According to various surveys and polls, it has come to light that a significant percentage of Canadians are badly hit by increasing inflation. In fact, over 50% of Canadians' top resolution was to save in 2023.

During a financial crisis, with no or little savings, millions of Canadians find it impossible to get a loan because of their bad credit score. In such circumstances, the only option you have is high-risk loans. You can get high risk loans guaranteed approval in Canada even if your credit score is on the lower side.

For your convenience, we have listed some of the best lenders for high-risk loans that you can opt for in 2023. If you are one of those Americans who need a no-credit check loan, go through the entire article.

Top 5 High-Risk Loans with Guaranteed Approval

Take advantage of our top-ranking lenders, which has been carefully done by experts. Choose the one you like and get rid of the hassle of filling in several application forms. Just fill in one application form and get connected to a wide lenders’ network to get various loan offers.

- 1. LoanConnect: Same Day Personal Loans Up to $50,000

- 2. Spring Financial: High Risk, Same Day $200-$35000 Payday Loans

- 3. Compare Hub: Best Rate Personal Loan. Free Credit Check

- 4. Loans Canada: Choose from Personal & Other Loan Options

- 5. Prets Quebec: Quick Personal And Commercial Loans

The lenders we have listed are completely trustworthy and have high customers’ ratings. Moreover, the loan process is also very easy. You can get it with minimal applications and requirements. Study the terms and conditions of all the lenders before signing the contract.

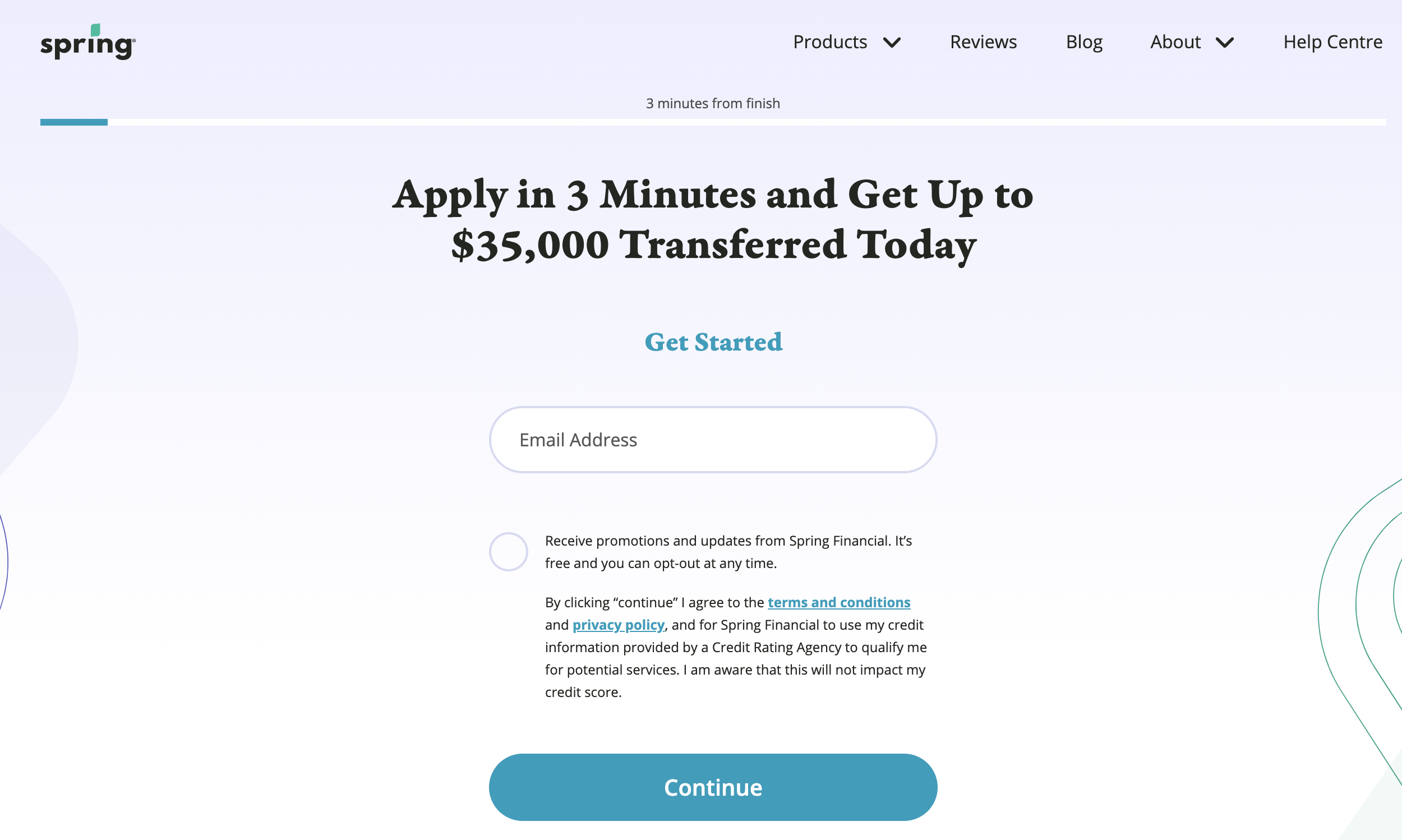

1. Spring Financial: High Risk Payday Loans

To be honest, Viva Payday Loan is the best to get fast payday loans to meet financial emergencies. To get loans from this platform, you need to fulfill a few certain criteria. Once you do that, getting a loan is as easy as 1-2-3.

Key features

- The loan amount can be between 100 – 35000 USD

- The payback time varies between 2 months to 2 years

- The minimum interest rate varies from 5.99% to 35.99%

- You can get quick approval

- Multipurpose loans are available

Viva Payday Loans has many happy customers as its service is excellent and loan offers are many, such as 100-dollar loans, unemployed loans, bad credit loans, cash advances and more. Browse through Viva Payday website to know more about their personal loan offers.

2. Compare Hub: Best Rate Personal Loan. Free Credit Check

On this platform, you can check the personal loan companies and compare them for free. The other two specialties of the site are that you can find good lenders for high-risk loans. Most importantly, you can check your credit score on this platform as well.

Key features

- It is a trusted platform for multiple loan offers

- It has the largest lender network

- You can get exclusive financial tips

- They provide hassle-free and fast approvals

- Popular for personal loans and others

Apart from personal loans, here you can also get business loans as well as auto loans. If you have any queries, their customer care executives are there to solve your queries and concerns. You can trust them for fast loan processing and the best interest rates.

3. Loans Canada: Choose From Personal & Other Loan Options

There are many reasons why Loans Canada is a favorite lender platform used by millions of Canadians. Here, everything is streamlined. Just fill out the application form and you will get loan offers from their lender network. You can compare and select the one of your choice.

Key features

- It offers fast approvals

- You can take loan up to USD 50,000

- You can apply for free

- Chance to make your credit score

- Various options available for affordable financing

- You need to apply once and get multiple options

- The application is easy and has three steps

It is a great platform for high-risk personal loans. No wonder it is trusted by over 1,500,000 Canadians.

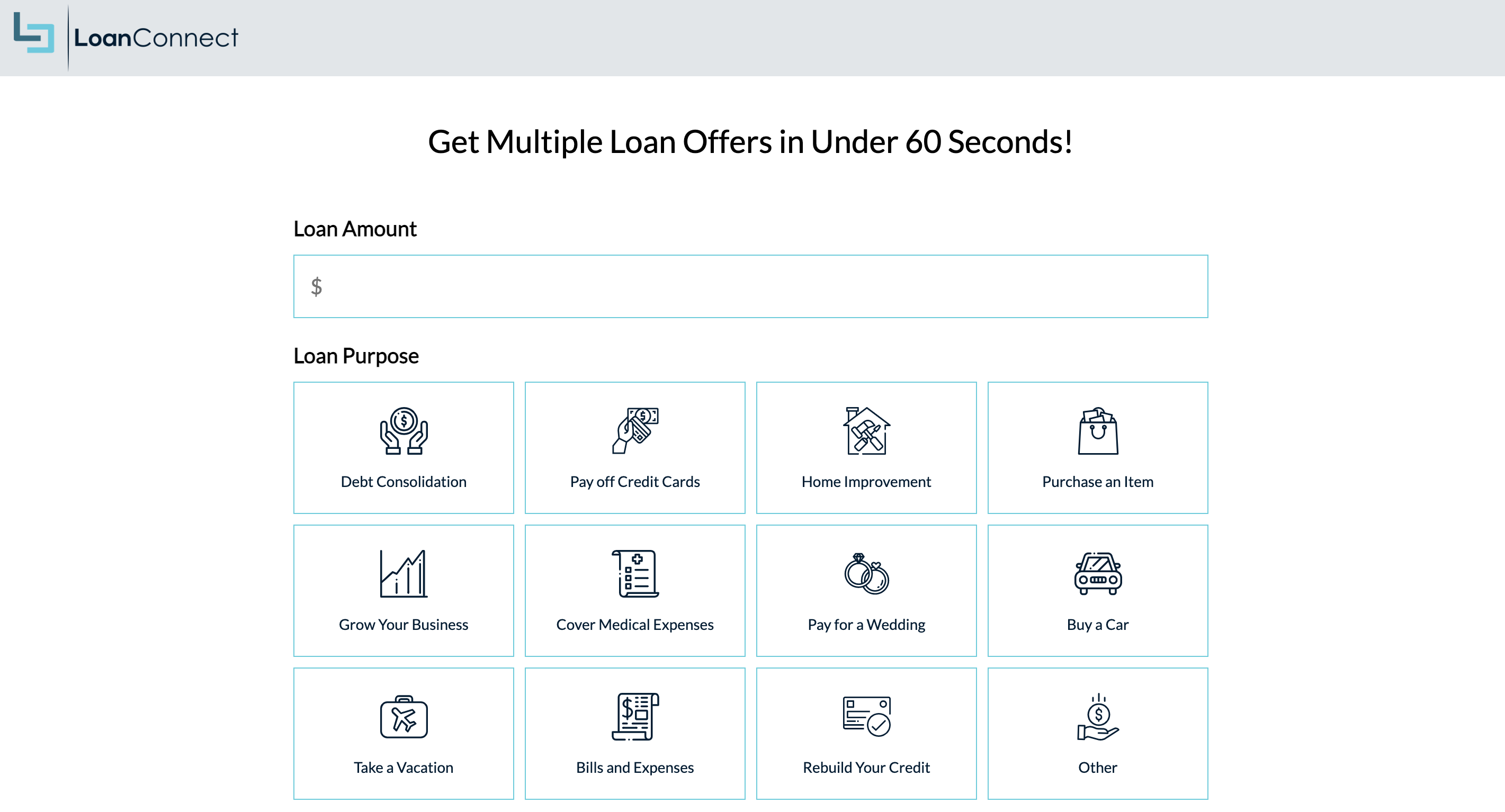

4. LoansConnect: Same Day Personal Loans Up to $50,000

LoansConnect offers a good option when you are looking for a high-risk loan amount. Using this search engine, you can apply for personal loans up to $50,000 in 5 minutes. They offer loans for 3 to 120 months at reasonable rates.

Key features

- The lending amount is between 500 – 50,000 CAD

- The interest rate begins from 6.99%* APR

- The repayment time is between 3 – 120 months

- Various loan options are available

- This is one of the trustworthy platforms.

Just fill in the application and get ready for various loan offers. If you need expert advice, you can get that too along with no service cost.

5. Prets Quebec: Quick Personal And Commercial Loans

One of the best personal loan platforms, here you can also get debt consolidation as well as car and business loans. Simply select the loan you want, submit an application and get the best deals from a wide network of lenders. This platform has the same parent company is same as Loans Canada. It offers a good number of benefits for your high-risk loan applications.

Key features

- You can get rapid approval

- You can get a loan up to 35,000 USD

- Get loans that help re-establish your credit score

- The application process is also simple

- Learning center to take informed decisions

To help you get a loan conveniently, just fill out one loan application, and receive offers from several lenders. All our lender platforms and search engines make loan application process as simple as A-B-C.

How to apply for High-Risk Loans Guaranteed Approval Canada?

Here is how you can apply for high-risk personal loans.

- Find a broker from the list we have recommended.

- Put in all the necessary information as required by the online loan application.

- Wait for the application review and loan offers.

- Select the loan offer you find the best according to your need.

- Once the loan is processed, you will get it in the bank account.

Do ensure that you are aware of all the terms and conditions of high risk loans guaranteed approval Canada. So, choose your lender and apply today.

What Do You Understand about High-Risk Loans?

You must have a thorough understanding of high-risk loans before applying for one. These loans are also called bad credit loans as these are for those with a poor credit score.

So, if you have a low credit history, you can get high-risk loans to meet your sudden expenses. However, be sure to repay on time or it may lower your credit score further.

They are called high-risk loans as those who borrow don't have a good debt repayment track record. High risk loans can be both secured or unsecured loans.

How do high-risk loans work?

If you have a credit score which is below 580, then it is considered a bad credit score. So, even if your credit score is fair, most lending companies will not accept your application. The reason behind rejecting your application is simple. A low credit score simply refers that you will not pay back your debt as understood from the credit history.

When you have a bad credit score, it will also limit your credit card facilities. Therefore, you need to find a company that accepts applications even with a bad credit score.

High risk loans usually do not require any collateral. Credit history may or may not be required. In most cases it is not which is why they are termed as bad credit loans too. Since the risk involved is high, interest rates are also high along with payment penalties. So, unless you are very sure of paying back on time, we suggest, don't go for such high-risk loans.

When you apply for high-risk personal loan, you first need to fill out the loan application at any of our lender network platforms listed above, Next, wait for your application to get reviewed. Once it is approved you will get loan offers from various lenders. You can carefully compare and choose your loan provider. Finally, understand the terms and conditions and sign the contract to get funds fast.

How Do I Know If I Qualify for a High-Risk Loan?

Not everyone qualifies for a $1000 personal loan, as there are specific criteria for that.

In Canada, a poor credit rating is one that is in the 300 to 600 range. It varies for every province and credit bureau. If your loan application is rejected, you have the option for high-risk mortgages. However, the lenders listed with us do offer high-risk loans to those with bad credit. So, do not get disheartened.

However, the interest rates may be as high as 20% and loan duration may be short.

To qualify for a bad credit loan, the basic eligibility pointers are:

- Must be 18 or 19 years as it is different in different provinces.

- Must be a permanent citizen of Canada.

- Should have a personal bank account.

- Should have a working phone number and email address.

- Must have a valid source of income.

Anyone who can meet all the criteria can get his loan approved. Fill out your loan application right now!

How Can You Improve Your Credit Score?

Having a thorough knowledge of how credit score work will let you understand how you can improve it. Let’s see what counts in the process:

- Total debt

- Payment and credit history

- Recent credit activity

- Types of accounts

- Lengths and credit history

All the above factors have a major contribution towards your credit score. To improve your credit score, you can take high-risk loan and repay it on time. Therefore, apply for a high-risk personal loan from the above-mentioned companies.

Remember that high risk loans can be a temporary solution to your immediate problem. So, it is needless to say that you have to work on your credit score. As you have no option of taking a loan using the traditional ways, the companies we have already mentioned will help you get a bad credit loan. On the other hand, repaying on time will help you fix your credit score as well.

As you take the high-risk loan and pay it back, you will still be able to lift your score. With that, you can always go for better loans in future. To improve credit score, follow the steps:

- First, choose a platform from our recommended high risk loan sites and then take a high-risk loan. You need to make a commitment to yourself that you will pay on time. Respecting the process will help you improve your credit score.

- You need to find out what are the negative claims in your report. When you eliminate those clauses, it automatically helps your credit points to lift to some extent.

- Many times, people fall into a situation where their debt becomes way bigger than their income. So, you must maintain a proper ratio of that.

Can I Get a High-Risk Personal Loan in all the Canadian Provinces?

Yes, personal loans are available in most Canadian provinces. The regulations and terms may vary, so do check with the lender. If you have a good credit score, your application will be approved right away. However, if you are looking for a high-risk loan, only specialized lenders will offer you such a loan. Please apply with any of the lending platforms listed above.

Pros and Cons of High-Risk Loans Canada

Like all other loans, high risk loans approval guaranteed Canada as have certain pros and cons. Check out below:

|

Pros |

Cons |

|

· Fast money transfer |

· High rate of interest |

|

· Improves credit score |

· High penalties on missing payments |

|

· Lenders in most Canadian provinces |

· Collateral may be required if credit score is very poor |

|

· Flexible loan repayment duration i.e. 3-60 months |

|

|

· Collateral may not be required |

|

With so many advantages and just a few disadvantages, you can sure go ahead with our lenders offering high risk loans approval Canada.

Alternatives to High-Risk Bad Credit Loans in Canada

Payday loans: If you want some financial assistance on an immediate basis, you can borrow a short-term high-risk payday loan. It would provide you with some quick and urgent cash. If you need somewhere about 1,000 or even less amount that, payday might be the option you have always been looking for. You need to pay the money back on your next payday.

Installment loans: Sometimes you might be in need of more than 1,000 USD. For example, you need something around 4,000 USD which you can only repay over the next few months and not the next month. You may need 12 or 24 months. The best option you have in hand is to go for high-risk installment loans. There are multiple loans available in the market to give you a high-risk installment loan even if you have a bad credit score.

Quick loans: There are times when you might need a loan that is way lower than 1,00 USD, such as 100 or 200 USD. These amounts of money can be borrowed via high-risk quick loans. You can easily find companies that provide you with a small amount of high-risk quick loans.

Secured personal loan: Finding a loan with a bad credit history can be difficult. In this situation, the perfect thing to do is to find a company that provides high-risk secure personal loans, such as a car title loan.

F.A.Q.

Is it possible to get a high-risk loan when your credit score is bad?

If your credit score is as bad as 300 or 400 points, your loan application will most likely get rejected. However, high-risk loans are made for these exact reasons only. As per many reports, millions of Canadians cannot take a normal loan because of bad credit score. It limits conventional credit options. If you have a bad score, go for high-risk loans provided by lenders we have listed above in this article.

Is high-risk personal loan a legal option to take?

Sure it is a legal option. However, what you need to be extra careful is that the lender should be trustworthy and registered or not.

Who can apply for bad loan credit scores in Canada?

Anyone who is a citizen of Canada or is a permanent resident in Canada can apply for loans with bad credit scores. You must have the required documents.

Can you get a loan of high risk if the credit score is 500?

Sure. One of the main benefits of high-risk loans is that they maintain a high approval. Therefore, you do not have to worry about what your credit score is. In fact, when you have a bad score, that is when you would require high-risk loans. On the other hand, having a credit score of 550 can put you on the top of the list. 500-550 will make a top percentage on the requests for high-risk loans. So, the chances of your application being approved with this kind of score are on top.

How can I improve my credit score?

It is very much possible to improve your credit score and use it for your future endeavor. One of the best ways of improving your credit score is to pay for your loans on time. In fact, when you borrow money from these high-risk platforms and pay them on time, you can improve your credit score in that process as well. Another option is hiring credit score repair companies. They completely work on making your credit score better. They help identify the negative claims and help to get them removed from your credit reports resulting in lifted credit score. You can apply for a free credit score Here

How do lending companies measure the creditworthiness of borrowers?

Creditworthiness is measured by 5 Cs i.e. the capacity to repay the loan, capital or assets owned by the borrower, and conditions i.e. external factors at the time of lending like economic trends, collateral worth, character i.e. integrity of the borrower and willingness to pay. So, when anyone goes for high-risk personal loans, these are the 5 Cs that will decide your creditworthiness and play a key role in your loan application getting approved.