Costco Canada: Are the deals worth It? Canadians have their say

Grocery bills are eating up a sizeable portion of Canadian household budgets, and families are looking for every possible way to stretch their dollar. In 2023, the average household spent about $12,000 a year on food, according to Statistics Canada — roughly $1,000 a month when you include groceries and restaurant meals. Just keeping the […]

Build Canada Homes launch sparks debate over Ottawa’s role in fixing housing crisis

The federal government has unveiled Build Canada Homes (BCH), a new $13 billion housing initiative aimed at delivering more affordable homes to Canadians. Prime Minister Mark Carney framed it as a major step toward tackling the nation’s long-running housing crisis. “Canada’s new government is relentlessly focused on bringing down housing costs”, Carney said in the […]

Gen Z still relying on parents’ pockets to survive, BMO survey finds

Canadian parents are increasingly serving as a financial lifeline for their adult children, with a new survey showing one in five Gen Zers rely on family support just to cover day-to-day expenses. The findings highlight a deepening trend of intergenerational dependence as young Canadians struggle to balance high living costs with slow wage growth. According […]

Industry experts sound the alarm as 2,500 units sit vacant in Vancouver. What does the slump mean for the city’s housing market?

A number of real estate experts see a rumbling storm on the horizon for Vancouver’s condo market, one that’s been brewing since 2022. According to the Canadian Mortgage Housing Corporation (CMHC), around 2,500 condos are sitting vacant in Metro Vancouver, double the amount from a year ago. Why? A flurry of reasons have been suggested […]

High interest rates aren’t stopping Canadians from crushing their credit card debt — here’s how they’re doing it

In a country where grocery bills keep rising and mortgage payments eat into paycheques, Canadians are fighting back — one credit card payment at a time. A new Money.ca reader poll shows that nearly 90% of Canadians pay their credit card balances in full every month, proving that even in an age of record debt […]

Leave more than money: practical legacy planning for Canadians

Many Canadians dream about the legacy they will leave behind — not just money, but the values, traditions and lessons for loved ones. Thinking ahead about how your wealth and life experiences will shape the future can provide clarity and peace of mind. That’s where legacy planning comes in. Legacy planning is the process of […]

12% of Canadians are hybrid investors — most plan to stay that way: CSA

A growing segment of Canadian investors is straddling the line between self-directed investing and professional advice. According to a new report from the Canadian Securities Administrators (CSA), about one in eight Canadians now manage some investments on their own while maintaining a separate portfolio with a financial advisor — a group the CSA calls “hybrid […]

Canadian travellers uncover hidden tricks to slash flight costs — and finally stop paying full price for airfare

Canadians love travelling, and we have a healthy obsession with trying to save money every time we take flight. Over the years I’ve read some pretty outlandish claims out there about the best way to go about doing that. Some sources insist that booking exactly 59 days before departure is the most cost-effective approach, while […]

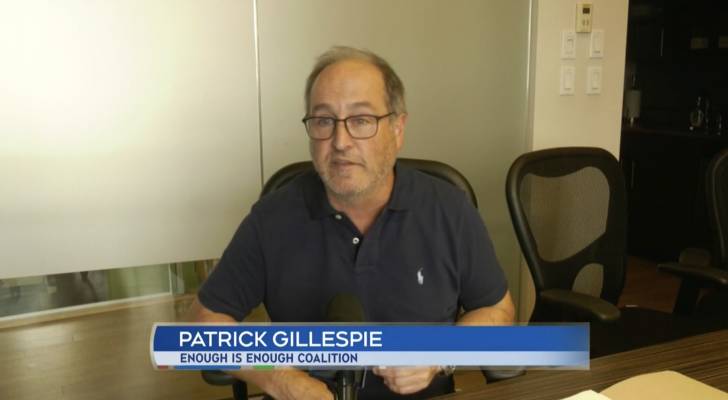

Moncton businesses say crime is hitting their bottom line

Downtown Moncton’s business community is speaking out against what it calls an alarming rise in crime — and the growing financial fallout that’s coming with it. The newly formed Enough is Enough Coalition, made up of business owners, landlords and property managers, is demanding action from all levels of government. In a statement last week, […]

TD survey finds small business owners still turning to costly credit in emergencies

Canadian small business owners say they’re ready for the unexpected — but their financial choices suggest otherwise. A new TD Insurance survey shows that while nearly all entrepreneurs (94%) have business insurance, just over half (52%) would actually rely on it first in case of an emergency. Instead, many report they would first lean on […]