A cheque? Uh, sure. Hold on.

I leave the canvasser at the door and walk back to my kitchen’s everything drawer. It’s filled with batteries, tape, paperclips and… somewhere buried between packs of Mabel’s labels and paperwork long overdue for a review, I find it. My chequebook.

“So, who do I make the cheque out to? I don’t know if I remember how to fill these things out anymore.”

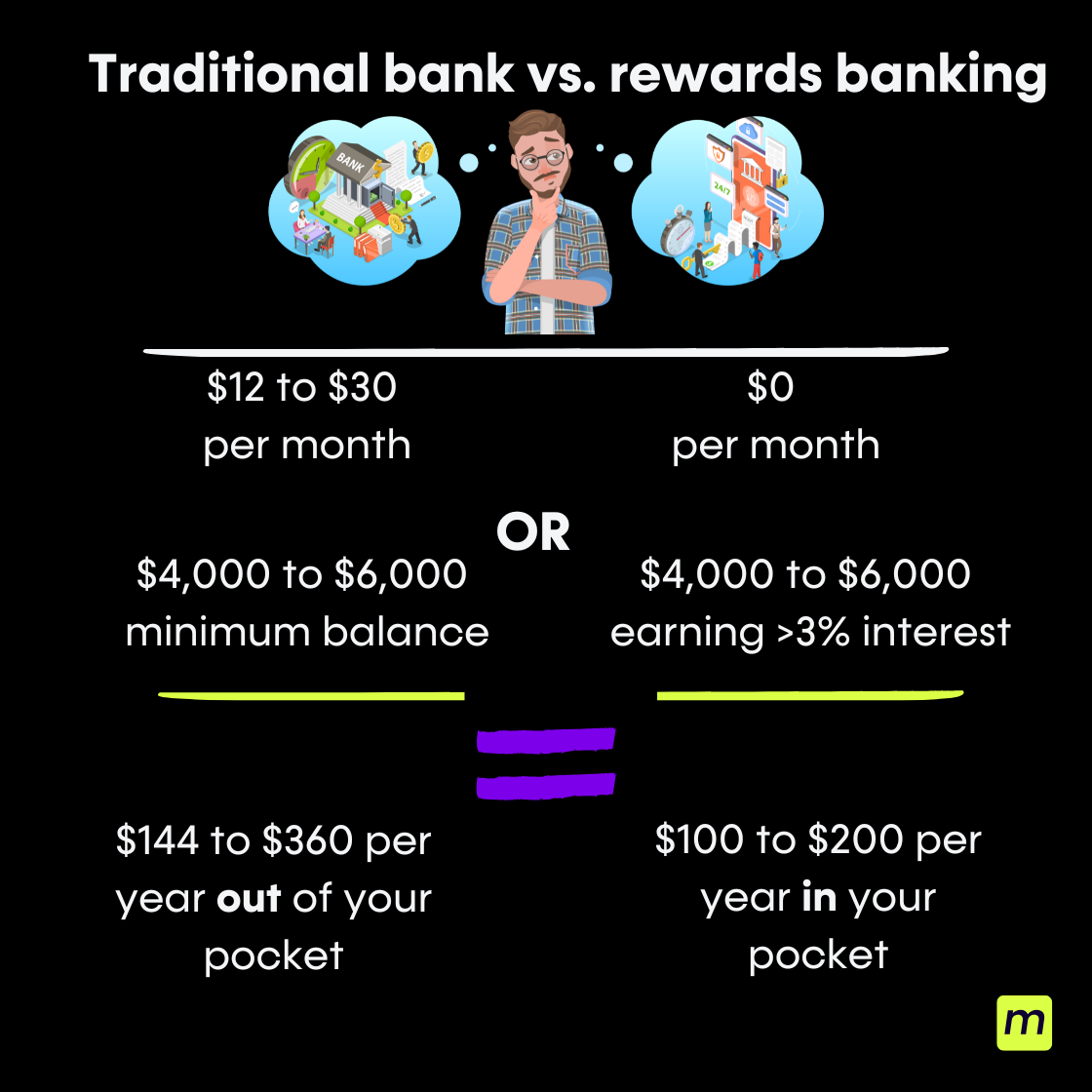

The Canadian chequing account is dying, or it’s already dead, yet hard-working Canadians continue to pay $16 to $30 each month — that’s $200 to $360 per year — for the privilege of a chequebook.

“You can stay with us,” the big banks say, “as long as you pay the fees.”

Or, you can avoid those account fees by maintaining high minimum account balances — typically $4,000 to $6,000. But, is having thousands of your dollars held hostage in your account for the privilege to use it in your best interest?

It’s certainly in the banks’ best interest. Our big six banks are among the most profitable companies in the world with regular appearances on Fortune 500 top companies by earnings.

Death of the chequing account

Stop wasting money on outdated chequing accounts. Switch to a modern alternative that rewards you for your everyday banking. It’s time to ditch the fees and start earning perks.

A standard chequing account is best if you:

- Collect paper payroll cheques

- Prefer speaking with a teller inside a brick-and-mortar bank

- Pay utility accounts, credit cards, and mortgage payments with cheques

- Need to cash a cheque

- Accept paying fees or holding high minimums in your account

A chequing account alternative is best if you:

- Have automatic, digital deposits from your employer

- Pay bills (utilities, mortgages, credit cards, etc.) through automatic bill payments

- Use e-transfers to split bills, such as a night out with friends for dinner or a shared vacation

- Use a mobile app or web browser to manage your accounts on the go

- Prefer the security of digitally encrypted transactions

- Enjoy no-fee rewards banking

As Canadians, we love the stability our big banks bring, but we’re not seeing higher earnings and better customer service that you’d think loyalty would afford us.

There is a better way but are Canadians ready for it?

According to a 2024 report from Statistics Canada:

- 82% of internet users used online banking in 2022

- 76% of people aged 65 to 74 banked online

- Over 88% of people aged 25 to 54 manage a chequing or savings account online

This large cohort of digitally-savvy, working Canadians are ready for rewards banking.

Rise of rewards banking

Big banks are smart and are adapting to changing customer demands and the rapid pace of technology and innovation. Financial technology (fintech) startups are deploying innovative technology at a rapid rate to improve and simplify financial services, offering faster, cheaper, and more user-friendly alternatives to traditional banks.

In the last year alone, Wealthsimple advertised its Cash Account as “Canada’s highest interest chequing account” — serving notice to Canadians a chequing account can earn interest. EQ Bank rebranded their “hybrid account” to something more colloquial as the “Personal account,” dropping the hybrid moniker as more Canadians’ blur the line between a chequing and savings account. Even KOHO, once known as a prepaid credit card with a high interest rate on balances, has entered the banking space by taking steps to obtain a full banking license in Canada, aiming to become a full-fledged bank.

Why does this matter? Because EQ Bank Personal, Wealthsimple Cash and KOHO Essential are all chequing account alternatives. None of these accounts use the term chequing, but all of them operate exactly like a chequing account offered by traditional, big banks — and more. Turns out these chequing account alternatives also offer clients more rewards and incentives, such as:

- Earn at least 2% interest on your paycheque

- Earn cash back when you spend money

- Pay bills and send e-transfers without limits

- Manage multiple accounts (emergency funds, sinking funds, bill funds, etc.)

- Get the exact Canadian Deposit Insurance Corporation (CDIC) insurance as the Big Six Banks

- Can open an account from your couch in minutes

*Interest rates vary by provider. EQ Bank offers 3.50% interest only with direct deposit; base rates may differ. Check individual account terms for details.

All those features are without the fees or minimum account balances required by traditional, big banks.

Afraid to switch? It costs nothing to open an account and test it out. It’s not complicated and the idea of using a fintech for your day-to-day banking needs is not a radical idea, even our American cousins opting for this approach more and more over the last decade.

Simple math: Traditional banks vs. rewards banking

If everything remains the same, after 30 years, you’ll have either paid over $6,000 for your chequing account or missed out on over $9,000 of interest from having $4,000 sitting in a 0% interest account to avoid the fees.

The opportunity cost alone should make you pull the proverbial plug on that outdated and costly chequing account.

Time to make your money work for you

Most Canadians, even newcomers, go to the bank their friends or relatives recommend.

Taking your banking online offers convenience, rewards, and an opportunity to look beyond a neighbourhood branch. When you bank on yourself, you open up your world to compare financial products that best suit your needs, not necessarily from one financial institution.

Perhaps Canada’s oldest banks will compete for our loyalty and win us back with better service and higher interest rates in our everyday accounts.

Sources

1. Fortune: Fortune Global 500 2024 edition

2. Statistics Canada: Trends in online banking and shopping (Mar. 21, 2024)

3. The Globe and Mail Online bank Koho Financial moves to next stage of approval toward gaining a banking licence, by Clare O’Hara (Jan. 26, 2024)

This article Death of the chequing account: How startups are enticing users to switch originally appeared on Money.ca

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.