SpotLoan is a good alternative when you need to borrow money online quickly, but it has serious flaws such as a strict max loan amount limit of $800, a higher interest rate than average, and a lower approval rate for bad credit and unemployed customers.

That’s why we’ve created this ranking, to share with you the best loans like SpotLoan that you can apply for now, to get the money you need quickly.

We’ve listed each alternative according to the area where it’s better than SpotLoan, to help you make the best decision. Come with us to check the ranking.

Overview of the Best Loans Like SpotLoan in 2024: Top 7 Alternatives

Here you have our ranking with the best SpotLoan alternatives that can bring you quick money under better conditions - choose your favorite one now:

- ZippyLoan: Best Overall Alternative

- HonestLoans.net: Lower Interest Rate

- Viva Payday Loans: Faster Approval and Disbursement

- CreditClock: More Availability

- Big Buck Loans: Higher Approval Rate for Bad Credit

- Low Credit Finance: Higher Approval Rate for Unemployment

- Heart Paydays: Better Customer Support Service

Now you can easily choose the alternative that better meets your needs and expectations, but if you need extra help, then our individual reviews will come in handy.

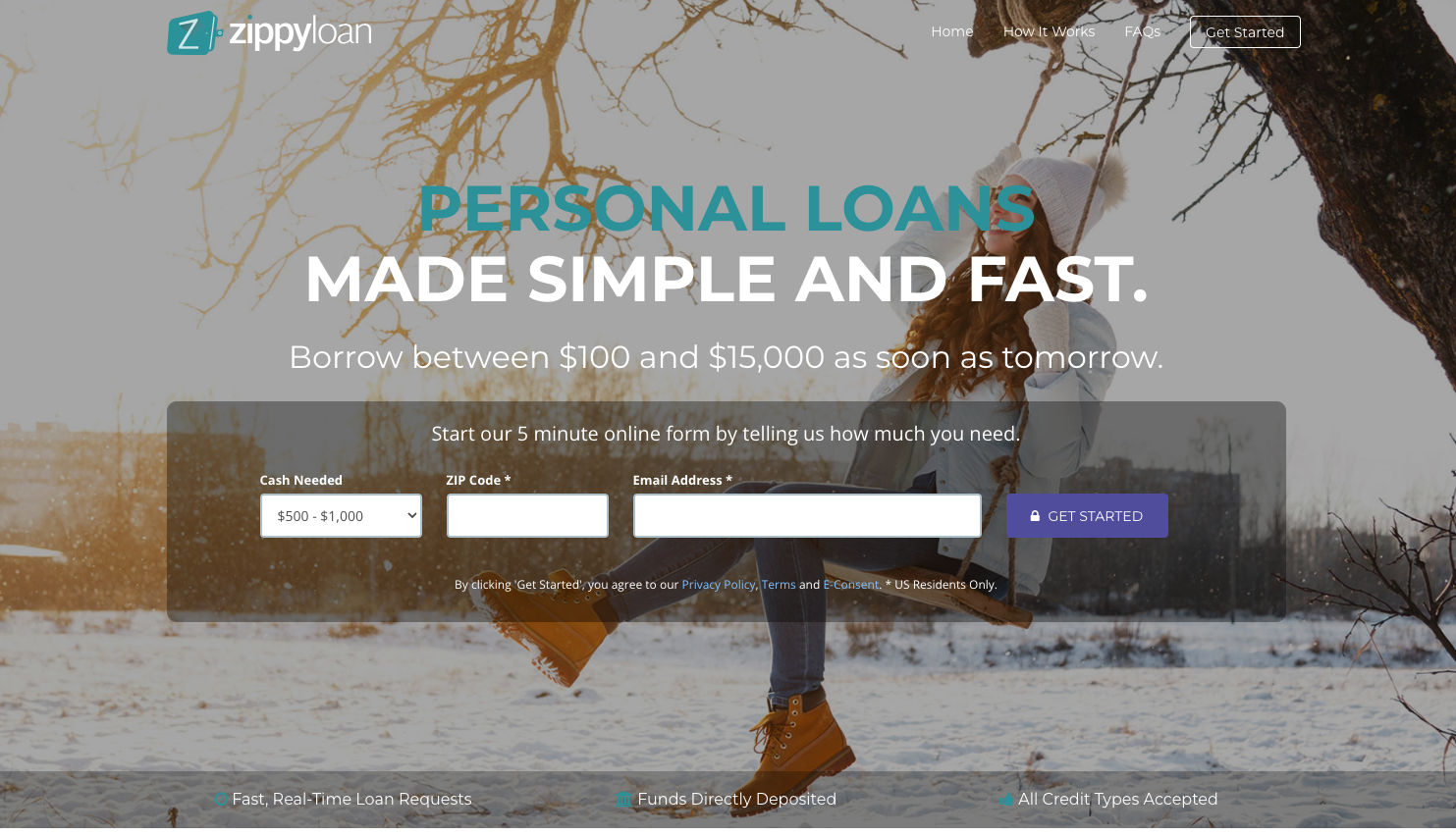

1. ZippyLoan: Best Overall Alternative

If you want to pick the alternative that surpasses SpotLoan in every single area, then it’s ZippyLoan. With a max loan amount limit of $15,000, faster approval and disbursement, lower interest rate, better customer support, and a higher approval rate for bad credit, limited credit history and unemployed borrowers, you can easily see why ZippyLoan is the best choice here.

2. HonestLoans.net: Lower Interest Rate

If you want to significantly reduce the cost of your loan then HonestLoans.net is a better choice than a SpotLoan. Thanks to their huge pool of direct lenders, you will find the best deal in the majority of cases with a competitive interest rate, flexible loan terms and conditions and fast approval and disbursement.

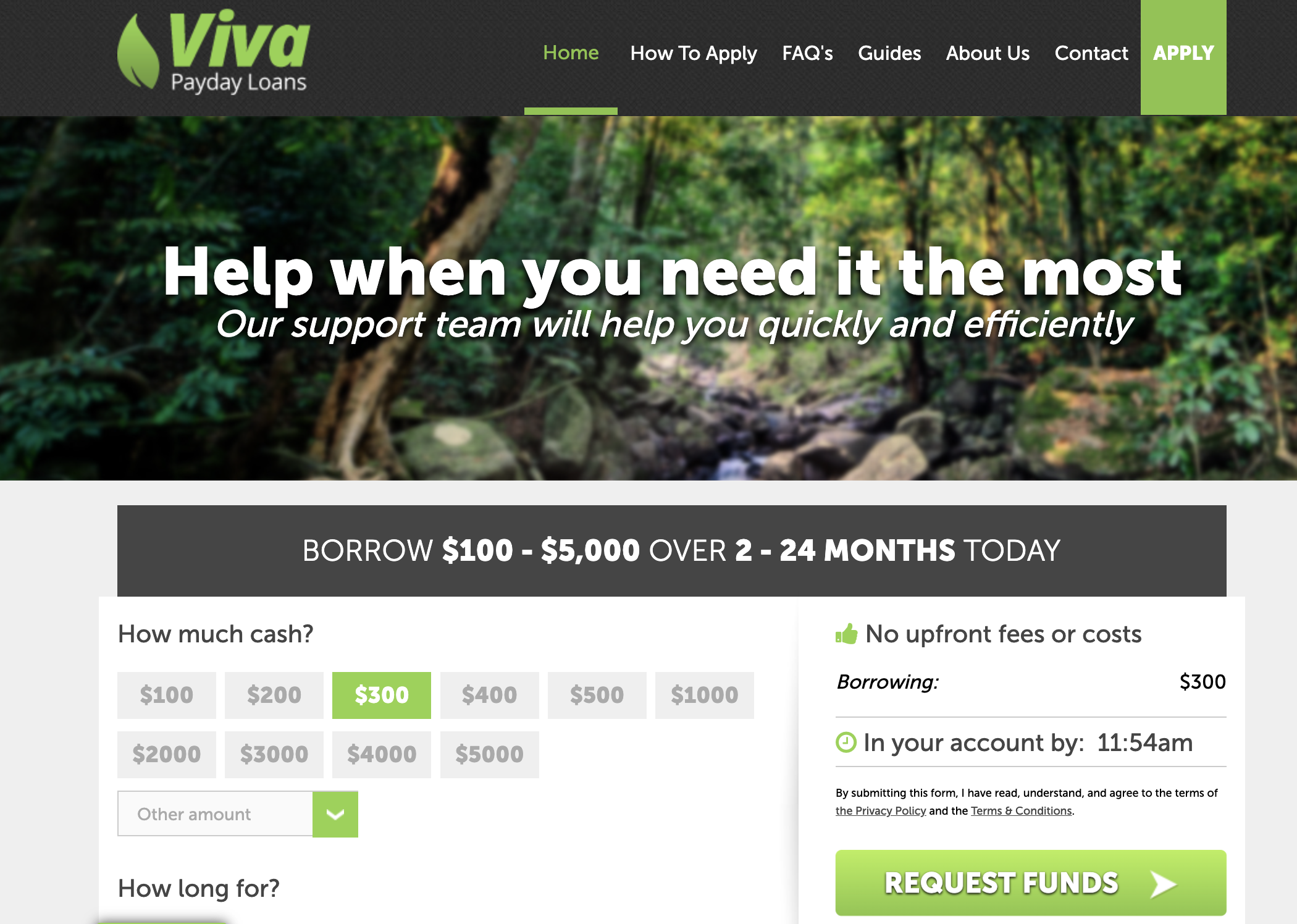

3. Viva Payday Loans: Faster Approval and Disbursement

Do you need a loan as soon as possible? Then you should consider applying for it at Viva Loans instead of SpotLoan, because this lender can approve your application instantly and proceed to deposit the money in 1-2 hours. And since they don’t ask intrusive questions about why you need the loan, you can use it for any purpose.

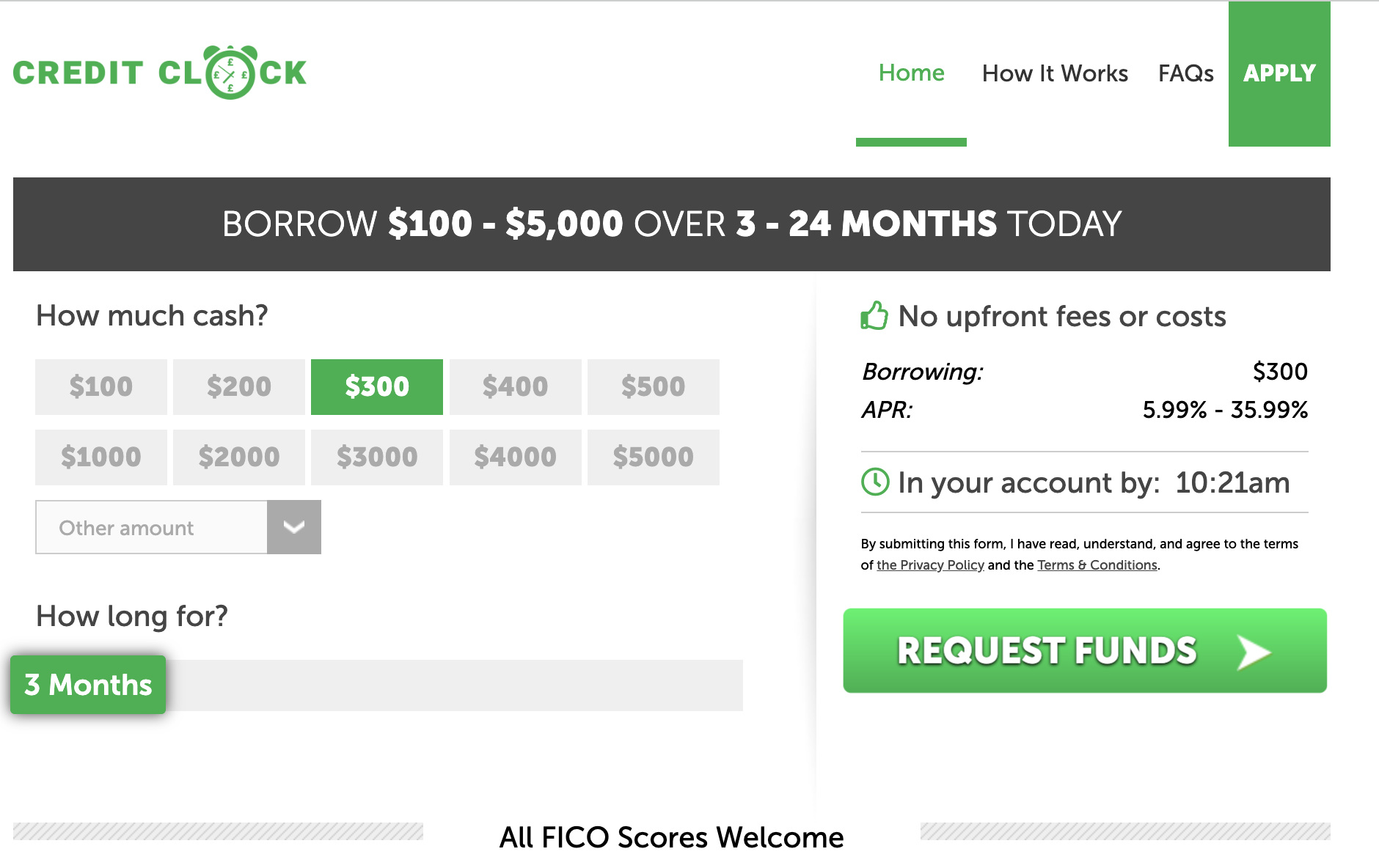

4. CreditClock: More Availability

CreditClock is more reliable than SpotLoan because it's available 24/7 every single day of the year. Even if you need money at 2 AM on Xmas, this company will be ready to review your application and disburse the money in record time.

5. Big Buck Loans: Higher Approval Rate for Bad Credit

We know it is hard to get a loan when you have bad credit, especially if you have a credit score of five hundred points or less, and this is where SpotLoan will fall short. They deal with bad credit customers but their approval rate is not that high, something that Big Buck Loans excels at by approving customers with even the worst credit score possible.

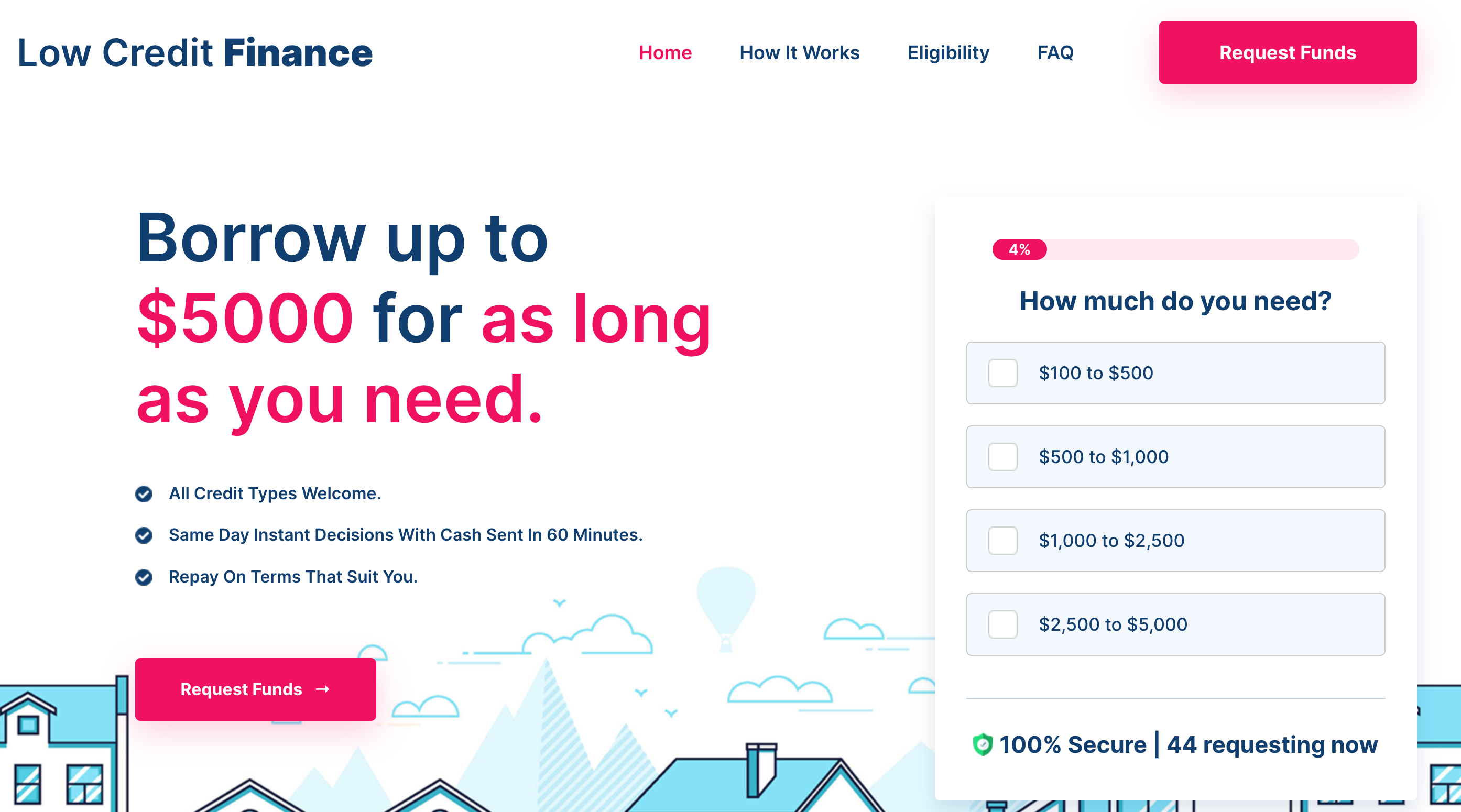

6. Low Credit Finance: Higher Approval Rate for Unemployment

If you are currently unemployed then it will be harder for you to get approved for a loan, and this is especially the case if you apply for one at SpotLoan. Thanks to their minimum monthly income requirement and that they accept multiple alternative income streams, you stand a better chance at getting approved by applying for your loan at Low Credit Finance.

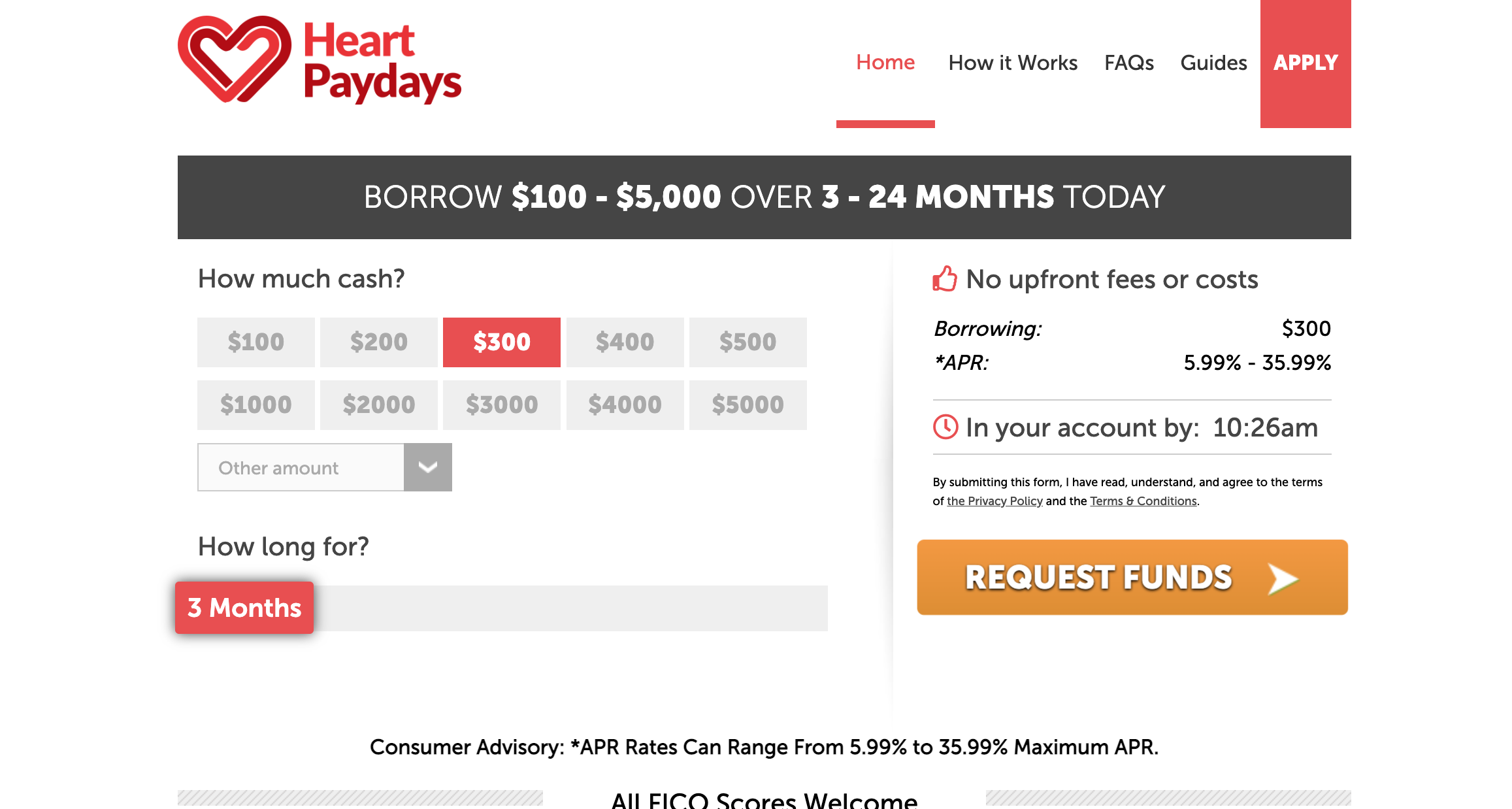

7. Heart Paydays: Better Customer Support Service

SpotLoan’s customer support is good, but it could be much better, something that Heart Paydays already does, and that’s why it’s a better option in this sense. Thanks to their fast, efficient and kind customer support service, you can get the help you need at the right moment. On top of that, Heart Paydays has a high approval rate for bad credit borrowers and it offers some of the best interest rates in the market.

How to Apply for Loans Like SpotLoan

If you’ve already picked the best alternative for your needs, then here’s how you can apply for your loan in 5 minutes or less:

- Go to the website of your favorite SpotLoa alternative

- Fill out the application form

- Submit the application form

- Wait for the lender to approve you

- Once approved, you will receive the money in your bank account.

Just make sure to only include accurate and real information to increase your chances of getting approved. Otherwise, you will diminish your own possibilities.

Since we only work with the fastest lenders, you can expect to get approved within minutes after sending your application, and to receive the money in your bank account the same day.

When You Should Consider Applying for Loans like SpotLoan

If you are facing any of the following situations, then it might be a good idea to request a loan from the SpotLoan alternatives we recommend:

- If your credit score is extremely bad: Even though SpotLoan can help customers with bad credit, if it’s extremely bad then it will be another story. If you want to maximize your chances of getting approved, then you now you have more suitable options such as Big Buck Loans, ZippyLoan or Low Credit Finance

- If you need more than $800: Many types of emergencies will require a lot more money than that, and our recommended lenders can lend you $1000, $2000, $5000 or even $15,000 for any purpose with fast approval and disbursement

- If you must get a loan outside of business hours: Emergencies can strike at any time, and unfortunately SpotLoan won’t be able to help you at 3 AM, which is something that an alternative like CreditClock can do thanks to their 24/7 availability

- If you need personalized help: SpotLoan is so-so when it comes to customer support, and that’s why we recommend a better option like Heart Paydays because their customer support department is faster, more efficient and specially kind with people who are applying for an online loan for the first time in their lives

- If you want to borrow several times: In case you are planning to be a repeat borrower, then our alternatives will prove to be a better options because you will save more money and get access to more products under better conditions

SpotLoan falls short in all of these areas and that's why our suggested alternatives will be a better choice for you.

F.A.Q

If you want to learn even more about the best loans like SpotLoan, then here you have the answers to the most frequently asked questions.

Are loans like SpotLoan legal?

Yes, they are legal since they have a stellar internet reputation, a spotless record, and are all registered in the states where they conduct business. You can therefore rely on our recommended SpotLoan substitutes.

Do loans like SpotLoan allow you to borrow more money?

Yes, while SpotLoan has a $800 USD maximum, all of the other options we provide let you borrow more money than that. You can simply obtain a loan of up to $15,000 USD from the lenders on our list.

Can you apply for loans like SpotLoan in California?

Yes, you can apply for the alternatives to SpotLoan that we suggest without any issues because they are lawful in California. But bear in mind that California has capped payday loan amounts to $300 USD. If you are applying for this product, the lender will cap it at $300 at a time.