‘Things feel a lot tighter now’: Young Americans are turning to ChatGPT for therapy and skipping ‘sober Ubers’ to save money — why cutting costs has become an urgent matter for Gen Z

Self-care for many Gen Zs used to mean shellac nails, oat milk lattes and a colorist on speed dial. But with prices rising and paychecks stretched, beauty routines are starting to look a lot more practical. Searches for “press-on nails” are up 10% since February, while “blonde to brunette hair” has surged 17%, according to […]

‘I saw the potential’: This 47-year-old spent $50K reviving 8 abandoned apartments — now they bring in $220K a year, but the hidden costs took her by surprise

It’s easy to fall for the charm and potential of a place like Minden, Louisiana — just ask Sara McDaniel. In 2020, she came across an opportunity to purchase an eight-unit, villa-style apartment complex that had been abandoned for nearly 40 years. By then, McDaniel was no stranger to real estate; she already owned over […]

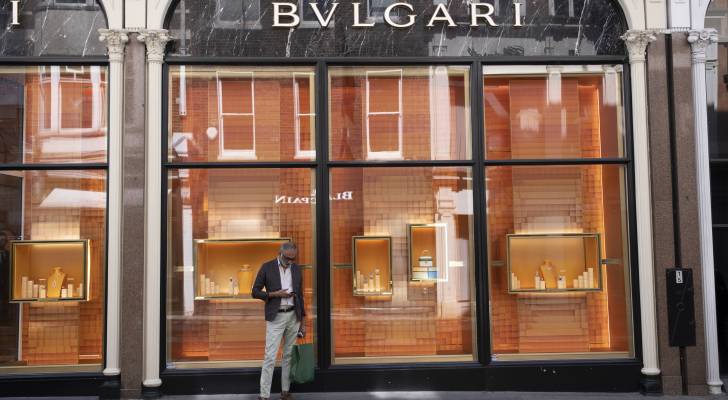

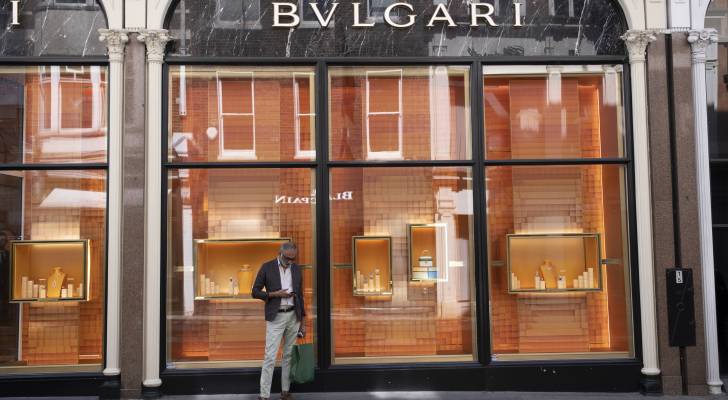

Bag it before it’s gone: Shopping for a smart, stylish hedge for your portfolio? Here’s why investing in tangible luxury can both pad your wallet and protect it from inflation

LVMH lost its title as Europe’s most valuable luxury company — and Hermès didn’t need a runway to take the lead. The luxury conglomerate behind Louis Vuitton, Christian Dior and Sephora reported €20.3 billion in revenue for the first quarter of 2025. While that signals solid performance, particularly in Europe, a softer U.S. market, lower […]

Living the dream, leasing the nightmare: Young renters are now paying over $6,000 a month to chase the ‘West Village Girl’ fantasy

To her million-plus followers, Miranda McKeon isn’t just living in the West Village — she’s selling the dream. At 23, her mix of polished fashion posts and raw honesty about her breast cancer journey has built a brand that feels both aspirational and relatable, with her West Side Village lifestyle front and center. Long before […]

This Netflix exec says her ‘big public failure’ was actually her ‘greatest’ lesson — here’s why shaking off the shame of getting fired can be the shot in the arm you need

While many Americans are busy climbing the corporate ladder, there’s one nagging fear that tends to keep them up at night: tumbling right back down. That’s exactly what happened to Bela Bajaria, now chief content officer at Netflix. Long before she held, arguably, one of the most coveted titles in entertainment, she faced what she […]

A New Jersey man borrowed $20K from his brother to go to law school, but bought a car instead — then crashed it. Here’s the advice he got on John Mulaney’s new Netflix talk show

When a loved one is in need, lending a helping hand can feel like second nature — even with a price tag. On a recent episode of his new Netflix talk show, Everybody’s Live With John Mulaney, the comedian explores what it really means to help someone — and the consequences that can follow. Don’t […]

‘It was a calculated attack’: This Chicago man won a whopping $800,000 in sports bets at Midwest casinos — but they refuse to pay. 3 ways to make sure you cash in on big wins

Thomas McPeek didn’t just stumble into a lucky streak — he studied for it. The 24-year-old from Chicago spent last year diving into the world of sports betting, placing dozens of complex, high-risk wagers on football — called parlays — based on odds he believed he could beat. “It was a calculated attack where I […]

Prices don’t go down: Jerome Powell says it’s too early to debate monetary policy as economy remains solid – but that optimism is not being felt in American households

Despite policy shifts under the Trump administration — from tariffs to immigration to federal spending — Federal Reserve Chair Jerome Powell says the U.S. economy remains on solid footing. While the long-term effects of the policy changes continue to unfold, Powell signaled no urgency to adjust monetary policy, citing a strong labor market and easing […]

‘There’s a huge percentage of the US population that isn’t getting access to these medications’: Novo Nordisk makes game-changing $2 billion deal for new obesity drug

Danish pharmaceutical company Novo Nordisk — best known for its blockbuster weight-loss drugs Ozempic and Wegovy — has signed a $2 billion deal to acquire the global rights to an experimental obesity treatment from China’s United Bio-Technology (Hengqin) Co. The March 24 agreement includes milestone payments of up to $1.8 billion, plus tiered royalties. Don’t […]

This CEO went from $300,000 in debt to a self-made millionaire. She says these 3 common money mistakes could be costing you thousands — here’s how to fix them

Bernadette Joy, CEO of Crush Your Money Goals, went from $300,000 in debt to earning her first million in just eight years — and it all started with one simple but powerful step: taking ownership of her finances. But before her fortunes began to turn, Joy often felt like she was broke and that her […]