See our complete ranking of the top personal loans offered without a credit check below. Fast Money Source earned the top spot since they satisfied all the requirements we had set forth while seeking a personal loan.

| Brand | Summary | Score |

| Fast Money Source | Instant Payday Loan | 10/10 |

| Fast Loans Group | Fast Release of Funds | 9.5/10 |

| Loan Raptor | Fast Approval | 9/10 |

| Honest Loans | Affordable Payday Loans | 9/10 |

| Credit Clock | Reliable Loans | 9/10 |

| Heart Paydays | Limited Credit history required | 8/10 |

| Low Credit Finance | Good for low income | 8/10 |

| Big Buck Loans | Good APR rates | 8/10 |

If you have bad credit, a limited credit history, you’re unemployed or your income is low at the moment, then it will be hard for you to qualify for a loan and get the money you need urgently.

However, our selected list of lenders that offer instant payday loans online guaranteed approval will be more than happy to lend you the money you need regardless of your credit score, credit history, or current employment situation.

If you want to get cash as soon as possible, then come with us to check out our ranking.

List of the Top 7 Lenders for Fast Payday Loans Online Guaranteed Approval

Now you can check out our recommended lenders to request your instant payday loan right now:

- 1. Fast Money Source: Best Overall Instant Payday Loans Online

- 2. Fast Loans Group: Fastest Disbursement

- 3. Loan Raptor: Instant Approval

- 4. Honest Loans: Most Affordable Instant Payday Loans

- 5. Credit Clock: Most Reliable Instant Payday Loans

- 6. Heart Paydays: Best for Limited Credit History

- 7. Low Credit Finance: Best for Low Income

- 8. Big Buck Loans: Best for Bad Credit

Thanks to their instant approval and fast disbursement, you will obtain the money you need in record time, making it ideal for emergencies and hardships.

Would you like to learn more about each lender? Then we will help you to make a good decision by bringing you more information about each company. Here you have our complete reviews.

1. Fast Money Source: Best Overall Instant Payday Loans Online

Fast Money Source is the firm representation of the best instant payday loan offer in 2024 because it offers you the following benefits:

- Receive the money in your bank account fast

- Reduce the cost of your payday loan thanks to their competitive interest rates (as low as 6%)

- Get approved even if you have bad credit, limited credit history of if you’re unemployed or low income

- Borrow as much as $50,000 without problems (if your state allows it)

- Relax and manage your debt without worries thanks to their flexible repayment terms and conditions

- Build a better credit score by using their instant payday loans

- Get help whenever you need it thanks to their efficient customer support service.

Now you can see why Fast Money Source is the best choice if you’re looking for an instant payday loan, because they offer you all the benefits that matter.

2. Fast Loans Group: Fast Payday Loans

Fast Loans Group is the fastest payday lender from our ranking when it comes to disbursement, and this is just one of the key advantages they offer you:

- Get the money you need the soonest thanks to their premium disbursement process

- Borrow the money you need at a fair cost

- Get approved even with bad credit

- Borrow as much money as you need and within the regulations of the state you live in

- Flexible repayment timers and conditions

The only aspects they should improve is their interest rate to make it more competitive when compared to Fast Money Source and Honest Loans, but other than that it’s one of the best choices in 2024, especially if you only care about receiving the loan money as soon as possible.

3. Honest Loans: Most Affordable Instant Payday Loans

Honest Loans is the instant payday lending company to trust when looking for the most affordable interest rate and fees, but this is just one of their many benefits:

- Get the most affordable instant payday loan thanks to their lowest interest rate (can be lower than 6% APR)

- Get approved instantly and receive the money in record time

- Get approved even with bad credit or low income

- Receive help fast thanks to their efficient customer support service

This company is one of our favorites because they have an incredible instant payday loan offer thanks to their low interest rate, fast disbursement, flexible loan terms and high approval rate, making it a great recommendation. The only aspect to consider is that they’re a broker, and hence the conditions might vary depending on the direct lenders.

4. Credit Clock: Most Reliable Instant Payday Loans

Credit Clock is active 24/7 and ready to approve your application instantly and disburse the money in just a few hours so you can use it for any sort of emergency, making it the most reliable company from our ranking. Here you have all the benefits that this company can offer you:

- Get money when you need it the most thanks to their 24/7 service

- Get money fast thanks to their quick disbursement process

- Get approved even with bad credit

- Repay the loan on your preferred terms and conditions.

If you need money for an emergency at odd times of the day, especially during holidays, then Credit Clock is the brand to choose. And since their interest rate is within the acceptable range, they can disburse the loan fast and they offer a high approval rate for bad credit customers, it’s one of the best options in our ranking.

However, they have a strict minimum income requirement, making it harder for low income customers to get approved.

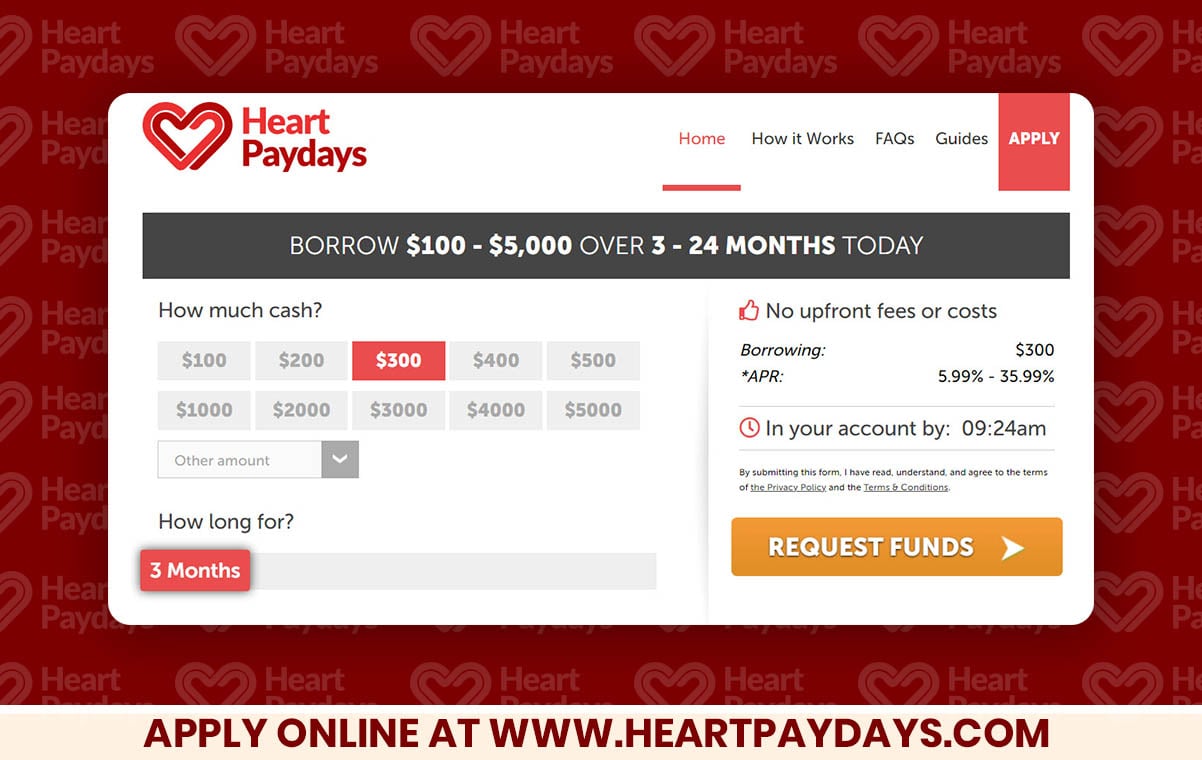

5. Heart Paydays: Best for Limited Credit History

Heart Payday is the best payday loans broker if you have a limited credit history, or even worse, zero credit activity. Thanks to their network of direct lenders that can approve customers with limited credit history, this broker is your best choice - and in addition you will enjoy these other benefits:

- Highest approval rate for customers with limited credit history

- Get approved even with bad credit or low income

- Get an instant payday loan at a fair cost thanks to their competitive interest rate

- Receive the money in record time thanks to their fast disbursement process

Because they don’t perform credit checks at all, direct lenders at Heart Paydays are highly likely to approve your application even with zero credit activity. As long as you can show that your income is verifiable, reliable and enough to cover the expenses of the loan, you will be approved in the majority of cases.

6. Low Credit Finance: Best for Low Income

If you have low income and your income source is not the usual job or business, then Low Credit Finance will be the ideal choice because they offer the highest approval rate for low income borrowers, even if you have an unconventional income source. And they can also offer you the following benefits:

- Highest approval rate for low income and unemployed customers

- Fast disbursement

- Accepts customers with bad credit

- Flexible repayment terms

As you can see, Low Credit Finance is a godsend for people struggling to make ends meet - because you can borrow the money you need and get it in your bank account the same day. However, watch out for their interest rate because it can be higher than average.

7. Big Buck Loans: Best for Bad Credit

If you have a low credit score, and even if you have extremely bad credit, Big Buck Loans is ready to bring you the instant payday loan online that you need. Since they have the highest approval rate for bad credit customers, it’s almost guaranteed that you will be approved - and you’ll also be able to enjoy these benefits:

- Highest approval rate for bad credit and extremely bad credit

- Fast disbursement

- Accepts customers with low income or unemployed

- Great customer support service

- Good repayment terms and conditions

If your credit score is pretty bad, then the choice is evident. And since they also accept low income and unemployed customers, they’re a solid company even if their interest rate can be higher than average.

How to Apply for Fast Payday Loans Online with Guaranteed Approval

The application process is simple, easy and fast. You can complete it in only 5 steps and you will receive the money in record time (usually the same day):

- Choose an instant payday lending company from our ranking

- Visit their official website

- Fill out the quick application form

- Send your application and wait for approval

- Get approved and receive the loan amount in your bank account.

This is the exact process you’ll have to follow when applying for a loan at our recommended companies. So don’t lose more time and apply for your loan now.

What Are Instant Payday Loans Online Guaranteed Approval?

These are payday loans that offer you instant approval and usually believed to offer guaranteed approval because their eligibility requirements are surprisingly easy to meet, even if you have bad credit, zero credit history or low income. However, no lender can offer guaranteed approval because it’s prohibited by the CFPB and other US banking regulators.

Nonetheless, since our recommended lenders make the qualification process so easy, you will be approved immediately as long as you meet the minimum eligibility requirements:

- Being at least 18 years old

- Being a US citizen or permanent resident

- Having a reliable income source

- Having an active bank account

“Guaranteed approval” would be a lie because you cannot get approved if you don’t have an income source, you’re not at least 18 years old or if the state you live in prohibits payday loans (13 US states do not consider payday loans as legal). However, since the standards for approval are low, you will be accepted in the vast majority of cases.

Dissecting Instant Payday Loans Online: What Are Its Features?

To understand what instant payday loans online with guaranteed approval are, then it’s a good idea to dissect it in its different features:

Short-term: You usually have to repay the payday loan as soon as possible, because the majority of lenders that offer such products will let you know that you have to pay it back in 7-28 days. However, our recommended lenders usually offer better conditions in this area, such as up to 24-36 months to pay it back

High Approval Rate: They usually believed to be “guaranteed approval” thanks to their high approval rate, which is the highest when compared to other types of loans such as personal loans, installment loans

Instant Approval: These lenders are famous for their highly efficient systems that are capable of automatically detecting if you meet their eligibility requirements, and if you do then they will approve you instantly

Fast Disbursement: They are also known for disbursing loans fast once you’ve been approved and you’ve agreed to the final terms and conditions

High Cost: Instant payday loans are usually more expensive than regular loans because they accept customers that other banks and financial institutions would never accept, but our recommended payday loan lenders offer the most competitive interest rate and fees in this sector of the market.

About the CFPB and US Banking Regulators

No payday loan lender can offer loans with “guaranteed approval” because it’d be impossible since they’d end up accepting customers with no money to repay the loan, making it a bad business decision for them. And in addition to this fact, the CFPB and US banking regulators forbid this type of practice.

The CFPB (Consumer Financial Protection Bureau) is a government agency whose mission is to protect you as a customer, and in this case, when applying and repaying a payday loan. Thanks to their rulings and regulations, payday loans companies cannot collect payments from your bank account in a way that would make you pay hefty fees or go against the terms and conditions of the contract and what you expected in the first place.

Therefore, the CFPB and the other US Banking Regulators are in charging of informing you, as a borrower, about your rights while making sure that payday lending companies meet all the of the current regulations for this industry.

Who Can Qualify for Fast Payday Loans Online with Guaranteed Approval?

The term “guaranteed approval” does not mean that all and every single person that applies will be approved - because you still need to meet some minimum eligibility requirements. Here’s what you need to know:

- You must be 18 years old or older

- You must be a US citizen or permanent resident status

- You must have a verifiable source of income

- You must have a solid, recurrent and stable income

- You must have a sufficient debt to income ratio

- You must have a valid bank account

- You must have a valid phone number and email address.

If you meet these requirements, then it’s highly likely that our recommended lenders will approve your application. Because as you have seen, you can still qualify for the loan you need with extremely bad credit, no credit history or if you’re currently unemployed.

Who Can Take Advantage of Instant Payday Loans Online with Guaranteed Approval?

These loans have been especially designed to solve specific problems that millions of Americans like you face when applying for an online loan. Therefore, here you have the list of customers that can make good use of these loans. Read more in This Article about our recommended loans.

Bad Credit

If you have a credit score lower than 670 points, then the majority of banks will reject your application right off the bat. And since they will perform a hard credit check, then it will reduce your credit score even more, leaving you in a worse situation than you were before applying for the loan.

On the other hand, our recommended lenders happily welcome customers with bad credit, and even extremely bad credit. If you’re in this situation, then you can apply for an instant payday loan at our recommended companies with total confidence, because chances are they will approve your application.

Related posts about Personal Loans with No Credit Check

Low Income

Life has ups and lows, and this also applies to the money we make for a living. And when you hit a low in your income, you will find it hard to get approved for a loan because you won’t meet the minimum monthly requirement by traditional banks and financial institutions. Fortunately, our recommended lenders accept low income borrowers, making it possible for you to get the money you need.

Limited or No Credit History

A limited or non-existent credit history is one of the most common reasons why a loan application will get turned down, because banks and traditional lenders simply won’t have enough info to evaluate your creditworthiness. However, since our recommended lenders rely on alternative factors to determine if you are eligible for a loan, you can get an instant payday loan even with zero credit history.

Unemployed

If you’ve lost your job recently due to the massive layoffs (just like thousands of Americans across the country), then it will be virtually impossible for you to get a loan, especially if you have bad credit or a limited credit history. The good news is that our selected companies accept unemployed borrowers, making it a reality for you to get fast cash in the form of payday loans.

Rejected

Even if you’ve been rejected by all the banks in existence in the United States, our recommended lenders won’t take this into account when reviewing your loan application. You can apply and get approved as long as you meet their eligibility requirements.

Why Our Recommended Instant Payday Loans Online Guaranteed Approval Are the Best Market in the Market

We’ve personally analyzed the entire market of instant payday loans online to identify the best lenders available in 2024. After reviewing each company carefully, by using the methodology you’re about to see, we’ve been able to find which loans that bring you money fast at a fair interest rate, low fees and with high limits for any type of purpose.

Lender Background

The lender must be registered in the states they do business in, they must meet all the regulations, standards and law by the CFPB and US Banking Regulators, they must have a clean record along with plenty of positive reviews and ratings, specifically talking about their instant payday loans.

Approval Rate

Since we are recommending lenders that can approve your application in the majority of cases, it’s only logical to focus on the companies that offer the highest approval rate. Be it for low income, bad credit, zero credit history or for unemployed borrowers, our selected payday lending companies will approve your application the majority of the time.

Approval Speed

Since we are recommending INSTANT payday loans, it makes sense to only select the lenders with the fastest approval process. That’s why all of our lenders and brokers can approve you application instantly, as long as you meet all of their eligibility requirements. All without performing a hard credit check that would hurt your credit score.

Disbursement Speed

Even though disbursement cannot be instant if you’re a new user, it should be as fast as possible. That’s why our selected brands offer the fastest disbursement process in the industry of instant payday loans, so you can get the money you need in record time.

Interest Rate and Fees

We know that payday loans are known for being expensive products, but you can relax now by knowing that we’ve selected the companies with the lowest interest rates and fees for instant payday loans. They’re still pricier than a regular loan for a customer with a high credit score, but when compared to other payday lending offers, you’ll find ours much cheaper and convenient.

Loan Term

Payday loans are also known for being short-term, bringing you anywhere from 7-28 days to pay back. Fortunately, the game has changed and our recommended brands are pioneers in doing this, because they’ve innovated payday loans when it comes to the loan term, bringing you more time to repay it. Be it 3, 6, 12 or even 24 months, our brokers and lenders can give you all the flexibility you need for repaying your payday loan.

Loan Amount

The maximum amount you can borrow will be determined by the state you live in. For example, California has set the limit for payday loans at $300, making $255 payday loans very popular as a result. However, our lenders are ready to lend you as much as you need, be it $100, $200, $500, $1,000, $2,000, $5,000 or even more - as long as your state allows it.

Advantages and Disadvantages of Instant Payday Loans Online with Guaranteed Approval

For quick comparison to make a fast decision, here you have our table with the advantages versus disadvantages of the payday loan we recommend.

|

Advantages |

Disadvantages |

|

You can get approved even with bad credit or extremely bad credit |

Instant payday loans are not available in all states |

|

You can receive the loan money the same day |

The average cost of an instant payday loan can be higher than a conventional personal loan |

|

You can get approved even with no job or if you have low income |

|

|

The interest rate can be as low as 6% |

|

|

You can use the money for any purpose |

|

|

You can use these loans to build up your credit and improve your credit score |

Now that you know the good and the bad, you will be able to make a good decision. And we have to add that the value of our recommended loans massively overcome their two downsides, making them a reliable source of money when you need cash urgently.

Alternatives to Instant Payday Loans Online Guaranteed Approval

If you’ve realized that an instant payday loan might not be the best choice for you, then here you have the best alternatives.

Installment Loans

If you’d like more flexibility when it comes to the loan terms, such as being able to repay the loan in 60+ months and in smaller monthly payments, then an installment loan would be ideal for you. And since the loan term will be longer, you can usually borrow even more money such as $5,000, $10,000, $50,000 or even more without the state-level restrictions that are usually applied to payday loans, many of which are capped off at $300-500 at a time.

Title Loans

If you want to reduce the interest rate and fees while increasing your chances of approval and the max loan amount, then a title loan would be an excellent choice. If you have a valuable asset such as a home that is titled to your name, then you can use it as collateral to obtain the money you need. See our list Here for top Title loan companies

Cash Advance

If you have an active credit card, then you can request your credit card company to turn a specific percentage or amount of your credit line into cash that you can freely use. For example, if you have a credit line of $2,000, then you could request your credit card company to bring you a cash advance of $500, which would be accepted easily since it doesn’t represent a big percentage of your available credit line.

F.A.Q

Here you will find more information about our recommended instant payday loans with guaranteed approval, in the form of answers to the most frequently asked questions about them.

Are instant payday loans online guaranteed approval safe?

Yes, all of our recommended instant payday loans are safe because they’re issued by lenders that are registered in the US states they do business in and that meet all the standards, laws and regulations of the CFPB and other US banking regulators. Additionally, the lenders we recommend are supported by the community, with a majority of positive reviews and ratings.

Do instant payday loans online with guaranteed approval disburse the money immediately?

No, unless you become a regular client. For new borrowers, the process will typically take anywhere from 1 to 24 hours, making it possible for you to get the cash the same day. If you need the money as soon as possible, then check out our ranking for the fastest lenders.

How much does an instant payday loan online with guaranteed approval cost?

This will depend on the fees and/or interest rate that the lender will charge you based on your income level, debt to income ratio, current employment situation and other factors. For example, if you opt for a flat fee of $20 per every $100 you borrow and you decide to apply for a $500 payday loan with instant approval, then you’d have to pay back $600 in total, from which $500 would be the capital and $100 the interest ($20 x 5).

Can you get an instant payday loan online with guaranteed approval in 1 hour?

Yes, but it depends on the lender you choose from our ranking. As you will be able to see Here, there are some lenders and brokers that are faster than others, and hence, if you need money fast, then you should apply for a loan at the companies with the fastest disbursement process.

Does an instant payday loan online guaranteed approval require a credit check?

Yes, although most of the time it'll be a light credit check that doesn't lower your score. The CFPB and the US banking regulators demand lenders to perform a credit check, but our selected lenders won’t take your credit score into account when evaluating your application.