In the digital age, protecting your identity has never been more crucial. With cybercriminals constantly devising new methods to steal personal information, identity theft protection services have become essential for safeguarding your financial and personal data.

IdentityIQ stands out as a leading provider in this sector. Known for its comprehensive and affordable protections against identity theft and digital threats, IdentityIQ offers a range of features designed to keep your information secure.

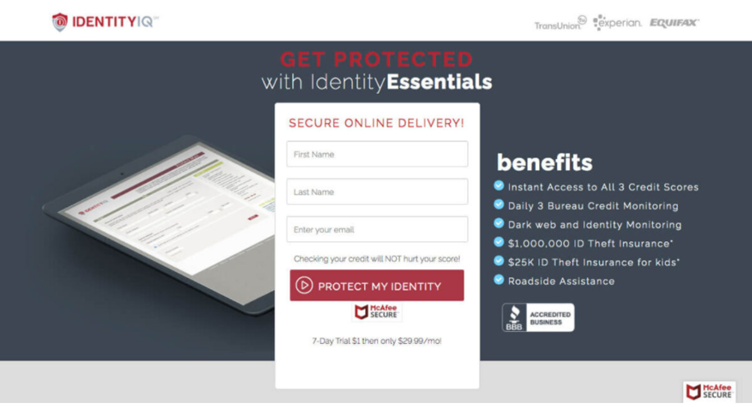

One of the most appealing aspects of IdentityIQ is its $1 free trial for seven days offer. This allows you to experience their robust identity theft protection services with minimal risk. By opting into this trial, you gain access to a suite of features that monitor your credit and non-credit activities, providing theft protection services from a leading american company and peace of mind in today’s interconnected world. Easily protect your funds and identity from getting used by criminals with the IdentityIQ free trial.

IdentityIQ offers robust credit monitoring services designed to safeguard your financial well-being. Leveraging data from the three major credit bureaus—Equifax, Experian, and TransUnion—IdentityIQ provides daily monitoring to detect and alert you about any suspicious activity on your credit accounts.

Credit monitoring is just one aspect of the comprehensive protection IdentityIQ provides. While it focuses on credit-related threats, other features extend protection beyond traditional credit monitoring.

IdentityIQ goes beyond conventional credit monitoring by extending its surveillance to non-credit areas where personal information is often traded illegally. These include the dark web and public records.

IdentityIQ offers extensive identity theft insurance coverage coupled with expert restoration assistance, ensuring you’re well-protected in case of identity theft incidents.

Insurance Coverage Details:

Restoration Assistance:

Incorporating both proactive measures like credit monitoring and reactive supports like insurance coverage illustrates how IdentityIQ delivers a well-rounded approach to protecting against identity theft.

👉 Get access to IdentityIQ ID Theft & Credit Protection – Free Trial $1

IdentityIQ goes beyond credit monitoring to protect your identity in areas that don’t involve credit. In today’s digital world, cybercriminals often trade personal information on the dark web and misuse public records. IdentityIQ’s non-credit monitoring services add an extra layer of security against these risks.

Dark Web Monitoring

The dark web is a hidden part of the internet where cybercriminals frequently buy, sell, and exchange stolen personal data. This includes sensitive information like Social Security numbers, credit card details, login credentials, and more.

IdentityIQ continuously scans the dark web for any signs of your information. If there’s any suspicious activity, you’ll receive immediate alerts so you can take quick action to minimize potential harm.

Public Records Monitoring

Public records are another source where your personal details can be exposed. IdentityIQ keeps an eye on various types of public records such as criminal records, court documents, property records, and address changes.

These records sometimes become targets for identity thieves who want to commit fraud or carry out other illegal activities using someone else’s identity. By monitoring public records, IdentityIQ ensures that any unauthorized use of your personal information is promptly identified and dealt with.

👉 Sign up for the limited IdentityIQ $1 free trial today!

IdentityIQ utilizes advanced algorithms and data analytics to monitor both the dark web and public records. Here’s a breakdown of the process:

This comprehensive approach means you’re not only shielded from credit-related risks but also from other forms of identity theft that may occur outside traditional financial activities.

Benefits of Non-Credit Monitoring

Non-credit monitoring brings several advantages in safeguarding your identity:

Potential Concerns

While the non-credit monitoring features are extensive, some users may have concerns about:

Despite these concerns, the benefits of having a comprehensive monitoring service like IdentityIQ far outweigh the potential drawbacks. The proactive measures offered by IdentityIQ ensure that you stay ahead of cybercriminals looking to exploit your personal information.

Recognizing the importance of protecting your identity beyond just credit-related activities highlights why IdentityIQ is a leading choice for holistic identity protection services.

👉 Protect Yourself Against Identity Theft with the $1 Free Trial of IdentityIQ

IdentityIQ stands out with its strong focus on identity theft insurance coverage and restoration assistance. This means that not only are you protected financially in the event of identity theft, but you also have expert guidance to help you navigate through the recovery process.

Comprehensive Insurance Coverage

IdentityIQ offers up to $1 million in identity theft insurance coverage, providing extensive protection against various expenses that may arise from identity theft:

Benefits:

Potential Limitations:

Expert Restoration Assistance

In the unfortunate event of identity theft, IdentityIQ provides expert restoration assistance to guide you through the process of reclaiming your stolen identity and restoring financial security.

Steps in Restoration Assistance:

The personalized approach ensures that you’re not navigating the complex maze of identity recovery alone.

Key Features:

Both the identity theft insurance coverage and restoration assistance offered by IdentityIQ provide a dual layer of protection, making sure that you have both preventive measures and responsive support in place.

👉 Try the seven-day IdentityIQ $1 trial before time runs out!

IdentityIQ offers a range of plan options designed to cater to various levels of protection and budget preferences. Understanding these options can help you choose the most suitable plan for your needs.

Selecting the right plan depends on your specific needs and budget. For instance, if you prioritize comprehensive coverage including family members, the Secure Pro or Secure Max plans might be ideal choices. Conversely, if you’re looking for essential protection at an affordable rate, the Secure or Secure Plus plans offer fundamental features with robust safeguards.

Understanding the details of each plan ensures that you get the best value for your investment while effectively protecting your personal information and financial security.

👉 The 7-Day Trial (charged $1) of IdentityIQ is waiting for you!

Taking advantage of the IdentityIQ $1 free trial signup is straightforward and grants you access to a suite of features designed to protect your identity. Follow these steps to get started:

Go to the official IdentityIQ website. You’ll find information on their services and the free trial offer prominently displayed.

Look for the option that mentions the $1 free trial. This will typically be highlighted on the homepage or under a dedicated section for promotions.

You’ll be prompted to select a plan that best fits your needs. While all plans offer a comprehensive set of features, choosing one during the free trial gives you an idea of what’s included in higher-tier plans.

Fill out your personal details to create an account. This step usually involves providing basic information like your name, email address, and phone number.

Although it’s a $1 trial, you’ll need to enter your payment details. This ensures a seamless continuation of service after the trial period if you decide to continue.

For security reasons, you may need to verify your identity through various means like answering security questions or providing additional documentation.

Once registered, you can immediately start using IdentityIQ’s monitoring features, including credit monitoring, dark web surveillance, and public records tracking.

By following these steps, you can easily begin exploring how IdentityIQ protects your sensitive information without any long-term commitment upfront.

👉 Sign up for the limited IdentityIQ $1 trial today!

When comparing IdentityIQ with other popular identity theft protection services like Aura and LifeLock, several unique features and advantages stand out.

In this comparison of “identityiq vs aura vs lifelock,” IdentityIQ stands out for its balanced approach to credit and non-credit monitoring, extensive family coverage, and dedicated restoration assistance. While Aura excels with its comprehensive digital security tools and LifeLock leverages its strong brand reputation and legal support offerings, IdentityIQ provides robust identity theft protection with an emphasis on affordability and inclusivity.

Taking proactive steps to safeguard your identity is crucial in today’s digital landscape. IdentityIQ provides advanced tools and services that can help you stay ahead of potential threats. From comprehensive credit monitoring to dark web surveillance and robust identity theft insurance, IdentityIQ offers a well-rounded protection plan.

The IdentityIQ $1 free trial is an excellent opportunity to experience these benefits firsthand without any significant financial commitment. This trial period allows you to explore the features and understand how they can protect your personal information effectively. Signing up is easy and provides immediate access to a suite of protective measures.

Don’t wait until it’s too late. Sign up for the IdentityIQ $1 free trial today and take the first step towards securing your identity. For more detailed insights, check out our full identityiq review and see how it stacks up against other services.

👉 The 7-Day Trial (charged $1) of IdentityIQ is waiting for you!

IdentityIQ’s credit monitoring feature works by continuously monitoring the user’s credit accounts to detect and alert them about any suspicious activities, such as unauthorized access or fraudulent transactions.

IdentityIQ extends its monitoring services to non-credit areas such as the dark web and public records, where personal information is often traded by cybercriminals. This helps in detecting potential threats to the user’s identity beyond traditional credit-related activities.

IdentityIQ’s identity theft insurance coverage not only protects the primary account holder but also extends to their qualifying family members. It offers comprehensive protection in the event of identity theft incidents, providing financial security and peace of mind for the entire family.

IdentityIQ offers flexible plan options with varying levels of features and benefits. The pricing for each plan differs based on the extent of protection and services provided. Readers can explore these options to select a plan that best suits their individual needs and budget.

Some concerns associated with IdentityIQ’s service include the lack of a dedicated mobile app, which may impact user experience and accessibility. Additionally, there may be questions about how customer data is shared with third-party entities, although measures are taken to ensure data privacy and security.

Readers can avail the $1 free trial offer from IdentityIQ by following a simple step-by-step guide for signing up. During the trial period, they can experience the benefits and features of the service firsthand before making a commitment.

IdentityIQ stands out from other identity theft protection services like Aura and LifeLock due to its unique features and advantages. A brief comparison highlights why individuals should consider IdentityIQ as their preferred choice for safeguarding their identities with confidence.