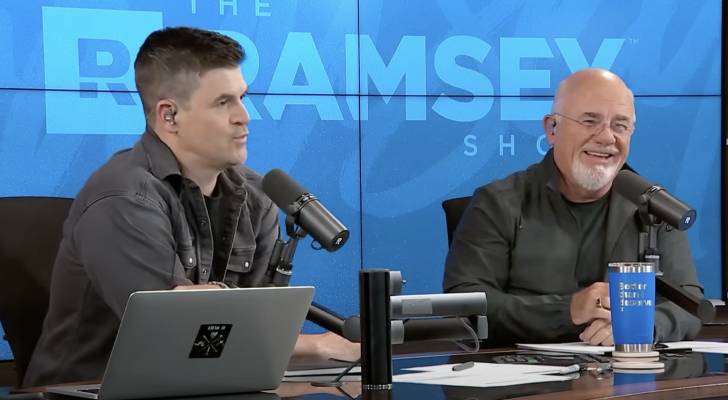

Heather, who lives in Fairfax, Virginia, called into The Ramsey Show and asked co-hosts Dave Ramsey and Dr. John Delony if there’s any hope to get an 18-year-old to budget when she’s always had easy access to and been surrounded by wealth.

Don’t miss

- I’m 49 years old and have nothing saved for retirement — what should I do? Don’t panic. Here are 5 of the easiest ways you can catch up (and fast)

- Gain potential quarterly income through this $1B private real estate fund — even if you’re not a millionaire. Here’s how to get started with as little as $10

- Robert Kiyosaki warns of a ‘Greater Depression’ coming to the US — with millions of Americans going poor. But he says these 2 ‘easy-money’ assets will bring in ‘great wealth’. How to get in now

She said her daughter was homeschooled and taught good values about money, but then went to a high school where “people will drive a different car to school every day just to show off their wealth.”

Heather says she has little control over her daughter’s spending habits since her husband insists on paying for everything, including college. Heather’s in-laws will also give her daughter money whenever she asks.

“You don’t have a daughter problem — you have a husband problem,” said Ramsey. He also said that no one with common sense would want to marry "princess girl" who has "never known a single boundary."

When parents aren’t on the same page

Heather’s daughter is acting like a typical 18-year-old, said Delony, and he “wouldn’t begrudge her a second” because the way she’s acting is “developmentally appropriate.”

That’s where parenting is supposed to come in.

Heather, who says she grew up poor, has been asking her husband to limit the amount of money they give their daughter — or, at least put it into an account they have access to so they can see how she’s spending it and discuss it with her. But he says it’s their daughter’s decision on how she spends that money and she needs to learn from her own mistakes.

Only it’s their money, not their daughter’s money.

Delony says a never-ending checking account for an 18-year-old is a “recipe for a disaster.” He said, "Prep yourself. Be prepared to wake up at 2 a.m. with a phone call from a Dean of Students of some college, cause it’s coming."

Since “your husband doesn’t care what you think,” he says Heather should start carving out some mom-and-daughter time each week. He suggests a regular breakfast date outside of the home until she graduates and leaves for college.

He thinks Heather should open up with her daughter about what life was like for her when she was 18 years old. These weekly chats are “planting seeds” so when Heather’s daughter is having trouble she’ll remember that she can trust her mom.

Ramsey says the answer lies in being proactive. Heather needs to insert herself into her daughter’s life and into her marriage in a proactive way — rather than standing on the sidelines watching a car wreck about to happen.

“If I’m you, I’m in a marriage counselor’s office real soon because your husband is a twerp and what he’s doing to you is unconscionable,” said Ramsey.

Read more: Want an extra $1,300,000 when you retire? Dave Ramsey says this 7-step plan ‘works every single time’ to kill debt, get rich in America — and that ‘anyone’ can do it

How to teach teens responsible money management

Only 28 states require high school students to take a personal finance course to graduate. That means parents may be a child’s only source of financial education, learning the basics of earning, borrowing, lending and investing.

A Quicken survey of 2,000 adults in the U.S. found a “clear correlation” between early education in money and financial success as adults. Those who learned about money in their formative years were three times as likely (45% vs 14%) to have an annual income of $75K or higher than those who didn’t.

The survey suggests that teaching your kids healthy financial habits isn’t a “one-time conversation.” Rather, “parents who talk with their kids once a week about the issue are significantly more likely to have kids who say they are smart about money.”

Ramsey Solutions recommends that instead of giving kids an allowance, give them a commission for work done instead.

“When they do their chores, they’ll earn a commission,” says the website. “And when they don’t, they’ll realize they’ve made what they earned — nothing.” If they’re old enough for a job, they’ll also quickly learn that lesson.

If your teen wants to make a larger purchase, like a laptop or used car, consider loaning them money and “charging nominal interest so they get used to the concept,” says Daniel Hunt at Morgan Stanley Wealth Management.

“This can be as simple as lowering their ongoing allowance by a small amount until any advance has been repaid, with the amount of the decrease not counted against the amount owed,” he said in a blog post. “Such an approach mimics a ‘minimum payment’ option on revolving debt.”

Most importantly, they should “understand that their debt is their responsibility and that there are serious consequences if they don’t keep it under control,” he said.

Teaching teens about money management also means modeling the behavior you want them to learn — after all, kids learn by example. “If you buy everything you want for yourself with no limits on spending, then your kids will see that as normal behavior and do the same,” according to John Boitnott at Debt.com. But if you show your kids how and why you save money, “then your kids may be more inclined to be financially responsible in the future.”

This can be a challenge if both parents aren’t on the same page, like in Heather’s case. When it comes to teaching kids about money management and financial responsibility, parents should be in alignment on how they model financial boundaries — including the consequences of spending more than they earn.

As Ramsey tells Heather, her husband won’t “participate with you in parenting,” so that may require marital counseling along with maintaining an open dialogue with her daughter. And, at least according to Ramsey, there may be no hope for their daughter until their “marriage crisis” is addressed.

What to read next

- JPMorgan sees gold soaring to $6,000/ounce — use this 1 simple IRA trick to lock in those potential shiny gains (before it’s too late)

- This is how American car dealers use the ‘4-square method’ to make big profits off you — and how you can ensure you pay a fair price for all your vehicle costs

- Here are 5 ‘must have’ items that Americans (almost) always overpay for — and very quickly regret. How many are hurting you?

Like what you read? Join 200,000+ readers and get the best of Moneywise straight to your inbox every week. Subscribe for free.

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.