A new snapshot of Canadian financial confidence shows that even in mid-2025 — with interest rates steady and inflation slowing — many Canadians still feel unsure about their money management skills.

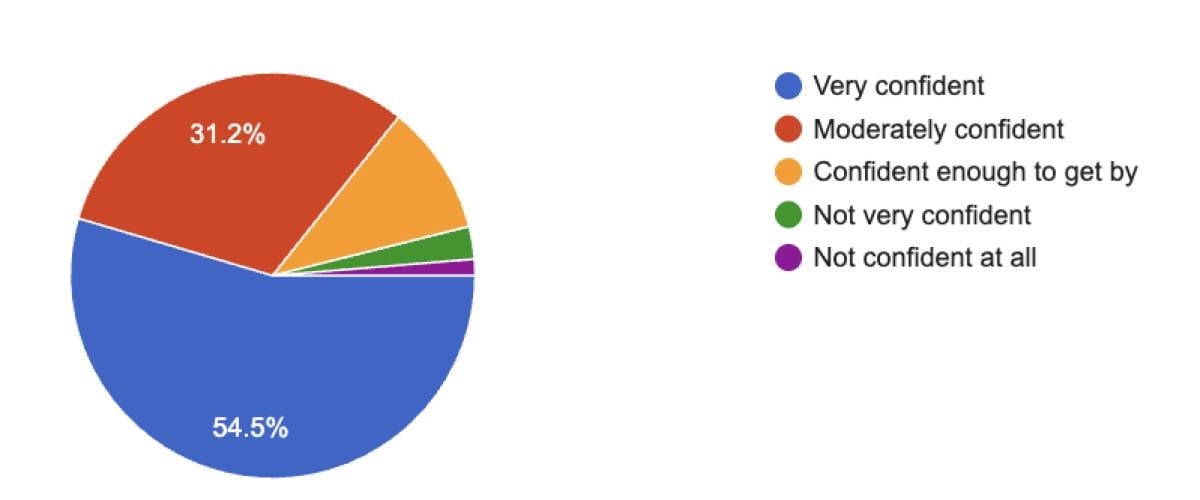

In a recent poll from Money.ca, only 54.5% said they feel “very confident” managing their finances, while 31.2% reported being only “moderately confident.” The rest admitted to feeling just barely in control or not confident at all — with 7.8% saying they’re “scraping by,” 3.9% “not very confident,” and 2.6% “not confident at all.”

This means more than 4 in 10 Canadians feel some level of doubt or insecurity when it comes to managing their money, highlighting a growing concern even among those not in financial crisis.

As financial editor, Kelley Keehn, has said: “Confidence is important, but it can be misleading. Without the basics — like a budget or emergency fund — people may overestimate how well they’re doing.”

Canadians still struggling with affordability

This confidence gap persists even as economic indicators point to stabilization. According to Statistics Canada, inflation rose 2.9% year-over-year in May 2025, with housing costs up 6.2% and grocery prices remaining elevated.

But for the average Canadian, it’s not just numbers on a page — it’s a lived reality. In another recent survey from Co-operators 72% of Canadians said that inflation was hurting their financial outlook, and nearly half (47%) cite housing affordability as an ongoing growing concern. An additional 43% pointed to a weak job market as a contributor to their financial unease.

Even for those who are investing, 27% say they don’t have enough money right now to keep contributing — a red flag that Canadians are feeling squeezed even if they’re financially literate.

Money.ca survey: How confident are you in your ability to manage your own finances?

Younger Canadians most vulnerable

The confidence gap is especially visible among younger adults. The Co-operators survey found that only 28% of Gen Z and 26% of millennials feel optimistic about their financial future. When asked if they could manage a major, unexpected expense, just 26% of Gen Z and 22% of millennials said yes.

This vulnerability is especially concerning given that younger generations face higher student debt, precarious employment, and rising rents — all of which can erode financial resilience over time.

The power of advice — but few access it

One bright spot? Canadians working with a financial advisor show significantly higher confidence levels. According to the Co-operators survey: 67% of Canadians with an advisor feel optimistic about their financial future, versus just 44% of those without.

Those with advice are more than twice as likely to feel “very confident” making money decisions. And 52% of advisor-supported Canadians believe they’re on track to meet their financial goals, compared to just 26% of DIYers.

Despite this, only 1 in 3 Canadians currently work with a financial advisor, and nearly half (43%) say they don’t know who to trust for financial help.

“We’re seeing a generation that’s hungry for support but unsure if they even qualify for financial advice,” said Co-operators executive Jessica Baker. “You do. Everyone does.”

A call to act now — not later

Looking back, 58% of Canadians say they wish they had started planning earlier. Experts agree that starting small — and soon — is key to building confidence and resilience.

Simple steps include:

- Creating a realistic monthly budget

- Paying down high-interest debt

- Building an emergency fund

- Using free financial literacy tools from FCAC and CPA Canada

As the cost of living continues to challenge Canadians, building financial confidence — through education, support, and smart habits — may be just as important as cutting expenses.

Survey methodology

The Money.ca survey was conducted through email in September 2024. Approximately 4,100 email newsletter subsribers, over the age of 18, were surveyed resulting in 77 responses. The estimated margin of error is +/- 8%, 17 times out of 20.

The Co-Operators online survey was conducted between June 9 to 12, 2025. A total of 1,500 adult residents from across Canada were surveyed. The sample was randomly drawn from Leger’s web panel of potential survey respondents. The sample was weighted by age, gender, and region to reflect Canada’s population distribution according to the 2021 Census data. An associated margin of error for a probability-based sample of this size would be ±3%, 19 times out of 20.

About Money.ca

Money.ca is a leading financial platform committed to providing individuals with comprehensive financial education and resources. As part of Wise Publishing, Money.ca is a trusted source of reliable financial news, expert advice, comparison tools and practical tips. Canadians get insight on a variety of personal financial topics, including investing, retirement planning, real estate, insurance, debt management and business finance.

Sources

1. StatsCan: CPI May 2025

2. Co-operators: Canadians are struggling with financial confidence, but human advice helps (June 26, 2025)

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.