‘I can make it any number I want’: Florida gas stations are charging customers $1 more a gallon for using credit cards — and it’s completely legal. Here’s how drivers can protect themselves

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links. Credit cards have long been a popular and convenient way to pay for most things — including filling up at the gas station — and there are benefits to […]

‘We wanted to escape’: This Texas couple ditched the big city to build their dream home for $60,000 out of two 40-foot shipping containers — and they claim you can do it, too

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links. Lexi Newkirk and her husband, Diego, weren’t interested in cramped city living. Instead, the young married couple from Austin, Texas, created their very own path to home ownership. “We […]

Mark Cuban said this will be the ‘No. 1 housing affordability issue’ for Americans — and predicts Florida will have ‘huge problems.’ How you can protect yourself in 2025

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links. There’s passionate debate about how to solve America’s ongoing housing crisis, much of which revolves around mortgage rates, zoning issues, immigration and construction. However, billionaire entrepreneur and investor Mark […]

Home insurance in America might double very soon — and not just in ‘disaster’ cities. Why rates are skyrocketing across the US and how to protect yourself now

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links. Home insurance used to be an afterthought, but these days it’s a rapidly escalating expense that is believed to be “deepening the housing crisis,” according to the Consumer Federation […]

Student loan borrowers in default could soon see 15% of their Social Security checks being garnished if Trump administration resumes collections efforts — who’s at risk and how to prepare

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links. For millions of older Americans relying on Social Security to cover their bills, another financial gut punch may be on the way — and it’s coming from their own […]

‘We have hit a wall’: Kevin O’Leary has bet 19% of his portfolio on crypto — but Congress has to pass these 2 bills to set off a trillion-dollar breakthrough

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links. Kevin O’Leary has come a long way from the time he called Bitcoin “garbage.” Now, the Shark Tank judge tells Moneywise, cryptocurrency-related assets make up 19.4% of his portfolio. […]

‘Economic euthanasia’: 52% of America’s 87 million pet-owning households have decided against vet treatment — and it’s leading to deadly consequences. Here’s what’s behind the alarming trend

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links. Fur babies are family. But for many Americans, the cost of caring for them is becoming unbearable. A Gallup poll found 52% of U.S. pet owners say they’ve had […]

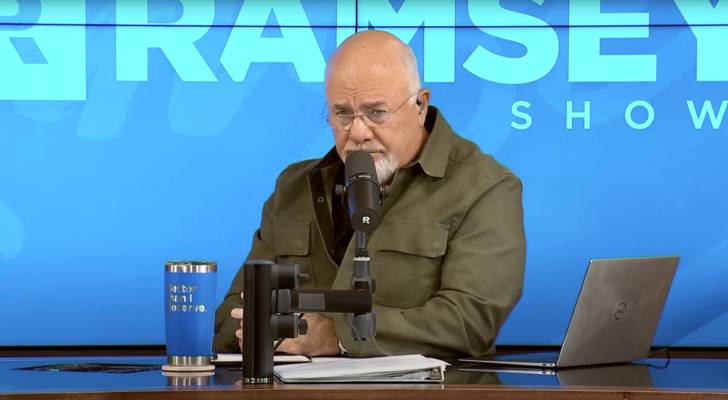

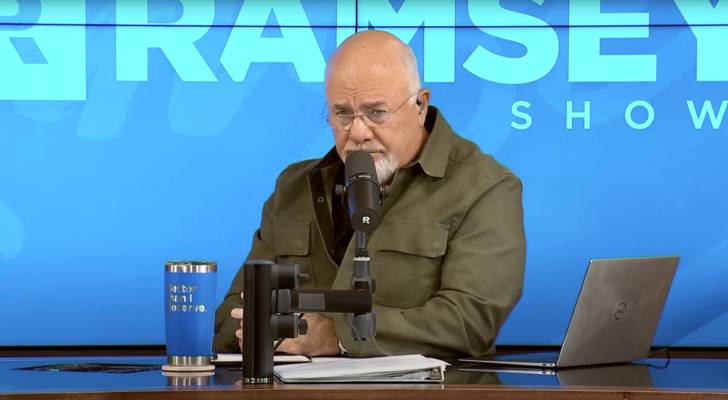

This San Diego married couple lives paycheck to paycheck on $500K-$600K a year — admits to $30K in monthly expenses including car lease payments. Here’s Dave Ramsey’s advice

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links. Despite earning an estimated combined income of $500,000 to $600,000 a year, Bill from San Diego admits he and his wife struggle to save any money — and it’s […]

‘We’re looking at a downsized America’: Kevin O’Leary cautioned any new house, car and lifestyle you take on will be a lot ‘smaller’ — here’s what he meant and how you can prepare

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links. Rampant inflation has cooled off significantly in America. While it remains slightly elevated, the Federal Reserve continues to hold its target interest rate. But if you think now is […]

Almost every millionaire in America owns these 5 simple things. You may have most of them already — and you could have them all

The average net worth among U.S. households in 2022 was $1,063,700, according to the Federal Reserve. However, the median net worth was only $192,900, suggesting that most Americans are not that close to being millionaires. That being said, millionaires tend to have similar money habits to everyday Americans that helped them get to where they […]