AI isn’t the biggest threat to Gen Z workers right now, says leadership expert — why ‘youngism’ is to blame for holding this generation back

While Gen Z workers might be worried about how AI will impact the job market, it’s not the only threat to building a career. While older workers may face discrimination in the workplace — being passed over for jobs or promotions — young workers have the opposite problem: youngism (1). Must Read Thanks to Jeff […]

NYC man blindsided after parents admit that they borrowed $17K for his college — and now want him to pay it off. What Dave Ramsey says he should do

James from New York graduated from college nearly a decade ago. But his parents just informed him that they had taken out a parent PLUS loan to help pay for his college tuition — a loan he wasn’t aware of — and now they want him to pay them back. Must Read Thanks to Jeff […]

This influencer is using her social media accounts to help retire early from the corporate world — here’s how she does it. Could you pull it off too?

Influencer Taylor Hayes, who runs a blog and several social media channels as imperfecttaylor, recently shared on TikTok that she’s leveraging brand deals and her growing number of followers to retire early [1]. Although she has 141,000 followers on Instagram and 49,400 on TikTok, she’s not a full-time influencer. Rather, she has a full-time corporate […]

This 1 ‘demoralizing’ employment trend is locking computer science grads out of their industry — and minimum wage jobs won’t take them either. Are $165K tech jobs permanently at risk?

For years, we heard about the tech talent shortage — that there was a glut of jobs and not enough bodies to fill them. For students studying computer science, a bright future was on the horizon. Upon graduation, they could expect multiple job offers, high starting salaries and lots of perks, from free food and […]

Caleb Hammer slams “girl math” and holds entrepreneur accountable for her downfall. Here are 4 major business miscalculations to avoid

Mackenzie, 26, from Melbourne, FL, works “four or five” jobs and side hustles. She considers herself an entrepreneur, but she’s drained her retirement savings and emergency fund — wracking up thousands of dollars in debt — in the process. She told Caleb Hammer on a recent episode of Financial Audit that she used to work […]

Sean Kingston sentenced to 3.5 years in prison by Florida court for wire fraud scheme — here are 2 major red flags luxury sellers should watch out for

Rapper Sean Kingston might be best known for his 2007 hit, “Beautiful Girls,” but now he’ll be remembered for something else: a million-dollar wire fraud scam he ran with his mother involving luxury goods. Kingston, whose legal name is Kisean Paul Anderson, has been sentenced to three and a half years in federal prison. His […]

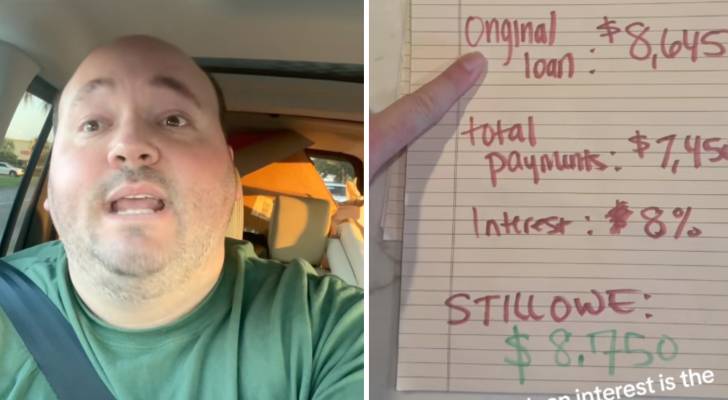

Florida man takes to TikTok to voice frustration that after years of making student loan payments he now owes $100 more than he took out — here’s why

TikToker cha_cha_p from Florida has paid $7,450 on a student loan with an original balance of $8,645. But, with an 8% interest rate, he now owes $8,750. So, even though he’s been paying his student loan off for years, he still owes $100 more than his original balance. “That’s why people hate student loans,” he […]

I’m going on 62 and want to switch to part-time work in my current role before retiring. How can I make it work — and persuade my boss?

Imagine this scenario: Tracey from Regina is going on 62 and while her friends are talking about retirement, she’s not quite ready to walk off into her golden years just yet. Mentally she’s still sharp as a tack. She loves having structure and purpose to her days, as well as the mental challenge of work. […]

I just lost out on an apartment — because my mom was secretly carrying a $6K credit card balance in my name. My credit is wrecked — what do I do?

Rosalie, a 20-year-old woman, just found out that her mother secretly carried a $6,000 balance on a credit card opened in Rosalie’s name when she was still a child. The card finally closed two years ago after being paid off and inactive, but it was mismanaged for years, leaving her with a “very poor” FICO […]

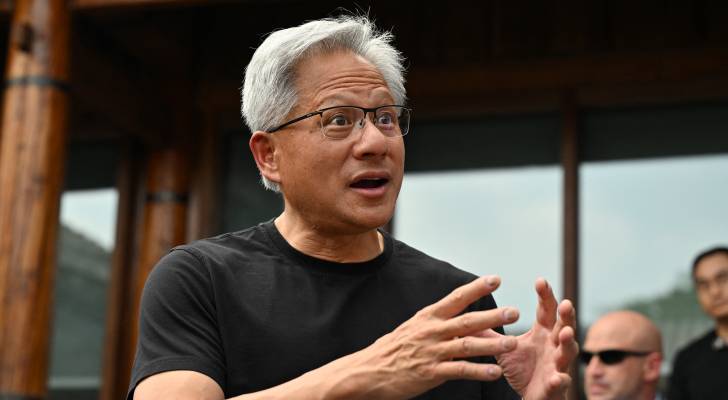

Nvidia’s founder calls AI the ‘greatest technology equalizer of all time’ and it’s already creating billionaires — is it time to hop on the trend?

Speaking during a tech summit hosted by the All-In Podcast and The Hill & Valley Forum [1] on July 23 in Washington, Nvidia CEO and co-founder Jensen Huang called artificial intelligence (AI) the “greatest technology equalizer of all time.” Nvidia is the trillion-dollar company that manufactures the chips that power many of today’s major AI […]