‘We have hit a wall’: Kevin O’Leary has bet 19% of his portfolio on crypto — but Congress has to pass these 2 bills to set off a trillion-dollar breakthrough

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links. Kevin O’Leary has come a long way from the time he called Bitcoin “garbage.” Now, the Shark Tank judge tells Moneywise, cryptocurrency-related assets make up 19.4% of his portfolio. […]

Jerome Powell quietly warned Americans there would be places in the US where you ‘can’t get a mortgage’ — and he’s not wrong. Here’s why and what to do if you’re part of this unlucky group

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links. Months after wildfires in California displaced thousands of residents and spurred a massive housing crisis in Los Angeles County, the ongoing impact points to a larger — and unquestionably […]

Colorado landlord gets massive shock after 300-plus police raid his property — turns out tenants were using the rental space as an illegal club linked with drug trafficking, gang activity

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links. Mike Moon got quite the shock when he found out what his tenants were really doing in his rental property. In late April, more than 300 law enforcement officers […]

I’m 52, putting away at least 10% of my paycheck for retirement — but my husband isn’t saving anything and has no plans to. What should I do?

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links. Jada, 52, is facing the existential dread of retirement. She doesn’t even plan to clock out until she turns 65, and she’s been saving for her golden years since […]

Mark Cuban said this will be the ‘No. 1 housing affordability issue’ for Americans — and predicts Florida will have ‘huge problems.’ How you can protect yourself in 2025

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links. There’s passionate debate about how to solve America’s ongoing housing crisis, much of which revolves around mortgage rates, zoning issues, immigration and construction. However, billionaire entrepreneur and investor Mark […]

This Florida family was left with staggering $700,000 in flood damage after Costco fridge installation turned into nightmare — why ‘free’ service often costs far more than you think

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links. What should have been a straightforward home upgrade has turned into an ongoing nightmare for one family in Jacksonville, Florida. The problem started when Bradley Byrd purchased a $3,500 […]

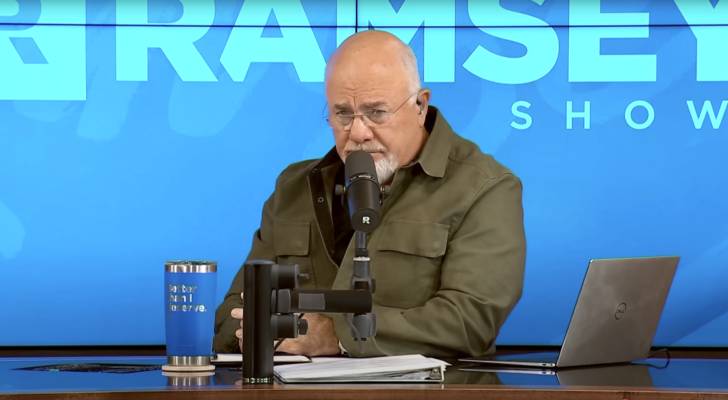

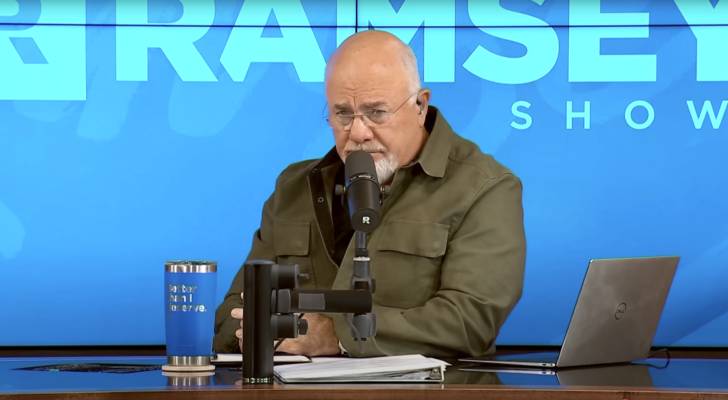

‘I’m kind of lost right now’: NY man’s debt explodes from $30K to 100K in under a year despite earning six figures. What Dave Ramsey says to do ASAP

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links. When Jelani from New York called into The Ramsey Show about his financial problems, he didn’t sugarcoat his situation. "I owe over $100,000. I’m kind of lost right now,” […]

I’m about to graduate high school and I always thought my wealthy parents would pay for college — but now they’re telling me having student loans will be character building. What do I do?

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links. Imagine you’re a high school senior nearing graduation and eyeing the start of your college career. You have the grades to get into a good school but fall short […]

This San Diego married couple lives paycheck to paycheck on $500K-$600K a year — admits to $30K in monthly expenses including car lease payments. Here’s Dave Ramsey’s advice

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links. Despite earning an estimated combined income of $500,000 to $600,000 a year, Bill from San Diego admits he and his wife struggle to save any money — and it’s […]

‘Don’t blame that on the Holy Spirit’: Dave Ramsey urges Missouri woman to instantly liquidate her $60,000 crypto portfolio to pay off debts — but she says she’s waiting for a sign from God

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links. Arabella from Springfield, Missouri called into “The Ramsey Show” because she was facing a financial fork in the road. With about $60,000 in cryptocurrency, $14,000 in student loans and […]