If Lendly’s offers, terms and conditions don’t work for you, then you need an alternative, and that’s why we’ve created this list with the best loans like Lendly you can apply for in 2024. With a lower interest rate, higher approval rate for bad credit, unemployed and low income borrowers, and higher limits up to $15,000 - our Lendly alternatives will bring you the benefits you want to get.

Come with us to check our ranking of the top Lendly alternatives and why they’re an excellent choice.

Overview of the 7 Best Loans Like Lendly in 2024: Full Ranking

There is no doubt that Lendly is popular and one of the main companies in the loans industry in 2024, but their terms and conditions simply don’t work for everyone. Here you have the 7 best alternatives that offer what Lendly can’t.

- HonestLoans.net: Best Lendly Alternative

- Fast Loans: Borrow More Money

- Fast Money Source: Faster Approval

- Credit Clock: More Availability

- Heart Paydays: Best for Limited Credit History

- Big Buck Loans: Higher Approval Rate for Bad Credit

- Low Credit Finance: Higher Approval Rate for Low Income

To apply for your loan at your preferred Lendly alternative, just click on their name and you will be redirected to the application form.

If you want to learn more about each alternative before making a final decision, then come with us to learn more about them.

1. HonestLoans.net: Best Lendly Alternative

Lendly’s interest rate can be quite high, they can take longer than expected to approve your loan and if you have bad credit, then your chances will decrease massively… if you don’t like that, then you should choose HonestLoans.net instead. Thanks to offering the lowest interest rate in this category, fast approval and disbursement, and a high approval rate for bad credit borrowers, it’s the #1 Lendly alternative in 2024.

2. Fast Loans: Borrow More Money

Lendly will only bring you a maximum of $2,000 USD - and that’s taking into account that your credit is good. If you need to borrow more money and your credit has been labeled as Fair or Poor, then you should rely on Fast Loans instead. You can borrow up to $50,000 easily with a low interest rate and fast approval without taking your credit score into consideration.

3. Fast Money Source: Faster Approval

Lendly can take more than 1 business day to approve your application and disburse the money - if you’re not willing to wait that much, then choose Fast Money Source instead. With an average approval and disbursement time of 2 hours, you can get the money you need in record time - and with a competitive interest rate.

4. Credit Clock: More Availability

Simply put, if you need a loan outside of Lendly’s business hours then you will need to look for an alternative, and the ideal one is Credit Clock because they’re available 24/7 even on holidays. It’s a better choice if you need money for an emergency at a fair price and with a high approval rate for bad credit.

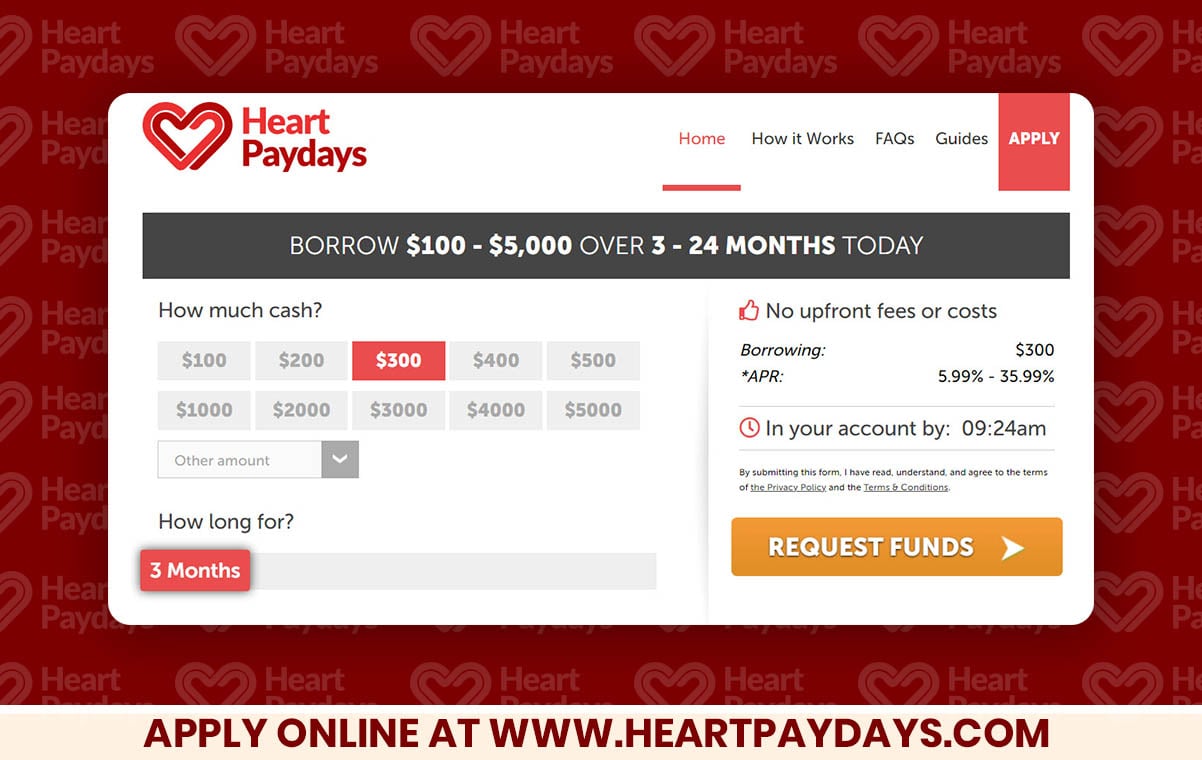

5. Heart Paydays: Best for Limited Credit History

If your credit history is fresh or limited, then Lendly might not approve your application. That’s why we recommend you to consider Heart Paydays instead because their direct lenders can approve your application even with zero credit activity. You can easily borrow up to $5000 with a fair interest rate.

6. Big Buck Loans: Higher Approval Rate for Bad Credit

If bad credit is your problem, then it’s likely that Lendly will reject your application, but that’s why we recommend you to check out Big Buck Loans. This company has the highest approval rate for bad credit borrowers, even if your score is in the range of 300-400 points.

7. Low Credit Finance: Higher Approval Rate for Low Income

If your income source has suffered a low or you have recently lost your job, then you don’t have to worry about it because Low Credit Finance is here to approve your application. They take other factors into account to offer the highest approval rate for low income and unemployed borrowers - two types of clients that Lendly will usually reject.

How to Apply for a Loan Like Lendly

If you’ve already selected your favorite Lendly alternative but you don’t know how to apply for a loan, then here’s how:

- Choose a Lendly alternative (HonestLoans.net, for example)

- Go to their website

- Fill out their application form only with real and accurate info

- Send the application

- Wait for approval

- Receive the money in your bank account.

You can do this in 5 minutes or less, and our recommended lenders will approve your application fast and proceed to disburse the loan funds in record time.

When Should You Look for Loans Like Lendly?

If you need more help to decide whether to apply for a loan at Lendly or at our suggested alternatives, then let’s check the different scenarios where an alternative loan will be the best choice:

- Do you want to save money? - If so, you should consider HonestLoans.net instead of Lendly because they offer a lower interest rate and cheaper fees in the majority of cases

- Do you need more than $2000? - Lendly will only lend you a maximum of $2000, but if you need more than that, then any of our recommended alternatives will loan you as much as $5000, and in the case of ZippyLoan, you can borrow up to $15,000

- Do you have bad credit? - Lendly is known for rejecting applications from bad credit customers, if you don’t want to face this situation, then consider applying for a loan at alternatives like HonestLoans.net, Big Buck Loans or Low Credit Finance

- Do you need a loan on a holiday? - And if you need money outside of business hours, then Lendly won’t be able to help you, but instead you can apply for a loan at Credit Clock, which works 24/7 and approves and disburses loans fast

- Are you unemployed? - If this is your case then Lendly will likely reject your application, but the good news is that Low Credit Finance will approve it instead.

F.A.Q

If you want to know more about our recommended Lendly alternatives, then come with us to check the answers to the most frequently asked questions.

What is the best Lendly alternative?

HonestLoans.net is the best Lendly alternative because it offers a lower interest rate, you can borrow up to $5000 (whereas Lendly limits it at $2000), it approves and disburses loans faster, and has a higher approval rate for bad credit, low income and unemployed customers. We have also done a comparison to ZocaLoans here for you to take a look at.

Are Lendly alternatives legal?

Yes, the companies we recommend as loans like Lendly are 100% legal because they are registered in all the states they do business in, and hence, they’re supervised and regulated. Furthermore, they have plenty of positive reviews and ratings online from satisfied clients.

Do loans like Lendly accept bad credit customers?

Yes, our recommended alternatives offer a higher approval rate for bad credit customers than Lendly. You can get approved even if you fall into the “Poor” credit score category. We have a more detailed article here on the best bad credit loans.

Can I use loans like Lendly for any purpose?

Yes, the alternatives we recommend will allow you to use the loans for any purpose. Be it for medical bills, college fees, home repairs, auto repair, or funding your business, our recommended loans like Lendly will be able to help you.