Calgary Stampede: Sheryl Crow, wagyu poutine and a side of rodeo

The Calgary Stampede, running from July 4 to 13, 2025, is not only a cultural celebration, but also a significant economic engine for Alberta. With its blend of world-class entertainment, culinary innovation and community spirit, the event invites residents and visitors to experience the “Greatest Outdoor Show on Earth” — all while fueling downtown restaurants, […]

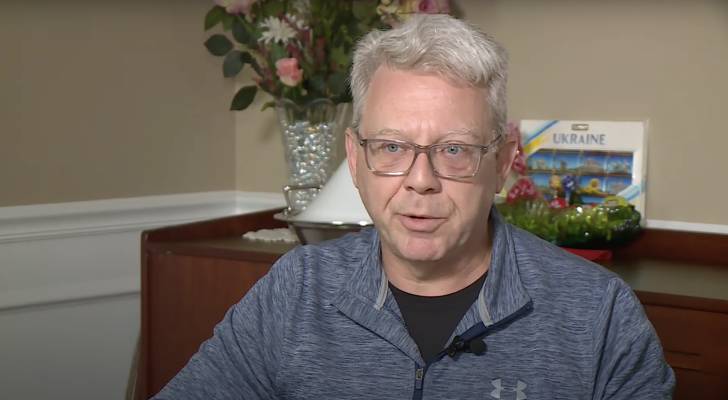

‘I sued the state of Missouri’: This man bought a trailer on Facebook Marketplace — but he says when he went to get the title, he was told ‘the only way’ to do that was to sue the state

Ben Shakman, a Wildwood, Missouri resident, purchased a trailer on Facebook Marketplace for $3,500 years ago and thought all was fine. Don’t miss I’m 49 years old and have nothing saved for retirement — what should I do? Don’t panic. Here are 6 of the easiest ways you can catch up (and fast) Robert Kiyosaki […]

Edward Jones bets big on alternative investments — what Canadian investors should watch

In an increasingly volatile investment landscape, traditional stock and bond portfolios are losing their appeal among high-net-worth investors. Edward Jones, a North American financial services firm with more than 20,000 advisors and over US$2.2 trillion in assets under care, has joined a growing wave of institutions expanding access to alternative investments — and Canadian investors […]

Love, lies, and $5 million: Winnipeg lottery battle exposes the high price of trust

A Winnipeg man’s $5 million lottery win has turned into a legal saga after his former partner claimed the winnings and allegedly cut off all contact. The case, now before Manitoba’s Court of King’s Bench, offers a stark lesson about the financial risks of informal arrangements in personal relationships. Lawrence Campbell alleges he purchased the […]

A combined $1.8 million in losses: Victims share their experience with GIC fraud — how to protect yourself from similar scams

In a time when financial insecurity is high and many are looking for ways to safeguard their money or increase their wealth, fraudsters are taking advantage of that vulnerability. Recently, three Canadians fell victim to a fraudulent scheme involving fake Guaranteed Investment Certificates (GICs), losing a combined $1.8 million. The scam, which has been gaining […]

Ontario women lose nearly $68K after scammers pretend to be from their banks. Here’s what happened and how you can protect yourself

As technology continues to develop at quickening rates, the tools available to financial fraudsters continue to broaden. But, sometimes, old devices work just as well. Three ON women — and one unidentified woman —are out nearly $68,000 after falling victim to a classic scam maneuver known as a spoofed phone call. The scammers called each […]

Trump’s tariffs, market chaos and the rise of inverse ETFs: How investors are hedging market downturns

In today’s turbulent economic climate, marked by President Trump’s recent tariffs on Canada, Mexico and China, concerns about a potential recession are escalating. As markets react to these developments, investors explore strategies to protect their portfolios. One such strategy involves inverse exchange-traded funds (ETFs). What are inverse ETFs? Inverse ETFs, also known as bear or […]

Think you’re healthy? Why critical illness insurance in Canada might still be essential

Choosing insurance is as much about planning for the future as it is about meeting your needs now. You choose your car insurance policy based on what car you’re driving and your health insurance according to what type of care you need this year. But there are many types of “what-if” insurance that are just […]

FIFA World Cup set to score big for Canada’s economy

Canada is about to host one of the biggest events on the planet and the economic playbook looks like a winner. With Vancouver and Toronto set to welcome fans from around the globe for the 2026 FIFA World Cup, economists and tourism officials alike are bullish on the potential windfall. According to a joint report […]

Ottawa woman accuses husband of ‘love bombing,’ leaving her $300K in debt

Browsing the internet or social media will bring about many first-hand accounts of dating and marriage horror stories that would render even the most hopeless romantic a cynic. Here’s one such story. Christina MacCrimmon of Ottawa claims she was the victim of ‘love bombing’, that left her nearly $300,000 in debt. "It’s just unimaginable to […]