A recent Money.ca reader poll found that a majority of respondents would need a significant financial incentive — or none would suffice — to sell their most treasured collectible.

Turns out almost 3 out of 4 Canadians (72%) said they’d sell their prized collectible for more than $1,000 or wouldn’t sell at all, shen asked, “How much would it take to get you to sell your most prized collectible?”

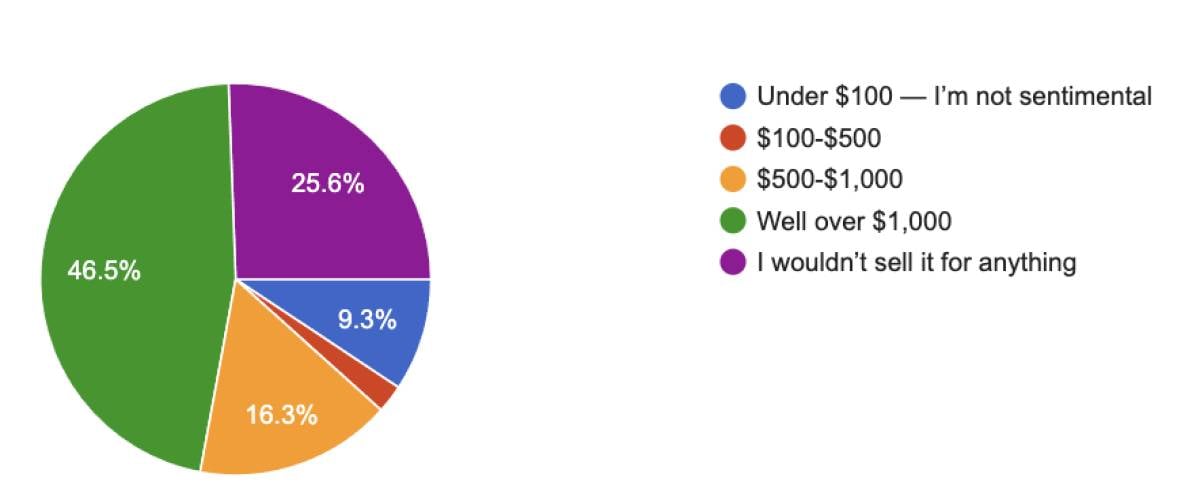

Specifically, 46.5% chose “Well over $1,000,” while another 25.6% said, “I wouldn’t sell it for anything.”

This strong emotional attachment stands in contrast to growing financial pressure on Canadians. According to a June 2025 report by Statistics Canada, household savings are declining while consumer debt levels remain high. Credit card balances rose by 1.5% in Q1 2025, with average balances sitting above $4,000.

Financial stress doesn’t always sway sentiment

While 72% held firm on the high value — or irreplaceability — of their collectibles, a smaller portion of the group were more open to selling for a lower sum. About 16.3% of respondents would part with their item for $100 to $500, while only 9.3% said they’d sell it for under $100, indicating a lack of sentimental attachment.

This divide mirrors a broader trend in Canada: while some are tightening their belts amid rising interest rates and stagnant wages, others continue to find value in non-monetary assets like memories, nostalgia, and personal history.

Spending habits shift, but not values

Consumer spending growth in Canada has slowed in 2025, particularly in discretionary areas like entertainment and collectibles. RBC’s latest economic outlook forecasts only a 1.2% growth in household consumption this year — down from 2.4% in 2024.

Despite these pressures, this poll suggests that for many Canadians, sentimental value continues to outweigh financial need. In a time when many are reevaluating what they spend and save, some things—like a childhood baseball card, a family heirloom, or a rare collector’s item—are simply not for sale.

Key findings from the Money.ca reader survey

- Nearly half (46.5%) said it would take well over $1,000 to convince them to part with their most prized collectible, showing that for many, the emotional value far outweighs the financial gain.

- 1 in 4 respondents (25.6%) said they wouldn’t sell for any price, underscoring the deep personal significance attached to certain items — even in a tough economic climate.

- Just 16.3% said $100 to $500 would be enough, suggesting that only a small portion of the population places moderate monetary value on their keepsakes.

- Only 9.3% would sell for under $100, a sign that very few people are willing to let go of sentimental items lightly, even as household budgets face growing pressure.

Together, these findings suggest that while Canadians are increasingly conscious of their finances, their most meaningful possessions remain off-limits — no matter the price tag.

Bottom line

This poll highlights a striking contrast between economic reality and emotional resilience. Even as inflation, interest rates and household debt reshape how Canadians spend and save, many still place immeasurable value on the things that connect them to their past. Whether it’s a childhood keepsake or a rare collector’s item, these prized possessions remain a firm reminder that not everything worth holding onto can — or should — be priced.

Survey methodology

The Money.ca survey was conducted through email in April 2025. More than. 6,640 email newsletter subscribers, over the age of 18, were surveyed resulting in 43 responses. The estimated margin of error is +/- 10%, 16 times out of 20.

About Money.ca

Money.ca is a leading financial platform committed to providing individuals with comprehensive financial education and resources. As part of Wise Publishing, Money.ca is a trusted source of reliable financial news, expert advice, comparison tools and practical tips. Canadians get insight on a variety of personal financial topics, including investing, retirement planning, real estate, insurance, debt management and business finance.

Sources

1. Statistics Canada: Leading indicator of international arrivals to Canada, May 2025 (May 10, 2025)

2. RBC Economics: Trade resilience, fiscal tailwinds boost Canada’s growth prospects (June 12, 2025)

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.