Imagine working your whole life, saving diligently, only to see your partner blow $200,000 of your money on a crypto scheme. That’s exactly what happened to one New York caller to The Ramsey Show, who’s now single and left with just $95,000 to her name.

Lisa’s question: What now?

Don’t miss

- Thanks to Jeff Bezos, you can now become a landlord for as little as $100 — and no, you don’t have to deal with tenants or fix freezers. Here’s how

- I’m 49 years old and have nothing saved for retirement — what should I do? Don’t panic. Here are 6 of the easiest ways you can catch up (and fast)

- Robert Kiyosaki warns of a ‘Greater Depression’ coming to the US — with millions of Americans going poor. But he says these 2 ‘easy-money’ assets will bring in ‘great wealth’. How to get in now

At 55, she’s now working as a server in a high-end restaurant and trying to figure out how to rebuild her financial future. Her biggest fear? That she won’t have enough to retire.

Lisa told Dave that she gave her (now ex) boyfriend the money because she believed they were in it for the long haul. They had been together for seven years, and while they never married, she thought the relationship would last.

Instead, he ended the relationship after losing most of her life savings. He’s now making small monthly payments, but she said that’s mostly just covering the interest, and she’s unsure if she’ll ever get the principal back.

“I’m leaving it in God’s hands if I get the money back,” Lisa said.

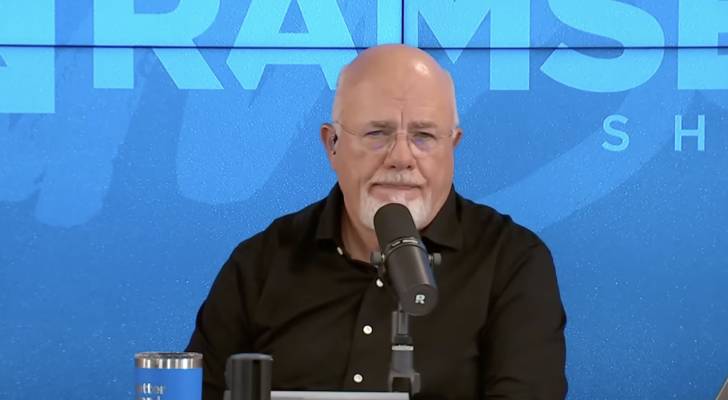

What advice did Dave Ramsey give her?

While Dave Ramsey acknowledged how painful the situation was, he quickly found a silver lining.

“Let’s just pretend none of that happened,” he said. “If you were calling in and said, ‘I’m 55 and I have $95,000,’ I’d say, ‘Yes, you’re going to be okay.’”

Still, being okay does come with conditions. Ramsey made it clear that Lisa’s savings alone won’t carry her through retirement. She’ll need to keep working, avoid debt and invest wisely. The key isn’t just having $95,000, it’s having a plan for what she’ll do with it.

Ramsey outlined a step-by-step investment strategy:

- Set aside an emergency fund: Keep three to six months of expenses in a high-yield savings account. For her, that’s about $15,000.

- Invest the rest: Move the remaining $80,000 into good growth stock mutual funds.

- Use a Roth IRA: Contribute each year to take advantage of tax-free growth.

- Consider her workplace 401(k): Even though there’s no employer match, Ramsey suggested contributing some of her income to her 401(k) since IRAs have lower annual contribution limits.

- Invest 15% of her income: With an annual income of around $60,000, she should aim to invest about $9,000 per year across her retirement accounts.

While Ramsey’s advice can be divisive, his guidance was substantiated in this instance. By steadily investing over the next 10 to 12 years, she can rebuild her nest egg. Investing in index funds or mutual funds also spreads out risk, making for a more diversified portfolio.

He also gave her one more caveat: never loan that kind of money again — a solid piece of advice we can all follow.

Read more: Want an extra $1,300,000 when you retire? Dave Ramsey says this 7-step plan ‘works every single time’ to kill debt, get rich in America — and that ‘anyone’ can do it

What should you do if a partner asks to borrow money?

This woman’s financial crisis didn’t start with a bad investment. It started with a bad decision in her relationship.

She gave her boyfriend $200,000 without a contract, legal protections or any guarantee she’d get it back. She either didn’t know what he was investing in or didn’t fully understand the risks of crypto. When love and money mix, those rose-colored glasses can cloud your good judgment.

If a partner asks to borrow money, especially for something risky like cryptocurrency, here are some smart ways to approach it:

- Take your time. Don’t let emotions rush you into a bad decision.

- Ask yourself: What advice would I give a friend or my child? Use that perspective to guide your choice.

- Never lend more than you can afford to lose. If the loss would impact your finances or retirement, don’t do it.

- Know what the money is for. Is it a car, a house, a business or something vague and risky like crypto? Understand the details.

- Treat it like a business deal. Put the terms in writing, including repayment expectations and interest.

- Strongly consider saying no. You can support someone without risking your financial future.

This woman thought she was investing in a shared future. Instead, she’s rebuilding her retirement fund at 55. But with a clear plan and disciplined investing, she still has time.

Her story is a reminder to make money decisions with your head, not your heart.

What to read next

- You don’t have to be a millionaire to gain access to this $1B private real estate fund. In fact, you can get started with as little as $10 — here’s how

- Here are 5 ‘must have’ items that Americans (almost) always overpay for — and very quickly regret. How many are hurting you?

- Accredited investors can now buy into this $22 trillion asset class once reserved for elites – and become the landlord of Walmart, Whole Foods or Kroger without lifting a finger. Here’s how

- Rich, young Americans are ditching the stormy stock market — here are the alternative assets they’re banking on instead

Stay in the know. Join 200,000+ readers and get the best of Moneywise sent straight to your inbox every week for free. Subscribe now.

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.