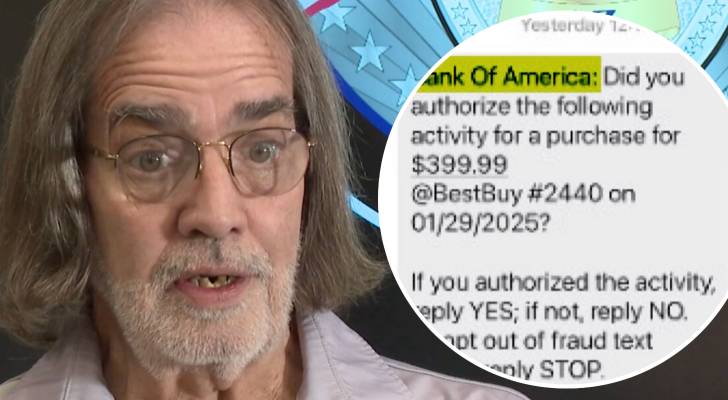

An Arizona resident who wishes to only be identified as Dave received a text while out running errands that looked like a standard fraud alert from Bank of America. The message asked if he had authorized a $399 purchase at Best Buy. He replied “NO.”

By the end of the day, he had unknowingly handed over his entire life savings of $27,000 to a scammer posing as a bank representative.

What followed was a meticulously orchestrated con that turned his iPhone into a tool for fraud and left him fearing he’d never see his money again.

Don’t miss

- Thanks to Jeff Bezos, you can now become a landlord for as little as $100 — and no, you don’t have to deal with tenants or fix freezers. Here’s how

- I’m 49 years old and have nothing saved for retirement — what should I do? Don’t panic. Here are 6 of the easiest ways you can catch up (and fast)

- Robert Kiyosaki warns of a ‘Greater Depression’ coming to the US — with millions of Americans going poor. But he says these 2 ‘easy-money’ assets will bring in ‘great wealth’. How to get in now

The text that cost him everything

After replying to the suspicious text, Dave received a follow-up message with a phone number to call. The person on the line claimed to be from Bank of America and warned that Dave’s account was compromised, even giving him a fake ID number to seem legitimate.

The caller then convinced Dave that the scammer targeting him was actually a Bank of America employee. To stop them, they said, he needed to immediately withdraw all of his money.

Staying on the phone the entire time, Dave went to a local branch and withdrew his full balance in two transactions, totaling $27,000.

Then came the twist: The scammer instructed Dave to “secure” the money using his Apple Wallet. They walked him through creating a scannable card on his phone that was secretly linked to their account.

Dave drove to the bank’s drive-thru ATM and deposited the cash, believing it was being transferred into a safe new account. In reality, the funds were instantly funneled to the scammer.

“This is my life savings, and I don’t have any assurances, but they sounded so real," Dave said.

A rare win in a losing game

When Dave realized what had happened, he called Bank of America’s fraud department, only to be told nothing could be done. But he refused to give up. He contacted the Peoria Police Department and was connected with Detective Michael Finney, a veteran of financial crime investigations.

Finney explained that the first 72 hours are critical in recovering stolen funds. After that window closes, the chance of success drops to under 10%.

In Dave’s case, Finney uncovered a new tactic: scammers using Apple Wallet as a real-time account-to-account transfer tool. The digital card created by Dave allowed the fraudster to siphon funds the moment they were deposited.

Finney quickly obtained a search warrant, froze the linked accounts, and worked closely with the bank. After five months, about 90% of Dave’s money was recovered.

“Without the help of Peoria Police, I’d be living with family,” Dave said. “I’d be completely destitute.”

Read more: Want an extra $1,300,000 when you retire? Dave Ramsey says this 7-step plan ‘works every single time’ to kill debt, get rich in America — and that ‘anyone’ can do it

Scams are evolving — how to protect yourself

In 2022, text scams drained $330 million from Americans, according to the FTC’s Consumer Sentinel Network, with a median loss of $1,000 per victim. In fact, 40% of people who reported a text scam in 2022 said the text impersonated a bank.

Text scams, phishing emails, and social engineering tactics are becoming more convincing and more dangerous, thanks to advancements in AI.

In December 2024, the FBI issued a public warning outlining how criminals are leveraging AI to supercharge these scams. Criminals now deploy hyper-realistic voices, deepfakes, and targeted messages that are personalized enough to fool even the most careful consumers.

Detective Finney offers one non-negotiable piece of advice: trust nothing that feels rushed or off-script. Instead, use the official number printed on the back of your card. Any email claiming you owe money or threatening legal action, especially from a “government agency,” is likely a scam.

Here are the FBI’s top recommendations to protect yourself:

- Never click on links in unsolicited emails or texts, even if they appear to come from your bank.

- Don’t share usernames, passwords, or verification codes with anyone.

- Use official phone numbers found on bank cards or official websites when verifying suspicious activity.

- Enable two-factor authentication on all accounts that offer it.

- Be cautious with social media. Scammers can use personal details to crack passwords or security questions.

- Check your credit reports annually at TransUnion, Equifax, or Experian. You’re entitled to one free report from each bureau per year.

- Report suspicious activity immediately to your local police department.

Dave was one of the lucky ones. Thanks to his persistence and a determined detective, he was able to recover most of what he lost. But many others aren’t so fortunate. Scammers are constantly evolving their tactics, and once the money is gone, it’s often gone for good. That’s why staying informed, skeptical and proactive is the best defense against becoming the next victim.

What to read next

- You don’t have to be a millionaire to gain access to this $1B private real estate fund. In fact, you can get started with as little as $10 — here’s how

- Here are 5 ‘must have’ items that Americans (almost) always overpay for — and very quickly regret. How many are hurting you?

- Accredited investors can now buy into this $22 trillion asset class once reserved for elites – and become the landlord of Walmart, Whole Foods or Kroger without lifting a finger. Here’s how

- Rich, young Americans are ditching the stormy stock market — here are the alternative assets they’re banking on instead

Stay in the know. Join 200,000+ readers and get the best of Moneywise sent straight to your inbox every week for free. Subscribe now.

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.