We’re in our 60s, retired, have $70,000 in savings and Social Security of about $3,780/month. But high health care costs eat into our budget — how can we survive at least 20 more years?

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links. If you and your partner are in your 60s and have $70,000 in savings, you don’t have a ton of money set aside for retirement. The good thing is, […]

Urgent warning issued for US consumers after ‘security breach’ of 184,000,000 passwords — here’s who’s exposed and how to protect yourself

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links. If you’ve been ignoring those pesky "suspicious login" alerts in your inbox, now might be the time to pay attention. Cybersecurity researcher Jeremiah Fowler discovered an unprotected online database […]

I have $2,700 in extra retirement income each month. Is it enough and what should I do with this money?

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links. Before you retire, you want to make sure you have enough income to cover your spending needs. But, plenty of people hope to leave work with the ability to […]

California woman, 63, hasn’t worked since 2007 and after burning through all her savings has just $4,000 left in the bank — here’s what The Ramsey Show hosts say she needs to do ASAP

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links. Cherie, a 63-year-old San Bernardino, California resident, has been surviving on dwindling savings since 2007. Now she’s down to her last few thousand. Concerned, she called in to The […]

I’m 41 years old, been married 10 years, and just found out my husband has been hiding $50K in credit card debt. Can I be held accountable for his money mismanagement?

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links. After 10 years of marriage, it can be hard to find new ways to surprise your spouse. But as some couples would tell you, that might not be such […]

Forget Florida — these two unexpected states are the new retirement hot spots, offering lower costs, tax perks and a better quality of life for retirees

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links. Retirees are flocking to some states in droves. While their motivations aren’t entirely clear, the growing cost of living — especially property taxes — is a likely factor. A […]

Here are 5 things that will likely get more expensive in 2025 — no matter what Trump does in the White House

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links. Imported household appliances that are made with steel parts — like washing machines, refrigerators and stoves — will be subject to President Trump’s expanded tariffs starting June 23, according […]

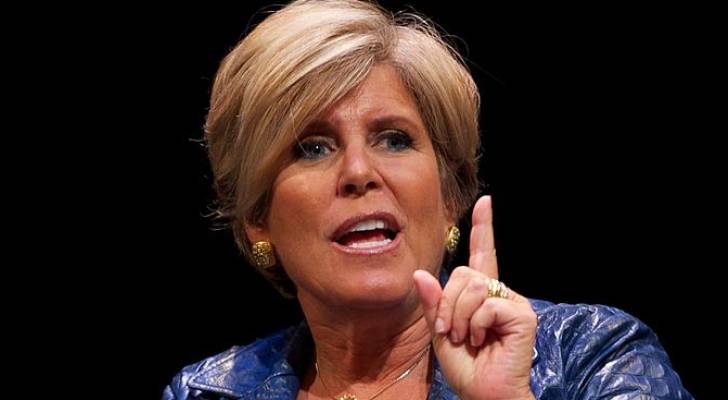

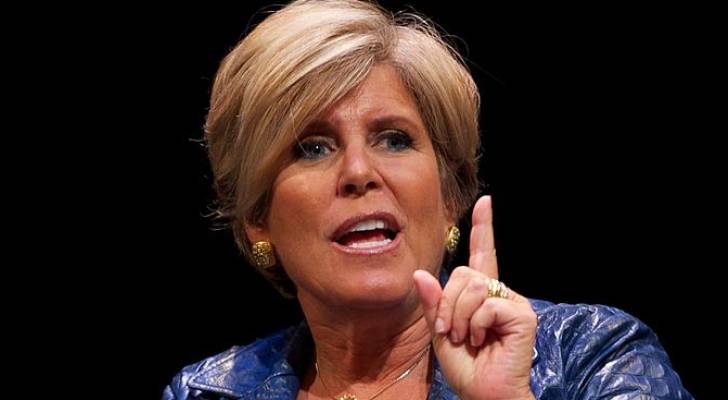

A California woman asked Suze Orman if she’d be responsible for her husband’s credit card debt if something happened to him — here’s what you need to know

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links. In an episode of Suze Orman’s Women & Money podcast, Jane from California wrote into the show to pick Orman’s brain about her husband’s credit card debt. Her question […]

‘We’re not robots’: As recession looms, Americans may be unsure about what to do with their 401(k) — here’s what experts recommend

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links. Since 1950, the US has weathered 11 recessions, proving time and again that downturns aren’t a question of if, but when. After a strong performance from the S&P 500 […]

‘Mr. Buffett, how can I make $30 billion?’: Warren Buffett once explained how he’d turn $10,000 into a huge fortune if he were a new investor — here are his 3 simple strategies

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links. Berkshire Hathaway’s annual meetings give shareholders the opportunity to pick CEO Warren Buffett’s brain on a wide range of topics. However, one investor who attended the conference in 1999 […]