Caleb Hammer refuses to agree ‘girl math’ is behind Florida entrepreneur’s debts, drained life savings — how to avoid 4 major business miscalculations

Mackenzie, 26, from Melbourne, FL, works “four or five” jobs and side hustles. She considers herself an entrepreneur, but she’s drained her retirement savings and emergency fund — racking up thousands of dollars in debt — in the process. Must Read Thanks to Jeff Bezos, you can now become a landlord for as little as […]

Experts warn of ‘ghost student’ scam that could leave any American saddled with ‘phantom’ student debt — here’s what to do if you’re targeted

There’s a scam targeting student financial aid, and it’s leaving some Americans with “phantom” student debt. As of October 1, applications for Free Application for Federal Student Aid (FAFSA) are now open. But, along with students, fraudsters will apparently be applying for aid, too. Thanks to Artificial Intelligence, “ghost students” are becoming a major problem […]

I’m 62 and not ready to retire, but I’m over working full-time. If I can persuade my boss to make me part-time, how do I make sure I can afford it?

Imagine this scenario: Tracey from Philadelphia is going on 62, and while her friends are talking about retirement, she’s not quite ready to walk off into her golden years just yet. She loves having structure and purpose to her days, as well as the mental challenge of work. Since she’s divorced and her adult children […]

Nearly 30M ‘solopreneurs’ bring in $1.7T for the US economy — with many leaning on this 1 thing to punch above their weight. But what are the risks?

Students earning cash with their first side hustle, parents working full-time to support their families and retirees pursuing their entrepreneurial dreams are among those harnessing AI to build their businesses. The release of new generative AI products is empowering sole businesspeople — aka solopreneurs — to develop businesses they only dreamed of building just a […]

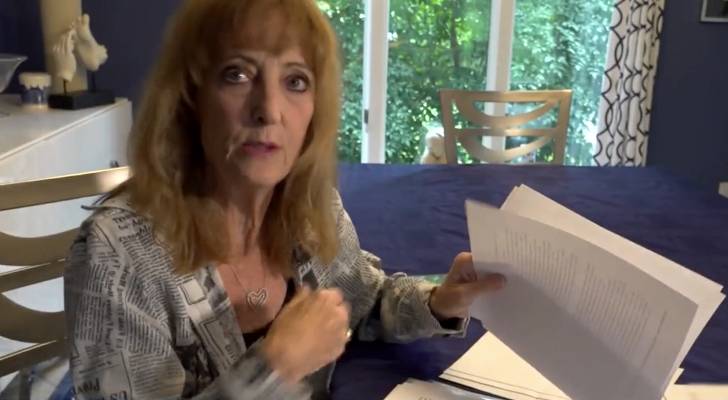

This Philadelphia woman’s insurer denied her coverage for her medication, so she turned to AI to build an appeal — and won. Would you try it?

Joani Reisen was in her 40s when she was diagnosed — along with her son — with attention-deficit/hyperactivity disorder (ADHD), and for about a decade she treated it with a prescription drug called Concerta. “It focuses me,” she told CBS News Philadelphia [1] in a story published Sept. 15. “I remember taking my first medication […]

This 1 ‘demoralizing’ employment trend is locking computer science grads out of their industry — and minimum wage jobs won’t take them either. Are $165K tech jobs permanently at risk?

For years, we heard about the tech talent shortage — that there was a glut of jobs and not enough bodies to fill them. For students studying computer science, a bright future was on the horizon. Upon graduation, they could expect multiple job offers, high starting salaries and lots of perks, from free food and […]

$30K to name your baby, $200/hour for a ‘pet nutritionist’ — niche consultants are making bank off the wealthy. Silly spending, or real investment?

Inside the world of ultra-specific consultants What some consider frivolous spending, others might see as an investment that will boost their chances of perpetuating wealth. But are baby-naming services, sorority rush consultants and pet nutritionists really smart ways to spend money to maintain social status, or are these spending habits driving people into debt? Must […]

Denver man racked up $37K in credit card debt over just 3 months gambling online — but Dave Ramsey bets just 1 phone call could slash that in half

Christopher from Denver fell into a familiar trap: the allure of online crypto casinos. With just a few months of blackjack play, he racked up tens of thousands in credit card debt — and even more in personal losses. He called into The Ramsey Show to ask for advice on his spiraling financial situation [1]. […]

Sean Kingston sentenced to 3.5 years in prison by Florida court for wire fraud scheme — here are 2 major red flags luxury sellers should watch out for

Rapper Sean Kingston might be best known for his 2007 hit, “Beautiful Girls,” but now he’ll be remembered for something else: a million-dollar wire fraud scam he ran with his mother involving luxury goods. Kingston, whose legal name is Kisean Paul Anderson, has been sentenced to three and a half years in federal prison. His […]

‘This is insanity’: Dave Ramsey told this Boston couple they should sell their stocks to pour $250,000 into their mortgage. Is that good advice?

Nick’s sitting on a classic money dilemma: take the $150,000 his wife has in a stock portfolio from her old job and knock down their mortgage, or stash it away as a safety net. The Boston couple is torn between peace of mind and the satisfaction of wiping out debt. Nick called into The Ramsey […]