Trump flaunts Oval Office’s 24-karat accents as gold hits record highs — is it time to start investing in this inflation-fighting asset?

President Trump took to Truth Social on September 28 to reveal a video of new decorations he has installed in the Oval Office, including 24 karat gold accents. As Newsweek notes, this decor is more in line with his properties Trump Tower and Mar-a-Lago, and less in keeping with the history of 1600 Pennsylvania Avenue. […]

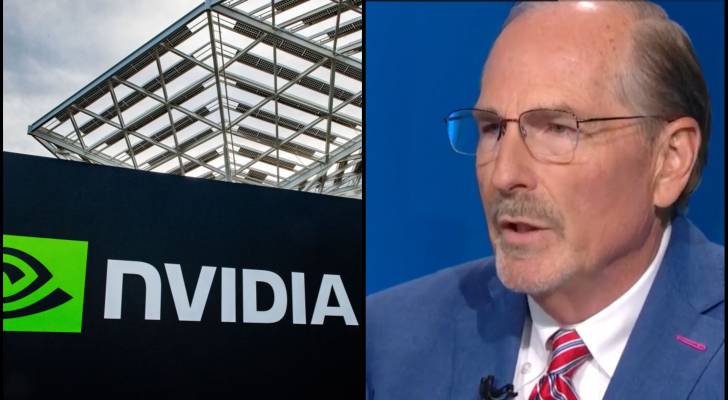

This chief investor is urging people to quit chasing this 1 stock sector, saying it’s not if but when ‘this thing breaks’ — is your portfolio ready?

If you’re invested in AI, you might want to pay attention. Bill Smead, founder of Smead Capital Management, says the market frenzy around AI has all the signs of a bubble, driven by the momentum of stocks like Nvidia. Must Read Real Estate: Thanks to Jeff Bezos, you can now become a landlord for as […]

Prime Day? Pass. Canadians can still score real holiday deals without Amazon

Every fall, Canadians are bombarded with countdown clocks, “lightning deals,” and inboxes full of urgent reminders that Amazon Prime Day — or the biggest and best Black Friday deals — are here. But as flashy banners return, a growing number of shoppers are asking: Are Amazon’s deals really that good? And is this really where […]

Holiday shoppers are pulling back as money gets tight — here’s how to spend less and boost your savings now

While the holiday season usually signals big spending and a sea of deals available to consumers in both digital and brick and mortar retail spaces, Canadians are adjusting their holiday plans to withstand widespread economic uncertainty. According to BMO, consumers expect to spend, on average, $2,310 on gifts, entertainment and travel this year (1). Online […]

Atlanta mother, daughter allege auto broker sold them Honda truck with 285K miles — 130K higher than advertised. Has your odometer been messed with?

When 25-year-old Shadayja Johnson and her mother Latrice spotted a used 2013 Honda Ridgeline listed for $6,400 on Facebook Marketplace, it looked like a great deal. Must Read Real Estate: Thanks to Jeff Bezos, you can now become a landlord for as little as $100 — and no, you don’t have to deal with tenants […]

The $1K ‘Trump Account’ for your child, which could grow up to 6 figures. Here’s a strategy keep it tax-free for life

If you’re having a baby between 2025 and 2028, your bundle of joy could come home with a $1,000 head start from the government. That’s the whole idea behind the new “Trump Accounts,” introduced as part of the One Big Beautiful Bill President Trump signed in July 2025. These accounts are meant to help families […]

My work is offering a 4% RRSP match and I’m torn. Should I shrink my paycheques?

When your employer offers to put extra money toward your retirement through a group RRSP match, it can feel like a rare workplace win. A guaranteed contribution of up to 4% of your salary is essentially free money, a perk many Canadians never see on their paycheques. Still, saying yes means choosing how much you […]

US gets hit with another credit downgrade, agency warns of ‘sustained deterioration’ of finances and ‘weakening’ governance. What you need to know

This article adheres to strict editorial standards. Some or all links may be monetized. It wasn’t that long ago that Moody’s knocked America’s sovereign credit rating down a peg — and now, the U.S. is taking another hit to its credit score. This time, it’s Scope Ratings sounding the alarm, warning that Uncle Sam’s financial […]

The world’s ultra-wealthy make themselves at home in these 7 US cities. How they’re preserving their wealth against the odds (and how you can too)

When money is no object and you can live anywhere in the world, where do you choose to live? It turns out the world’s richest like to settle where other rich people settle. Must Read Real Estate: Thanks to Jeff Bezos, you can now become a landlord for as little as $100 — and no, […]

Illinois man’s wife wants to keep $75K in a safe at home for her own comfort — but Ramsey Show hosts say her ‘scarcity mindset’ only creates more risk

While some people like to keep cash on hand for emergencies, how much is too much? Bill from Illinois called into The Ramsey Show out of concern for his wife, 64, who wants to keep $75,000 in cash at home in a safe, which would make her feel “comfortable.” (1) Must Read Real Estate: Thanks […]