Christy spent the last 14 years as a stay-at-home mom in Sioux Falls, South Dakota, raising six children, ages four to 18.

Her husband of nearly 20 years recently dropped a bombshell that he plans to file for a divorce this summer, and she’s worried she’s unprepared for the financial fallout.

Don’t miss

- I’m 49 years old and have nothing saved for retirement — what should I do? Don’t panic. Here are 6 of the easiest ways you can catch up (and fast)

- Robert Kiyosaki warns of a ‘Greater Depression’ coming to the US — with millions of Americans going poor. But he says these 2 ‘easy-money’ assets will bring in ‘great wealth’. How to get in now

- You don’t have to be a millionaire to gain access to this $1B private real estate fund. In fact, you can get started with as little as $10 — here’s how

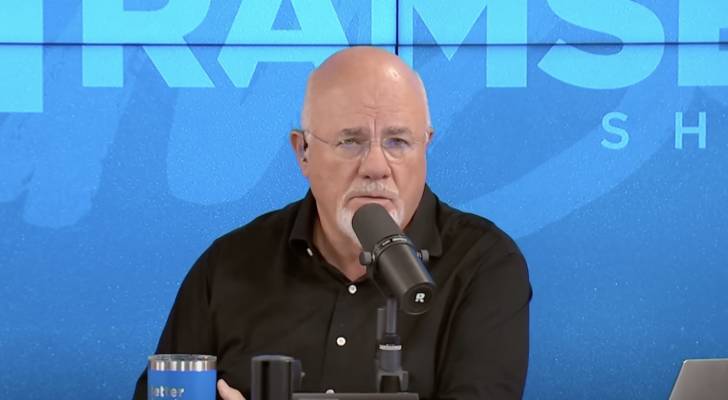

“I’ve had a little bit of part-time income, which works with our kids’ schedules, but essentially everything’s valued under him so to speak,” she told personal finance expert Dave Ramsey when she called into his show recently and explained her situation.

“Holy moly,” responded Ramsey.

Hidden debts and a looming legal battle

The couple once tackled debt together — in 2010 they paid off every loan.

However, in 2020, when the couple refinanced their house, Christy’s husband confessed that he had been using credit cards and was carrying debt. They rolled those balances into their mortgage, and he promised he would get rid of the credit cards.

Earlier this year, she discovered he had driven up nearly $60,000 in credit card debt. Again, they tapped home equity, taking a second mortgage to cover sky-high interest charges.

“Things went downhill really quickly after that,” she said. “I’m a preschool teacher to try to make money because I can have my son with me … I just found out that he hasn’t been paying my life insurance.”

She said her husband, who earns about $117,000 a year, is still living in the family home but avoids her and doesn’t communicate with her about the kids. He remains under their roof even as he pulls back from every other obligation.

Ramsey’s response was blunt but reassuring: the law would make sure her family is secure.

“ Your legal rights in most states with six children and a 20-year marriage are, he’s not gonna have much of that one $117,000 left by the time he finishes with alimony and child support. It is almost all gonna go to you and the kids,” he said. “So you’re not going to have to take care of the kids and feed them and pay the house payment on a part-time daycare salary.”

He urged Christy to meet with an attorney — and to insist her husband move out immediately. She said she has scheduled that meeting to clarify her legal rights under South Dakota law.

“You need to start taking a position of strength on this,” said Ramsey.

As for her husband’s credit card debt, the good news is most states, including South Dakota, follow common-law property rules. According to Experian, this means courts in these states usually hold the spouse who incurred the debts solely responsible for repayment. You usually would only be responsible for credit card debt solely in your name, joint credit card debt in both your name and your spouse’s or credit card debt from an account that you cosigned for your spouse, even if not owned jointly.

Read more: Want an extra $1,300,000 when you retire? Dave Ramsey says this 7-step plan ‘works every single time’ to kill debt, get rich in America — and that ‘anyone’ can do it

Preparing financially for a divorce

Even stay-at-home parents can shore up their finances at the first hint of divorce. Here are some ways to prepare yourself for this shift:

-

Document every dollar: Gather tax returns, bank statements, investment account statements, pay stubs, mortgage statements, insurance policies, credit card bills and all other financial documents. Keep copies in a secure physical or cloud-based location to build a clear record of income, assets and liabilities.

-

Separate your accounts: Open a personal checking and savings account, plus at least one low-limit credit card in your name. Even small balances build a credit history, which may be critical if you need to rent or buy independently.

-

Build a budget: Use a zero-based budgeting tool to track all expenses and identify where to stretch every dollar. Factor in immediate needs (housing, utilities, groceries) and plan for one-income realities.

-

Establish an income plan: Leverage skills you can monetize quickly: childcare, tutoring, virtual assistance, freelance writing or bookkeeping. For example, Christy found work as a preschool teacher, which allows her to bring her four-year-old to class.

-

Secure new insurance: Shop for individual insurance policies to protect your children and yourself. Obtain quotes now and compare costs before coverage gaps occur.

-

Build an emergency fund: Even $500 set aside can cushion against immediate crises — car repairs, medical bills or gaps between paychecks.

-

Seek professional guidance: A family-law attorney will explain alimony and child-support rules in your state. A financial planner or credit counsellor can help you manage debts and rebuild your credit.

Christy’s road ahead will not be easy, but a proactive approach can transform chaos into control. By documenting finances, securing her accounts and crafting a realistic budget with a path to income, she can navigate from uncertainty to stability — and ensure her six children come through this transition with their needs met.

What to read next

- Financial aid only funds about 27% of US college expenses — but savvy parents are using this 3-minute move to cover 100% of those costs

- Here are 5 ‘must have’ items that Americans (almost) always overpay for — and very quickly regret. How many are hurting you?

- How much cash do you plan to keep on hand after you retire? Here are 3 of the biggest reasons you’ll need a substantial stash of savings in retirement

- This is how American car dealers use the ‘4-square method’ to make big profits off you — and how you can ensure you pay a fair price for all your vehicle costs

Stay in the know. Join 200,000+ readers and get the best of Moneywise sent straight to your inbox every week for free. Subscribe now.

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.