For us Credit Clock has to be the top choice for Tribal Loans, We have reviewed all of our recommended lenders and ranked them in the table below. This should give you all the details you require to find the best loan for you.

Easiest Tribal Loans Bad Credit & Quick Approval

If you’re in dire need to apply for a quick loan, here is a clue of where you can start:

- Credit Clock - Best tribal loan provider.

- Fast Money Source - Borrow up to $50,000.

- Loan Raptor- Fast Tribal Loans

- Fast Loans - Easy Tribal loans for bad credit

- Honest Loans - Super smooth online application.

- Big Buck Loans - Longer repayment periods.

- Low Credit Finance - Zero credit checks.

- Heart Paydays - Access to a variety of installment loans.

With inflation on the rise, over 64% of Americans are living paycheck to paycheck, leaving them vulnerable to unexpected financial emergencies that they may not have the funds to cover.

From emergencies to last-minute expenses, these extremes can have a large impact on you as an individual or your family, and for these circumstances, we've found Credit Clock loans or Loan Raptor to be the best options.

It is during these times that easily accessible payday or tribal loans can come in handy, especially those that can extend a loan to you regardless of your credit history, income level, or employment status.

Here are a few of our top picks of Tribal loan and Payday loan companies, if you are currently in the US and looking to access quick cash without a hassle.

Choose any of the options from the list above that best fits your current financial needs. Simply click on the respective link to visit the site and complete an application form. Once approved, you will receive the requested loan amount, typically within 1-2 hours.

If you want a more detailed comparison of the lenders listed above, keep reading to see their unique features and benefits. This will help you narrow down your options and select the one that suits you best.

1. Credit Clock: Best tribal loans provider

At the top of the list of our recommended broker alternatives, we have the Credit Clock which is an excellent option for traditional tribal loans. The lending rates here are 5.99% - 35.99% and the loans guaranteed are from $100 to $5000 with a repayment period of between 2 to 24 months. It is a good alternative for the following reasons:

- No credit checks.

- Easy to apply.

- Quick payout.

- Fast approval.

- Minimal interest rates.

- Convenient.

- Flexible loan amounts.

Most individuals qualify for Credit Clock offers loans, and even those with bad credit reputations can access a vast variety of loans that one may easily pick from to suit their needs.

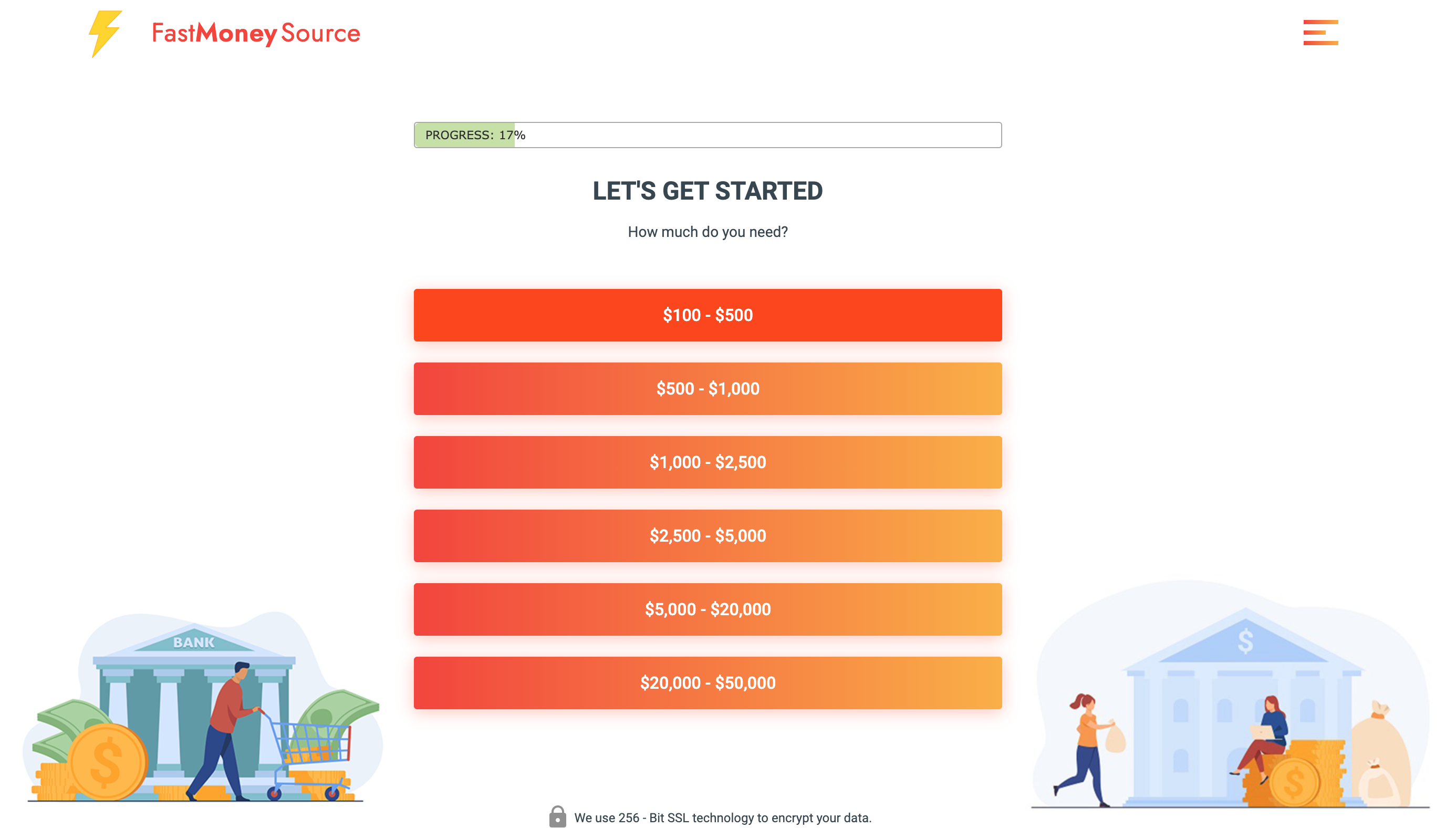

2. Fast Money Source: Borrow up to $50,000

Are you looking for quick fix funds from a lender who is regulated by the Online Lenders Alliance(OLA)? Look no further for Fast Money Source is just what you’re looking for. With the ability to provide vast options to you as a borrower, they can sustain a borrowing limit of up to $50,000 per client. The transfer to your bank is made as quickly as possible and at no extra cost.

Here are some of the main benefits of using Fast Money Source:

- No waiting in line.

- No going into a physical store.

- Low fees and interest.

- Safe transactions.

- It is regulated.

- Fast approvals.

- Quick payouts.

Overall, Fast Money Source is a good loan intermediary that is easy to use. It ensures that you get the best lenders available on their network. But more importantly, they offer suitable rates and are transparent in their dealings.

3. Fast Loans: Easy Tribal loans for bad credit

If you are in need of amounts between $200 and $50,000, Fast Loans is your lender of choice. They have a vast connection to third parties and lenders who can offer such amounts all at your comfort. Here are the reasons why Fast Loans should be among your first go-to platforms for a loan:

- Fast disbursement of funds.

- Easy to use.

- Convenient.

- Instant approval.

- Safe transactions.

Fast loans is a remarkable choice for people who are looking for large sums of loans as it is conveniently easy to use and features instant approval even for large amounts.

4. Honest Loans: No credit check loans guaranteed approval direct lender

If you are looking for an easy online application process that provides options for credit repair or debt relief services in case of loan disapproval by the banks and other financial institutions, then Honest Loans is right for you.

The following are some of the reasons why Honest Loans is a top choice for loans:

- Easy to apply.

- Quick funding.

- Fast approval of loans.

- Easy application.

- Get a variety of loans.

Honest Loans is more than ready to join you with your lender of choice to give you payday loans at lower prices and your convenience.

5. Big Buck Loans: Longer repayment periods

If you are stuck and are in dire need of money, Big Bucks Loans is the place for you. They offer loans between $100 and $5000 and at relatively lower interest rates of between 5.99% and 35.99%. On top of that, they offer long repayment periods of between 3 to 24 months to repay.

The following are some of the reasons why Big Bucks Loans should be where you turn to if you need some money urgently:

- No extra costs.

- Relatively low interest rates.

- Good reputation.

- Quick payouts.

- Flexible amounts and policies.

- Easy to apply.

Big Bucks Loans stand out from the rest of the companies in the sense that its payouts and approvals are made within 15 – 20 minutes. As such, you don’t have to wait for lengthy approvals to get your loans.

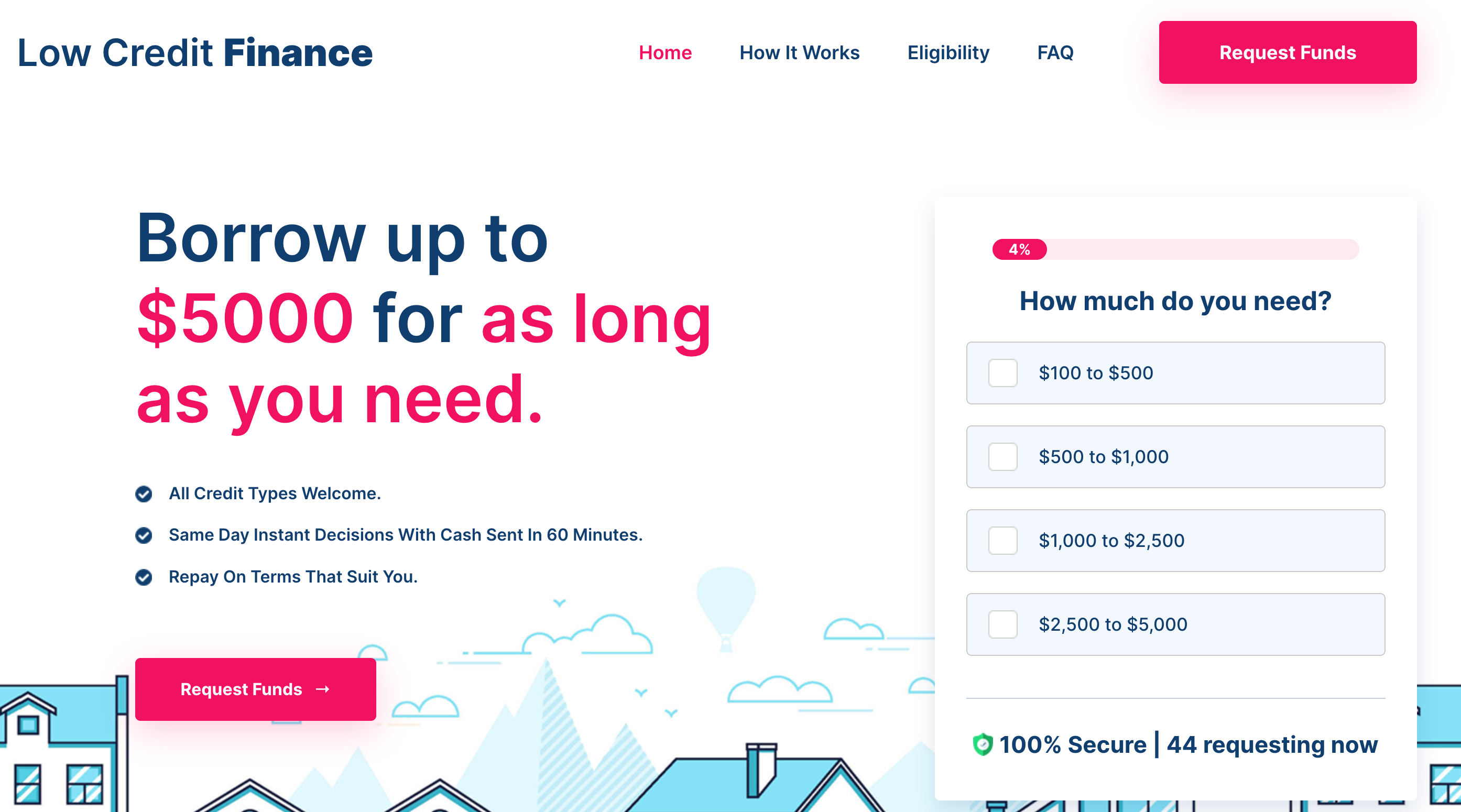

6. Low Credit Finance: Zero credit checks

If you have a bad credit history and need some money without the worry of credit checks being conducted. Also, if you have no credit history, Low Credit Finance is the go-to place for such. Listed below are reasons why you should consider Low Credit Finance for your loan purposes:

- Quick cash loans.

- No paperwork.

- No hidden fees.

- Almost instant online lending decision.

- Large network of lenders.

- Alternative options.

Low Credit Finance is where you find quick finance without the worry of credit history being put into question.

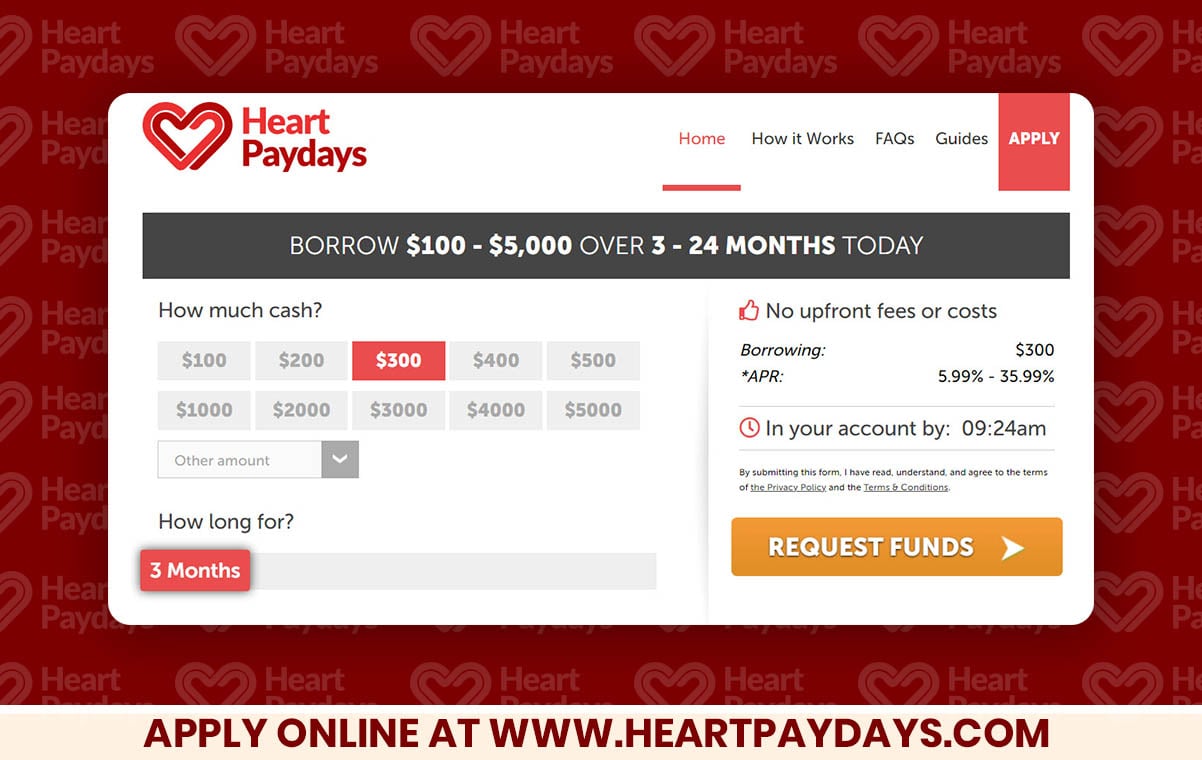

7. Heart Paydays: Access to a variety of installment loans

Heart Paydays are known experts in offering installment loans to borrowers that need $200 - $5000 urgently. The loans are extended to individuals who are in no way interested in taking traditional loans from other financial institutions due to one reason or another. The following are some of the reasons why you should consider Heart Paydays:

- No upfront fees.

- Fast disbursement.

- Relatively longer repayment periods.

- Easy to apply.

- Large variety of loans.

- Unrestricted access.

Heart Paydays offers a comprehensive platform whereby you as a loan borrower can turn to whenever you need loans and other traditional lenders have denied them the loans.

How to Apply For an Easy Tribal Loan in 5 Minutes or Less

Applying for any of these payday and tribal loans is quite easy as they often do not have many requirements. The ease of application is owed to the fact that everything is done online at one’s convenience. Here is a summarized version of applying for a quick payday or tribal loan.

- Choose a lender from our list.

- Fill out the application form.

- Wait for the system to review it.

- Get notified that you’ve been approved.

- Receive the amount in your bank account.

Whether this is your first time using such platforms or you're a seasoned borrower, you can rest assured that the interface will be user-friendly and easy to navigate, making the application process hassle-free. Additionally, responses are fast, so you won't need to worry about long waiting periods. Please see this article on thedailyworld.com for more info on Tribal Loans.

What is a Payday Loan?

Just as the name suggests, payday loans are quick fixes loans that are lent to service needs or emergencies that may arise before “payday”. They are usually instantaneous as approvals are fast and they may not perform rigorous checks like traditional loans to give you the money.

They are flexible and have flexible terms whereby one can negotiate with the lender the various policies that are to be applied to the loan. The terms may range from penalties to repayment periods and amounts. It is however important to note that the borrower is under no obligation to accept the various lender’s policies.

Notably, Payday loans usually have higher interest rates. This is owed to the high risks that are attached to them. Risks such as bad credit and low credit scores are the reason. But, in this article, we have hand-picked for you some of the cheapest players in the market.

Related posts about Best Payday Loans $500

What is the Process for a Payday Loan?

Payday loans typically work similarly to traditional loans in that an applicant must first submit an application, wait for approval, and then the money is disbursed to the bank. Payday loans feature higher interest rates, faster payouts, and lenient rules regarding the quantity and length of repayments, therefore these two may be different.

The application procedure is also simple because you may complete it all online at your convenience. The process is largely automated, so if all the requirements are completed, the systems will verify for eligibility and authorise the loan.

You will then receive information about some of the current policies. You are required to accept and agree to the contract after the policies are advantageous and suitable for you, at which point the money will be paid out.

| Credit Clock | Best tribal loan provider | Apply Here |

| Fast Money Source | Best High-Value Tribal Loans | Apply Here |

| Loan Raptor | Fast Tribal Loans | Apply Here |

| Fast Loans | Best for Bad Credit Tribal Loans | Apply Here |

| Honest Loans | Easy Online Application | Apply Here |

| Big Buck Loans | Best for Long Repayment | Apply Here |

| Low Credit Finance | Easy Credit Check Approval | Apply Here |

| Heart Paydays | Best for Instalment Loans | Apply Here |

Qualifications for Payday Loans

Some of the main qualifications necessary to qualify for the aforementioned payday loans include:

- You have to be a US citizen or permanent resident.

- You need to be at least 18 years old.

- You need to have a verifiable source of income.

- You must have a bank account.

- You need a phone number or email address.

Most of these qualifications are easy to meet for most individuals and as a result, the approval rate is almost at 99.99%. If you have bad credit, check out this Bad Credit Loans article

Impact of Credit Score on Accessing Payday Loans

Credit scores are of no importance when applying for a credit loan. This means that even if you have a bad credit history, you can still apply and get a loan as most traditional loans do not give such individuals the opportunity.

Most lenders will however perform some checks, but most of them are soft. This makes it easier for you to get a loan extended to you.

As much as your credit history does not play a part in borrowing and lending the loan, they do have an impact on your credit score in the sense that timely repayment of these loans has a positive impact on your credit score. For individuals with bad credit history and those that have none, these loans offer a good way to start.

States that Allow Payday Loans

Fortunately, or unfortunately, not all states have statutes that allow payday loans to be disbursed to their residents. Some however have caps on the amounts that can be loaned to borrowers. The ones that allow payday loans of $1000 and above are:

- Delaware

- Idaho

- Illinois

- Ohio

- Oregon

- Virginia

- Nevada

Other states that have caps of $300 - $500 are California, Florida, Montana, and Alabama to mention just but a few. In such states, some lenders may still provide higher payday loans under different conditions from the ones under payday loans. Please read Here if you are looking for a $250 Payday Loan.

Pros and Cons of Payday Loans

|

Pros |

Cons |

|

They are the fastest and easiest ways to get loans. |

Higher fees and interest rates compared to regular loans. |

|

You can get the loan even with a bad credit history. |

They are not available in all states. |

|

You can get the loan if you are unemployed. |

|

|

You can get the loan if you have a low income. |

|

|

Flexible repayment periods that may vary from several weeks to months. |

|

|

You can use it to build a credit score and credit history. |

|

|

You can get access to more loans by making timely payments. |

From this comparison above, it is quite clear that the pros outweigh the cons by far.

Alternatives of Payday Loans

Depending on the amount of loan that you need, there are several alternatives that one may select from. These include:

- Smaller Payday Loans

These are payday loans that offer small amounts that may be suitable to meet your needs or abrupt expenses. - Bigger Payday Loans

If the amount needed is large, there is also that provision. As you have seen above, some are willing to loan you amounts of up to $50000. This amount is however state-sensitive because of the different statutes in the states. Installment Loans

Payday loans are usually repaid in very short terms, if this does not suit you, you can opt to repay the amount in installments according to what you and the lender will agree on.

FAQ:

Where Can I Borrow Money Immediately?

You won't be better off going to a bank if you need money straight away. Apply for an instant loan instead; you can receive one in as little as 60 minutes if you use payday platforms. Depending on the lender, the time frame could change and can go up to 24 hours. However, lenders are renowned for processing loan approvals and disbursements as quickly as feasible.

How long does it take to get a payday loan?

Because payday loans are approved quickly, the money is often disbursed as soon as feasible. This window of time could be as short as a few minutes or as long as 24 hours following approval, giving you enough time to cover any unforeseen costs.

What happens if you don't pay back a payday loan?

If you don’t repay the loan on time, some penalties will be served to you. They may include extra charges or a negative impact on your credit score. This will hurt your credit history, limiting the number of lenders who may be able to loan you.

Are payday loans expensive?

Payday loans are more expensive than traditional loans. However, the above-selected recommendations offer low APR and fees. The early payment as a result of flexibility may help one counteract interest rates.

Can you get a payday loan with bad credit?

Yes. You can. The companies recommended above can extend payday loans to you even if your credit history is tainted or you have no credit history. Either way, you can get the loan. We have written a separate article on the Top lenders for Bad Credit.