Millennials are the ‘biggest losers’ in US society, according to new data. Here’s why — plus key things Americans of any age can do to help build lasting financial security

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links. A quick Google search reveals that millennials are often characterized as entitled whiners who are quick to complain about their financial struggles — but it’s not a fair assessment. […]

Here’s how American car dealers use the ‘4-square method’ to make big profits off you — and how you can make sure you’re paying a fair price for all your vehicle costs

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links. Car dealers aren’t always known for prioritizing your budget — and the lengths some will go to to separate you from your hard-earned money are greater than you might […]

‘You’re going to live on beans and rice’: This Arizona senior told Dave Ramsey she has zero savings and student loans — 3 retirement saving tactics to get you back on track

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links. In a call on an episode of The Ramsey Show, a 73-year old Arizona resident named Robin shared that she has no 401(k) or mutual funds and more than […]

Rich older Americans are using these 3 retirement saving strategies to supercharge their nest eggs — here’s how to use them to prepare for a comfy retirement

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links. The U.S. Department of Labor estimates you’ll need 70–90% of your pre-retirement income to maintain your standard of living in your golden years. Citizens Financial Group reported that a […]

Warren Buffett says you only have to do ‘very few things right’ in life — as long as you don’t do too many wrong things. 3 bad investing mistakes that put your retirement at serious risk

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links. After nearly seven decades of experience, investing legend Warren Buffett has accumulated more than $142 billion in personal wealth — and the Oracle of Omaha believes much of his […]

‘I failed many times’: Shaq said he made so many money mistakes from when he was younger because he did ‘no research’ and ‘no due diligence’ — but now he’s worth $500M. How he got better

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links. Shaquille O’Neal, the NBA Hall of Famer, has seen significant success off the court, largely thanks to early investments in companies like Google, Ring, Apple, and Lyft, contributing to […]

These are 3 huge perks ultra-rich Americans get from their banks — can you get them too?

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links. When it comes to picking a bank, most people focus on things like access to ATMs and monthly account fees. For rich people, those things matter — but most […]

This under-the-radar mortgage hack is saving some Americans thousands of dollars per year — here’s what you need to know before talking to your lender

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links. With mortgage interest rates falling, homeowners are hunting for ways to cut their monthly payments. Refinancing remains hugely popular, but a lesser-used hack could also save you hundreds each […]

Here’s why the Fed’s most recent rate cut won’t fix the US housing problem and homebuyers likely face a tough year ahead — plus a few alternative ways to invest in high-demand real estate

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links. The dream of homeownership feels out of reach for many, with 70% of Americans in an IPX study saying buying a home in 2024 seems unrealistic. High mortgage rates […]

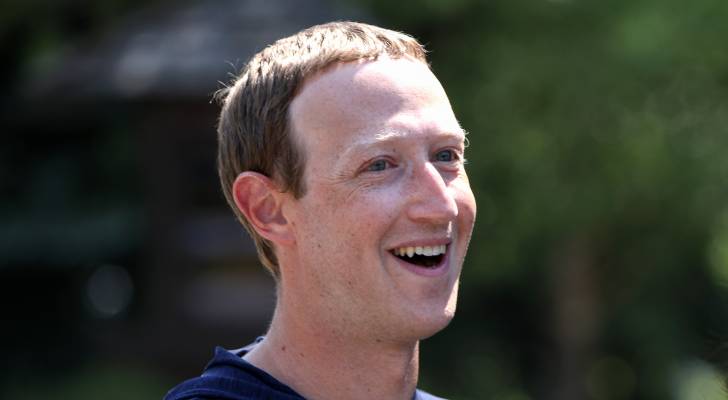

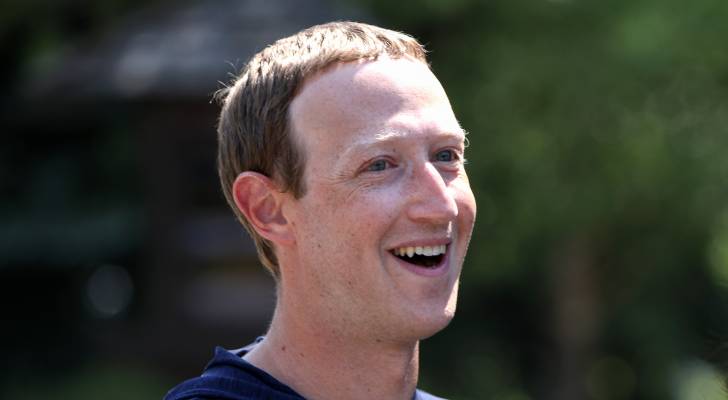

Super-rich Americans like Mark Zuckerberg and Jay-Z have taken out mortgages for homes they can easily afford — here’s why

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links. For many people, the only way to afford a home is to finance it with a mortgage and pay off that loan over time. During the third quarter of […]