Struggling to secure a quick loan due to a bad credit score? We have found the top lender for your needs, with Honest Loans being number one for ticking all the boxes for bad credit quick loans. See the list below for other lenders that are the best out there.

| Brand | Summary | Score |

| Honest Loans | Fast Approval | 10/10 |

| Credit Clock | Flexible Repayment terms | 9/10 |

| Fast Loans Group | Easy Application | 9/10 |

| Fast Money Source | Low Interest Rates | 9/10 |

| Big Bucks Loans | No Credit History Needed | 8/10 |

| Heart Paydays | Good for Bad Credit | 8/10 |

| Low Credit Finance | Fast Release of Funds | 8/10 |

Our team has done the legwork and identified the best $1,000 quick loan no credit check companies available in the US for 2024.

$1000 Quick Loan No Credit Check Lenders

- 1. Honest Loans – Trustworthy quick loan broker.

- 2. Credit Clock – Flexible quick loan repayment options.

- 3. Fast Loans Group – Fastest quick loan funds disbursement.

- 4. Fast Money Source – Cheapest quick loans.

- 5. Big Bucks Loans – No credit file impact.

- 6. Heart Paydays – Most secure quick loans.

- 7. Low Credit Finance – Most reliable quick loans broker.

To help you make a more informed decision, we've delved deeper into each company's features and why they're a top choice.

These companies offer the perfect solution for anyone facing unexpected expenses or emergencies. With their assistance, you can bridge the financial gap and meet your obligations without having to worry about your credit score.

Keep reading to discover how these quick loan no credit check companies can provide the assistance you need, precisely when you need it.

1. Honest Loans: Best $1000 quick loan

Honest Loans is another trusted broker used by thousands of Americans seeking quick loans with no credit checks. With one of the highest lending amounts in the market ($50,000), Honest Loans is the go-to company for a $1,000 quick loan with no credit check.

In addition to their flexible lending amounts, Honest Loans charges no upfront fees and offers considerably low-interest rates. With fast approvals, you can be sure to meet your deadlines and fulfill your obligations that have been put on hold due to a lack of liquidity.

Below are the reasons why Honest Loans are a top company in lending quick loans:

- No credit checks.

- Flexible lending options.

- Fair interest rates.

- Bad credit is accepted.

- Same-day funding.

- Fast approvals.

Honest Loans is the best broker to go to when you need a quick loan and no credit checks performed.

2. Credit Clock: Quick Loan with no credit check

Credit Clock is one of the best companies for accessing a $1,000 quick loan with no credit check. What's even better is that Credit Clock offers longer repayment periods, providing the flexibility you need to repay your loan. The repayment period can extend up to 24 months.

Through their favorable lending options, Credit Clock can provide quick loans ranging from $100 to $5,000 with no extra charges. With fast approvals and quick fund disbursement, you can quickly and easily meet your unexpected expenses and bridge the financial gap before your next paycheck arrives.

Here is why Credit Clock ought to be on top of your list when considering a quick loan lender with no credit checks:

- Fast approvals.

- Low-interest rates.

- No hidden charges.

- Flexible loan amounts.

- Variety of loans.

- Easy application.

Credit Clock is a trusted lender guaranteed to get you out of a financial crisis in just a few clicks.

3. Fast Loans Group: Fastest quick loan disbursement

For the quickest disbursement of funds when you need a $1,000 quick loan no credit check, Fast Loans Group is the broker of choice. They have fast approvals and offer same-day funding to help you lift some financial burden.

Fast Loans Group has a high-quality team of lenders who have specialized to work with individuals who have bad credit scores. As such, they offer flexible amounts that range from $100 to a maximum of $50,000.

The following are some of the reasons why Fast Loans Group qualifies to be on top of the list for your quick loan with no credit check:

- Vast lending network.

- Regulated lending.

- Flexible loan options.

- No hidden charges or fees.

- Low-interest rates.

- High approval rate.

Fast Loans Group has efficient systems that will enable you to make your $1,000 quick loan no credit check application as swiftly as possible.

4. Fast Money Source: Cheapest quick loans

For the cheapest $1,000 quick loan no credit check, Fast Money Source is the place to look. This lender provides quick loan options to people in the US regardless of one’s credit history. Fast Money Source's no credit check routine enables a majority of applicants to qualify for quick loans.

These quick loans of between $100 and $50,000 help not only to meet financial emergencies but also come to the rescue when a few unexpected repairs or expenses arise.

The following reasons make Fast Money Source a strong contender for quick loans with no credit check:

- High approval rate.

- Competent customer support.

- Fair market rates.

- Regulated lending.

- Fast approvals.

- Same-day funding.

Fast Money Source offers you the advantage of being a part of the Online Lenders Alliance and so you are guaranteed of getting a legitimate $1,000 quick loan no credit check.

5. Big Bucks Loans: Best for bad credit

If you are looking for a lender who does not in any way affect your credit file, Big Bucks Loans is your broker for a quick loan with no credit check. Big Buck Loans grant loans to individuals with a poor credit history.

With a high approval rate, they see to it that a good number of their clients can access quick loans of up to $5,000. Their low APR on the loans makes them a good choice for a quick loan with no credit check.

The following factors make Big Bucks Loans a suitable choice for $1000 quick loans no credit check:

- They allow all credit scores.

- Easy online application process.

- Flexible repayment options.

- Soft credit checks.

- Fast disbursement of funds.

- Low-interest rates.

With Big Bucks Loans, you are almost guaranteed a $1,000 quick loan approval from their diversified pool of lenders who work fast to ensure that your funds are approved.

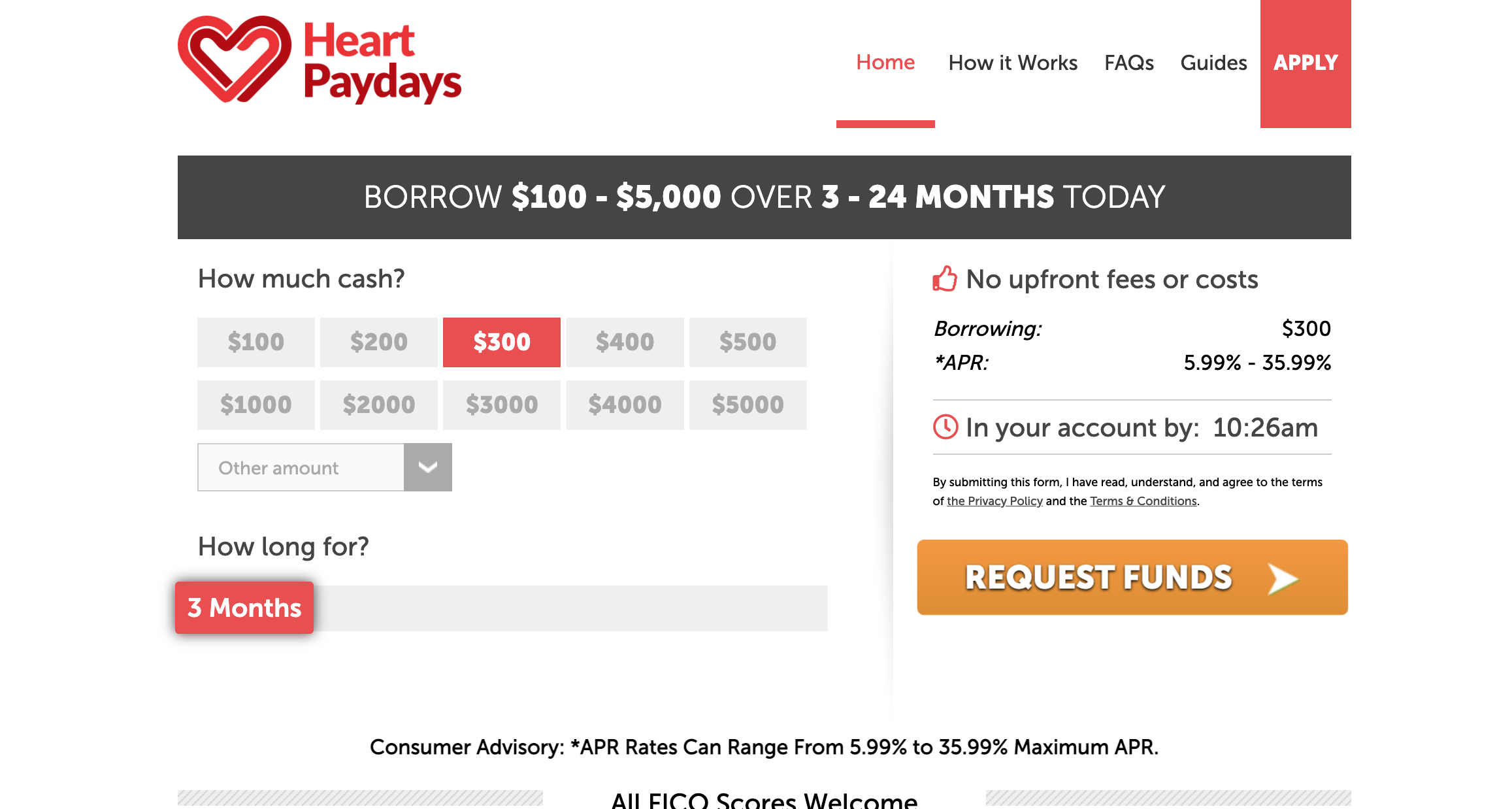

7. Heart Paydays: Most secure quick loans

Heart Paydays is another leading quick loan no credit check lender in the US that extends loan amounts to individuals with bad credit scores. In addition, if you have no credit history, Heart Paydays does not hesitate to connect you with a lender who has the best options.

With Heart Paydays, you can secure quick loans of up to $5,000 at low-interest rates and no extra or upfront fees required. Once your request is approved, you are guaranteed the amount requested without delay.

Heart Paydays is a viable consideration for the following reasons:

- Instant approvals.

- Fast disbursement of funds.

- Flexible repayment options.

- User-friendly interface.

- High approval rate.

- No upfront fees.

For a safe and secure $1,000 quick loan no credit check application, Heart Paydays is the best option.

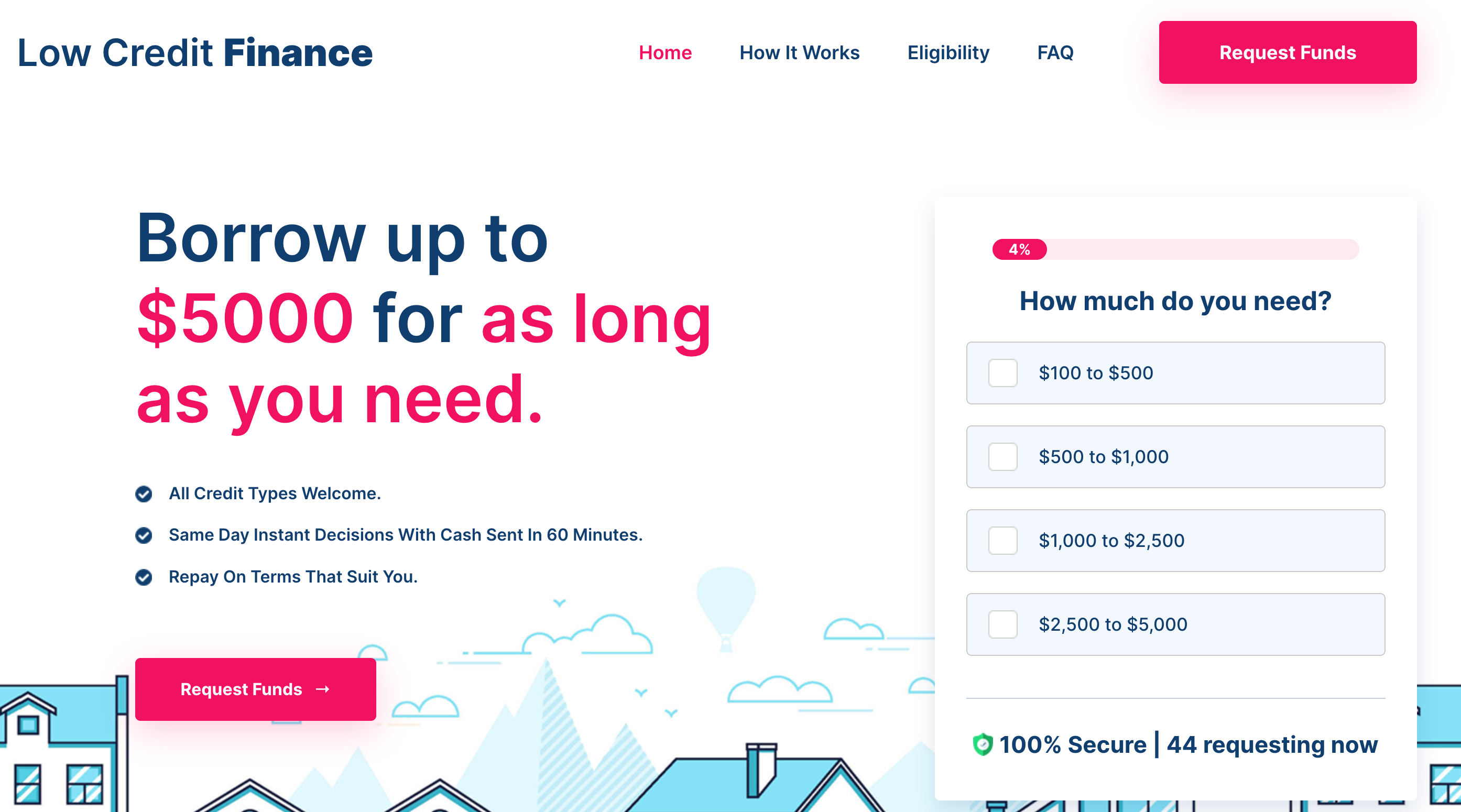

7. Low Credit Finance: Most reliable quick loans broker

Low Credit Finance also offers $1000 quick loans no credit check in the US. Individuals who have low income with bad credit history or no credit history at all can seamlessly apply for a loan through this lender. With Low Credit Finance, you are assured of a quick loan limit of up to $5,000.

Similar to its counterparts, Low Credit Finance has no credit checks on its applications and so, you can apply and get a loan even with bad credit. These loans are granted at fair market rates and as a result, are easily affordable even to the unemployed.

The following factors make Low Credit Finance a solid option for quick loans with no credit check:

- High approval.

- Safe transactions.

- Easy to use.

- Hastened payouts.

- No queues.

- Minimal interest rates.

- No credit checks.

Low Credit Finance offers an excellent option for $1,000 quick loans with no credit checks as it is a reliable broker that makes ends meet.

What is a $1000 Quick Loan No Credit Check?

A quick loan is a type of loan that provides you with a fast and convenient way to access funds on short notice. They are unsecured, meaning they don't require collateral for them to be issued. Designed to be processed as fast as possible, quick loans are normally ready within a few minutes or hours, and in extreme cases, a day from the time of application.

Quick loans are available from various lenders such as banks, credit unions, and online lenders. They are a helpful option if you need money urgently, it is however important to note that they often come with higher interest rates and fees compared to traditional loans.

Related posts about Personal Loans with No Credit Check

Types of Quick Loans in the US

Quick loans come in various forms and as such offer you a wider spectrum to choose from which. The various types of quick loans are discussed in detail below.

- Personal loans – A personal loan is a type of loan that is granted based on creditworthiness and financial history, without the need for collateral. It is often used to finance personal expenses, such as home renovations, medical bills, debt consolidation, or unexpected expenses. The approval process for personal loans can vary, but they are often processed quickly, with funds deposited directly into the borrower's account.

- Payday loans - Payday loans are short-term loans that are designed to provide borrowers with quick access to cash before the borrower's next payday. They are usually easy to qualify for as they require minimal documentation and credit scores, making them a popular option for those with poor credit or no credit history.

- Installment loans - Installment loans are a type of lending that allows borrowers to repay the loan over a fixed period in regular installments as opposed to a single lump sum. They are usually available with or without collateral and can offer more flexible repayment terms than payday loans.

- Cash advances - Cash advances are loans taken out against a credit card or line of credit and provide quick access to funds. They have a lower credit limit than the borrower's available credit and for this reason, they may not provide full access to certain amounts needed.

- Title loans - Title loans allow borrowers to use their vehicle as collateral for a loan. They are processed quickly but come with the risk of losing the vehicle if the loan is not repaid on time.

Quick loans are a useful resource for those who need immediate access to funds. Nonetheless, it is important to carefully consider the policies of each type of quick loan and explore alternative options before making a decision.

Pros and Cons of Quick Loans

Pros

- Fast access to funds - Quick loans are designed to provide access to cash quickly, often within a few hours or days of applying, and in some cases minutes.

- No collateral required - Many quick loans do not require collateral, therefore, you don't have to put up any asset as security.

- Flexible repayment options – With repayment options that can be discussed by the borrower and lender, quick loans are a go-to option.

- Convenience - With many lenders offering online applications and instant decisions, applying for a quick loan has never been convenient,

Cons

- High-interest rates - Quick loans often come with high-interest rates, which can make the cost of borrowing significantly more expensive over time.

Risk of debt - If not managed responsibly, taking out a quick loan can lead to increased debt eventually getting trapped in a debt cycle.

Risk of predatory lending - Some lenders may take advantage of borrowers who are in desperate need of cash making them grant loans with unfair terms.

Methodology Used to Choose the Above Recommended Quick Loan Brokers

Below are the criteria that we considered to come up with the above list of the best lenders of quick loans with no credit check in the US in 2024.

- Timely approval - The pure essence of a quick loan is to have the chance of getting approved instantly. As such, the above lenders can disburse the loan money shortly after you are through the approval stage. This ensures that you get your funds without delay.

- Approval rate – Our recommended brokers have a history of approving quick loans to applicants without discrimination whatsoever. This includes the applicants with bad credit scores. Since most applicants have poor credit scores, it was important to consider brokers that would grant them loans.

- Interest rate and fees - Our selected lenders bring you the financing you need at a fair price regardless of your credit score and history. Having a bad credit score and no credit history should not be a hindrance to getting loans at fair prices.

- Borrowing amount – The above-mentioned brokers have flexible lending and as a result, you can easily get brokers who are willing to grant quick loans with no credit check to tunes of up to $50,000. Our recommended lenders are ready to help you with as much money as you need, and you can use it for any purpose.

- Repayment terms – Our recommended brokers are in a position to negotiate with you the repayment terms and even go to the extent of reviewing the policies therein. One of the terms subject to discussion is the repayment period which could go for as long as 24 months.

- Customer support – To curate the above list, we had to ensure that a broker is in a position to respond to the various queries raised by applicants via the communication channels available. Another factor that was considered was how fast they attend to the issues on their mentioned communication channels. You can be sure that our recommended companies can bring you the quality of customer support service you need.

Alternatives to Quick Loans No Credit Check

While quick loans are helpful in emergencies, it is important to have alternative options. Relying solely on quick loans can lead to a cycle of debt and financial instability. Below are some of the alternatives you could consider:

- Credit counseling - A credit counselor will help you create a budget, negotiate with creditors, and develop a plan to get out of debt.

- Peer-to-peer lending - Peer-to-peer lending platforms allow you to borrow from individuals rather than traditional lenders. This provides a cheaper borrowing option as peers don’t charge high-interest rates and their approval process is usually faster.

- Developing good financial habits – This is an important alternative to quick loans because it helps individuals avoid the need for instant cash and financial stress that may cause the need for a quick loan.

- Personal lines of credit - A personal line of credit allows you to borrow funds up to a certain limit. Unlike a quick loan, you only pay interest on the amount you've borrowed, not the full amount of the line of credit.

Conclusion of the Best $1000 Quick Loan No Credit Check

As a parting shot, quick loans offer convenience if you need instant access to cash. Albeit, it is of utmost essence to consider all the potential drawbacks and upsides and make a conclusive evaluation on whether quick loans are the best solution for your financial needs. If not, the alternatives mentioned above could play a huge part in bridging the difference. With a crystal clear understanding of the pros and cons that come along, it should not be an uphill task to decide on the most responsible choice to support your financial well-being.

Frequently Asked Questions

How quickly can I receive the funds from a quick loan?

The speed at which you can receive funds from a quick loan depends on the lender and the type of loan. Some lenders can provide funds within minutes of approval, while others may take a few days.

Can I get a quick loan with bad credit?

Yes, it is possible to get a quick loan with bad credit. However, the terms and interest rates may be less favorable compared to borrowers with good credit. Some lenders specialize in bad credit loans and may be more willing to work with you.

What are the requirements to qualify for a quick loan?

The requirements to qualify for a quick loan vary by lender and loan type. However, most lenders will require you to be at least 18 years old, have a steady income, and have a valid bank account.

Are quick loans safe?

Quick loans can be safe if you work with a reputable lender. Be sure to research the lender and read reviews before applying for a loan. Also, make sure you understand the terms and conditions of the loan and the repayment schedule before accepting the loan.

Can I pay off a quick loan early?

Yes, the majority of lenders let you pay off your loan early without paying any fees. However, carefully review the loan terms because certain lenders might impose penalties for early repayment.