Have bad credit but don’t want to use a guarantor; we have found some Direct Lenders who accept bad credit. We have listed some of the top lenders for what you may need, with Loan Mr being the top of the list as they have an easy application with no guarantor needed.

Advertisement by Season Marketing Limited, who are authorized and regulated by the FCA with reference number: 727385

Warning: Late repayment can cause you serious money problems. For help go to moneyhelper.org.uk

Are you tired of feeling disoriented and stressed out whenever unexpected expenses arise? Your finances can easily take a hit due to poor planning or unforeseen emergencies, leaving you struggling to make ends meet.

But fear not, because we have compiled a list of top-ranking payday loan companies in the UK that offer very bad credit loans with no guarantor and instant approvals, even if you have bad credit. With their help, you can maintain a smooth lifestyle and get back on track financially.

So why wait? Check out our recommendations below and get the money you need deposited instantly into your account.

Top UK Bad Credit Loans - No Guarantor

- Loan Mr - Easy loan application and quick approval.

- Speedy Lends- Loans with no upfront fees.

- Cash Now- Loan with no guarantor and good for bad credit.

- Rapid Loans- Loans at no hidden costs.

- Tap Credit- Get your loans the same day.

- Mr Payday- Highest loan limit.

You can easily access a payday loan from a direct lender of your choice from this list. All you have to do is click on any of the links and proceed to apply for a loan, regardless of whether you have a bad credit history or no guarantor.

If you want more detailed information to help you make the right choice, continue reading below to have a broader view of the features offered by these UK payday loan providers.

1. Loan Mr: Best for very bad credit

If you find yourself in need of amounts between £100 and £5,000, then Loan Mr is the best option to connect you to a direct lender who will finance your needs in an instant.Applying to get a loan from Loan Mr is an easy process and the approvals are instantaneous. This is in the implementation of their same-day funding principle to allow you to cater to your needs as soon as possible.

Additionally, poor credit does not deter you from getting a direct lender on their platform. The platform is safe and privacy is ensured in all the transactions as everything happens online.

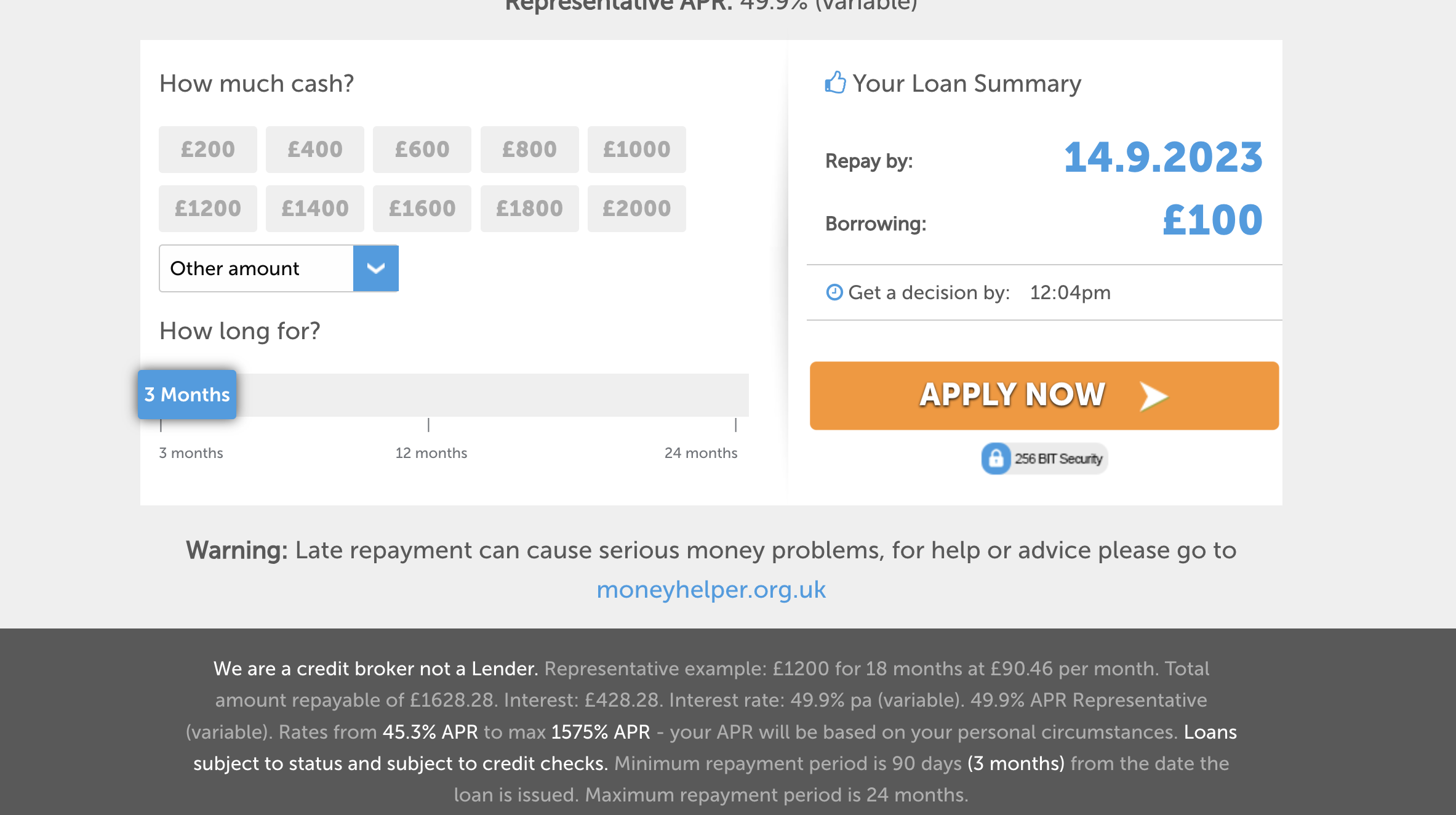

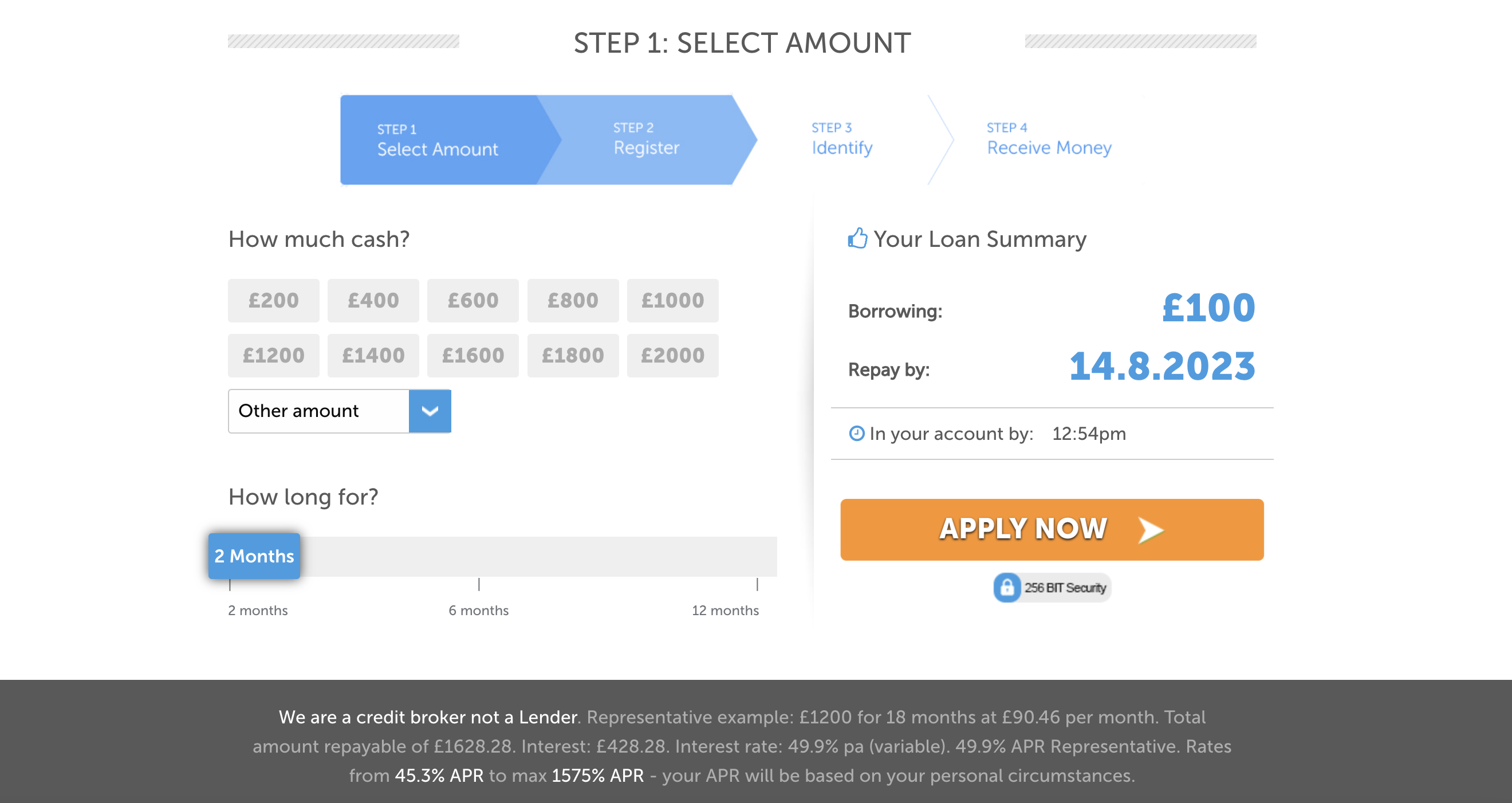

2. Speedy Lends: UK Loans with no Guarantor

If you have no cash to pay upfront fees and are in dire need of a loan, then look no further for Speedy Lends is the best in the game. Even with a bad credit score, you are likely of getting the amount instantly in your account.

With a loan range of between £1,000 and £5,000, you can easily apply for a loan that will sort out your shortcomings. Their loans don't have high-interest rates, making it a favourable pick.

Furthermore, Speedy Lends panel offers flexible repayment periods that give you the freedom of easy management of the payments.

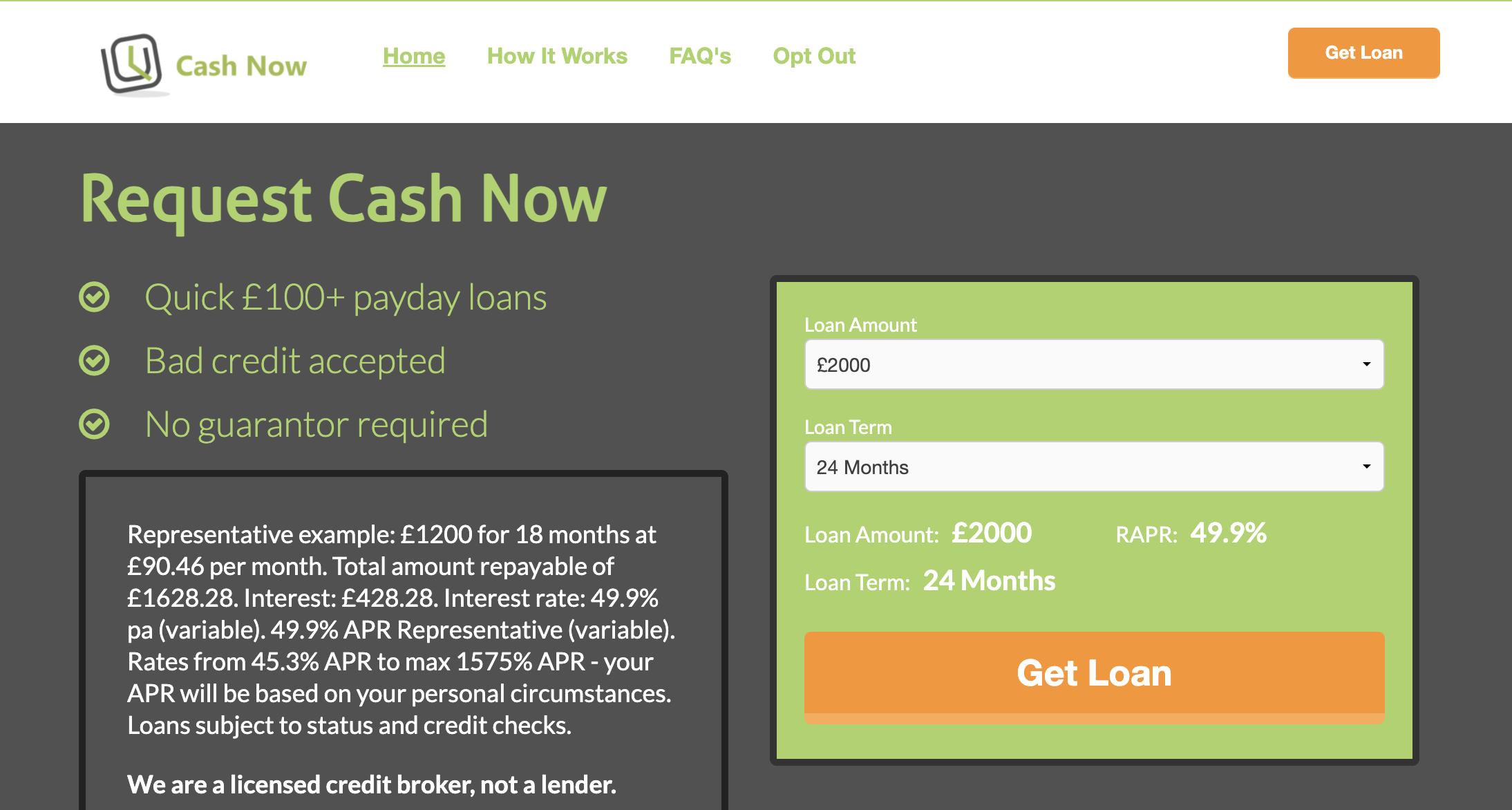

3. Cash Now: Loan with no guarantor and good for bad credit

If you are in need of a loan and you have no guarantor, Cash Now is just the right pick for you. With them, you can receive your loan the same day, subject to lender approval, all credit histories are considered.

Get your loan without having to hassle as the application process is as easy and they have quick approvals and fast payout. With a lending amount between £50 and £5,000, Cash Now can help you find the right direct lender.

With a belief that bad credit should not be a hindrance to getting a loan, Cash Now is sure to have your back in a time of need.

4. Rapid Loans: Loans with no hidden costs

If you are looking for a commendable third party who has experience in the UK payday loans field, and who considers those with all credit types. Rapid Loans is the best.

Rapid Loans flaunt having no extra or hidden costs and very quick approvals and cashouts for the loans, which are usually between £100 and £5,000.

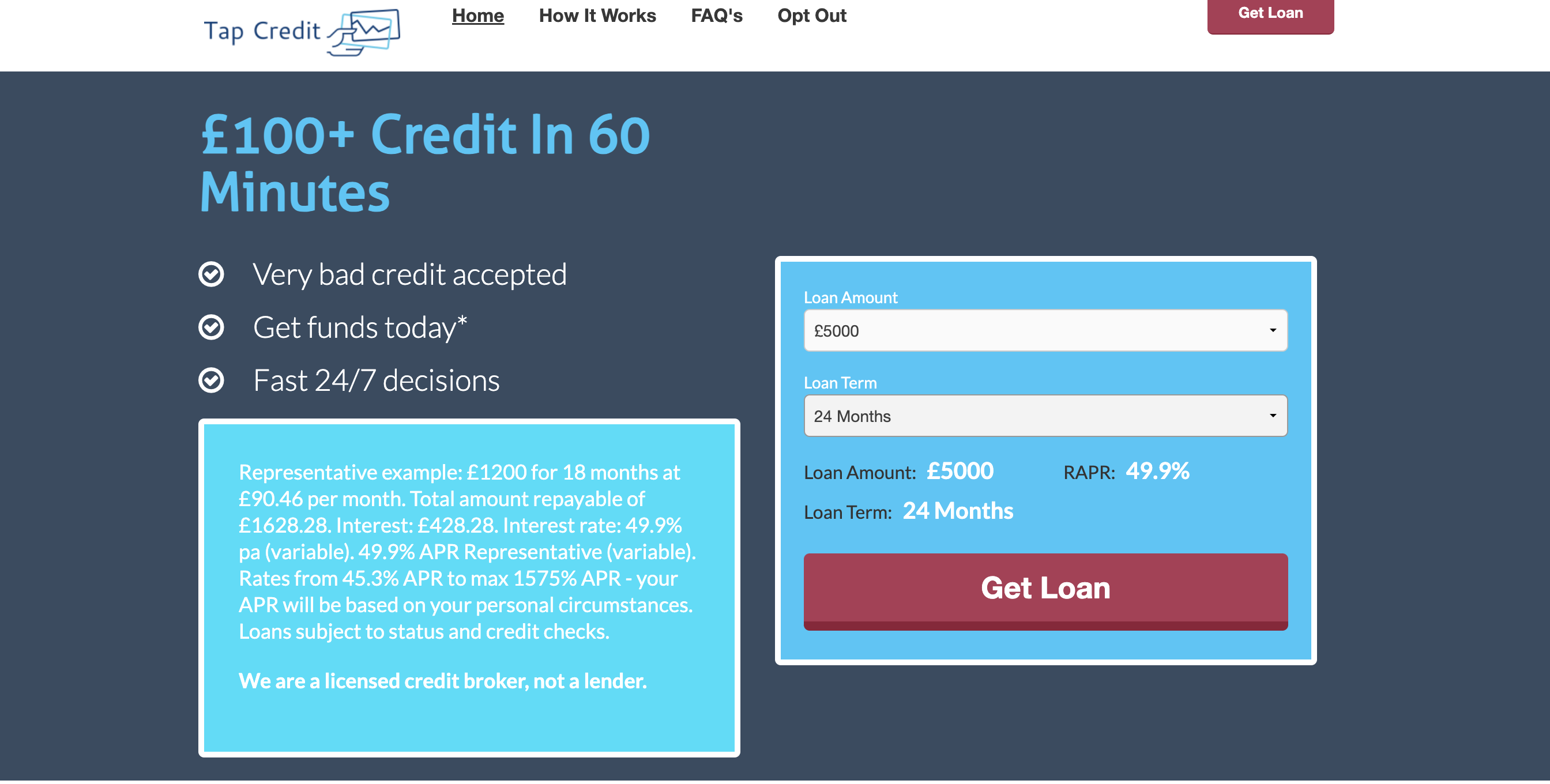

5. Tap Credit: Get your loan instantly

If you are having unexpected bills and expenses and you need some cash immediately, Tap Credit has access to one of the largest panels in the country and it only takes them a few minutes to match you to A direct lender and approve your loan.

Quick payouts are a feature you will get to enjoy as they understand in depth the urgency that is in lacking money.

Borrow loan amounts of up to £5,000 to meet your urgent needs with Tap Credit and get quick approval, subject to further checks and cash deposited directly into your account.

6. Mr Payday: Best for Quick Loans

If you are looking for a payday company that has exemplary ratings coupled with low and suitable rates for the members then Mr Payday is perfect for you.

With a maximum lending amount of £5,000 that you can get the same day and a repayment period that can span 2 years, you are sure that all your financial needs can easily be met by Mr Payday.

Understanding the Eligibility Criteria for Very Bad Credit Loans Direct Lenders in the UK

For you to qualify for a payday loan in the UK, there are some requirements that you must satisfy. They are:

- You must be a UK citizen or permanent resident.

- You must be at least 18 years old.

- You must have a bank account.

- You must have a monthly income.

- You must have contact information such as an email and phone number.

The approval rate for these loans is very high as all these qualifications are easily met by a good number of borrowers who need instant cash. As a result, applying for a payday loan is easy and approvals are instantaneous.

It is however good to note that most of the lenders will only approve the loan if your income, which ought to be from a verifiable source, is at least £800.

Step-by-Step Guide to Applying for a Payday Loan in the UK

Applying for a payday loan has never been easier. For instance, applying for one only takes 5 steps and the rest is waiting for approval. The ease and swift application are attributed to the fact that all the procedures are done online as opposed to the conventional ways that involve a lot of paperwork. Below are the steps to apply for a payday loan in the UK:

- Choose a payday loan company of your liking.

- Fill out the online application.

- Upload the requested documents.

- Submit your application.

- Wait for the approval message.

It is important to note that the loan approvals might vary in terms of the time taken to approve and make the deposit in the accounts. The periods vary from a couple of hours to more than a day if the loan request is made after business hours.

Another important aspect to consider while applying for these payday loans is, as much as they are easy to apply for and have a high approval rate, some may fail to get to the approval stage since any of the aforementioned requirements are not met.

Related posts about Best Payday Loans $500

Understanding How the Direct Lender Loans in the UK Function

The basic principle behind a payday loan is borrowing to repay once your income hits your account. It is in line with this principle that having a verifiable source of income is a mandatory requirement for a payday loan to be advanced.

The broker companies have mechanisms whereby, once you make the loan application, the advanced systems will automatically determine whether you meet all the requirements, which if you do, you will be matched with a direct lender who will then inform you of your approval. Once the approval is confirmed, the lender will deposit the amount in your bank account.

The various lenders have different repayment plans which are relative to the loan amount and the agreement with the borrower. Late payments may attract penalties whilst early payments will significantly reduce the borrowing cost.

Criteria Used to Rank the Best Very Bad Credit Loans In the UK

About to be discussed in this section of the article is how we arrived at the above ranking for the best payday loans in the UK, regardless of bad credit scores.

Company history and reputation

To begin with, we verify the legitimacy by checking that they are authorized by the Financial Conduct Authority (FCA) to legally operate in the country. This is done to protect the end-consumers from predatory payday loans that look forward to exploiting innocent users.

A further step is taken to scour the entirety of the online history and reputation. The positive reviews have to outweigh the negative ones. On top of that, the negative comments and reviews are looked into to establish whether there is a scandal that the company has or had an involvement in.

Eligibility Requirements

We make sure that the eligibility requirements are minimal and similar to the ones mentioned above. An important aspect of eligibility such as bad credit may however vary from one company to another. Nevertheless, most of them are not keen to check credit scores but rather focus on the source and amount of income received at the end of the month. As a result, you find that you can still get a loan even if you have bad credit.

Software and Processing System

Bearing in mind the fact that a faulty system would make it impossible for clients to have the instant approvals that payday loans provide, a company must have state-of-the-art software and a processing system.

Consequently, we ensure that all the brokers have systems that are backed by the most recent upgrades available. This is done to be sure that the lenders they work with approve the loans instantly after all the requirements are met.

Cost of the loan

It is critical to understand that payday loans are costlier relative to other loans. The high cost is attributed to the high levels of risks that are attached to it. Regardless of this, we perform checks to affirm that all the brokers on our list have costs that are approved and regulated by the standards of the FCA.

In light of this, you can be assured that the brokers we recommend have regulated interest rates and fees, and if anything, we have selected the companies with the cheapest services.

Loan limits

Payday loans do not have a very high loan limit as other loans are fit for that purpose. Be it as it may, our recommended brokers have the highest loan limits in the market this year and so you can be sure of getting the ideal sums to offset the cash balance needed.

Repayment terms

We emphasize flexible repayment terms to be agreed upon between the lender and the borrower to see to it that the terms are favourable. Some of the factors in the terms are the exact payments to be made, the payment schedules, the total loan cost and the implications of late or early repayment.

Generally, early repayment translates to a lower cost while late repayment leads to penalties. That being the case, our recommended brokers often get a solution whenever you cannot make timely payments.

Customer support

Since high-quality customer support is paramount for the best experience, we recommend brokers that can look into your issue and solve it as fast as humanly possible.

As a result, we authenticate the availability of numerous channels of communication such as phone, live chat, and email, from which issues can be raised. That being the case, we put the channels to the test of how they handle the various issues raised to see how well the issue is tackled to affirm suitability.

Once all the above conditions are met by a broker, they then qualify to be on our list of top-ranked payday loan companies.

The Advantages and Disadvantages of Using Payday Loans in the UK

Payday loans have pros and cons that tag along with them. Here, we will give unbiased pros and cons that will further enlighten you and guide you to making a good decision about them.

Advantages of Very Bad Credit Loans in the UK

Listed below are some of the advantages of our recommended payday loans:

- Solve an emergency or last-minute expense thanks to fast approvals.

- Get access to funding even if you have a bad credit score or fresh credit history.

- Minimal requirements.

Payday loans provide a flexible and accessible solution for those in need of quick funding regardless of bad.

Table of Very Bad Credit Loans

| Brand | Summary | Score |

| Loan Mr | Easy Application | 10/10 |

| Speedy Lends | No Fees apply | 9/10 |

| Cash Now | Good for Bad Credit | 9/10 |

| Rapid Loans | No Upfront Fees | 8/10 |

| Tap Credit | Instant Funds | 8/10 |

| Mr Payday | Good Interest Rates | 8/10 |

Disadvantages of Payday Loans in the UK

Even though the pros are captivating, it is important to consider the downside to refine the decision-making process. The following are the cons:

- They have a higher interest rate when compared to other types of loans.

- You can request only small amounts up to £1,000 in most cases.

- Severe penalties when you don't pay on time.

Is a Payday Loan the Right Choice for You?

Yes. It is, but only if you are sure of paying as soon as you get your paycheck.

The fact that you have a list of reputable payday loan companies ought to make things easier for you.

What Are the Alternative Options When Your Payday Loan Application is Declined?

The following are the steps to follow in this event:

- Get a source of income that is certified – Failure to verify the source of income is the main reason why payday loans are not approved and so, to avoid such, attach a verifiable source.

- Choose the most appropriate lender – borrowing from a lender that has requirements that you do not meet will be a reason for failure to approve your payday loan. In this case, look for another suitable lender.

- Enhance your credit score – Improving your credit score will not only allow you to get payday loans but also other loans, all at better conditions that include lower fees and interest rates.

- Contact your lender – reaching out to the lender via various communication channels could help you know the reason for the denial of the loan and as a result help you correct that in the next application.

- Avoid requesting excessive amounts – Be sure to request amounts that are well within your borrowing limits.

FAQs

Below are some of the answers to some of the most frequent questions asked regarding payday loans. If you're interested in knowing more about the ranking of the payday loans mentioned in this article, read on.

When should you apply for a payday loan with instant approval?

When you need money for a last-minute emergency or when other types of funding are not available to you due to fresh credit history or issues with your credit score. In these scenarios, a payday loan can bring you the relief you need right now.

Do payday loans in the UK with instant approval require a credit check?

Yes, our recommended brokers are likely to perform a credit check when evaluating your application. However, it is not a decisive factor, because another important aspect is proving that you have a verifiable source of income. That's why our recommended options like Loan Mr are willing to bring you a payday loan even if you have bad credit.

Related posts Personal Loans with No Credit Check

Can you get a payday loan with instant approval with bad credit?

Yes, even with a low credit score, our suggested firm Loan Mr. can provide you with a payday loan that is approved quickly. It is easier for you to obtain a loan accepted even if you already have bad credit because our firms consider your employment/education history, potential assets, monthly income, and employment/education in addition to your credit score.

Can you get a better payday loan with a good credit score?

Naturally, the circumstances will improve with a higher credit score. For instance, if your credit score is high enough, the lender could be able to offer you a lower annual percentage rate (APR) and significantly raise the likelihood that your application would be accepted. They might even present you with alternative products that have better terms for repayment, higher limits, and extra bonuses.

Can you repay a payday loan early?

Yes, our recommended brokers allow you to repay your payday loan early without penalties or extra fees. However, make sure to read your contract to be aware of all the details regarding paying back the payday loan early.

What happens if you don't pay back a payday loan?

If you don't pay the payday loan on time, then you will have to face severe penalties such as late payment fees, and this will also decrease your credit score rating. Therefore, before requesting this loan, make sure that you can pay it back to avoid problems that will only affect your finances negatively.

Alternatively, if you are worried about managing your money and would like more help, please see resources below.

- StepChange www.stepchange.org 0800 138 1111 . Free advice on debt problems and finding the best solution for you.

- Money Helper www.moneyhelper.org.uk 0800 138 7777. Offers free, unbiased and independent advice to people who want to manage their money more effectively. Face to face sessions available.

- National Debtline www.nationaldebtline.org 0808 808 4000. Free, confidential debt advice service run by the Money Advice Trust.

Warning: Late repayment can cause you serious money problems. For help go to moneyhelper.org.uk.

Advertisement by Season Marketing Limited, who are authorized and regulated by the FCA with reference number: 727385