If you are looking for a Legal Lender in California with fast cash, then look below; we have found that the top lender is Fast Money Source, along with other lenders like Fast Loans Group and Honest Loans; the reasons why are listed in the table below.

Are you looking for an affordable and fast payday loan in California? Then you’ve arrived at the right place because we’ve built a ranking with the best payday loans online in California in 2024, so you can borrow up to $300 with same day disbursement and a low interest rate.

We’ve only selected the payday loan lenders that meet all the regulations of the state of California and that offer the lowest interest rates so you can borrow money at the best price. And you can apply for these payday loans from any of the 482 cities in California such as Los Angeles, San Diego, Fresno, San Jose, San Francisco, etc.

Come with us to check out our ranking so you can apply for your payday loan right now.

List of the Best Payday Loans Online in California 2024: Apply Now for Fast Money

Here you have our ranking of the best payday loan lenders in California so you can apply for a loan right now to get the money you need as soon as possible:

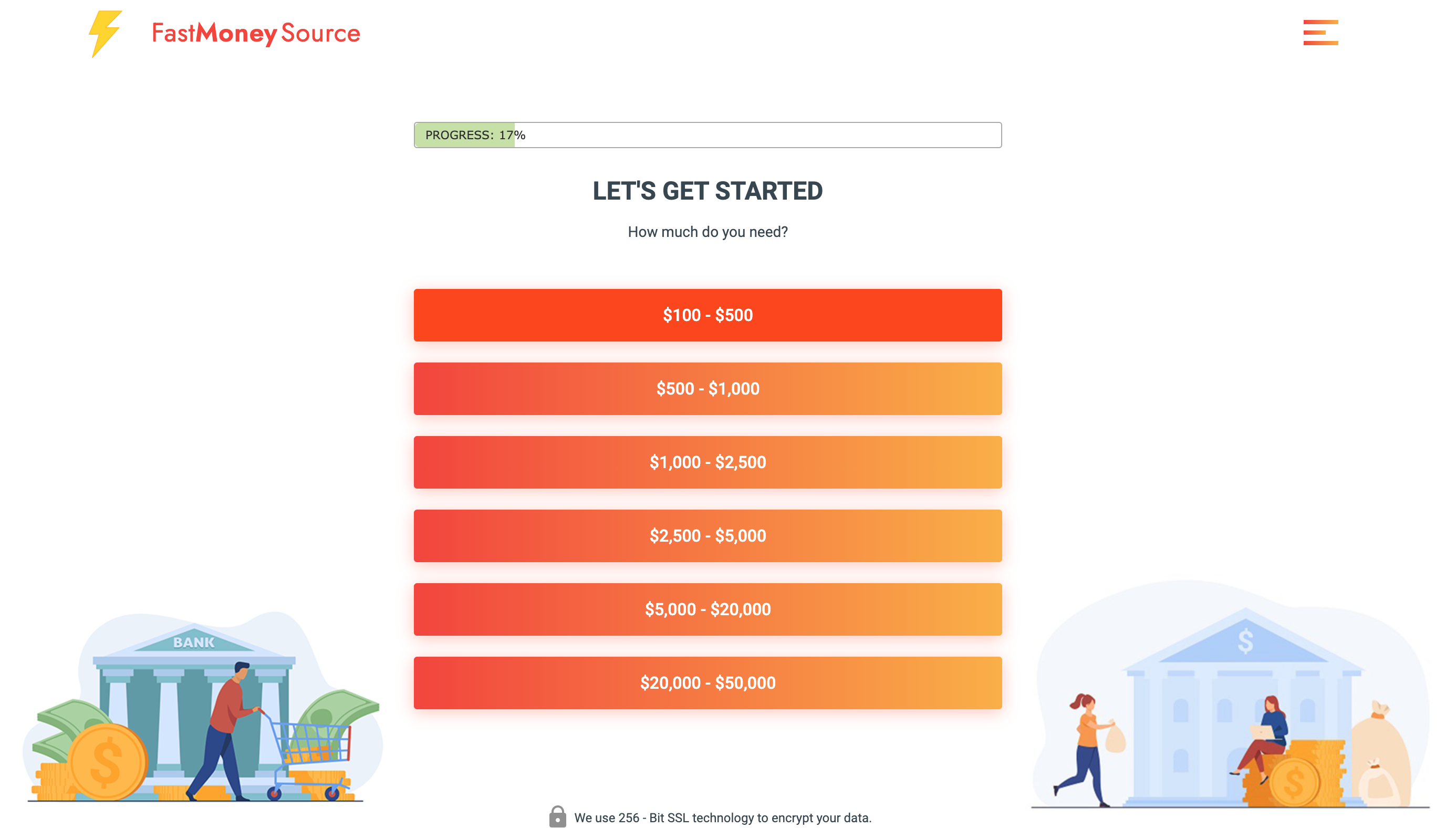

- Fast Money Source: Best Payday Loans in California

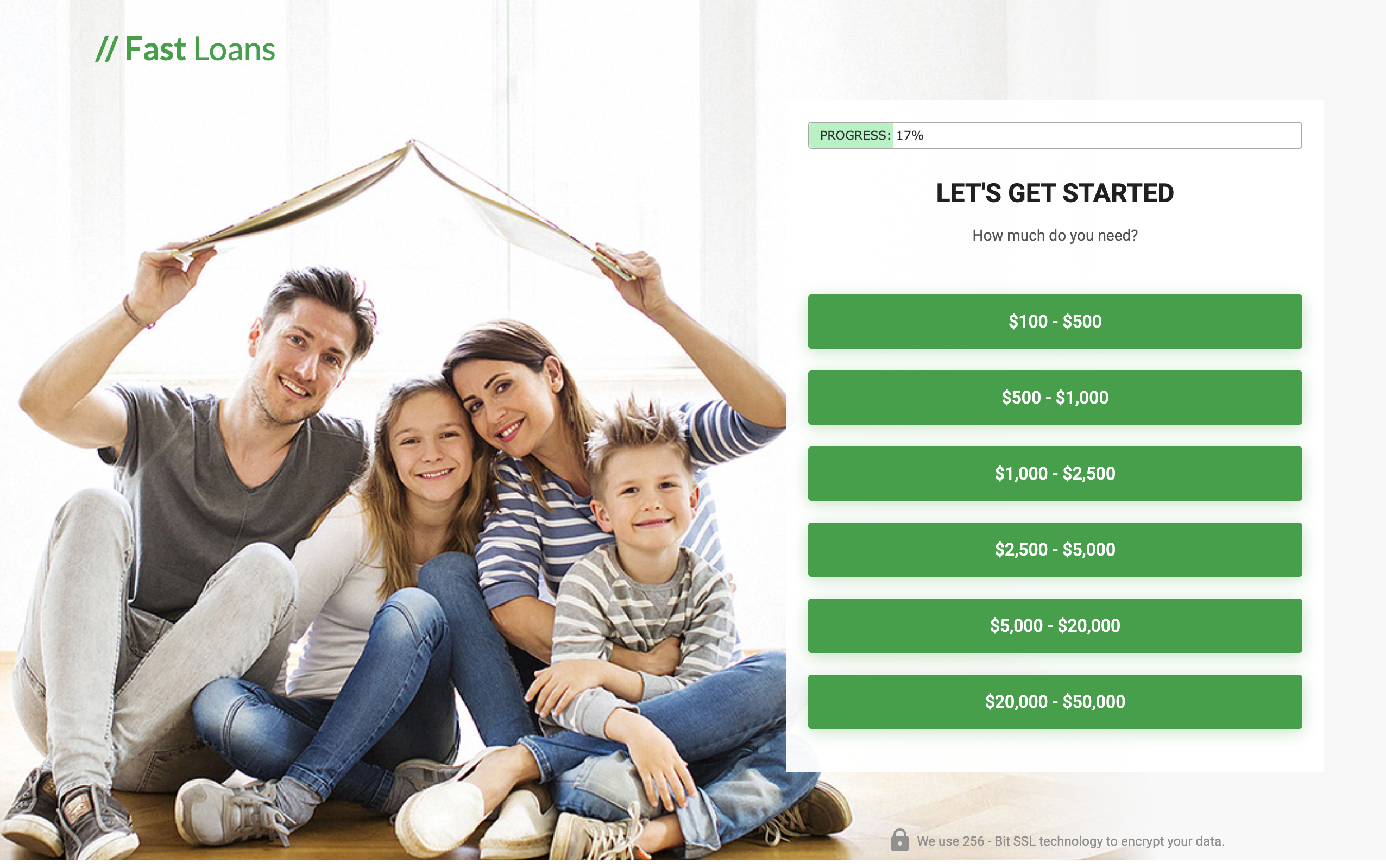

- Fast Loans Group: Fastest Approval and Disbursement

- Honest Loans: Lowest Payday Loan Interest Rate in California

- Credit Clock: Most Reliable Payday Lender in California

- Big Buck Loans: Best for Extremely Bad Credit

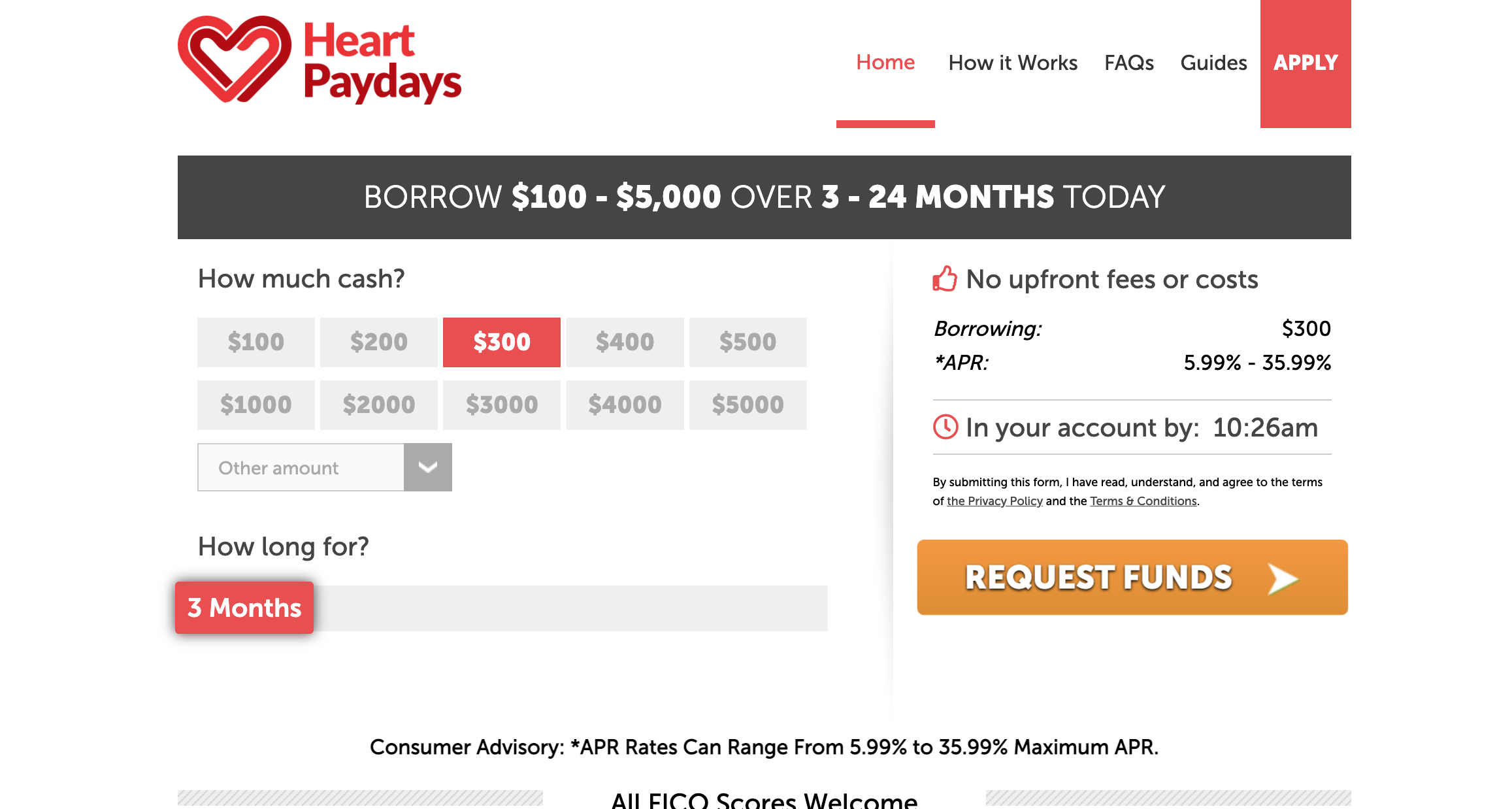

- Heart Paydays: Best for Limited Credit History

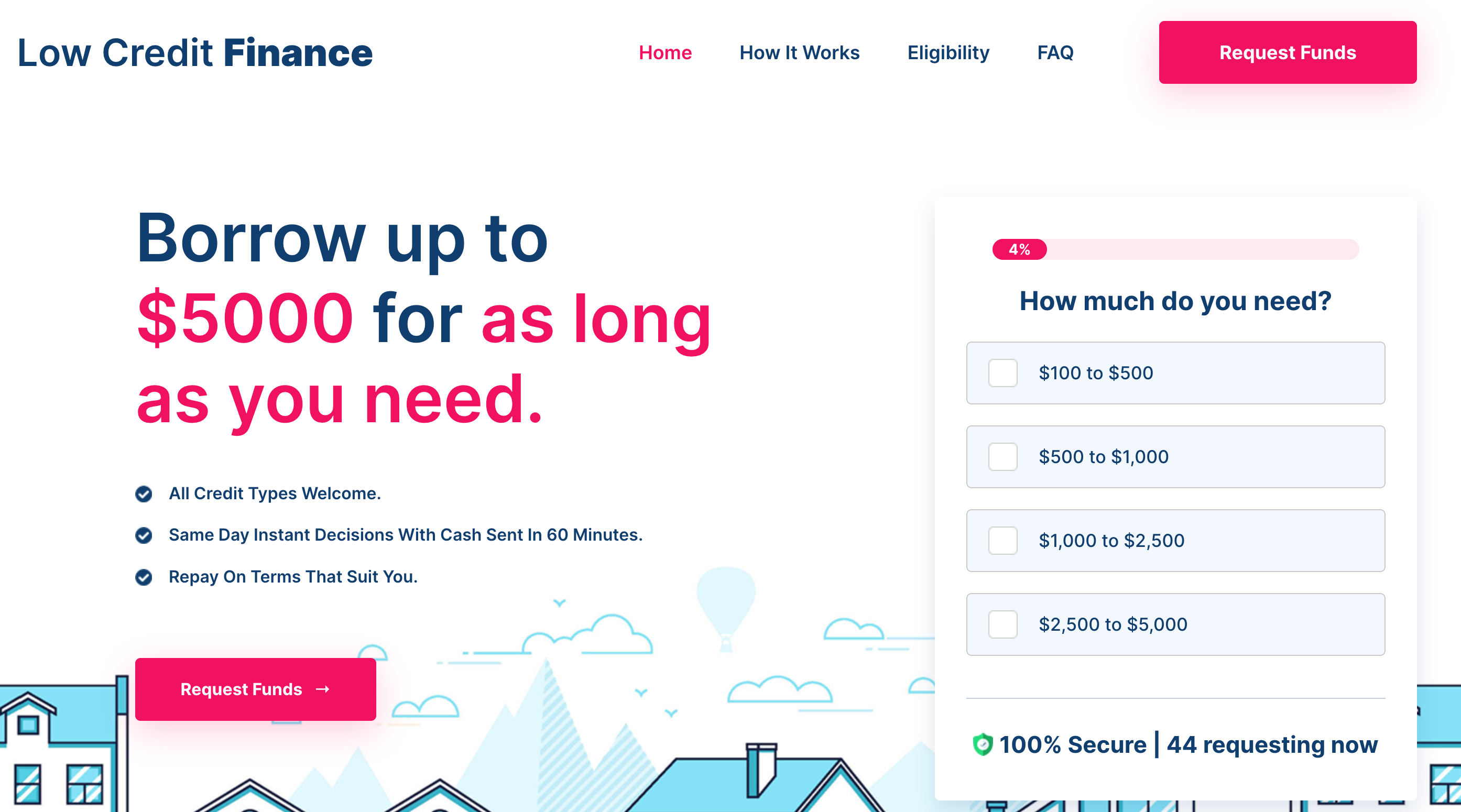

- Low Credit Finance: Best for Low Income

All of our recommended payday lenders cover the 482 cities in California. You can request it from Los Angeles, San Diego, Fresno, San Jose, San Francisco, Sacramento, Long Beach or any other city. They will process your application instantly and proceed to disburse your loan once you’ve been approved.

If you need more details about each lender before making a decision on which one you will pick, then you will find the pros and cons about each platform so you can pick the best one for you.

1. Fast Money Source: Best Payday Loans in California

|

Pros |

Cons |

|

#1 Payday Loan Lender in California |

Late payment fees might apply |

|

It will approve you fast and disburse the money the same day |

|

|

It will let you use the loan money for any purpose |

|

|

It will bring you a payday loan at an affordable rate |

|

|

You can get approved even with bad credit |

|

|

You can use this payday loan to build up your credit |

Fast Money Source is here to bring you different types of payday loans in California such as $50, $100, $150, $200, $255 or even a $300 payday loan with fast approval and disbursement, as well as a competitive interest rate with favorable repayment conditions. This is why we’ve ranked it as the #1 payday loan lender in California because it offers the most complete pack of benefits for you as a borrower.

2. Fast Loans Group: Fastest Approval and Disbursement

|

Pros |

Cons |

|

It will approve you and disburse the loan money the fastest |

Late payment fees might apply |

|

It will bring you a payday loan with a competitive interest rate |

Repayment terms might change depending on your creditworthiness |

|

It will allow you to use the loan money for any purpose |

|

|

You can complete the application process in less than 5 minutes |

|

|

You can get approved even with bad credit |

If you are looking for the fastest payday loan lender in California, then Fast Loans Group is exactly what you need. With a record speed for approving applications and disbursing the loan money up to $300, you will receive the cash you need with a competitive interest rate that you can use for any sort of purpose or emergency.

3. Honest Loans: Lowest Payday Loan Interest Rate in California

|

Pros |

Cons |

|

It will bring you a California payday loan with the lowest interest rate |

It can take up to 24 hours to disburse the payday loan |

|

You can use the payday loan for any purpose |

The application process could be faster |

|

You can select the payment schedule that better meets your needs |

|

|

You can use this payday loan to build up credit |

|

|

You can get approved even with bad credit |

If you want to get a payday loan in California for the lowest price, then Honest Loan is the payday lender you need. Featuring the most affordable interest rate for payday loans in the state, it’s one of our favorite platforms, especially since they also offer a high approval rate for bad credit and low income customers.

4. Credit Clock: Most Reliable Payday Lender in California

|

Pros |

Cons |

|

You can apply for a payday loan 24/7 and get the money within a few hours |

Low approval rate for customers with low income or who are currently unemployed |

|

You can get approved even with bad credit |

Strict penalty fees for late payments |

|

You can use the money as you wish |

|

|

You will get an emergency payday loan at a competitive interest rate |

Do you need a payday loan outside of business hours? Then Credit Clock is the unique payday loan lender in California that will be there to help you, because they work 24/7 even on holidays. You can get approved even with bad credit and you will receive the loan money within a few hours after getting approved (which is instantly the majority of the time).

5. Big Buck Loans: Best for Extremely Bad Credit

|

Pros |

Cons |

|

You can get approved even with extremely bad credit |

High interest rate |

|

You can get approved even if you have low income or are currently unemployed |

Severe late payment fees |

|

It will approve and disburse your payday loan fast |

|

|

You can use this payday loan to improve your credit score |

Is your credit score worse than bad? If it’s lower than 580 points, then it will be considered as “extremely bad credit” by most lenders in California, but Big Buck Loans won’t have a single problem approving your application so you can get the money you need in record time. And even if you have low income too, you will stand a high chance at getting approved by this lender.

6. Heart Paydays: Best for Limited Credit History

|

Pros |

Cons |

|

Highest approval rate for customers with limited credit history in California |

Disbursement can take up to 1 business day |

|

You can get approved with bad credit |

Severe late payment fees |

|

You can get approved with low income |

|

|

Ideal payday loan to build up credit |

If you have a limited credit history, or even zero credit activity, then Heart Paydays will be the ideal payday lender for you in California. Because it offers the highest approval rate for customers with limited credit history, and on top of that they will offer you a competitive interest rate and you can get approved even with low income.

7. Low Credit Finance: Best for Low Income

|

Pros |

Cons |

|

Highest approval rate for low income borrowers in California |

High interest rate |

|

You can get approved even if you’re unemployed |

Severe late payment fees |

|

Highest approval rate for alternative income sources |

|

|

Fast approval and disbursement |

If you have a very low income or if you are currently unemployed, then Low Credit Finance will be your best choice in California. It offers the highest approval rate for customers with low income, who are unemployed and those with alternative income sources such as freelancing, pensions, unemployment benefits, etc.

Table of Loans in Cali, United States

Brand |

Summary |

Score |

|

Best Payday Loan |

10/10 |

|

|

Fast Approval Process |

9.5/10 |

|

|

Great interest Rates |

9.5/10 |

|

|

Good for Poor Credit |

9/10 |

|

|

Flexible Repayment Terms |

8/10 |

|

|

Easy Application |

8/10 |

|

|

Fast Release of Funds |

8/10 |

How to Apply for a Payday Loan Online in California - Step by Step

The application process is simple and straightforward, just follow these steps and you will complete it in less than 5 minutes:

- Select a payday loan lender from our ranking

- Visit their official website

- Complete the application form and send it

- Wait for the notice of approval

- Receive the contract in your primary language

- Agree to the contract and receive the loan money in your bank account.

Our recommended lenders and brokers use the most advanced technology to process loan applications, so you can expect to receive a response within minutes and the money will be deposited in your bank account the same day.

Remember that our recommended lenders cover all the cities in California, be it San Diego, Los Angeles, San Jose, Anaheim, Long Beach, Fresno or Sacramento, you can apply for a payday loan now and our recommended lenders will help you.

Payday Loan Regulations in California 2024: What You Must Know

It’s also important to know what the current regulations for payday loans are in California, because it will let you know more about your rights as a borrower, how much you can borrow, what the max cost of a payday can be, amongst other important details.

Overview

Payday loans are legal in the state of California, but they are subjected to strict regulations and rules in order to protect customers like you from predatory fees and other abusive practices that might end up damaging you financially. These regulations target areas such as the maximum price, maximum loan amount, and maximum loan term.

Therefore, the current regulations have transformed payday loans in California into short-term loans with strict price caps, and hence they’re better suited for small emergencies and unexpected expenses that won’t surpass the mark of $300 USD. Let’s check all the details so you can see what you can expect from payday loans in California.

In case you just want a complete yet quick overview on these regulations, then the following table will help you:

|

Overview on the Payday Loan Regulations in California |

|

|

Max Payday Loan Amount |

$300 |

|

Max Payday Loan Term |

31 days |

|

Max Payday Loan Price |

15% of the loan amount |

|

Max Number of Payday Loans at a Time |

1 |

|

Max Fee for Check Bounce |

$15 |

Now, let’s check all the regulations one by one, so you can know more about your rights as a borrower of a payday loan in California.

Number of Payday Loans

The current regulations in California only allow you to get a maximum of one payday loan at a time. You cannot apply for a new payday loan if you’ve not paid the previous one in full, and hence no direct lenders or broker will be able to process your petition.

This will protect you as a customer, and it will also help you to boost your credit score, because if you repay the loan on time and you proceed to request another, then you can start populating your credit report with positive items that will build up your credit.

Maximum Payday Loan Amount in California

You can borrow a maximum of $300 in the form of a payday loan in California. Therefore, you will be able to find different types of payday loans such as a $50, $100, $150, $200, $255 or a $300 payday loan offer in California. This way the state protects customers from borrowing more than they can afford to pay back, and hence it will prevent them from committing expensive financial mistakes.

Max Payday Loan Term in California

Payday loans in California can only be borrowed for a maximum of 31 days, which means that these loans are only for the short-term by default due to the state law. You can opt for paying your payday loan back in 7, 14, 28 or 31 days - our recommenders brokers and lenders will bring you different options where to choose from.

Furthermore, there’s no penalty for repaying the loan early, which will make it easier for you to handle your debt in case you get the necessary money to repay your payday loan.

Max Cost of a Payday Loan in California

Payday lending companies and direct lenders can only charge a maximum of 15% of the amount of the payday loan check. Evidently, this regulation will protect you against predatory fees that could affect you negatively, and all of our recommended brokers and direct lenders respect it.

The following table will help you to see the maximum cost of all the different types of payday loans you can apply for in California:

|

Payday Loan Type in California |

Interest Rate |

Total Interest |

Total Payment |

|

$50 Payday Loan |

15% |

$7.50 |

$57.50 |

|

$100 Payday Loan |

15% |

$15.00 |

$115.0 |

|

$150 Payday Loan |

15% |

$22.50 |

$172.5 |

|

$200 Payday Loan |

15% |

$30.00 |

$230.0 |

|

$255 Payday Loan |

15% |

$38.25 |

$293.25 |

|

$300 Payday Loan |

15% |

$45.00 |

$345.00 |

However, it’s important to note that our recommended lenders can bring you a better rate than 15%. For example, if your income source meets all the eligibility standards, then you can receive an interest rate of just 10% or even lower - it will all depend on your creditworthiness.

Additional Regulations to Take into Account

Now that you know about the payday loan regulations in regards to the maximum price, maximum loan amount and maximum loan term, it’s also important to talk about the following regulations that all payday lending companies, brokers and direct lenders must meet:

- All the payday lenders in California must be licensed by the Department of Financial Protection and Innovation (DFPI)

- Payday lenders must bring you a contract in your primary language, and taking into account that over 28% of the population in California speaks Spanish, they’re obligated by law to bring you the contract in Spanish in case you’re not proficient in English as of now

- All online payday lenders are obligated by law to publicly post their license by the DFPI and their respective fee schedule

- Payday lenders in California are only allowed to charge a one-time fee of up to $15 in case the loan check bounces

- Payday lenders cannot charge you extra fees if you request an extension of your payment plan. However, you must remember that payday lenders are not obligated by law to accept your extension request, and hence they may apply late payment fees or penalties

- Payday lenders cannot prosecute you in criminal courts in case you’re unable to repay the payday loan, but they can report you to credit bureaus and this will negatively impact your credit score, making it much harder for you to get a new loan

All of our recommended payday loan lenders and brokers meet the current regulations of the state of California. Therefore, you can apply for a loan without problems because your rights as a customer will be respected and backed up by the state law.

Find a Payday Loan Online in California Near Me: What Cities Do Our Recommended Lenders Cover?

You can obtain a payday loan online from any of the 482 cities in the state of California. Our recommended payday loan lenders in 2024 can help secure the funds today.

Therefore, it doesn’t matter if you live in Los Angeles, San Diego, Fresno or Pasadena, our recommended brands will happily accept your application and lend you the money you need right now. Don’t lose any more time and apply for your own payday loan now.

How We Selected the Top Payday Loans Online in California

Here you will find all the details about our methodology and selection process that has allowed us to build this ranking of the best payday loans online in California.

Platforms that Meet the Payday Loan Regulations in California

We make sure to only add lenders that meet all the current regulations for payday loans in the state of California. For starters, we make sure that they’re licensed by the Department of Financial Protection and Innovation (DFPI) and then we proceed to verify the other factors.

For example, all of our recommended lenders can bring you up to 31 days to repay the payday loan, as well as flexible payment terms and conditions that will benefit you as a borrower.

Furthermore, we’ve made sure that all of our ranked lenders cover all the cities in California. From San Francisco, San Diego, Los Angeles and San Jose to Santa Ana, Fontana and Fullerton, so you can apply for a payday loan from anywhere in the state.

Average APR and Fees

Even though the maximum price for a payday loan is set at 15% of the total loan amount, we only include payday loan lenders that can do better than that. Therefore, if your profile meets all the eligibility standards, you can get approved for a payday loan at a lower rate, for example just 10%, which will help you to save money in the long run in case you want to apply for a payday loan multiple times throughout the year.

Eligibility Criteria and Approval Rate

The approval rate will vary from lender to lender, but we’ve made sure to only pick the ones with the highest approval rate. Be it that you have extremely bad credit, low income or a limited credit history, our recommended payday loan lenders can approve you if you meet their minimum eligibility requirements.

Application Process

Our recommended payday lending platforms offer an easy-to-complete application process that will take you only 5 minutes to complete, even if you’ve never applied for an online loan before. You only have to enter basic information and the lender will take care of the rest.

Approval and Disbursement Speed

Payday loans must be fast, and our recommended lenders are specialists when it comes to fast approval and disbursement. You will receive a response automatically and they will proceed to disburse the loan the same day if you’re approved.

F.A.Q

If you want more information about our recommended payday loans in California, then here you have the answers to the most frequently asked questions about them.

Are online payday loans legal in California?

Yes, they are legal as long as the lender or broker is licensed and registered to do business in the state of California. Furthermore, they need to meet all the current regulations for payday loans in order to be a legal company that can issue payday loans to people who live in California, in any of the 482 cities in the state be it San Francisco, San Diego, Los Angeles, Sacramento, San Jose or any other location.

Can I apply for a $255 payday loan online in California?

Yes, $255 payday loans online are available in all the cities of California such as Fresno, Los Angeles, California, San Francisco, Santa Barbara, etc. Because they are below the maximum payday loan amount of $300 dollars, as dictated by the current regulations for payday lending in the state of California.

How much can I borrow with a payday loan in California?

A payday loan in California will bring you a maximum of $300 USD, because it’s the current limit set by the state regulations. You can borrow any amount equal or less than $300, such as a $100 or a $200 payday loan, which have become very popular options in CA. We have listed the best companies for a $300 loan Here

Do online payday loans offer guaranteed approval in California?

No, the regulations in California prohibit online payday lenders to promise “guaranteed approval” to their clients because it’s not possible to guarantee it. Because all the lenders will have to review your application to determine your creditworthiness before issuing a loan. We have listed the loan companies that offer guaranteed approval in other states Here

Can I get multiple payday loans in California?

No, the current regulations for payday lending in the state of California have set that you can only borrow one payday loan at a time for a maximum of $300 USD. Once you’ve paid it back in full, then you will be able to apply for a new payday loan. Keep in mind that this rule will apply to any city in California such as Los Angeles, San Diego, Fresno, San Francisco, etc.

What do you need for a payday loan in California?

All you need is to be at least 18 years old, a US citizen or permanent resident, to have a verifiable source of income, a favorable debt-to-income ratio and an active bank account. This way they will be able to consider you as a creditworthy, and hence they will disburse your payday loan the same day you’ve been approved.