Choosing insurance is as much about planning for the future as it is about meeting your needs now.

You choose your car insurance policy based on what car you’re driving and your health insurance according to what type of care you need this year. But there are many types of “what-if” insurance that are just as important, if not even more.

Critical illness insurance is one type of policy you should look into, even if you don’t need it now.

What is critical illness insurance?

Critical illness insurance provides financial protection for policyholders if they are diagnosed with certain medical conditions. Typically, these are life-threatening conditions that tend to require long-term and intensive care.

For example, most policies cover the following:

- Cancer

- Heart attack

- Stroke

- Alzheimer’s

- Paralysis

- Blindness

However, the exact conditions covered depend on the policy you choose and the provider you go with. This is important.

How does it work?

If you do purchase critical illness insurance and end up developing a covered condition, you will receive a lump-sum payout for whatever amount of coverage you paid for. You can use the money however you need to, whether that’s for your mortgage, medical bills, or both.

Even if you think your regular health insurance policy does a pretty good job covering your everyday medical needs and helps out with emergencies too, chances are that developing a serious illness would drastically affect your financial situation even with these policies. You can think of this type of insurance as another layer of protection.

Who needs critical illness insurance?

It’s difficult to predict what might happen to you later on in life. And we get it, thinking about having these illnesses is unpleasant. But you might want to protect yourself with critical illness insurance if:

- You don’t have any savings (or enough to full cover six months’ worth of living expenses)

- Your other insurance policies do not cover critical illness care or you’re uninsured

- You have dependents or others counting on you for financial support

- You are at an increased risk of certain covered illnesses

Not everyone needs this type of policy, but if you meet any of the descriptions above, it might be a good idea to look into it.

If you have an emergency fund that will keep you covered for six months or more and your family would financially stay afloat without your income if you were to get sick, you might not need critical illness insurance. You also may not need it if you’re well-covered by your health and life insurance.

How much coverage should you have?

For most Canadians, critical illness coverage for six months or more of living expenses is highly recommended. This includes your housing payments, food spending, child care, utilities – that sort of thing.

Think bills and necessities. This is the minimum your policy should cover but you may decide to add more coverage if you have a lot of debt, a larger mortgage payment, etc.

What is the best critical illness insurance provider in Canada?

Like other types of insurance, not all critical illness policies are the same.

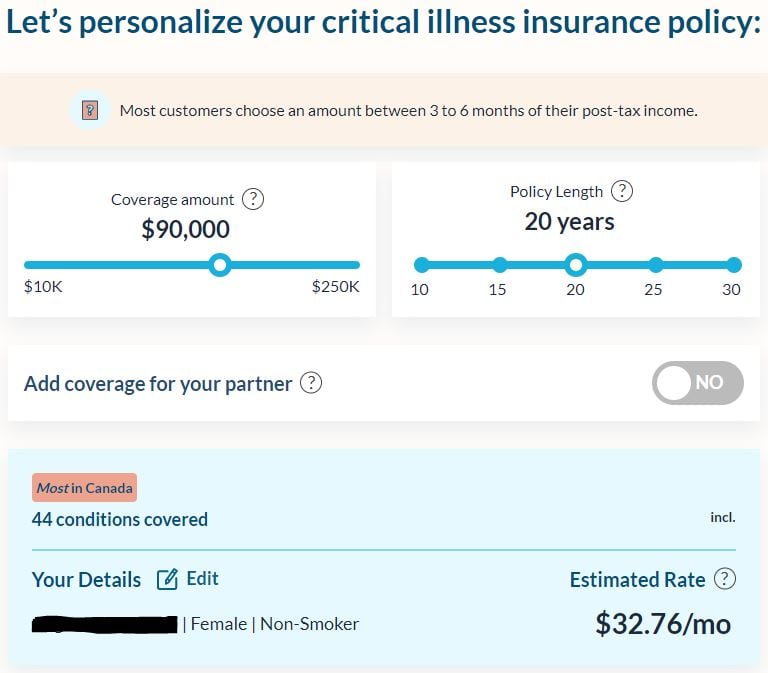

There are a number of great providers offering critical illness insurance, but the best option for many Canadians is going to be PolicyMe. This insurance provider has excellent term life insurance policies as well as above-average critical illness insurance.

If you’re going to pay for peace of mind, you should be getting more of it. PolicyMe understands that Canadians searching for this type of coverage are planning for the worst-case scenario and provides a long list of fully- and partially-covered conditions, including many not covered by other policies.

Most Canadian insurance companies cover around 30 different conditions. PolicyMe covers 44.

Plus, PolicyMe policies are flexible and come with benefits like:

- 30-day grace period for missed payments

- Fixed rates

- Optional conversion to a longer policy within the first five years

- One-on-one quote support

- 100% online application process with instant decisions

How to apply for critical illness insurance

The easiest way to apply for critical illness coverage is online. Many providers offer fully digital applications that don’t require you to make an appointment, submit documents, or even wait for a decision. This includes PolicyMe.

To apply for a policy with PolicyMe, you can go to the website and select “Get Started” from the home page. First, you’ll answer questions about the people in your household and then provide your date of birth.

You can either get a quote just for yourself or get one for your partner too, a feature not included in many applications. From there, you’ll indicate your nicotine/tobacco habits in the past twelve months and your gender.

That’s all you have to do to get a quote.

Next, you’ll see if you’re actually eligible for coverage. And if you’re approved, you can decide how much coverage you want and start setting up your policy right away.

Is critical illness insurance worth it?

Whether or not critical illness insurance is worth it for you depends on your financial and medical situation. If you can qualify for a low rate and the coverage makes you feel safer and less anxious, that might be worth paying for. Hopefully, you never have to cash out. But if you do, you won’t regret having it.

If there’s a little room in your budget, more insurance is a worthy expense for many.

The bottom line

Thinking about getting sick is uncomfortable. Really uncomfortable. But it gets a little less distressing when you know you’re protected. After all, no one would argue against the age-old saying: It’s better to be safe than sorry.

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.