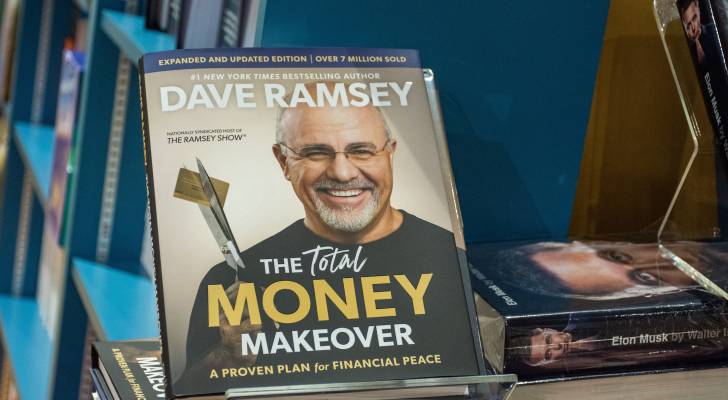

Pay off your mortgage with $150K stock portfolio? Dave Ramsey says ‘absolutely’ — but here’s why you might not want to

Nick’s sitting on a classic money dilemma: take the US$150,000 his wife has in a stock portfolio from her old job and knock down their mortgage, or stash it away as a safety net. The Boston couple is torn between peace of mind and the satisfaction of wiping out debt. As a result, Nick called […]

My daughter’s father died, but her stepmother is mum on his estate — which is about $2,000,000. We’re unsure if there’s a will. What are our options?

Losing a parent is one of the most traumatic things a child can experience. Take the example of Angie, whose dad, Hugh, has recently passed away. It’s been devastating for her. She shared a strong bond with her dad and helped care for him as his health declined in the last two years of his […]

‘That should be a warning’: 65-year-old with no savings doesn’t know where to start. Dave Ramsey says he should axe this one thing first

Mark from North Carolina is 65 — but he’s not retiring any time soon because he’s made “absolutely horrible decisions with money all my life.” He told The Ramsey Show (1) that he has “no nest egg.” His wife has about US$10,000 in a 401(k) — the American equivalent of a RRSP — and he […]

Ray Dalio says choosing the right partner is life’s most important decision — and your wallet might agree. Do you align on these 3 money musts?

There are a lot of qualities we might look for in a life partner: trustworthiness, shared values and possibly a sense of humor. One that might not come to mind is whether you have a similar money mindset. But it’s an important factor to consider. “There is no more important decision that you can make […]

Some premium credit cards have hiked their annual fees by 45% — how to stop ‘fee creep’ from from robbing you of your hard-earned rewards

For some Americans, paying a high annual fee on a premium credit card is worth it for the perks. But, with credit card companies hiking those annual fees — by as much as 45% — is fee creep starting to cancel out those benefits (1)? In June, JPMorgan Chase announced it would be raising the […]

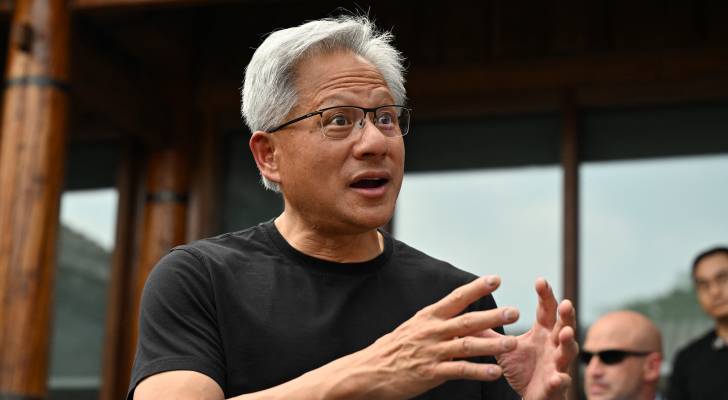

Nvidia’s stock is on an ‘epic run’ in 2025, but chasing the AI trend could distract investors from this 1 ‘most proven’ path to long-term growth

If you own stock in Nvidia, you’re likely feeling pretty good about the company’s performance in 2025. The tech giant’s stock has been on an incredible run, climbing more than 50% year to date. In fact, its record-setting performance in 2025 launched Nvidia into unchartered territory, as it became the first company ever to reach […]

Nvidia’s founder calls AI the ‘greatest technology equalizer of all time’ and it’s already creating billionaires — is it time to hop on the trend?

Speaking during a tech summit hosted by the All-In Podcast and The Hill & Valley Forum [1] on July 23 in Washington, Nvidia CEO and co-founder Jensen Huang called artificial intelligence (AI) the “greatest technology equalizer of all time.” Nvidia is the trillion-dollar company that manufactures the chips that power many of today’s major AI […]

Cornell researchers have found the secret to happiness and it only costs $400. Here’s how 1 simple exercise can lead to living a richer life

It’s that time of year again — the season for giving. But charitable giving isn’t just about getting a tax break. It could hold the secret to happiness, for as little as $400. A six-year study from Cornell University found a simple “happiness hack” that could lead to a more fulfilling life. Here’s how the […]

Houston man borrowed $10K from his uncle — who was then busted by the FBI for a $1.4M green card scam. Dave Ramsey says he still owes the money back

About a year ago, Eric from Houston was facing legal trouble and needed a lawyer. So he turned to his uncle, who works for a law firm. His uncle arranged for a lawyer at a cost of about $10,000. What Eric didn’t know at the time was that his uncle was allegedly running a fraudulent […]

Think slowing your ‘burn rate’ can keep you afloat if you lose your job? Here’s why it probably won’t last long — and what you should do instead

If you’re furloughed or lose your job, do you know how much money you’d need to bridge the gap until you start getting a paycheck again? This refers to your so-called “burn rate” — a term commonly used by startup companies to measure how quickly cash reserves are spent before they become profitable. Must Read […]