Are you looking for an alternative to Credit Ninja? Be it that your application was rejected or you’ve become aware of the problems of this lender such as their high interest rate, expensive origination fees, limited availability to bad credit and unemployed customers, and slow approval process, we’re here to suggest you the best loans like Credit Ninja you can apply for in 2024.

Come with us to check our exclusive ranking right now.

Overview of Similar Loans to Credit Ninja

Here you have 7 solid alternatives that are better than Credit Ninja in areas such as interest rate, approval rate, disbursement speed, customer support and max loan amount:

- ZippyLoan: Best Credit Ninja Alternative

- HonestLoans.net: Lower Interest Rate and Fees

- Viva Loans: Faster Approval

- CreditClock: Better Availability

- Heart Paydays: No Credit History Required

- Big Buck Loans: Better for Bad Credit

- Low Credit Finance: Better for Unemployed

Now you can choose the lender that better meets your needs to get the loan that will solve your problems as soon as possible and at the right cost.

If you need more information before you make a decision, then keep reading because we’ll bring you more data about each one of the Credit Ninja alternatives that we recommend.

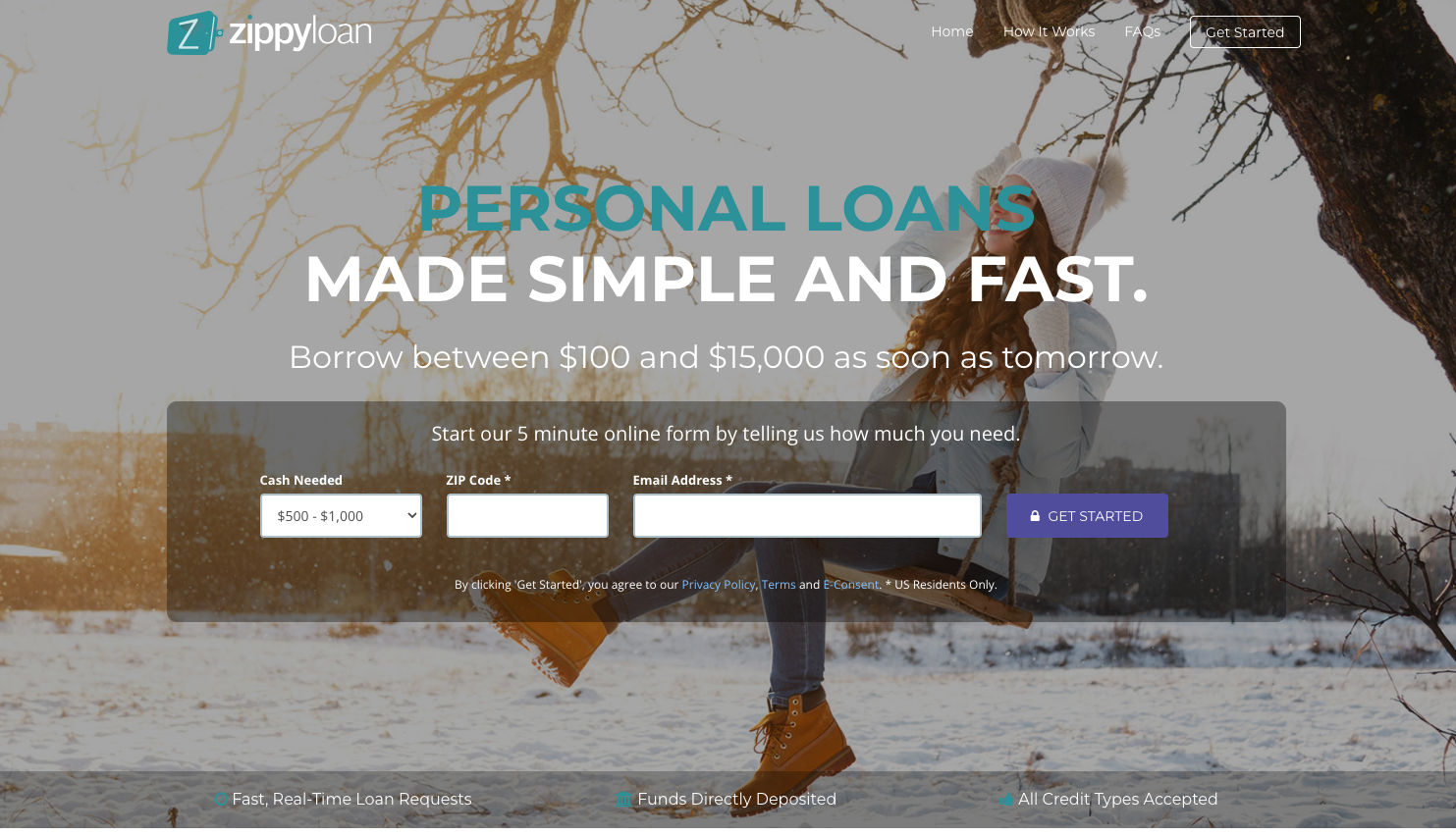

1. ZippyLoan: Best Credit Ninja Alternative

Credit Ninja charges a high origination fee, they don’t approve as many no credit history, bad credit or unemployed borrowers as they say, they have a slow approval process and their interest rate can be quite high -so many problems that you won’t face if you choose ZippyLoan instead.

With a low interest rate, cheap fees, quick approval and same day disbursement, a high approval rate for bad credit, no credit history and unemployed customers, and the possibility to borrow up to $15,000 - ZippyLoan is the best Credit Ninja alternative in 2024.

2. HonestLoans.net: Lower Interest Rate and Fees

Credit Ninja can charge an origination fee of 5% in addition to their high interest rate (especially if you have bad credit), two things that will make your loan considerably more expensive. If you only want to pay the fair price, then you should choose HonestLoans.net instead because it offers a low interest rate, cheaper fees and a higher approval rate for bad credit borrowers.

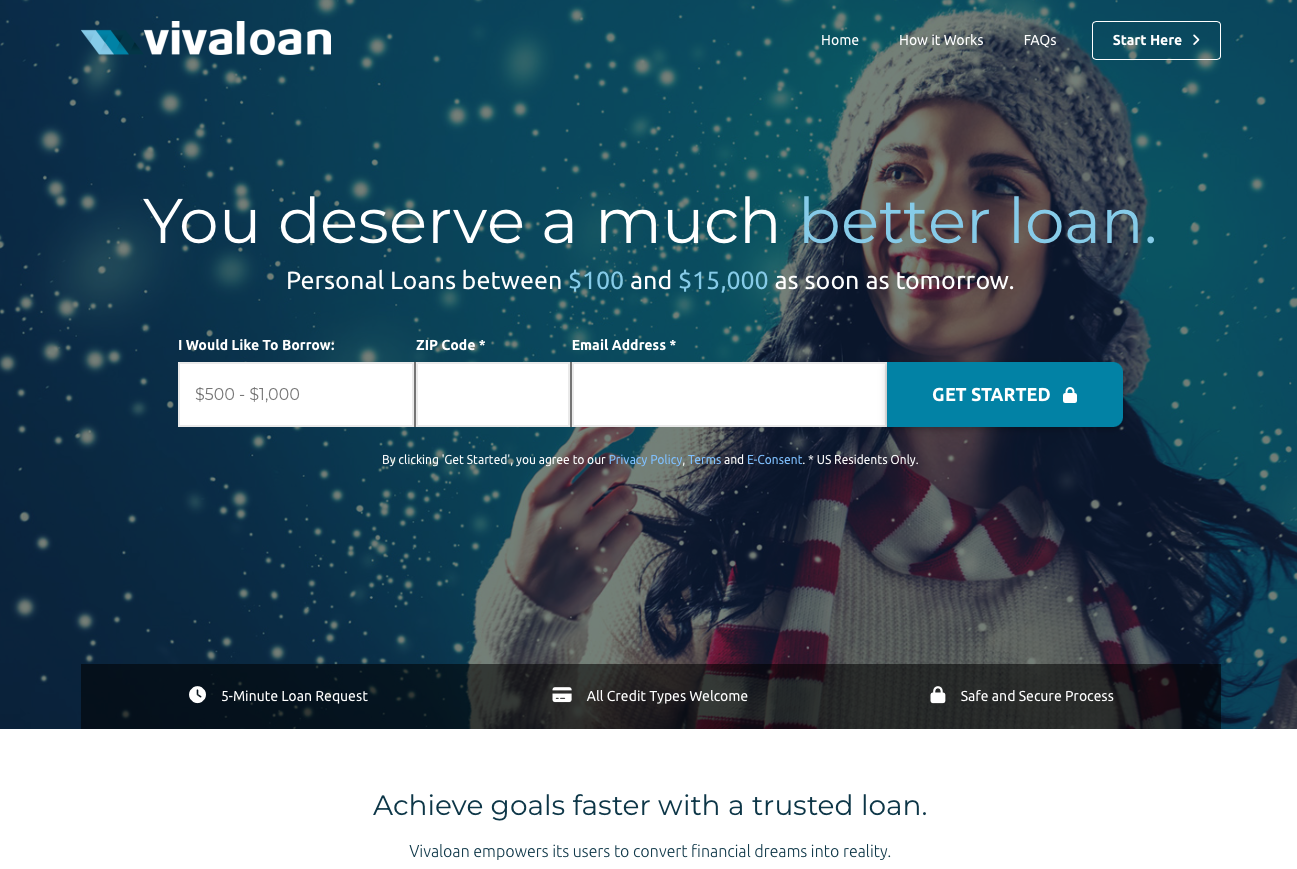

3. Viva Loans: Faster Approval

Credit Ninja can take a while to approve your loan, that’s why we recommend you to choose Viva Payday Loans instead because they can approve your loan immediately and disburse the money the same day - barely 1 to 2 hours in the majority of cases. And it also offers a high approval rate for bad credit and a competitive interest rate + fees.

4. CreditClock: Better Availability

Credit Ninja won’t come to save you if you need money at 2 AM on Thanksgiving but CreditClock will surely help you thanks to their 24/7/365 availability. If you need money for an emergency outside of business hours, then CreditClock is the best choice especially because they offer a competitive interest rate and fast approval and disbursement.

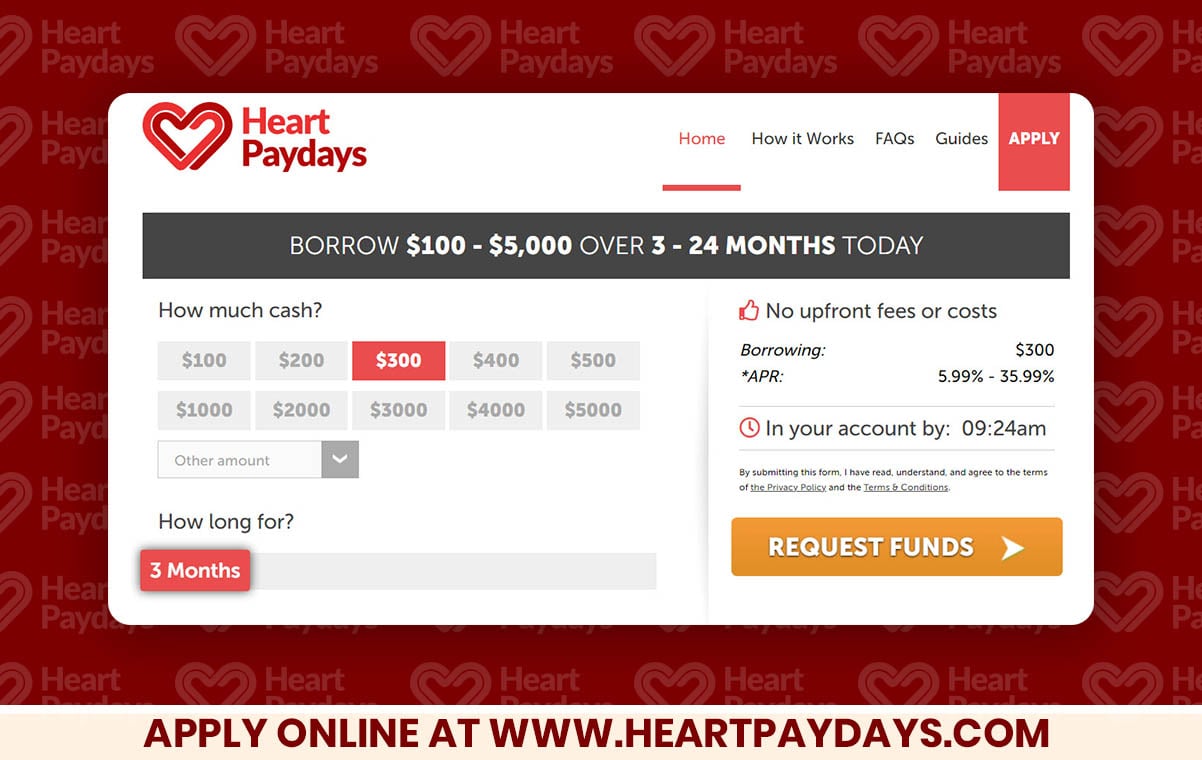

5. Heart Paydays: No Credit History Required

It is almost certain that Credit Ninja will reject your application if you don’t have a credit history, which is something that Heart Paydays doesn’t take into account when reviewing your application. If your credit history is fresh and you want to only pay a fair price, then this lender is a good alternative.

6. Big Buck Loans: Better for Bad Credit

Getting approved for a loan at Credit Ninja can be very hard, but thankfully you can count on Big Buck Loans to bring you the loan you need even if you have an extremely low credit score. Even if it’s only 300 points, you can get approved quite fast.

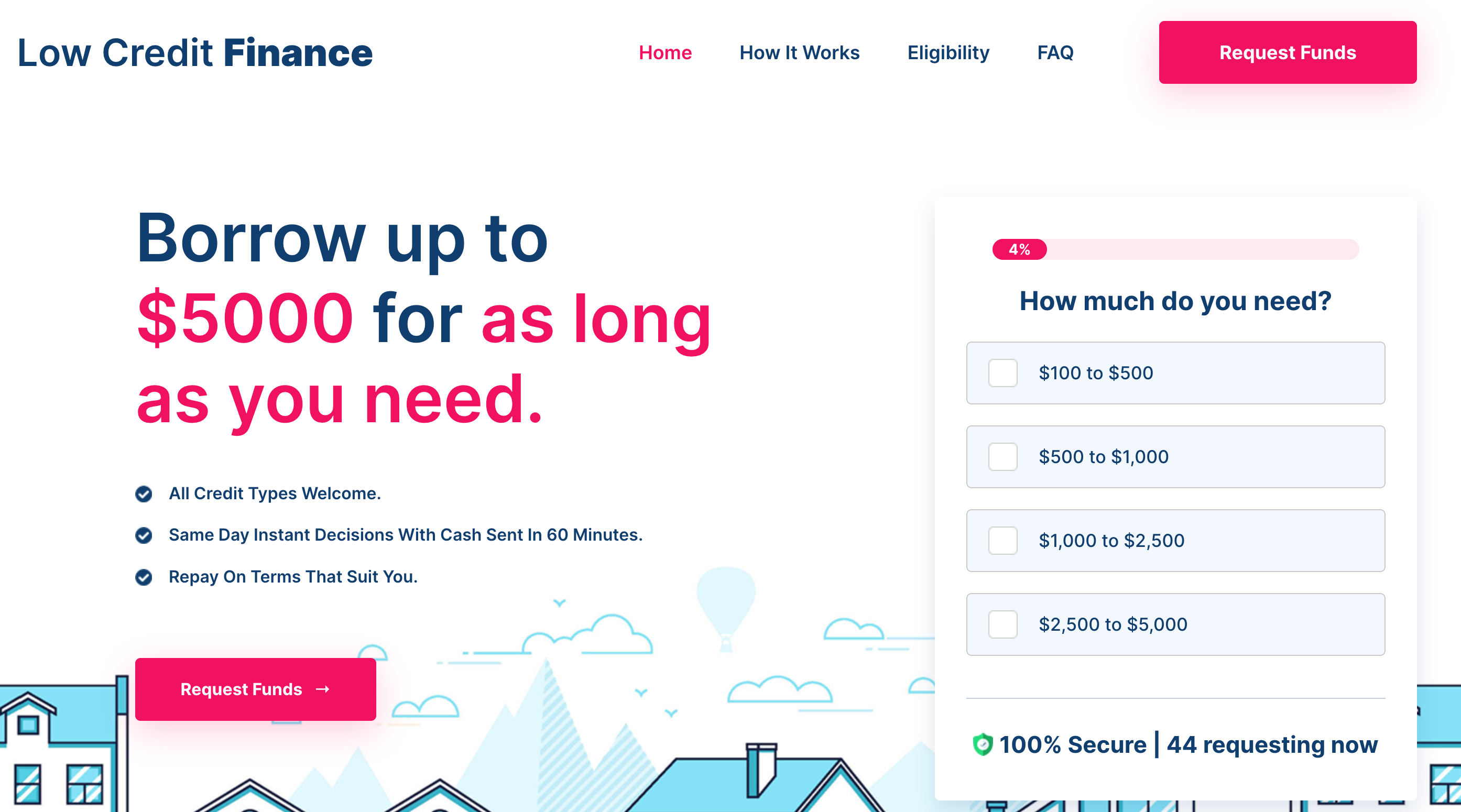

7. Low Credit Finance: Better for Unemployed

If you are unemployed, or you currently have a low income, then Low Credit Finance will prove to be a better choice than Credit Ninja because they have a higher approval rate for these types of clients. And since their approval and disbursement process is fast, you can get the money you need the same day.

How to Apply for Loans Like Credit Ninja in Only 5 Steps

If you’ve decided that you want to apply at any of our recommended lenders instead of Credit Ninja, then here’s how you can do it in only 5 steps:

- Select a Credit Ninja alternative from our list

- Visit their website

- Complete the application form

- Send the application

- Wait for approval and receive the cash in your bank account.

The entire process will barely take you 5 minutes, and since our recommended lenders have the most advanced application review software and systems, you can get approved and receive the money you need the same day.

The Problems of Credit Ninja and Why You Should Consider an Alternative

Credit Ninja is a solid lender in our opinion, but it lacks certain benefits that might not make it the ideal choice for you. Let’s explore the problems of Credit Ninja to understand why our recommended alternatives might be a better choice for you. We have also written a similar article here about Speedy Cash alternatives.

High Interest Rate

It can be as high as 349% - and when compared against our recommended alternatives in a similar time frame, you will find that our lenders are much more affordable. And this can be even worse if you have bad credit.

Origination Fees

Credit Ninja can charge you an origination fee as high as 5% - and that’s a huge downside especially when you apply for a loan for $5,000 for example. Our recommended lenders don’t charge origination fees, and if they do in some cases, it will be lower than 5%.

Slower Approval

Even though they advertise that they can approve your application and disburse the money the same day, it’s not the case the majority of the time. After testing it, and comparing it to fast lenders like Viva Payday Loans, ZippyLoan and CreditClock, we’ve found out that Credit Ninja falls short in this area.

Late Fees

The majority of lenders will charge late fees if you fail to pay back on time, but Credit Ninja charges more than average. This is another downside you should consider if you plan on getting a loan from them.

Low Approval Rate for Bad Credit and Unemployed Customers

Even though they say that they will accept customers with bad credit, their approval rate of this type of customers and unemployed borrowers is still low when compared to our other lenders.

F.A.Q

Here you will find the answers to the most frequently asked questions about loans like Credit Ninja.

What is the alternative to Creditninja?

The best alternative to Creditninja will depend on what you need, but overall the best choice is ZippyLoan because it allows you to borrow more money at a lower interest rate and with a faster approval and disbursement.

Are loans like Credit Ninja legit?

Yes, all the Credit Ninja alternatives we’ve listed are properly registered in all the US states they do business in, and they have an excellent record of clean business free from scandals. You can apply for your loan at their websites with total confidence.

Do loans like Credit Ninja accept bad credit customers?

Yes, the alternatives we’ve listed will accept your application even if you have bad credit or a limited credit history. However, the best options in this case are Big Buck Loans and Low Credit Finance, because they have the highest approval rate for bad credit customers.

Do loans like Credit Ninja allow you to borrow more money?

Credit Ninja allows you to borrow up to $5,000, which is an excellent limit. However, you might need more money, and that’s why we recommend you to apply at ZippyLoan instead because it will allow you to borrow up to $15,000 USD. Check out our list of Best Bad Credit Loans for $5000 here.