Super-rich Americans like Mark Zuckerberg and Jay-Z have taken out mortgages for homes they can easily afford — here’s why

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links. For many people, the only way to afford a home is to finance it with a mortgage and pay off that loan over time. During the first quarter of […]

Residents in this US state now spend 10% of their income on groceries — the highest rate in America. Here’s how struggling families are making ends meet

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links. If your grocery bill feels like it’s been getting out of hand lately, you’re certainly not alone — especially if you live in Nevada. A recent LendingTree analysis of […]

I’m 41 years old, been married 10 years, and just found out my husband has been hiding $50K in credit card debt. Can I be held accountable for his money mismanagement?

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links. After 10 years of marriage, it can be hard to find new ways to surprise your spouse. But as some couples would tell you, that might not be such […]

Forget Florida — these two unexpected states are the new retirement hot spots, offering lower costs, tax perks and a better quality of life for retirees

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links. Retirees are flocking to some states in droves. While their motivations aren’t entirely clear, the growing cost of living — especially property taxes — is a likely factor. A […]

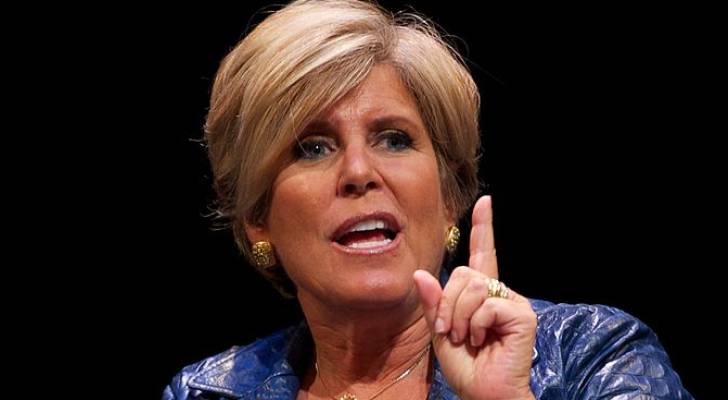

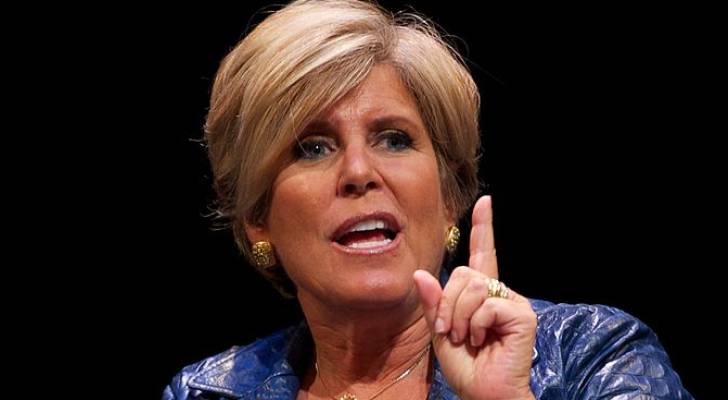

A California woman asked Suze Orman if she’d be responsible for her husband’s credit card debt if something happened to him — here’s what you need to know

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links. In an episode of Suze Orman’s Women & Money podcast, Jane from California wrote into the show to pick Orman’s brain about her husband’s credit card debt. Her question […]

‘We’re not robots’: As recession looms, Americans may be unsure about what to do with their 401(k) — here’s what experts recommend

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links. Since 1950, the US has weathered 11 recessions, proving time and again that downturns aren’t a question of if, but when. After a strong performance from the S&P 500 […]

JPMorgan studied 5 million retirees across America — and found 3 surprising spending shockers. Is your 7-figure nest-egg actually hurting you?

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links. Most retirees worry about running out of money because of spiralling inflation and unexpected medical costs as they age. However, after studying the spending patterns of five million retirees, […]

This is the true value of having a fully paid-off home in America — especially when you’re heading into retirement

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links. There’s great news for America’s homeowners: A growing percentage now own their homes outright. No mortgage, no liens. U.S. Census Bureau data showed that in 2024, about 38.8% of […]

NFL legend Steve Young still drives a broken down 2011 Toyota Sienna with 132,000 miles — made over $49M in football but Dad told him to ‘get the most’ out of cars. Here’s what you can learn

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links. Legendary 49ers quarterback Steve Young earned nearly $49 million playing football, according to Spotrac, but you’d never guess it from the beaten-up 2011 Toyota Sienna he drives. In a […]

America’s seniors are happiest living in these 5 US states, study says — do you live in one of them?

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links. One of the great perks of reaching your golden years is the newfound freedom to live wherever you choose. With the kids out of the house and work no […]