If you are searching for financial help for some sudden unplanned expense but do not have a good credit score, a car title loan will give you a sigh of relief. There are millions of Americans, about 20%, like you who do not have enough savings.

It is true that most loan applications get rejected due to lack of a good credit score, but a car title loan from the best title loan company is a blessing when there is a sudden financial burden to take care of.

Here in this article, we will help you find a reliable lender who has helped millions handle such a crisis seamlessly. Our goal is to connect you with lenders who are transparent, offer the best interest rates, and instant funding on loan approval.

Our post also explains everything about title loans, and how they would work to ensure you know all the nitty-gritties about them.

Best Title Loan Companies in 2024

It is vital to ensure that you get the best rates, irrespective of whether you are looking for a payday loan or a car title loan. We have scuffed through several car title loan companies to come up with the below 4 top rating car title loan companies.

- 1. Max Cash Title Loans: High Approval Loan in 3 Easy Steps!

- 2. Loan Mart Title Loans: Car Title Loan for Any Car, Any Year!

- 3. LoanAutoTitle.com: Speedy Loans Up To $35,000!

- 4. Loans4Title.com: FREE Service & Fast Title Loans!

We want you to make an informed decision and urge you to explore the website of each lender we have listed and decide on your own about your favorite lender. Accordingly, you can visit their website and fill out the loan application form. On approval, the loan will be in your account in a couple of hours.

For a comparative study of our lenders and to know if they are the best fit for your fast cash needs, read our reviews below.

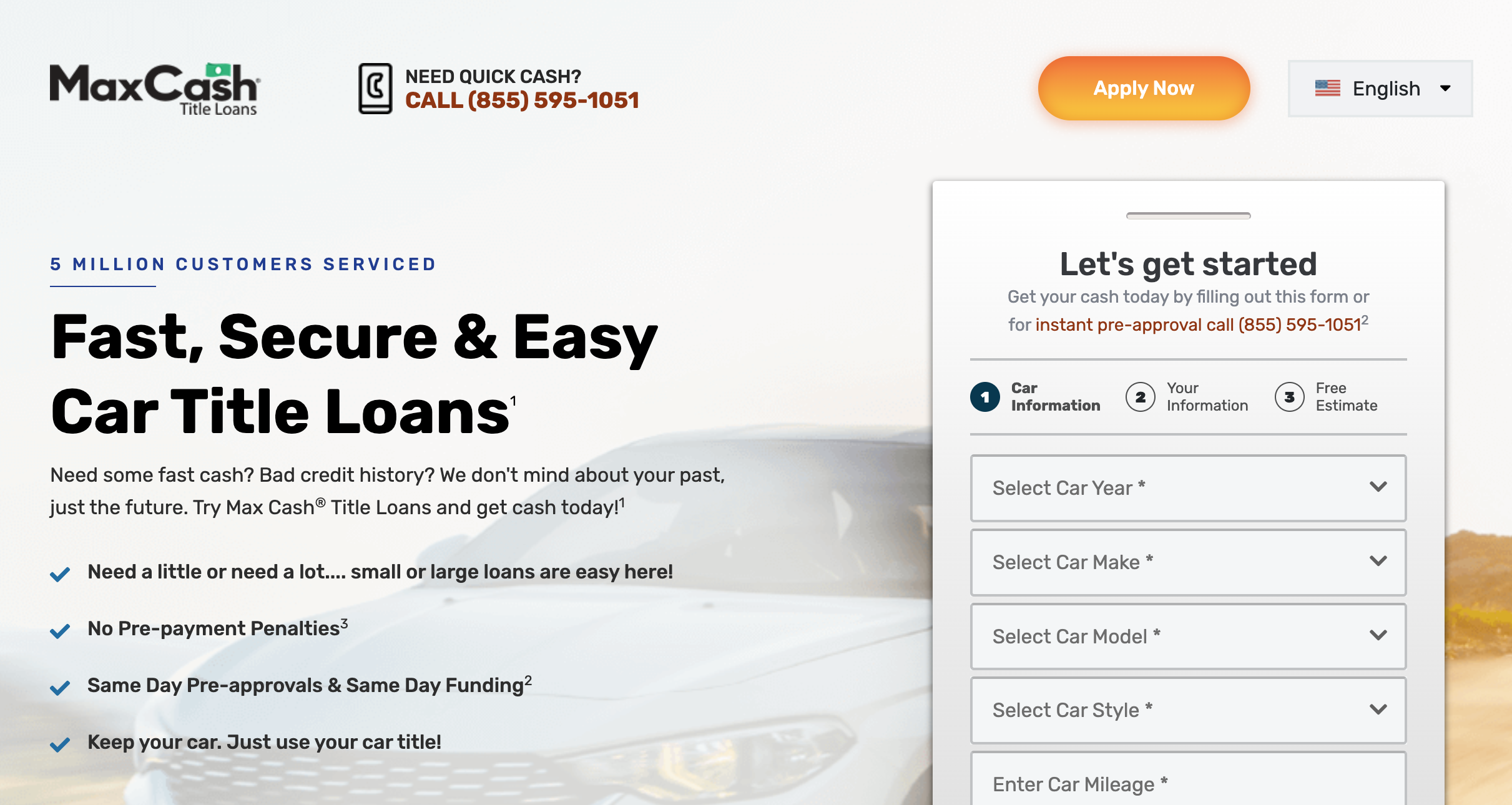

1. Max Cash Title Loans: High Approval Rate

Max Cash is a third-party financial institution that has aided over 500,000 people and their families across the United States to help find the best title loan option. You will be surprised to know that they have funded title loans worth $100 million to date. They offer services across 38 states, have a great reputation for customer satisfaction, and their services are entirely free of cost.

Major Highlights

- Easy application, high approvals

- Better rate comparisons

- Same-day amount disbursal

- Top Google Rating by customers

- Swift customer services

If you have a bad credit score, it is not an issue. Max Cash Title Loan works with several lenders across the United States, as you will have several offers once you submit your application. As one of the best title loan company, they can aid you in getting competitive interest rates and the loan terms that work best for you.

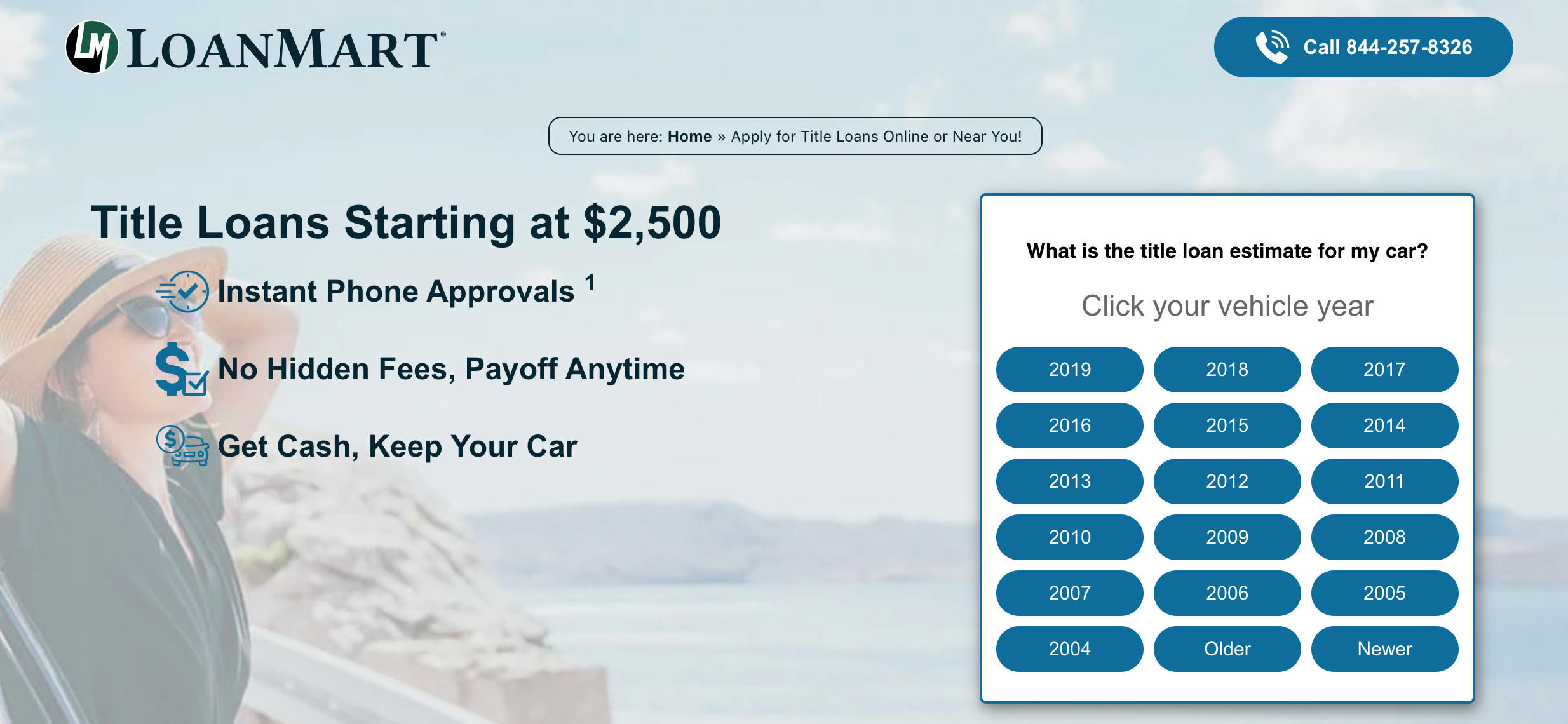

2. Loan Mart Title Loans: Car Title Loan for Any Car, Any Year!

LoanMart is there to help people get title loans whenever they need them. They have serviced over 250,000 customers and is the number one choice for fast title loans. Moreover, it is backed by a good rating from consumers.

Major Highlights

- Money in 3 simple steps

- Bankruptcy/bad credit poses no problem

- Apply over the phone or online

- Same-day funds transfer

- Best loan service and professional support

- Higher rates of approvals

Title loans by Loan Mart can be availed by following a few easy steps. On loan approval, fund transfer is instant. So, stop worrying about your credit score and apply right away to meet financial emergencies.

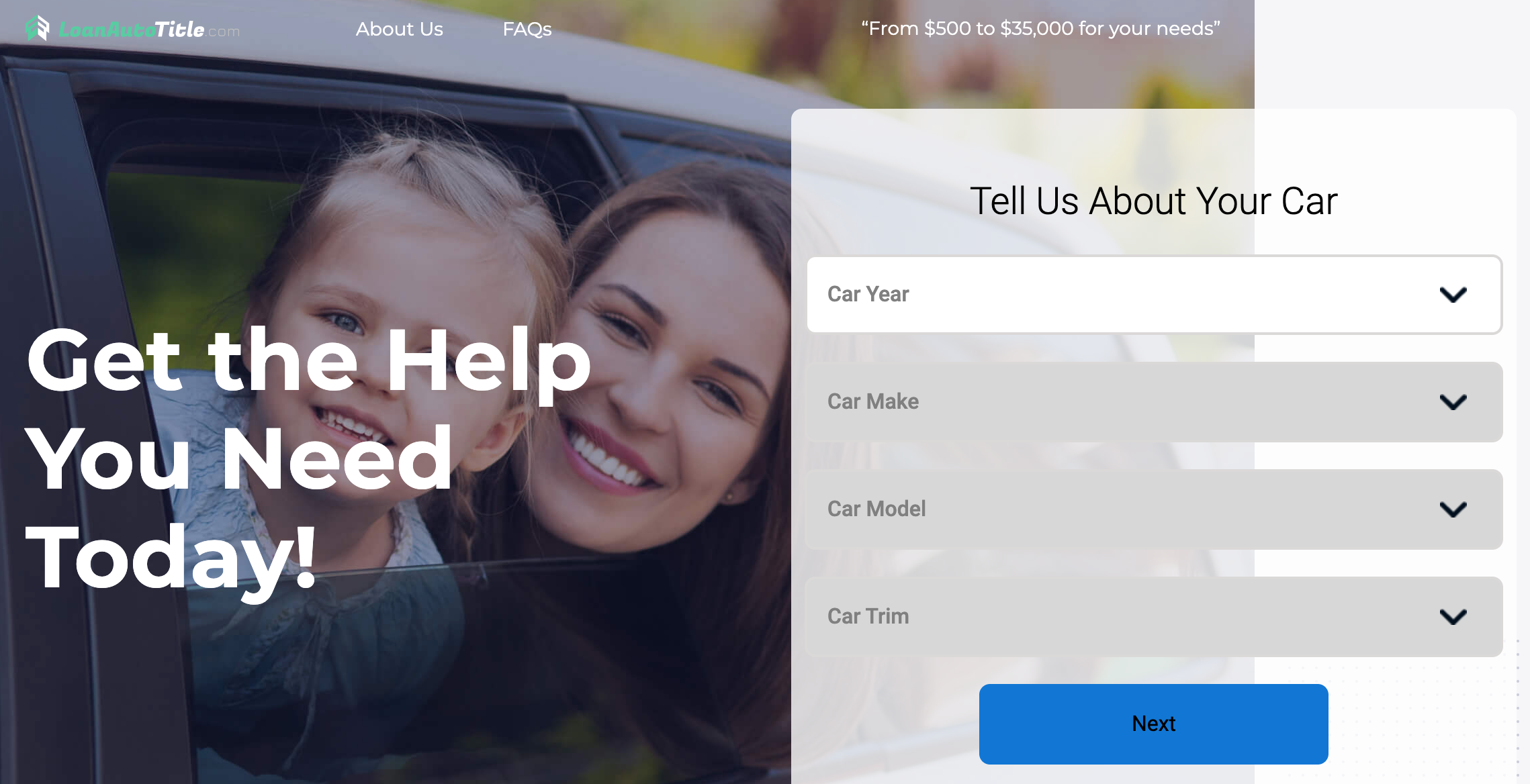

3. LoanAutoTitle.com: Speedy Loans Up To $35,000!

LoanAutoTitle is among the best title loan companies as it strives to offer you the best loan solution from one of the trusted lenders in their database. Credit scores hardly matter. Throughout the entire tenure of the loan, you can easily use your car or any other vehicle you have put up as collateral. The lender even reviews every specific case to inspect the type of loan they can bring together to meet your financial requirements.

Major Highlights

- Loans from $500-$35000

- Serves in numerous states in the US

- Same-Day Loan processing

- No credit checks

- Safety of personal information

If you need cash fast in your account, Loan Auto Title can be a good choice of lending partner. Even with poor credit scores, here you can get fast approval. Moreover, customer service here is always there to resolve your queries related to the entire process from the start to the end.

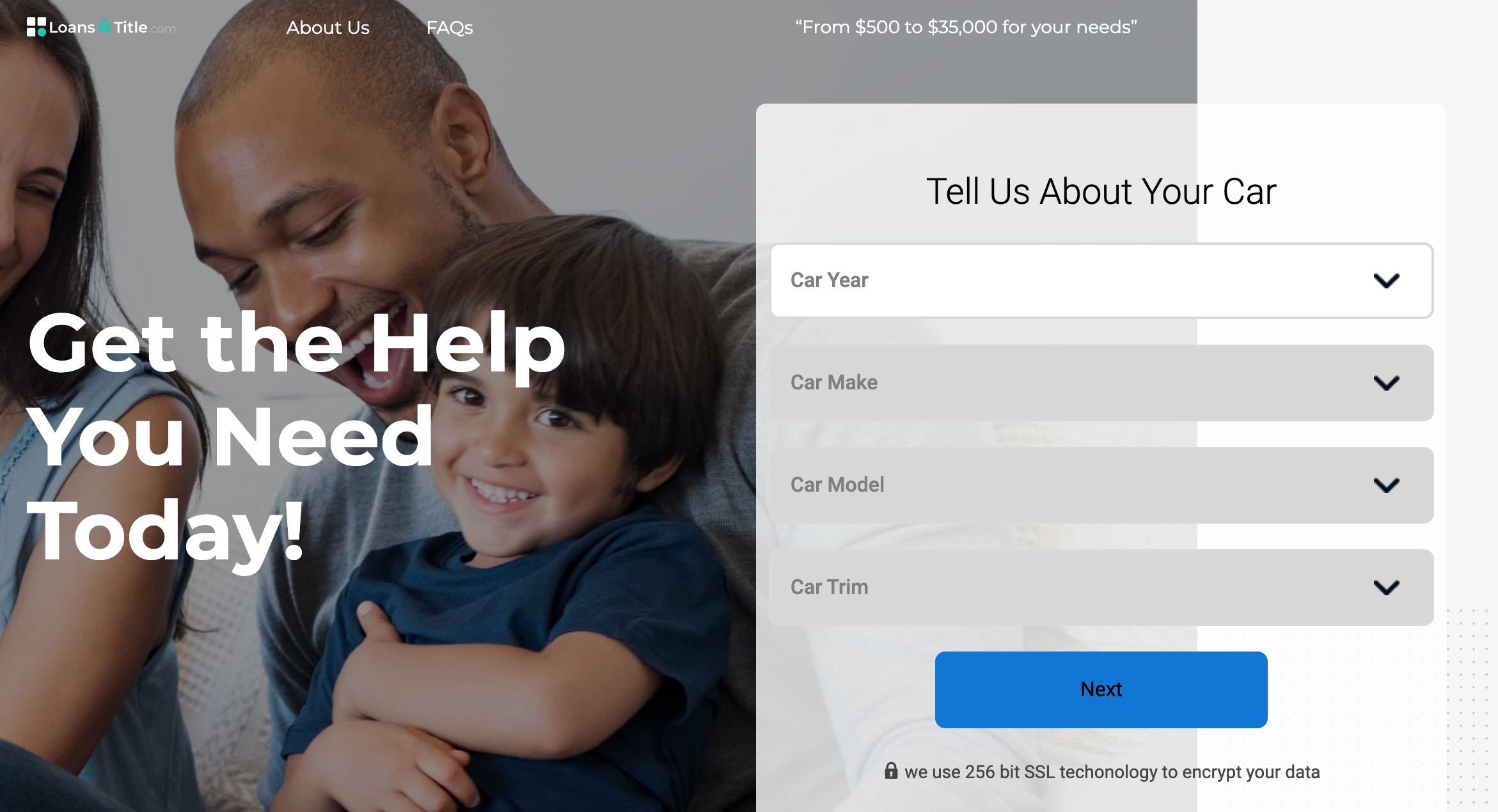

4. Loans4Title.com: FREE Service & Fast Title Loans!

Loan4Title is a direct online lender offering reasonable interest rates and is considered the best title loan company you can pick. They strive to serve customers in numerous states in the United States.

They offer a straightforward online application process, ranging from car title loans to pre-approvals done on call. They have lending partners in many different locations. You can borrow up to $35,000 with loan terms of around 48 months, which keeps the monthly payments lower.

Major Highlights

- Competitive interest rates

- Flexible payment options

- Easier repayment options

- Instant title loans in 24 hours

- Loan terms to around 48 months

- Easy-to-apply loans

We understand how a sudden financial requirement makes things go topsy-turvy. This is why we have listed the title loan companies that offer you the best interest rates and offers. All the companies listed offer speedy and secure loans. Select any one as your best title loan company.

How to Apply for a Car Title Loan in 5 Minutes or Less

Car title loans are the easiest way to get instant cash with a simple application process. The requirements vary across different states and lenders however, typically, the loan process is as follows:

- Step 1: Selecting the best title loan company based on your research and expert recommendations.

- Step 2: Visiting their website and filling in the application form.

- Step 3: Waiting for loan confirmation.

- Step 4: Receiving your loan approval notification.

- Step 5: Finally, getting the loan amount transferred in your bank.

After you are prepared with all the documents, shop around for the best title loan company and compare their rates across different lenders to make sure of availing the best in your offerings. You should understand the entire amount that must be repaid and by when before you sign any document.

What is a Car Title Loan?

A title loan is a kind of loan that permits you to borrow money by using your car as collateral. Unlike unsecured payday loans, title loans are secured to use the vehicle as collateral.

Usually, numerous auto lenders do not perform credit checks as part of the loan procedure as these loans are secured by the vehicle title. A car title loan allows you to borrow about 25 to 50 percent of the vehicle's total value in exchange for the vehicle's title to the lender as collateral. These are short-term loans that generally need to be repaid within fifteen to thirty days.

How Do The Title Loans Work?

Once you apply for a car title loan, the lender will evaluate your car and documents like the car title, registration number, etc. Upon evaluation of your car, he will offer you the loan amount you can get that can be anywhere between 25% to 50% of the current car’s value. The interest rate is usually high and varies for different companies.

On approval of your loan application, the funds are transferred immediately to your bank account. These loans need to be paid back mostly within a month’s time.

Although the term "car" is used commonly when discussing a title loan, these loans can also be obtained against two-wheelers, boats, and other vehicles.

You can easily apply for car title loans online. No need to go anywhere or stand in long queues. However, you might have to visit the physical store later to show your car to the lender and sign the contract.

You must also prepare to offer your lender a clear title, photo ID, and proof of insurance while applying for a title loan. You remain the car owner during repayment unless you default on your loan paybacks.

Just in case, it is not possible for you to pay back on time, you can roll over the loan to a new one with a higher interest rate.

What is the Qualification Criteria for a Car Title Loan?

The eligibility for the car title loan is more or less the same across the US states; however, it may vary a bit from state to state. The key qualification criteria is:

- A car title in your name

- Minimum 18 years of age

- US citizenship or permanent resident

- A basic car insurance (depending on the lender)

- No bankruptcy (depending on the lender)

- No previous loans or liens on your car

- A government-authorized car registration number

- An active bank account

- Contact number and email address

The above eligibility requirements can be met easily. Therefore, the title loan has a higher approval rate even if you have bad credit, low income, or no job. You can apply now to get fast cash.

Does A Title Loan Impact Your Credit Score?

If you get a title loan, it will not impact your credit score. This is because a car title loan is a secured loan where you place an asset, such as your car, as collateral. A car title loan differs from unsecured loans when it comes to the requirement of a good credit score. Unsecured loans require a credit check and higher credit scores to avail greater funds. You do not require any credit with a car title loan.

In simple words, getting a car title loan does not include a credit check as you borrow money against your car. As credit history hardly matters in this type of loan, people with bad credit scores divert to this route to avail themselves of some emergency instant cash, which they cannot get in unsecured personal loans. Unsecured loans are at a greater risk since no collateral is involved, hence credit score is evaluated.

Pre-payments of a title loan also do not affect your credit score since this car title loan involves no credit checks. The risk you face is losing your car if you default on the pay affected negatively is hardly any issue.

If you are looking to apply for such a loan, search for the best title loan company that is trusted and ranked well.

Can You Get a Car Title Loan in All the US States?

You cannot get a car title loan in every US state. The following are the states where you can get a title loan:

- Alabama

- Arizona

- California

- Delaware

- Georgia

- Idaho

- Illinois

- Mississippi

- Missouri

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Virginia

- Wisconsin

In states, such as Nebraska, Ohio and Minnesota, title loans are provided but there are certain constraints. In Montana too there is a specific cap on them. All this is done only to protect those in search of some instant cash.

Alternatives to Car Title Loans

Irrespective of how you are planning for your future and holding the savings, there are times when sudden expenses can impact you. If you do not have sufficient cash for them, then you have no choice other than to search for alternatives. Given below are your options other than car title loans.

Payday Loan

A short-term payday loan is a small amount of loan usually under $1000 and used to cover expenses until your next paycheck. You can easily apply for it online, and the loan amount gets credited to your bank account on the same day you apply.

A payday loan is a form of unsecured loan that does not rely on guarantees as the owner of the car or house.

Payday loans serve as a beneficial solution for short-term cash flow requirements. To qualify, you should be older than 18 years and employed or have a monthly salary of around $750. You should also have a bank account. We have reviewed the top Payday Loan Companies Here.

Payday Alternative Loans

A few federal credit unions also offer PALs or payday alternative loans of $200 to $1000 for tenure or one to six months and a maximum APR rate of 28%. The borrower should be a credit union member for around a month, as there are limitations on the frequency at which the member can take out a PAL.

Personal Loans

You can apply for a personal unsecured loan from a bank, credit union or a private lender. These loans are usually given for large amounts of money as compared to payday loans. The duration to pay back is also longer. These loans help improve credit scores when repaid on time. They are somewhat cheaper than payday loans in terms of interest rates and fees. Several financial institutions offer personal loans with an easy online application process.

Credit Card Cash Advance

A credit card cash advance is yet another way to avail yourself of instant cash. Cash advances mainly have higher interest rates, and you may have to pay a cash advance fee too. The credit card cash advance is easier to apply and cheaper compared to the car title loan, even with these additional charges. Additionally, you can avoid the risk of repossession that arises with using your vehicle as collateral.

F.A.Q

Do I need to have employment to get a title loan?

No. Several title loan lenders do not check your employment status. The only strong requirement they have is you should be the sole car owner.

Can I get a car title loan on any other vehicle?

The title loan is common; however, these loans can be taken even on trucks, motorcycles, and other vehicles. These are often called auto title loans. Lenders need the borrower to show proof of vehicle ownership to get a title loan.

Can a title loan impact my credit?

Title loan companies never ask for your credit scores as the loan is given on behalf of the car title. For this reason, the loan does not impact your credit in any way.

Are title loans provided in all US states?

No title loans are not provided in all US states as they are prohibited in some and have certain restrictions in others.