I’m 69 with $375K in savings but I’ve got a $250K reverse mortgage causing me serious stress. Should I just use most of my savings to pay it off ASAP and aim to survive on CPP?

This article adheres to strict editorial standards. Some or all links may be monetized. We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links. Imagine this scenario: Samantha is retired at 69, but a few years back she took […]

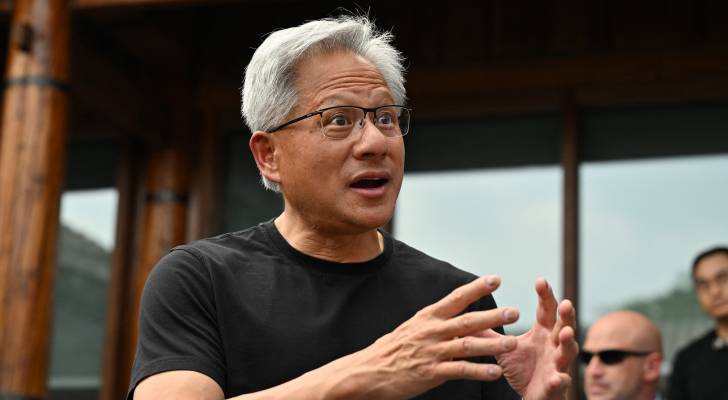

Nvidia’s founder calls AI the ‘greatest technology equalizer of all time’ and it’s already creating billionaires — is it time to hop on the trend?

Speaking during a tech summit hosted by the All-In Podcast and The Hill & Valley Forum [1] on July 23 in Washington, Nvidia CEO and co-founder Jensen Huang called artificial intelligence (AI) the “greatest technology equalizer of all time.” Nvidia is the trillion-dollar company that manufactures the chips that power many of today’s major AI […]

6 practical ways to make a rental property work for you as a Canadian investor — and save on taxes owed

Maybe you already own an income property (or two), and you’re looking to expand your portfolio. Perhaps you’d like to get your foot in the door to owning rental property. But maybe you have limited time, complex finances or anxiety around property management. For those looking to enter the market or manage their existing properties, […]

Crypto traders go head-to-head in South Korea’s live-stream event — is gamified investing the next big thing?

Investing gamification took a hyper-leap at the latest Korea Blockchain Week held in Seoul from September 21 to 27. One of the side events, Perp-DEX DAY, was a live e-sport style spectacle where competitors traded perpetual futures — a type of cryptocurrency derivative. It’s a new prospect for gaming and entertainment, but despite the declarations […]

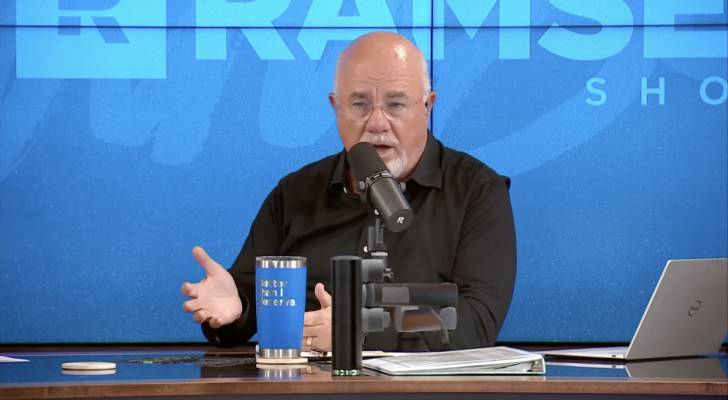

Houston man borrowed $10K from his uncle — who was then busted by the FBI for a $1.4M green card scam. Dave Ramsey says he still owes the money back

About a year ago, Eric from Houston was facing legal trouble and needed a lawyer. So he turned to his uncle, who works for a law firm. His uncle arranged for a lawyer at a cost of about $10,000. What Eric didn’t know at the time was that his uncle was allegedly running a fraudulent […]

Think slowing your ‘burn rate’ can keep you afloat if you lose your job? Here’s why it probably won’t last long — and what you should do instead

If you’re furloughed or lose your job, do you know how much money you’d need to bridge the gap until you start getting a paycheck again? This refers to your so-called “burn rate” — a term commonly used by startup companies to measure how quickly cash reserves are spent before they become profitable. Must Read […]

This ‘demoralizing’ trend is keeping computer science grads out of work — minimum wage jobs won’t take them either. Are 6-figure tech careers dying?

For years, we heard about the tech talent shortage — that there were a glut of jobs and not enough bodies to fill them. For students studying computer science, a bright future lay ahead. Upon graduation, they could expect multiple job offers, high starting salaries and lots of perks, from free food and gym memberships […]

5 easy ways to save an extra $1K a month for retirement

This article adheres to strict editorial standards. Some or all links may be monetized. We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links. It’s not always easy to save for retirement. After all, 46% of Canadians live paycheck […]

This 1 Southwest state has been ranked the worst US state to live in — here’s why and how to figure out if your state is to blame for your unhappiness

From its vast deserts and snow-capped peaks to a rich cultural heritage, there’s a reason why New Mexico is dubbed the Land of Enchantment. Unfortunately, when it comes to livability — such as safety and cost of living — it also ranks as the worst state to live in. Must Read Thanks to Jeff Bezos, […]

Trump’s new law set for next year will leave you paying taxes on gambling losses — here’s why lawmakers are fighting it, saying it would be a mistake

Rolling the dice just got a whole lot riskier under President Donald Trump’s One Big Beautiful Bill. A few short lines in the 940-page bill could have an oversized impact on the gambling and sports betting industry. The bill, which was signed into law in July, goes into effect next year. Must Read Thanks to […]