Here’s the income you need to be in the top 1%, 5%, and 10% in the US — and 3 essential tips to help you climb higher on the wealth ladder in 2025

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links. When you think of the top 1% of American earners, the first people who might come to mind are likely well-known investors and entrepreneurs like Warren Buffett and Bill […]

Here are the facts on 5 damaging Social Security myths that can ruin your retirement

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links. The ins and outs of Social Security benefits can seem as complicated as they are crucial to Americans’ financial comfort — or even survival — in retirement. Personal finance […]

Can you afford to retire at this exact moment? Here are 3 simple rules of thumb to figure out if you can make the move in 2025

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links. America is about to experience a retirement tidal wave. According to an article from Empower’s publication The Currency, an estimated record 4.1 million Americans turned 65 this year. However, […]

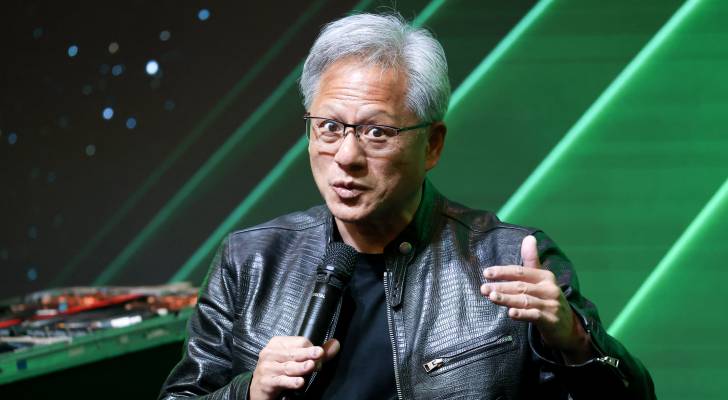

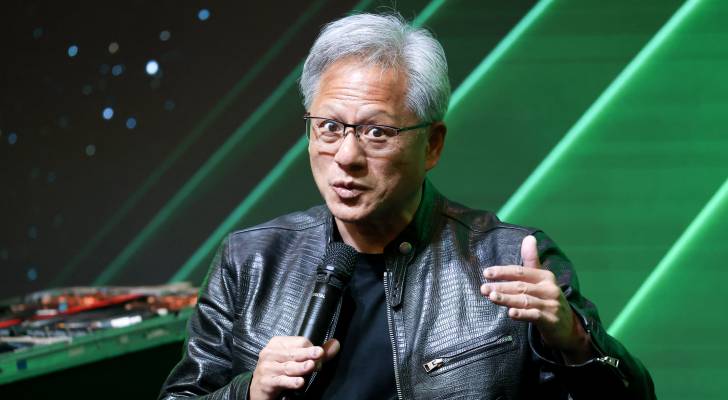

Nvidia’s billionaire CEO sold over $700M of the company’s stock after his net worth took a big hit this year — here’s how to help protect your portfolio against market swings in 2025

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links. The story of Nvidia (NVDA) founder and CEO Jensen Huang is a compelling testament to the American Dream. His journey began humbly, working as a dishwasher at Denny’s, where […]

Want to set yourself up in a home for retirement but you’re strapped for cash? You can use your IRA — but here’s why you may want to explore other options

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links. When retirement is on the horizon, it’s natural to start thinking about where you want to spend your later years. In fact, you may even be tempted to buy […]

This 1 habit could transform your finances in 2025 — here are 3 ways to create real wealth in the new year

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links. As you look ahead to 2025, are you aiming to get a better handle on your finances? Are you trying to save for an important goal or want to […]

Retirement villages were supposed to be ‘utopia’ for Australian seniors — instead, some residents faced ‘corporatised elder abuse.’ What can American retirees learn from their plight?

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links. After decades of preparing for it financially, retirees should be able to enjoy the fruits of their labor. But as thousands of older adults in Australia found, nest eggs […]

Warren Buffett once said ‘money has no utility’ to him. here’s the personal asset he prizes above all others — and how you can take advantage of it

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links. Known for his savvy investments and sharp wit, billionaire Warren Buffett is also celebrated as one of corporate America’s great philosophers. In a 2016 interview on Bloomberg’s The David […]

You’re a 47-year-old surgeon, you and your wife make $573,000/year and still feel broke — is your financial advisor ripping you off? Here’s what you need to know before you hire someone

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links. Countless Americans are chasing the dream of one day becoming rich. But at some point in the race, many of them come to find there’s an important difference between […]

‘World War III has already begun,’ Jamie Dimon warns — says his team is preparing for serious conflict with China, Russia. 3 assets to protect yourself in 2025

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links. The head of America’s largest bank told an audience at the Institute of International Finance earlier this year that his team is running scenarios in preparation for a global […]