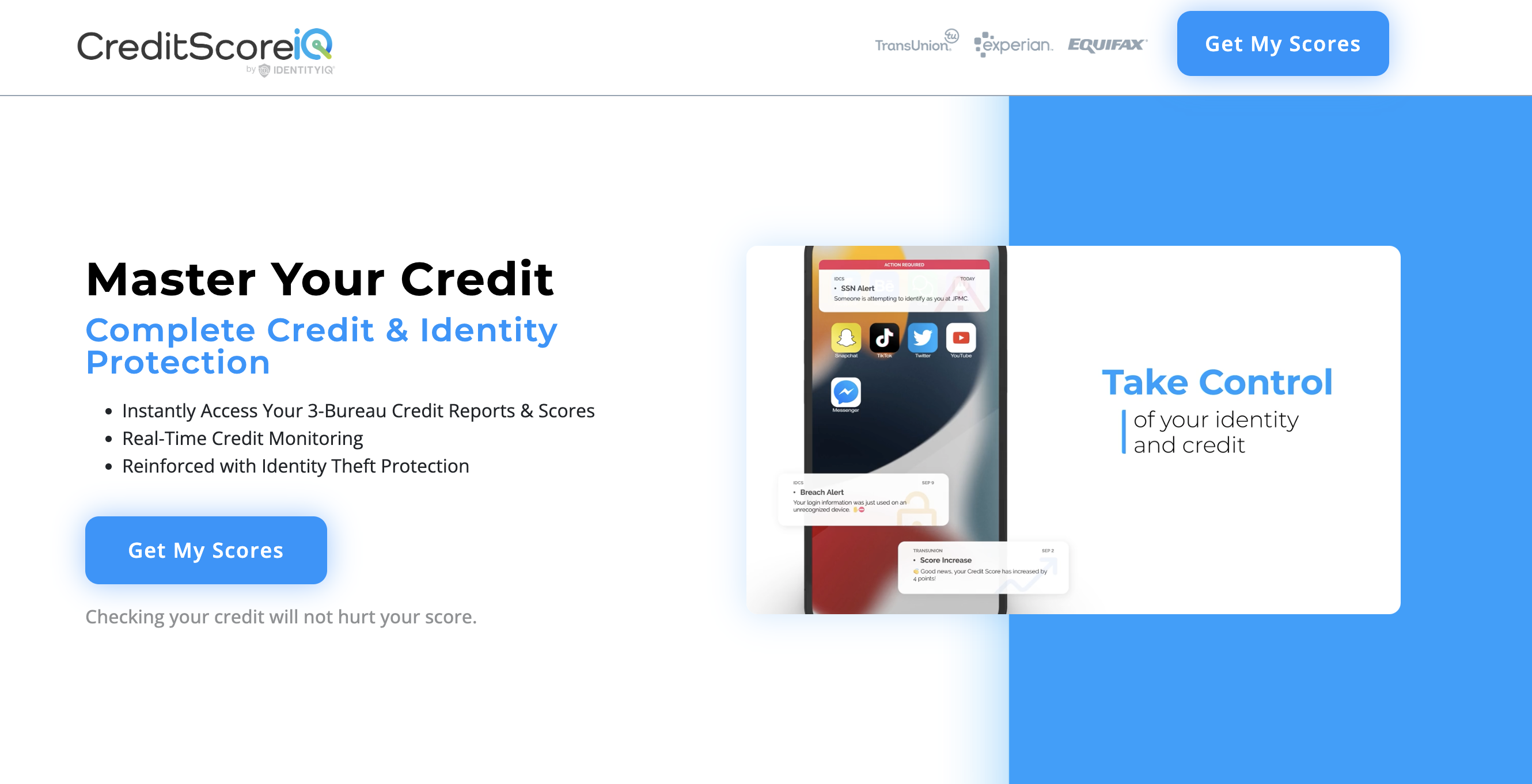

1. Credit Score IQ: Best Overall Credit Repair App

|

Pros |

Cons |

|

Top rated credit repair app |

Not available in all US states |

|

Affordable pricing |

|

|

Highest success rate even for extremely bad credit |

|

|

Identity theft solutions |

|

|

Accurate credit report analysis |

|

|

Fast results |

What does it offer?

- Highly Successful Credit Report Disputes: This credit repair app has the most successful team when it comes to detecting and disputing negative or inaccurate claims on your credit report

- Accurate Credit Monitoring: They will actively monitor your credit to spot any change and alert you so you can take prompt action

- Identity Theft Solutions: They will monitor all the available sources to identify cases of identity theft or crimes committed in your name, and that includes monitoring the Dark Web

Credit Score IQ is our #1 credit repair app because it delivers all the solutions you will ever need to repair your credit, even if it’s extremely bad. All without breaking the bank. Because they believe in offering effective credit repair solutions at a fair cost - thanks to their specialized team of credit repair specialists that will actively work on your case.

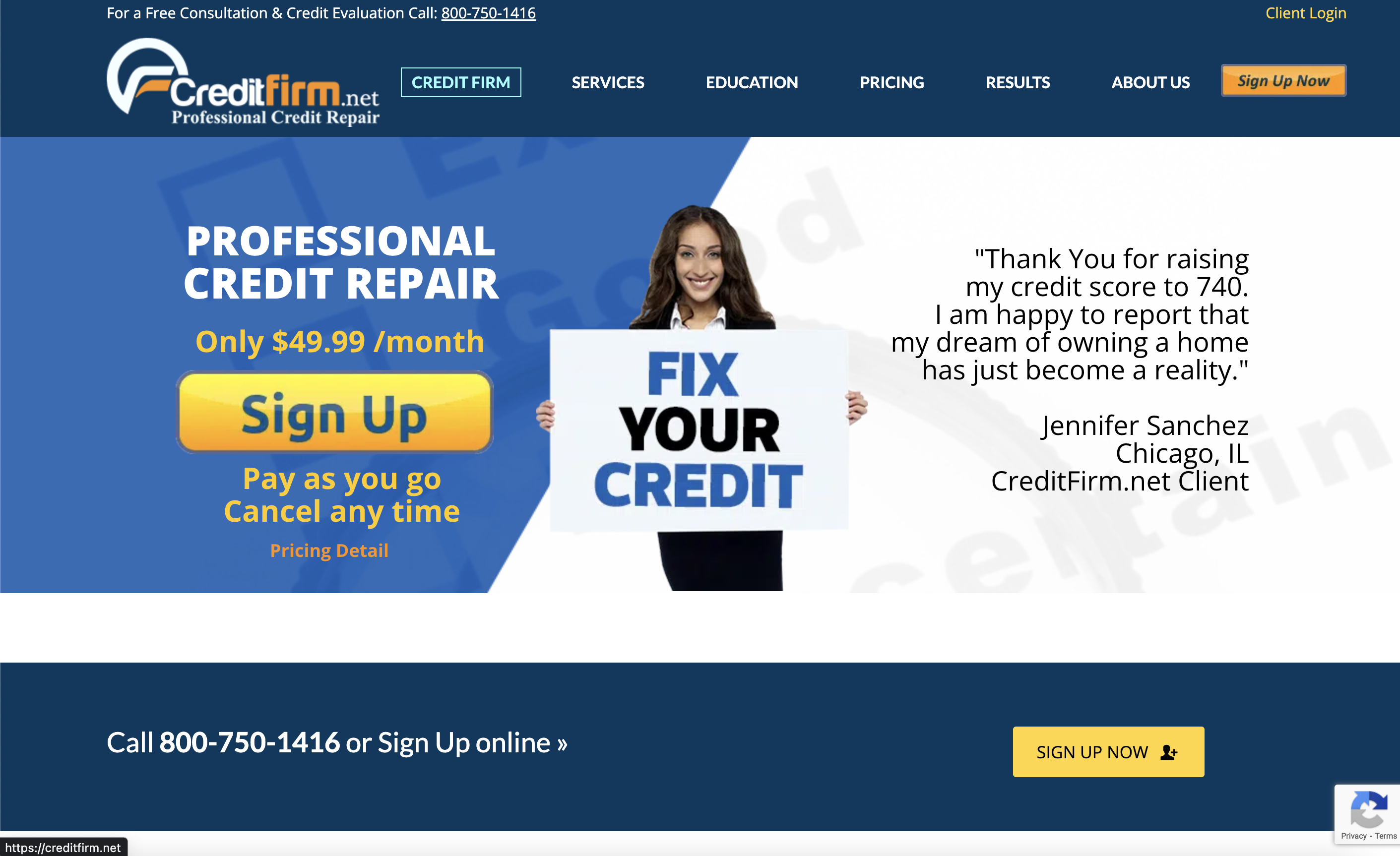

2. CreditFirm.net: Most Affordable Credit Repair App

|

Pros |

Cons |

|

Most affordable pricing in the market |

No identity theft solutions |

|

Unlimited disputes of negative or inaccurate items |

|

|

Advanced credit report analysis |

|

|

Credit monitoring |

|

|

High success rate |

What does it offer?

- Advanced Credit Report Analysis: They will request your credit reports from the main credit bureaus to start analyzing it, in order to discover all the items they can remove

- Successful and Unlimited Disputes: This app stands out from the rest because it will bring you unlimited disputes presented by their team of specialists on credit repair with 20+ years of experience, once again at the lowest price in the market

- Debt Validation: They also offer debt validation solutions to smartly remove negative items from your credit report, which is surprising provided the competitive pricing that this credit repair app charges

CreditFirm.net offers a complete pack of credit-boosting solutions at the lowest price in the market in 2023. Therefore, if you want to fix your credit without breaking the bank, then this credit repair app will deliver exactly what you need.

3. Credit Nerd: Best for Repairing Extremely Bad Credit

|

Pros |

Cons |

|

Highest success rate for extremely bad credit |

No free credit score monitoring |

|

Easy to use |

|

|

High success rate |

|

|

Affordable Pricing |

|

|

Trial available |

What does it offer?

- Specialized Credit Report Analysis for Extremely Bad Credit: They will obtain the credit reports from the main credit bureaus in order to analyze them

- Disputes for Extremely Bad Credit: This type of situation will require specialized solutions, and Credit Nerd is capable of disputing different negative items by using resources such as debt validation

- Premium Credit Monitoring: Receive updates about the latest updates of your credit score

You can clearly see that Credit Nerd’s solutions are exactly what you need if your credit is extremely bad, anywhere from 300 to 579 points FICO. They can deliver results in 3-6 months and help you move out of the Poor credit score category to massively improve your creditworthiness.

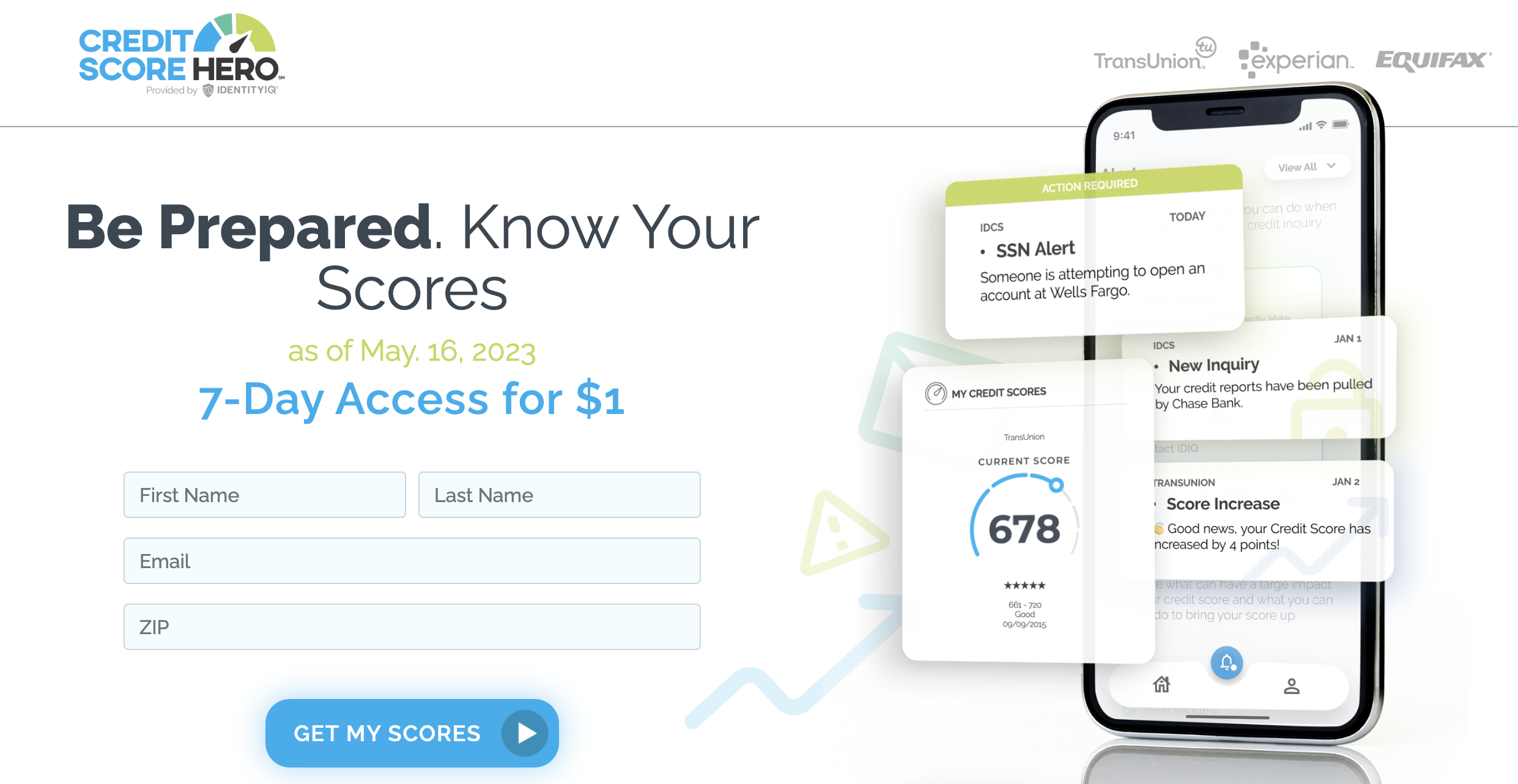

4. Credit Score Hero: Best 7-Day Trial

|

Pros |

Cons |

|

Best 7-day trial offer at $1 |

It might not be the best choice for extremely bad credit |

|

Easy to use |

|

|

High success rate |

|

|

Accurate credit report analysis |

|

|

Credit monitoring |

Credit Score Hero is a credit repair app with a high success rate and an unbeatable trial offer: just $1 to use the app for 7 days.

What does it offer?

- Credit Report Analysis: Credit Score Hero will analyze your credit report to understand your current situation and what items they can remove

- Disputes: This credit repair app will allow you to easily dispute negative or inaccurate items that are hurting your credit score

- Fast Updates: They will also provide fast updates about the latest changes that are affecting your credit score.

If you only need simple credit repair options because you just need to remove some inaccurate items from your credit report, and you want to take advantage of the best 7-day trial, then Credit Score Hero will be the best option for you from our ranking.

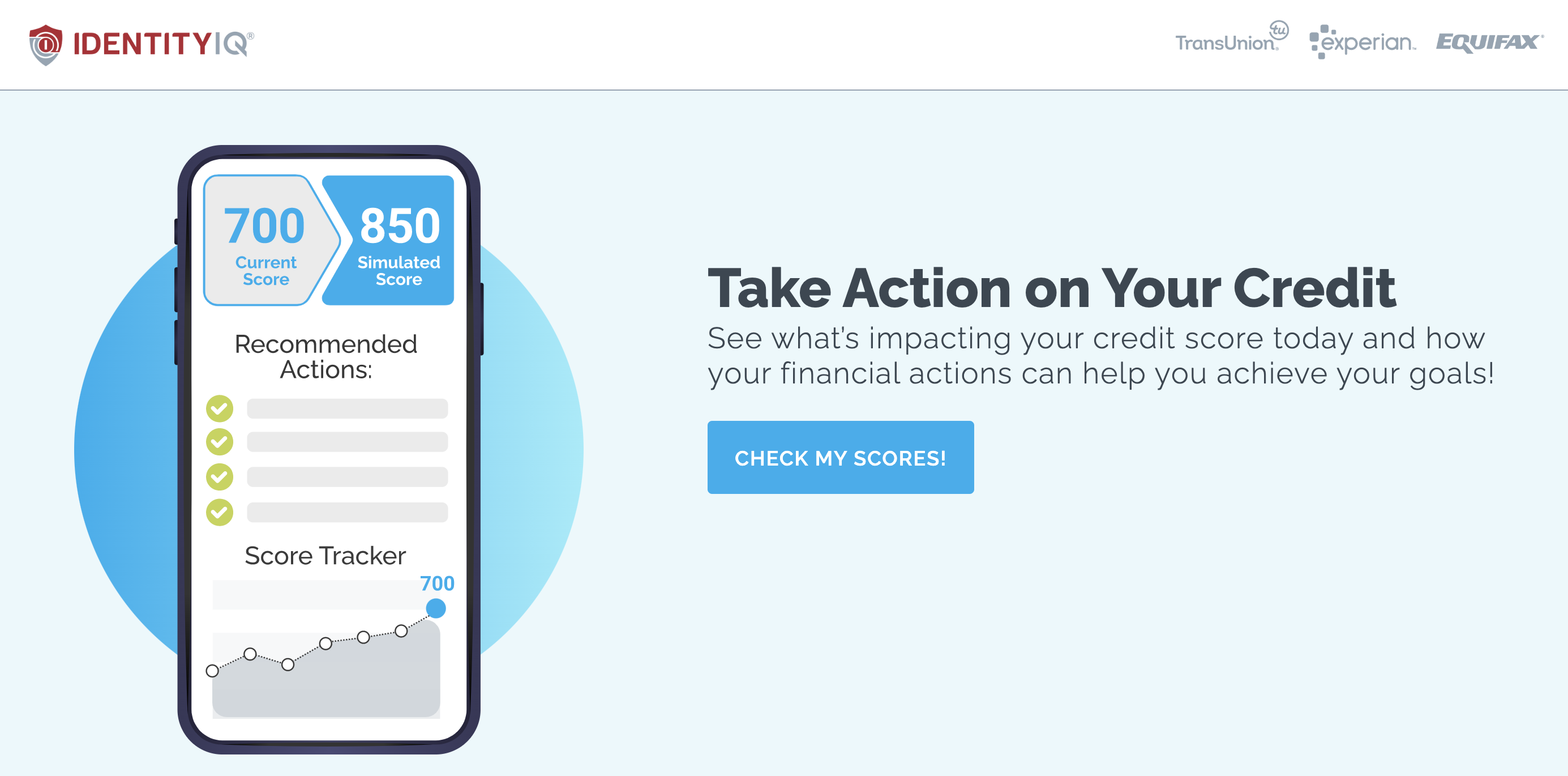

5. IdentityIQ: Best for Identity Theft

|

Pros |

Cons |

|

Most effective credit repair app for identity theft |

You need to buy the top plan to unlock all the benefits |

|

Credit reporting and score changes alert |

|

|

Insurance and Reimbursement |

|

|

Effective solutions for improving your credit score |

What does it offer?

IdentityIQ offers you the following solutions to improve and protect your credit score:

- Total Identity Theft Protection: This credit repair app will offer you the most complete bundle of solutions to prevent, detect and solve cases of identity theft that might affect you. They even include insurance coverage and reimbursement in case of fraud

- Credit Reports and Analysis: The team behind the app will take care of requesting credit reports from the main credit bureaus as well as an in-depth analysis to detect and dispute negative items

- Credit Monitoring: The tech of this app will allow you to monitor your credit score to detect recent changes timely.

Therefore, if you’re looking for a credit repair app that will mainly focus on protecting you against identity theft and related crimes committed in your name, then IdentityIQ will be the best choice for you.

The Basics of Credit Scoring

Before you focus on repairing your credit, it’s important to understand how it works, and this is why we’ll explain it to you in different sections.

What Is Credit Score?

Credit score is a metric used to measure your creditworthiness on a numeric scale. It ranges from 300 to 850 points by FICO, and it’s calculated based on your credit history, current credit products, number of credit accounts, etc. The higher your credit score is, the higher your creditworthiness will be, making it easier for you to qualify for loans at a low APR.

How Is Credit Score Measured?

Here you have the list of factors that are used to calculate your credit score:

- Payment History

- Length of Credit History

- Credit Utilization

- Recent Credit Activity

- Number and Types of Credit Accounts

Therefore, you need to work on improving these factors to increase your credit score. And credit repair apps will move the needle here because they will help you to remove inaccurate and negative items that are damaging your credit.

What is Considered as Bad or Poor Credit?

Bad credit is any score that falls into the Fair or Poor categories, because it means that your creditworthiness is low, and hence you’ll have problems when applying for a new loan. Here you have the different scales for credit score by FICO:

- Excellent: 850-800

- Very Good: 799-740

- Good: 739-670

- Fair: 669-580

- Poor: 579-300

If you need a credit repair app, then it’s because your score falls into the Poor or Fair Category, and our recommended services will increase your chances of moving into the top categories: Good, Very Good or Excellent. If you are looking for a loan with bad credit, then check out our list of options here.

Why Should You Focus on Repairing Your Credit?

Repairing or fixing your credit will yield plenty of benefits for your life in different aspects - here you have a full list of the reasons why you should start doing it now with the help of our recommended apps:

- An excellent credit score will massively increase your approval rate for any type of loan, be it a personal loan, business loans, mortgage loans, home equity loans, etc.

- A higher credit score will lead to a lower APR even when taking out big loans

- A high credit score will allow you to access exclusive products such as large credit lines

- Having a great credit score will elevate your success rate when applying for a new job

- A solid credit score will make it easier for you to rent a new home or apartment because homeowners will check your credit when evaluating your proposal

All in all, improving your credit score will benefit your life in different senses: finances, business, career, lifestyle, etc. And this is why we invite you to start using our recommended credit building and repair apps, because they will help you to enjoy all of these benefits.

What Are Credit Repair Apps?

These are apps specialized in improving your credit by detecting inaccurate or negative items in your credit report that they will dispute on your behalf. These apps will connect you with a dedicated team of credit repair specialists that will analyze our credit reports and then proceed to contact the different credit bureaus such as Equifax and TransUnion to remove these negative items.

To make it easier for you to repair your credit, these companies have created mobile apps that you can use on any Android or iOS device. This way you can quickly bring the team behind the credit repair app all the information they need to start working on raising your credit score.

How Do the Best Apps for Credit Repair Work?

Now that you know what credit repair apps are, it’s time to understand how they work. Here you have a full explanation on how they can help you to improve your creditworthiness.

What Do They Do?

Credit repair apps will obtain credit reports from the principal credit bureaus in order to analyze them to detect wrong, negative and inaccurate items. Then, their team of credit specialists and lawyers will proceed to verify each one of these items, in order to contest them and make credit bureaus delete them.

Furthermore, credit repair apps are equipped with the latest tech to detect serious problems such as identity theft.

What Are the Limitations of a Credit Repair App?

Credit repair apps cannot solve issues such as unpaid debt or valid negative items. If you have not been responsible with your debt, then no credit repair app in the market will be able to help you. They work on the basis that you are repaying your debt on time, and that you just need help removing inaccurate or wrong data that is hurting your credit score.

How We Selected the Top 5 Apps for Credit Repair in 2023

Here you have the exact criteria we used to build this ranking of the 5 best apps for credit repair in 2023, so you can learn why you can trust our recommendations.

Success Rate

We only recommend credit repair apps with the highest success rate - because you’re going to invest money into fixing your credit, and hence you need to have the certainty that you will obtain results. Our recommended apps will let you know the chances of success and if they can help your case beforehand.

We also consider how long it takes the credit repair app to deliver results, and even though each will be different, we only recommend apps that can improve your creditworthiness in a time frame of 3 to 6 months.

Solutions

Our recommended credit fixing apps will bring you solutions such as credit reports, analysis of credit reports, contesting inaccurate or wrong items on your report, contacting credit bureaus, instructing on how to keep improving your credit score, protection against identity theft and more.

Pricing

You already know how important it is to improve your credit score, but it should not mean that you have to break the bank to raise your credit score. This is why we’ve only picked credit repair apps that offer the highest success rate and the most complete pack of solutions at the best price in the market.

Online Reputation

Current and past users will be able to tell you more about the credit repair app you’re about to use, and hence we factor in this feedback as well. We check the ratings and reviews about each one of the apps we’re going to recommend, to make sure that they’re heavily supported by their current and past users.

Ease of Use

A proper credit repair app will make your life easier, and hence we’ve only considered apps that are extremely easy to use even if you’ve never used one before. Be it on Android, iOS or any other operating system, you’ll quickly learn how to use our recommended apps to start improving your credit score.

How to Boost the Power of Credit Repair Apps to Rebuild Your Credit Fast

Credit repair apps are effective on their own, but there are some ways by which you can boost their power. Here’s what you need to do to repair and rebuild your credit faster than ever.

Repay Current Debt

If you have outstanding debt, especially if you have missed payments, then you should start repaying it as soon as possible. If it’s not possible to pay it in full, when in contact with your lender or credit company to discuss solutions such as a payment plan. Because these negative items cannot be removed by a credit repair app because they’re valid and accurate.

Organize Your Finances

If you have missed several payments on loans or credit lines, then it’s because you need to organize your finances better. Once the credit repair app has helped you to boost your credit score, it’s about time to learn from your past mistakes such as making a budget when taking out a loan, never spending more than you can really afford and to keep your debt-to-income ratio below the 35% mark.

Work on Maintaining a Good Credit Score

Once our recommended credit repair apps have managed to deliver the results you expected, then it’s time to work on maintaining a good credit score. Simply stick to paying your debt on time and you will protect your creditworthiness.

Credit Repair Apps vs. DIY Credit Repair

If you’re wondering if fixing your credit on your own is a better idea than using a credit repair app, then this comparison will come in handy. Let’s explore all the reasons why using a credit repair app will prove to be a better option than attempting to improve your creditworthiness the DIY way.

Credit Repair Apps Will Free Up Your Time

Fixing your credit the DIY way is time consuming because you will have to request credit reports from different credit bureaus and then proceed to analyze them line by line. Chances are you’re an already busy person, and adding this time-consuming and stressing task to your day will not be a good idea.

On the other hand, since there’s a team of professionals behind credit repair apps, they will take care of this work so you don’t have to.

Credit Repair Apps Are More Accurate

Unless you come from a background of working with financial and credit products, it’s highly likely that you don’t know how to properly analyze a credit report, nor how to dispute inaccurate or negative items. And if we talk about identity theft, you might not know how to recognize and what to do about it.

This is why we recommend credit repair apps over fixing your credit alone, because these apps are far more accurate, and hence your chances of improving your credit will increase massively.

Credit Repair Apps Will Bring Results Faster

Since you will have a dedicated team working on improving your credit score, such as specialists on credit products and lawyers who have experience detecting and disputing negative items, you will obtain results faster.

Keep in mind that credit repair apps will take from 3 to 6 months to deliver results, which is much faster than doing it on your own, because if you’re not accurate enough, then it could take you 12 months or even longer to see a noticeable improvement.

About Identity Theft and Credit Repair Apps

Did you know that 1 in 4 Americans have been victims of identity theft? It’s a frequent issue that could demolish your creditworthiness by adding negative items to your credit report that were never your responsibility. Fortunately, credit repair apps can help you to solve this problem, here you have all the information you need.

How Can Identity Theft Affect Your Credit score?

If someone uses your personal information to take out a loan, open a new account or get a new credit line, then they will hurt your credit score when they fail to pay back the loan, which is the most logical consequence since they are cyber criminals. And once they start missing payments, then your credit score will take a massive hit and it will leave you with bad credit.

How Can Credit Repair Apps Help with Identity Theft?

Our recommended credit repair apps, especially Identity IQ which is specialized in this service, will let you know if you’ve been a victim of identity theft by analyzing your credit report. Thanks to their monitoring services, they will let you know as soon as possible when they detect a new possible case of identity theft.

The apps from our ranking will also let you know the steps you need to follow to dispute these fraudulent charges to prevent them from further hurting your credit. It will start by filing a report at the Federal Trade Commission, in order to make them aware that you’ve been a victim of identity theft.

About the Fair Credit Reporting Act (FCRA)

The Fair Credit Report Act brings you the right to dispute any item that you consider to be inaccurate or incomplete on your credit report. This Act will make the credit bureau contact the corresponding credit reporting agency to verify the accuracy of the contested items, and if you’re right, then the credit bureau will proceed to remove the wrong items.

Therefore, the FCRA will be your best ally if you’ve been a victim of identity theft. Because you will be able to contest the wrong items that were the result of the activities of criminals and not your own responsibility.

It’s also important to know that the FCRA will allow you to put a freeze on your credit report that will stop lenders and other companies from performing a hard credit enquiry that would damage your credit score even more.

F.A.Q

We’ve collected the most frequently asked questions about credit repair apps, and here you have the answers. They will help you to understand more about how they work and how they can benefit your credit repair efforts.

Do credit repair apps help with credit rebuilding?

Yes, credit repair apps have been especially designed for fixing and rebuilding your credit. If you have negative items on your credit report, then a credit repair app will help you to deal with them to boost your credit score, and thus improve your creditworthiness.

Are credit repair apps a fast way to repair your credit?

Yes, because credit repair apps will bring you everything you need to start improving your credit score. They will help you to remove negative and inaccurate items from your credit report, an action that will lead to a higher FICO credit score, boosting your creditworthiness as a result. Our recommended credit repair apps will take from 3 to 6 months to bring results.

Are credit repair apps necessary?

They’re not a must, but they’re incredibly helpful when trying to repair your credit in record time, especially if you’re dealing with issues such as multiple negative items and identity theft. Even though you can repair your credit on your own, a credit repair app will make the process more effective and faster.

Do credit repair apps offer credit monitoring?

Yes, our recommended credit repair apps can also offer your credit and identity theft monitoring. These functions will allow you to monitor and protect your credit score from taking a hit by alerting you about suspicious situations or new negative items, so you can quickly dispute and solve them.