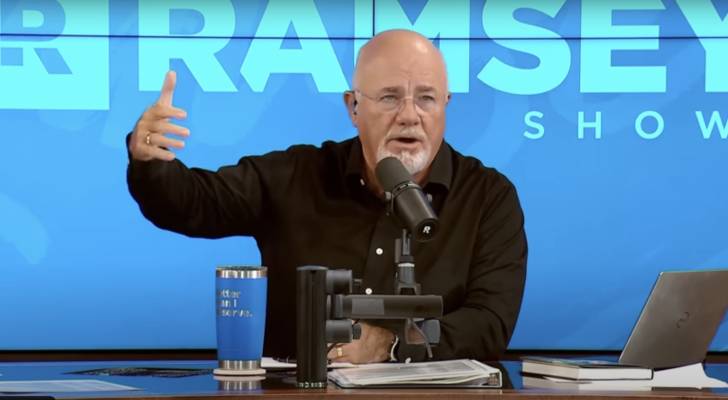

After 20 years of offering financial advice, selling 12 million copies of his book and creating an audience of over 10 million regular listeners, Dave Ramsey says he’s absolutely certain about one thing: the debt snowball method is the best way to reduce debt.

“I’m 1,000% sure this works,” the 64-year-old radio host said on a recent episode of The Ramsey Show. “The debt snowball is probably what we’ve become best known for.”

Don’t miss

- I’m 49 years old and have nothing saved for retirement — what should I do? Don’t panic. Here are 5 of the easiest ways you can catch up (and fast)

- You’re probably already overpaying for this 1 ‘must-have’ expense — and thanks to Trump’s tariffs, your monthly bill could soar even higher. Here’s how 2 minutes can protect your wallet right now

- Gain potential quarterly income through this $1B private real estate fund — even if you’re not a millionaire. Here’s how to get started with as little as $10

The snowball technique involves sequentially paying off all debt, except for the primary residence, starting from the smallest loan amount and working your way up to the largest balance.

In theory, every loan paid off gives you more room and more momentum to target the next one until you’re debt-free.

Ramsey insists that the technique is not only effective but also superior to other debt-reduction techniques such as the avalanche method or consolidation. And the reason is less mathematical and more psychological.

Snowball technique works with brain chemistry

As of March 2025, 23% of U.S. adults say they have unmanageable amounts of debt, according to Experian.

Fortunately, 45% of adults also say that they have paid off debt that they previously considered unmanageable and 26% of them said they used the snowball method to do so.

However, advocates of the avalanche method or debt consolidation argue that these techniques are more mathematically efficient.

Debt consolidation involves paying off all your loans with a single loan, potentially at a lower interest rate. The avalanche method, meanwhile, prioritizes outstanding balances with the highest interest rate first.

In both cases, lowering your monthly interest burden gives you more wriggle room. It also slows down the compound growth of your liabilities, making them more manageable.

However, Ramsey encourages his listeners to look beyond the math. "Honey, if we were doing math we wouldn’t have debt!” he said. “It’s not a math problem, it’s a stupid problem. We have to fix the stupid, not the math.”

He insists the magic ingredient that makes the snowball method superior is “brain chemistry.”

Read more: Want an extra $1,300,000 when you retire? Dave Ramsey says this 7-step plan ‘works every single time’ to kill debt, get rich in America — and that ‘anyone’ can do it

“Dopamine is released when you complete a task,” he says, explaining that this boost creates a feedback loop that makes it easier to commit to the method over the long term.

“A series of behaviors put you into debt, and you don’t fix a behavior problem with a math solution,” he explans. “You fix a behavior problem with a behavior solution.”

Despite his conviction, there’s no evidence to suggest the snowball method is superior to other forms of debt management.

None of these techniques is a one-size-fits-all solution, and most people would be better off picking a strategy that fits their own personality.

Personal approach to debt management

While the snowball method might be best for those who need constant reinforcement to stay disciplined, others might be more motivated by the math. After all, getting rid of a balance with a hefty interest rate can also offer a psychological reward.

With this in mind, consider the avalanche method if you think some of your most expensive loans are causing you more distress.

Alternatively, you could consider debt consolidation if you find it easier to manage one loan instead of several different ones.

Also, consider other methods to pay down debt. Roughly 36% of adults who paid off an excessive loan said they took an additional job or a side gig to do so, according to Experian’s survey.

Meanwhile, 23% said using a budgeting app was enough to help them mitigate their burden.

There’s no silver bullet. The best method is just the one you think you’re most likely to commit to over the long-term.

What to read next

- Don’t have the cash to pay Uncle Sam in 2025? You may already be eligible for a ‘streamlined’ handshake with the IRS — here’s how it works and how it can potentially save you thousands

- Robert Kiyosaki warns of a ‘Greater Depression’ coming to the US — with millions of Americans going poor. But he says these 2 ‘easy-money’ assets will bring in ‘great wealth’. How to get in now

- Here are 5 ‘must have’ items that Americans (almost) always overpay for — and very quickly regret. How many are hurting you?

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.