Even as Canadians kick back and enjoy exploring their own country or relax into summer while soaking up sunshine rays, many are still struggling with the higher cost of living.

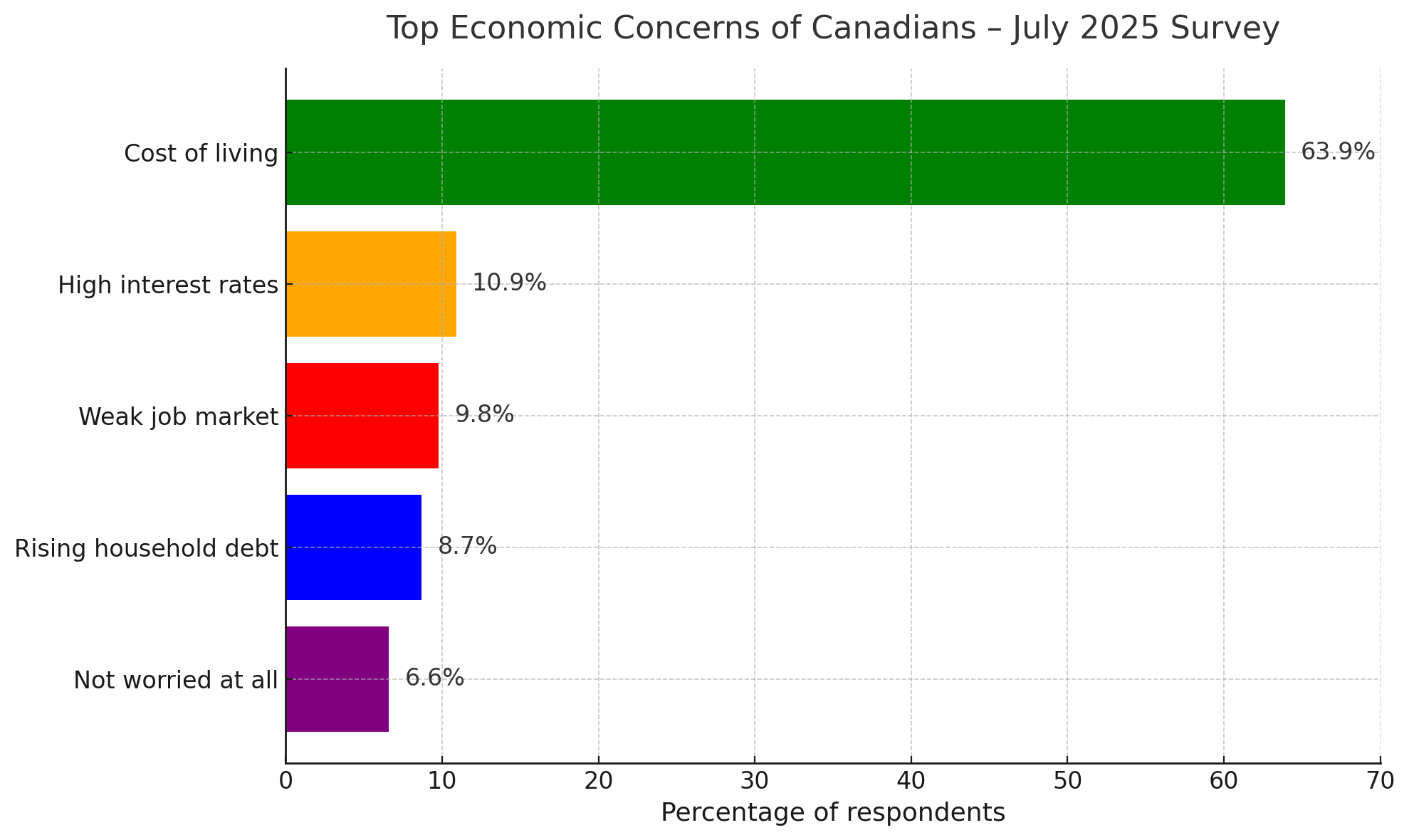

As the Bank of Canada prepares for its next interest rate decision on July 30, 2025, a recent survey from Money.ca shows that nearly two-thirds of respondents (63.9%) confess that the cost of living is their top economic concern — dwarfing worries about borrowing costs, jobs or debt levels. The findings highlight a growing divide between current economic indicators and how Canadians actually feel about their day-to-day finances.

Cost of living dominates the economic anxiety

The findings of the Money.ca survey offer a clear signal of what Canadians are feeling most acutely — a feeling that could influence how the central bank frames its next interest rate policy decision. While past rate hikes were aimed at taming inflation, households are now more preoccupied with ongoing affordability challenges than with the cost of borrowing itself.

Based on survey data is appears Canadians continue to feel the pressure of elevated grocery prices, rent, and transportation costs. There may be hope from some that the nation’s central bank will consider consumer sentiment as it decides whether or not to cut, hold, or raise the overnight benchmark rate.

Will the Bank of Canada cut, hold, or hike?

The Bank of Canada held its policy interest rate at 4.75% at its last meeting in June 2025, after cutting from 5% earlier that month. Some economists anticipate another small cut this time around, as inflation continues to cool modestly and job growth softens. Yet, others expect the Bank to pause and wait for more data before making additional moves.

No matter which way the BoC decides to go, the decision appears to come with risks. Cutting too soon could weaken the Canadian dollar and reignite inflation — especially if the U.S. Federal Reserve maintains its higher rates for longer. Holding steady might keep mortgage and loan costs high, worsening household affordability. Finally, a hike in rates (although very unlikely) could potentially worsen consumer sentiment and tip some households into financial distress.

Canadians’ top concern is broader than interest rates

While the Bank of Canada’s rate decision will impact living costs, most survey respondents did not consider higher intererest rates as their primary concern. Turns out fewer than 1 in 9 Canadians selected “high interest rates” as their top concern — despite more than two years of rapid hikes. This suggests that while interest rates are affecting Canadians, they are seen more as a side effect of deeper economic problems like inflation, housing, and everyday affordability.

This is most likely due to the perceptoin that while high rates have slowed inflation, the damage is done — people are still paying more for food, gas and rent. This also emphasis the gap the continues to emerge between macroeconomic indicators and household realities.

What’s next

All eyes are now on the Bank of Canada’s July 30 announcement. While core inflation is gradually trending downward, and the job market is beginning to show signs of strain, the Bank of Canada’s decision will ultimately depend on whether it believes consumer pain — especially related to cost of living — outweighs the risk of reigniting inflation.

Whatever the move, the signal from Canadians is clear: affordability — not just inflation — is now the top issue.

Survey methodology

The Money.ca survey was conducted through email between July 16 to 21, 2025. Approximately 6,220 email newsletter subscribers, over the age of 18, were surveyed with 183 responses. The estimated margin of error is +/- 6%, 18 times out of 20.

About Money.ca

Money.ca is a leading financial platform committed to providing individuals with comprehensive financial education and resources. As part of Wise Publishing, Money.ca is a trusted source of reliable financial news, expert advice, comparison tools and practical tips. Canadians get insight on a variety of personal financial topics, including investing, retirement planning, real estate, insurance, debt management and business finance.

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.