This Atlanta Burger King employee worked a last-minute shift in graduation gown after high school ceremony — now he’s $87,000 richer. Here’s what the teen can teach you

While many high school graduates are celebrating the season with dinners, parties and well-deserved rest, one teen in metro Atlanta marked the milestone a little differently — trading his cap and gown for a shift at Burger King. Still wearing his graduation medals around his neck, 18-year-old Mykale Baker showed up to work at the […]

This finance personality freed herself from $300K in debt — by replacing her shame with strategy. Here’s how she helps others find purpose in their finances through ‘curiosity’

You might recognize her as @TheBudgetnista on TikTok, sharing money wisdom with warmth and wit. But Tiffany Aliche’s impact goes far beyond viral videos. Before the books, the interviews and the online following, she was on the ground teaching women, particularly women of color, how to navigate financial systems not built with them in mind. […]

‘Only his death stopped the hemorrhaging’: Before Brian Ketchum died in his 80s, he spent $45K on a dating chat site — why so many seniors fall victim to ‘liars and thieves’ online

Whether it’s the loss of a spouse or a fresh start after divorce, the need for companionship doesn’t fade with age — if anything, it deepens, especially as social isolation sets in. It can make emotionally vulnerable people financially vulnerable, too. That’s what happened to 82-year-old Brian Ketcham, as his son Christopher relates in The […]

‘It was worth every penny’: One woman confesses to shelling out $24K to meet her husband — as luxury matchmaking services grow, are singles getting a sufficient return on their investment?

Meeting a partner was often reliant on chance encounters — a glance across a room, a friend’s casual introduction or meeting an unexpectedly charming neighbor in the lobby of your building. Now, dating has become less about serendipity and more about strategy, subscriptions and some serious spending. The dating services industry in the U.S. hit […]

This 28-year-old from Miami started selling this 1 very basic clothing item 2 years ago — and it’s already achieved cult status, bringing in over $16,000,000/year. But can she keep it up?

If you’ve noticed your daughter wearing an oversized sweatshirt with “PARKE” stamped across the chest, you’re not alone. Launched in 2022 by 28-year-old Chelsea Kramer, the brand has quickly become a Gen Z wardrobe staple. Kramer started out focusing on upcycled vintage denim, but it was the simple, cozy and limited-edition sweatshirts that created a […]

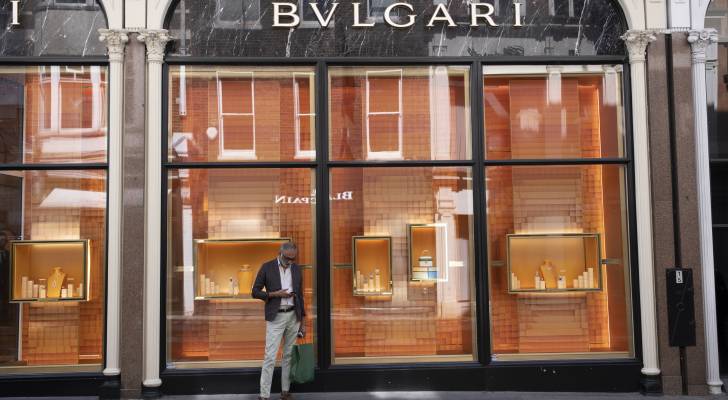

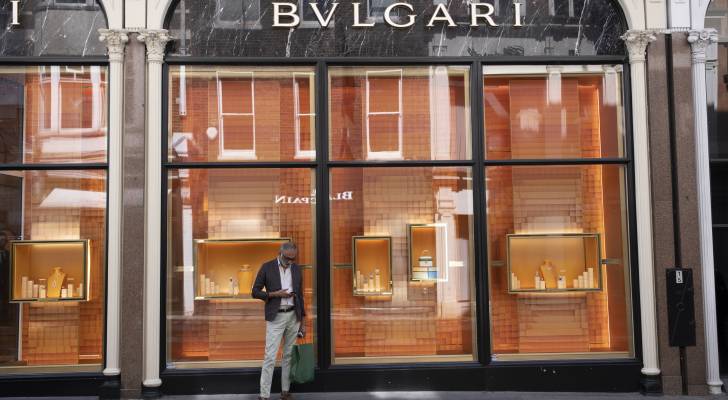

Bag it before it’s gone: Shopping for a smart, stylish hedge for your portfolio? Here’s why investing in tangible luxury can both pad your wallet and protect it from inflation

LVMH lost its title as Europe’s most valuable luxury company — and Hermès didn’t need a runway to take the lead. The luxury conglomerate behind Louis Vuitton, Christian Dior and Sephora reported €20.3 billion in revenue for the first quarter of 2025. While that signals solid performance, particularly in Europe, a softer U.S. market, lower […]

‘They’re coming for the American dream’: Kevin O’Leary lashes out at Trump’s ‘strong move’ blocking Harvard from taking international students — adds it could have far-reaching consequences

Since returning to office, President Trump has intensified efforts to reshape America’s higher education landscape — and Harvard is directly in the crosshairs. On May 22, the Trump administration announced plans to halt the university’s ability to enroll international students, cutting off a major revenue stream for one of the nation’s oldest and wealthiest institutions. […]

Living the dream, leasing the nightmare: Young renters are now paying over $6,000 a month to chase the ‘West Village Girl’ fantasy

To her million-plus followers, Miranda McKeon isn’t just living in the West Village — she’s selling the dream. At 23, her mix of polished fashion posts and raw honesty about her breast cancer journey has built a brand that feels both aspirational and relatable, with her West Side Village lifestyle front and center. Long before […]

A New Jersey man borrowed $20K from his brother to go to law school, but bought a car instead — then crashed it. Here’s the advice he got on John Mulaney’s new Netflix talk show

When a loved one is in need, lending a helping hand can feel like second nature — even with a price tag. On a recent episode of his new Netflix talk show, Everybody’s Live With John Mulaney, the comedian explores what it really means to help someone — and the consequences that can follow. Don’t […]

Prices don’t go down: Jerome Powell says it’s too early to debate monetary policy as economy remains solid – but that optimism is not being felt in American households

Despite policy shifts under the Trump administration — from tariffs to immigration to federal spending — Federal Reserve Chair Jerome Powell says the U.S. economy remains on solid footing. While the long-term effects of the policy changes continue to unfold, Powell signaled no urgency to adjust monetary policy, citing a strong labor market and easing […]