I’m 58 years old, single and simply over the daily grind. I’ve got $970,000 stashed in my 401(k) — can I retire today?

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links. You’ve hit your late 50s, you’ve got a nice cushion in your 401(k) and suddenly you find yourself wondering if that cushion will provide you with enough comfort to […]

‘I work for a living’: Whoopi Goldberg says she relates to Americans ‘having a hard time’ — admits she’d leave ‘The View’ if she had ‘all the money in the world’

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links. Whoopi Goldberg has been co-hosting ABC’s “The View” since 2007, making her the longest serving member on the successful daytime show’s panel. However, the celebrated actor and comedian with […]

‘Built on a throne of lies’: Texas woman is ‘freaking out’ after her husband lied about having a $1 million net worth — he’s actually $150,000 in debt. 3 simple ways to get out of the red

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links. Just a few months into her marriage, Veronica from Texas is “freaking out” after discovering her husband, who she thought was worth nearly $1 million, lied about his finances […]

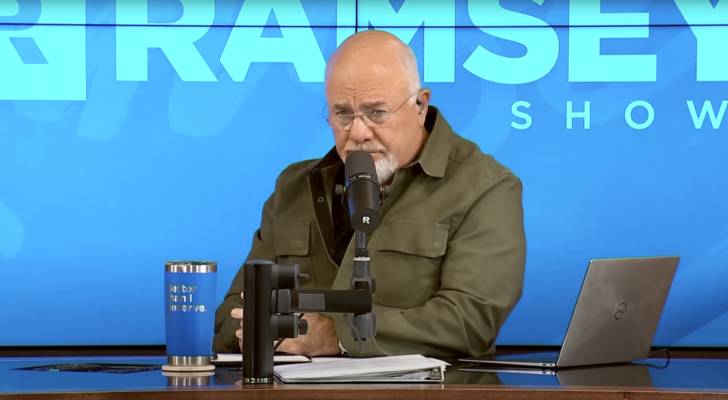

This Phoenix man inherited roughly $3,000,000 from his late father’s estate — now his stepsister wants him to share the wealth. Dave Ramsey gave him some blunt advice

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links. Dividing an inheritance is rarely straightforward, but in blended families, the stakes and emotions can be particularly high. On a recent episode of The Ramsey Show, Jared from Phoenix, […]

NFL star Odell Beckham Jr. took his $750,000 salary in this 1 asset back in 2021 — folks called it ‘dumb’ but now he’s laughing all the way to the bank. How to make a similar move in 2025

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links. NFL star Odell Beckham Jr. is taking a victory lap, but not on the field. The Miami Dolphins player took to X to celebrate Bitcoin’s price topping $100,000 last […]

This Florida couple bought a vacant lot for $17,500 — but now they’ve discovered they’re barred by law from building on the new property. Here’s why and how to avoid a similar situation

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links. When Donna Hartl and her husband purchased a vacant lot in Brooksville, Florida, they thought they’d found the perfect location for their dream home. Nestled between Islewood Drive and […]

This San Diego married couple lives paycheck to paycheck on $500K-$600K a year — admits to $30K in monthly expenses including car lease payments. Here’s Dave Ramsey’s advice

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links. Despite earning an estimated combined income of $500,000 to $600,000 a year, Bill from San Diego admits he and his wife struggle to save any money — and it’s […]

‘People are going to lose their property’: This Illinois woman’s property tax is poised to pop from $756 to over $10,000 — a shocking 1,222% spike. Here’s why she’s not alone

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links. Landowners in Montgomery County, Illinois are grappling with a dramatic spike in property taxes after having their bills reassessed. Brandi Lentz told 5 On Your Side she paid $756 […]

I’m 65 years old, have zero savings and can’t afford to retire — but I really don’t want to work until I die. What can I do?

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links. A 2024 report by AARP found that 20% of Americans aged 50 and over have no retirement savings at all. The U.S. Government Accountability Office paints an equally dire […]

Some Americans are rushing to pay less than $20K for 2-bedroom tiny houses on Amazon. It may be a low-cost route to homeownership — but here’s the catch

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links. Imagine buying a home for less than a Honda Civic, ordering the house to your location, and unpacking your new home on top of your property. A two-bedroom prefabricated […]