If you are in need of guaranteed approval, then we have you covered. Below we have listed the top lenders that are guaranteed approval; our number one lender is Fast Loans Group, along with others which you can check out below.

Do you find yourself in urgent need of cash but have been denied a personal loan due to bad credit? You're not alone. In fact, 42% of Americans are facing the same issue of being unable to secure loans from traditional financial institutions.

But don't lose hope just yet. We've gathered a list of the top companies offering bad credit loans with guaranteed approval of up to $1000 in the US.

Keep reading to find out the top credit lenders in the US where you can apply for a quick personal loan regardless of your credit score.

Best Bad Credit Loans Guaranteed Approval for $1000

- Fast Loans Group – Best for Guaranteed Approval $1000

- Honest Loans – Suitable loan repayment terms.

- Credit Clock – Smooth loan application

- Fast Money Source – No bad credit checks.

- Big Bucks Loans – No credit file trails.

- Heart Paydays – Low-interest bad credit personal loans.

- Low Credit Finance – Convenient personal loan application.

The loan companies listed above offer guaranteed personal loans approval for your emergency financial needs with just a click. Once you have chosen the company that best suits your requirements, the funds will be deposited into your account as quickly as possible, the loan approval takes between 1-2 hours.

We recommend that you read on to learn more about each lender’s unique features to make a more informed choice tailored to your financial needs.

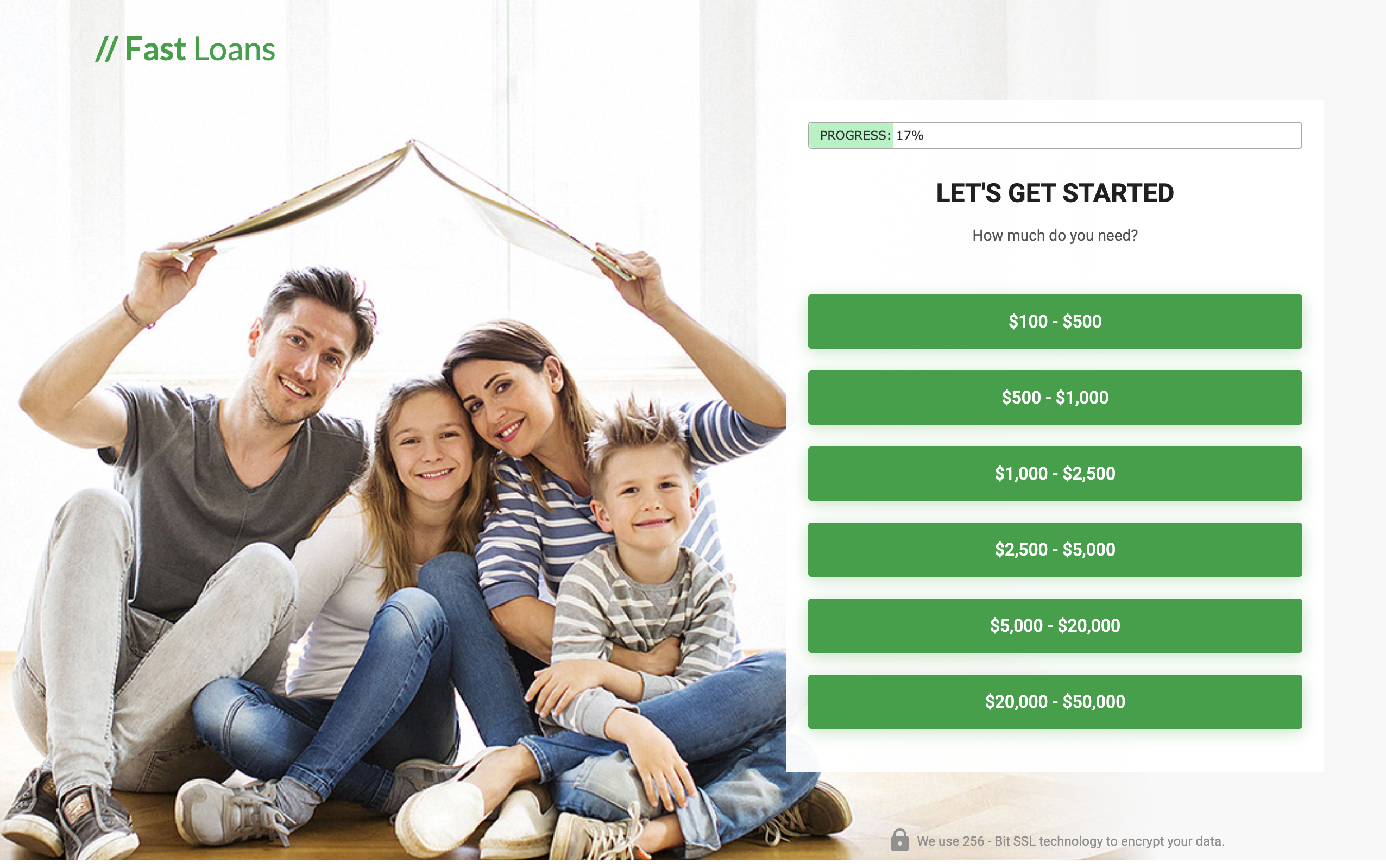

1. Fast Loans Group: Best for Fast Approval

If you're in the market for a personal loan provider in the US that can help you access financing regardless of your credit history, look no further than Fast Loans Group. With a wide network of lenders, Fast Loans Group offers bad credit personal loans with guaranteed approval up to $1000, and limits ranging from $100 to $50,000, giving you the flexibility to meet your financial needs.

But that's not all, here are some additional reasons why Fast Loans Group stands out as a top choice for your lending needs:

- Easy application process.

- Quick approvals.

- Same-day funding.

- Convenient processing.

- Low fees.

- No hidden charges.

Fast Loans Group provides a convenient and speedy way for people to access funds when they need it most. With a range of options available, you can be sure to find the loan that best fits your financial situation and needs.

2. Honest Loans: Best repayment terms

If you're struggling to obtain a personal loan due to a poor credit score, Honest Loans is another viable solution to your financial needs. With bad credit personal loans with guaranteed approval up to $1000, Honest Loans can provide loans ranging from $100 to $50,000. This loan range is designed to cater to any unexpected or emergency expenses you may encounter.

Here are some of the standout features that make Honest Loans a top choice for bad credit personal loans with guaranteed approval:

- Low-interest rates.

- No hassle of visiting an office.

- Instant loan approval.

- Quick funding.

- Smooth application process.

- Flexible loan terms

Honest loans have other various loans that they extend to their clients in addition to the large sums that they can give to borrowers.

3. Credit Clock: Best for Bad Credit

When it comes to obtaining bad credit loans guaranteed approval $1000 in the US, Credit Clock should be among your top choices. They offer quick financing solutions for urgent needs, without considering your credit history. With loan amounts ranging from $100 to $5,000, flexible repayment options, and repayment periods up to 24 months, Credit Clock is a reliable source of support in times of financial need.

Here are some of the reasons why Credit Clock stands out as a good option for your bad credit personal loan with guaranteed approval:

- Guaranteed approvals.

- No credit checks.

- Fast approvals.

- Quick funding.

- Low fees.

- Longer repayment periods.

Credit Clock understands that there is an urgency attached to having cash at your disposal. It is for this reason that they streamline their services and make it easier for you to get a bad credit personal loan as fast as possible.

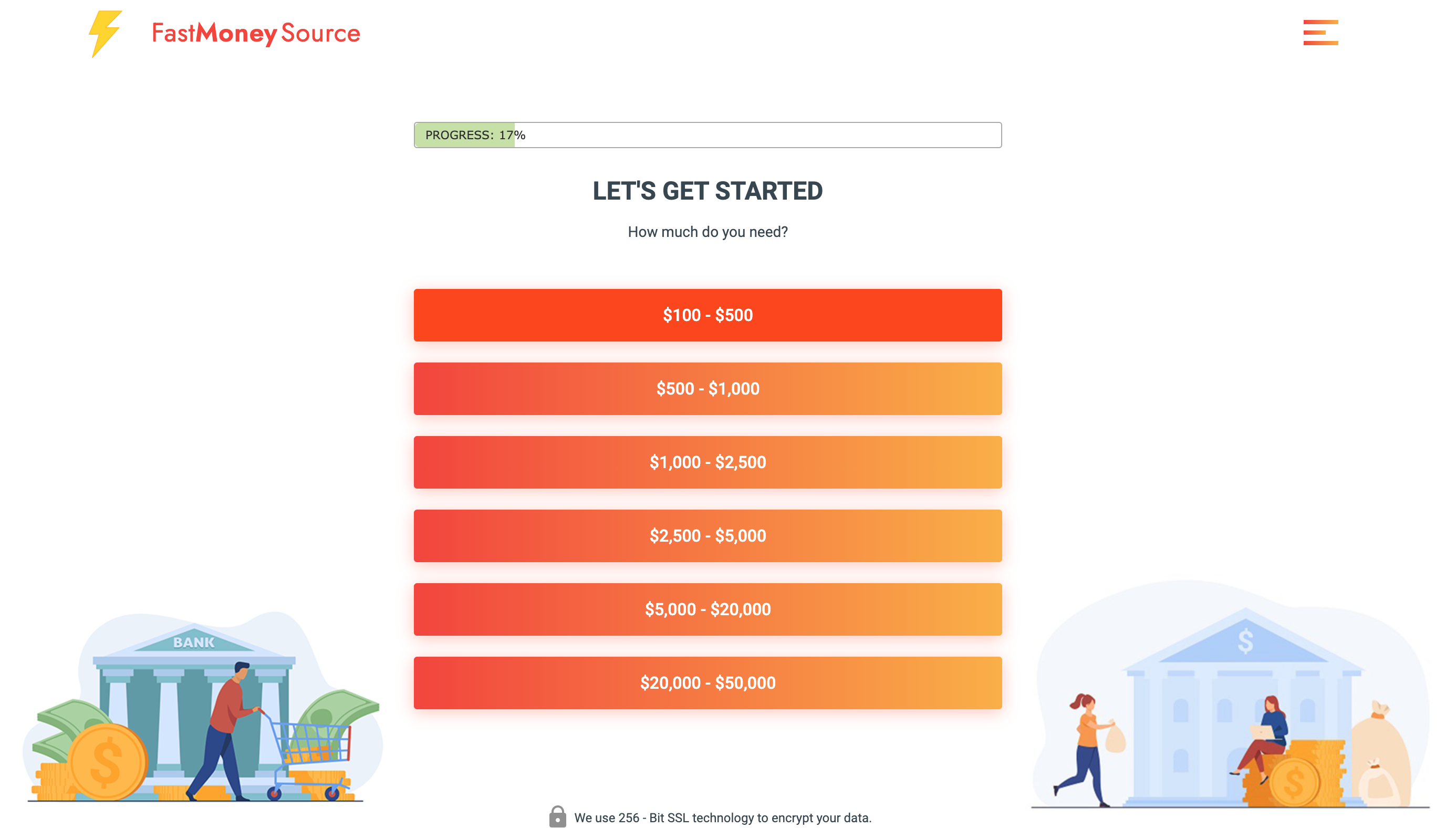

4. Fast Money Source: Best for Quick Funding

Fast Money Source offers bad credit personal loans with guaranteed approval of up to $1000, and without the hassle of long queues in banks. With loan limits ranging from $100 to $50,000, Fast Money Source ensures that you have access to the funds you need to bridge the gap between your expenses and available cash.

Here are the top reasons why Fast Money Source is a good consideration for your personal loans lending needs:

- Convenient borrowing.

- Fast approvals.

- Flexible repayment options.

- Loan varieties.

- Simple application.

- Friendly interface.

Fast Money Source stands out as one of the fastest personal loan approvers in the field as they understand the need that comes with needing cash in an instant.

5. Big Bucks Loans: Best for Low Repayments

If you're seeking a broker that won't negatively affect your credit file, Big Bucks Loans is the right choice for you. With personal loan amounts ranging from $100 to $5,000, they offer the flexibility needed to cover unexpected expenses. Additionally, Big Bucks Loans provides guaranteed approval personal loans for those with bad credit.

Consider the following reasons why Big Bucks Loans stands out as a top option for bad credit loans guaranteed approval of up to $1000:

- FICO scores are not a determining factor.

- No effect on the credit file.

- High likelihood of approval.

- Low-interest rates.

- Flexible repayment options.

Bad credit does not stop you from getting a guaranteed loan approval from Big Bucks Loans as that is exactly why they are here.

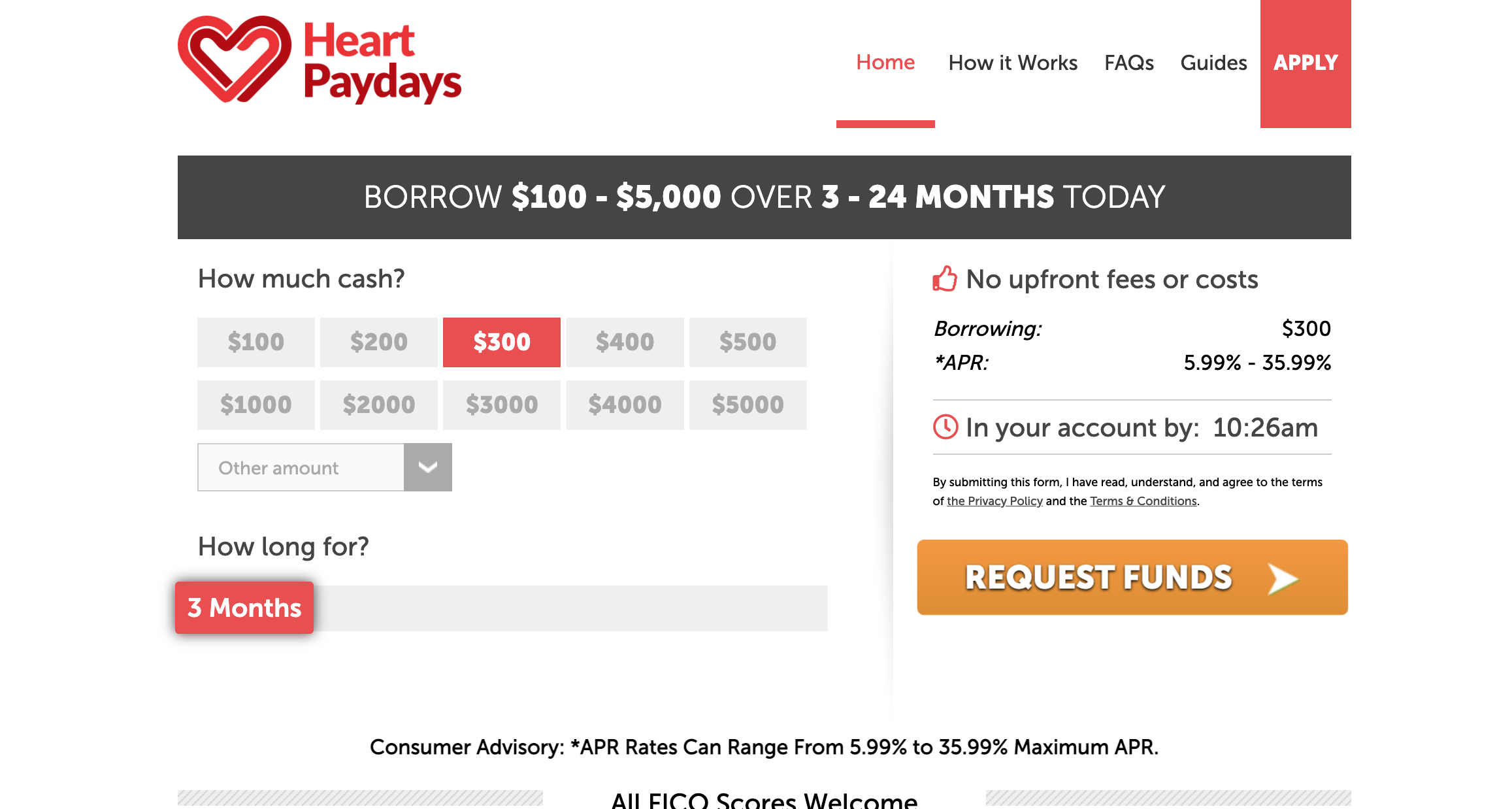

6. Heart Paydays: Low-interest bad credit loans

If you are seeking a reputable loan broker that overlooks bad credit scores when approving personal loans, Heart Paydays is an excellent starting point. They offer guaranteed approval for loans ranging from $100 to $5,000, making them an ideal choice for anyone seeking bad credit personal loans with guaranteed approval for $1000.

What's more, Heart Paydays boasts some of the lowest interest rates in the industry, and here are the other top reasons why they stand out as a top choice for guaranteed approval personal loans:

- They offer a variety of loans.

- Flexible repayment options.

- Low fees.

- High approval rates.

- Unrestricted access.

- Quick approvals.

As a broker, Heart Paydays can ensure your personal loan needs are met quickly and efficiently.

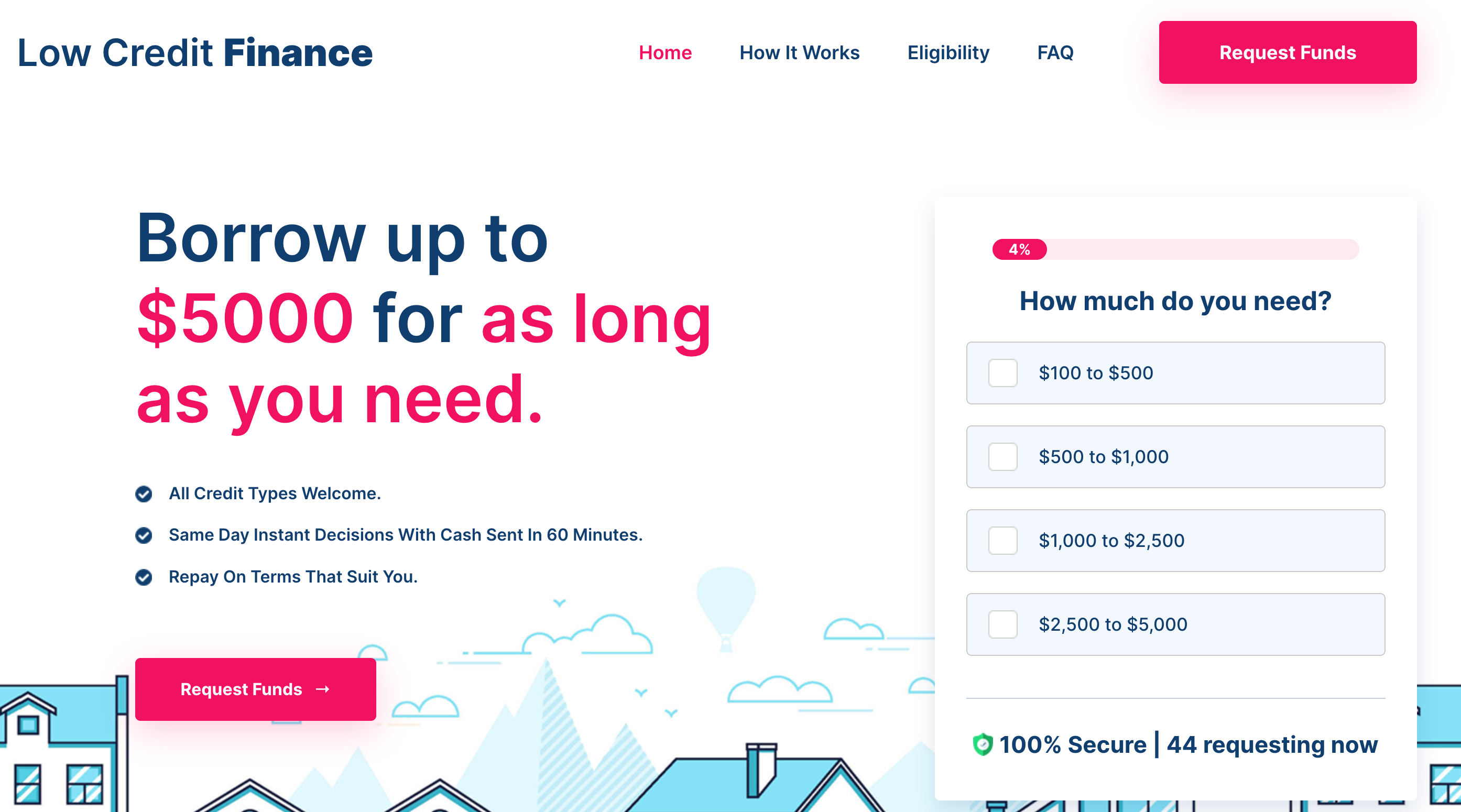

7. Low Credit Finance: Best personal loan application

If you're seeking a hassle-free way to obtain a bad credit personal loan, Low Credit Finance may have just the solution you're looking for. Their simplified application process ensures a quick and easy loan approval process, with lending amounts ranging from $100 to $5,000.Despite a history of poor credit, Low Credit Finance offers competitive interest rates and minimal fees.

Here are a few reasons why Low Credit Finance should be your preferred broker for bad credit personal loans with guaranteed approval of $1000 or more:

- No credit score discrimination.

- Fast approvals.

- Instant payout.

- User-friendly interface.

- Wide range of lender options.

- Transparent fee structure.

- No hidden charges.

Don't let past credit issues hold you back from accessing the funds you need. Low Credit Finance can provide a hassle-free solution to your bad credit guaranteed loan needs.

List of ranked Lenders for Bad Credit Loans that are Guaranteed Approval

| Brand | Summary | Score |

| Fast Loans Group | Fast Approval Process | 10/10 |

| Honest Loans | Great Repayment Terms | 9/10 |

| Credit Clock | Easy Application | 9/10 |

| Fast Money Source | Good for Bad Credit | 8.5/10 |

| Big Bucks Loans | No Credit Check Needed | 8/10 |

| Heart Paydays | Low Interest Rates | 8/10 |

| Low Credit Finance | Available 24/7 | 8/10 |

Bad Credit Loans: How They Work and What You Need to Know

One kind of loan that can be utilized for any reason is a negative credit loan. Personal loans are unsecured loans that don't need collateral, in contrast to mortgages and auto loans, which are secured loans using the asset as collateral. They can be utilized for anything, such as financing home improvement projects or paying off credit card debt.

How Do Bad Credit Loans Work?

Bad Credit Loans are typically offered by banks, credit unions, and online lenders. The amount of the loan, the interest rate, and the repayment period are determined by the lender based on the borrower's credit history, income, and other factors.

The application process for a personal loan is relatively simple. The borrower fills out an application and provides information about their income, employment, and credit history. The lender then reviews the application and makes a decision on whether or not to approve the loan.

If the loan is approved, the borrower will receive the funds in a lump sum, usually within a few days.

The borrower then repays the loan in monthly installments over a period of time, usually between one and five years.

What You Need to Know About Personal Loans

Before you apply for a personal loan, there are a few things you should keep in mind:

- Credit Score: Your credit score is one of the most important factors in determining whether or not you will be approved for a personal loan. If you have a low credit score, you may be denied or offered a higher interest rate. It's a good idea to check your credit score before you apply for a loan and take steps to improve it if necessary.

- Interest Rates: Personal loan interest rates can vary widely depending on the lender and your credit history. Shop around to find the best interest rate and loan terms for your needs.

- Fees: Some lenders may charge fees for origination, prepayment, or late payments. Be sure to read the fine print and understand all of the fees associated with the loan before you agree to the terms.

- Repayment Terms: Make sure you understand the repayment terms before you accept the loan. How long will you have to make payments? What is the monthly payment amount? Will you be charged a penalty if you pay off the loan late?

Benefits of Bad Credit Loans

Bad Credit loans can be a good option for many people for a variety of reasons:

- Versatility: Personal loans can be used for a variety of purposes, including debt consolidation, home improvements, and unexpected expenses.

- No Collateral: Unlike secured loans, personal loans do not require collateral. This means you don't have to put your assets, such as your home or car, at risk.

- Fixed Interest Rates: Many personal loans offer fixed interest rates, which means your monthly payments will remain the same throughout the life of the loan.

- Fast Funding: Once you're approved for a personal loan, the funds are usually available within a few days, making it a quick and easy way to get the money you need.

- Credit Building: If you make your payments on time, a personal loan can help build your credit score over time.

Conclusion

After evaluating the above bad credit personal loans with guaranteed approval providers, it is safe to say they are lifesavers in times of financial emergencies. With the quick and easy approval processes, these loans offer access to funds that may not be available through traditional lending institutions. We have listed the best loans for $200 Here

Having said that, it's crucial to remember that payday loans are a short-term fix for financial problems. High fees and interest rates can add up rapidly, increasing debt and possibly making financial difficulties worse.

Therefore, in order to avoid getting trapped in an unbreakable debt cycle, it is imperative that you thoroughly review the terms and circumstances of the loan and make sure that repayment is achievable within the allotted time frame.