How has your individual retirement account (IRA) fared this year? Has it met your expectations in terms of performance? If you haven't considered incorporating precious metals like gold into your retirement strategy, then you might be overlooking a crucial aspect of diversification.

In order to include physical gold in your IRA, you must either have a self-directed IRA or establish one. This particular type of retirement savings account allows for investment alternatives beyond traditional options like stocks, bonds, mutual funds, and exchange-traded funds (ETFs). Among these alternatives are gold, silver, platinum, and palladium.

Converting your Roth IRA, Traditional IRA, or 401(k) to a gold IRA means transferring funds from your current individual retirement investment account to a self-directed IRA overseen by a custodian who specializes in precious metals.

-

Transfer: For Roth and Traditional IRAs, this process involves a trustee-to-trustee transfer.

-

Rollover: In the case of a 401(k), provided you are no longer employed by the sponsoring employer, the funds can be rolled over to a gold IRA.

To avoid potential tax penalties, these processes should be conducted directly between custodians and in compliance with IRS rules and regulations.

If you're interested in learning more about converting your IRA to gold, including the pros and cons, we recommend downloading a free gold IRA investment guide. It contains all the valuable information you'll need to make a successful transfer.

If you haven't set up a self-directed IRA yet (sometimes referred to as a gold IRA when precious metals are involved), you can do so through a reputable gold IRA custodian. If you already have a self-directed IRA account, any transfers from other retirement accounts should be handled by your account's custodian to ensure compliance with IRS regulations.

Setting up a Gold IRA Account

To open a new gold IRA account, also known as a self-directed IRA, you must locate a firm that specializes in such accounts.

We suggest Augusta Precious Metals, a renowned and trusted company in the gold and silver IRA industry. It boasts an impeccable reputation among its customers and has garnered significant media attention. Augusta holds an A+ rating from the Better Business Bureau (BBB) and a AAA rating from the Business Consumer Alliance (BCA). Money magazine has named it "The Best Overall Gold IRA Company," while Investopedia honored it as "The Most Transparent Gold IRA Company.

After completing the necessary forms and creating your account, you'll need to deposit funds, select the gold and other precious metals you wish to invest in (only specific ones are allowed by IRS regulations), and instruct your account custodian to purchase precious metals for you. Once the transaction is complete, your investments will be moved to a secure storage facility.

How to Transfer IRA to Gold IRA

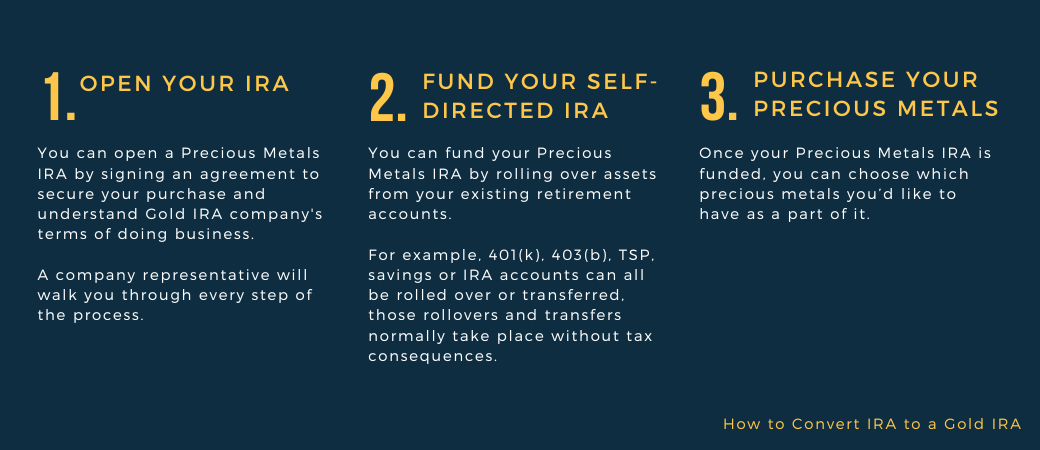

Once your account is open, transferring existing IRA funds to a gold IRA is relatively simple. To roll over funds from your current IRA to a self-directed gold IRA, follow these steps:

-

Get in touch with your current IRA account administrator and inform them that you want to initiate a transfer.

-

Complete the necessary paperwork, providing information about your new account and the amount you wish to transfer.

-

Wait for your account administrator to wire the funds to your gold IRA. After the funds are received, you can start buying gold and other physical precious metals.

-

Decide which gold you want to purchase, keeping in mind that only certain coins and metals are eligible.

-

Instruct your gold IRA account custodian to make the purchases using the funds in your account.

Your metals will be sent to a secure depository for safe storage. Storing gold at home is generally not advisable, despite claims from some gold IRA companies. Be cautious of anyone promoting this, as it may expose you to significant IRS penalties.

Monitor your account statements and keep an eye on your investments' performance. Your gold IRA provider may offer tools to assist you with this.

Precious Metals IRA Regulations to Keep in Mind

Taxes and Fines

Typically, a gold IRA transfer is not subject to taxes, so there's no tax implications involved. To maintain tax-free status and avoid possible fines, the funds must be moved from the original retirement account to the gold IRA within a 60-day window. Failing to complete the transfer within this timeframe will result in the funds being considered a distribution, subjecting them to potential taxes and penalties.

Gold IRA Transfer Timeframes

Reputable gold IRA companies have vast expertise in guiding clients through the gold IRA transfer procedure. A company's representative will collaborate with your existing 401(k) or IRA custodian to ensure a smooth transition.

While most gold IRA transfers are completed without issue, there is always a chance for miscommunication, misplaced paperwork, or other obstacles. Our specialists are familiar with potential complications and will work with you to ensure a swift transfer of funds into your gold IRA, allowing you to purchase physical gold as soon as possible.

Tax Benefits

Gold IRAs share the same tax benefits as other IRA accounts. Traditional precious metals IRAs are funded with pre-tax money, with taxes applied upon distribution. In contrast, Roth gold IRAs are funded with post-tax money, and distributions are tax-free.

Since a gold IRA rollover enables you to transfer existing retirement assets into gold ownership without incurring distribution and tax payments, it helps secure your gains and protect your assets in a gold IRA against potential losses during market downturns. A physical gold IRA serves as an additional instrument for wealth preservation.

Required Minimum Distributions (RMDs)

The rules for required minimum distributions (RMDs) are the same for gold IRAs as they are for any other IRA. For a traditional IRA, RMDs must begin at age 72, while Roth IRAs do not require RMDs.

Custodians and Storage Facilities

Like all IRAs, gold IRA assets must be overseen by a custodian. The concept of a "home storage gold IRA" that supposedly permits at-home storage of gold IRA assets is misleading and could lead to tax and penalty liabilities. Therefore, consulting with financial and tax advisors before making such decisions is crucial.

When initiating a gold conversion, the assets used to fund the gold IRA will be transferred to an account managed by an IRA custodian. Augusta Precious Metals collaborates with reputable custodians experienced in handling precious metals IRA assets. After acquiring gold coins with the funds from your gold IRA transfer, the purchased metals will be stored at a secure gold bullion storage facility. Augusta also partners with trusted storage facilities to guarantee the safety of your gold IRA assets.

What Are the Best Companies for Gold IRA Investments?

Here are the most top-rated gold IRA companies in the industry that will help you convert your IRA to gold:

1. Augusta Precious Metals

Augusta is the best company for gold and silver investments. Customers of Augusta Precious Metals enjoy affordable rates with full transparency on pricing, earning the company recognition as the top silver IRA company for clear pricing. It is crucial to consider pricing when evaluating gold IRA firms. While many claim to offer low fees, only a few actually disclose all costs involved.

Augusta's fee structure and pricing scheme are both transparent and easy to understand, making them our top choice for the best gold IRA in terms of transparent pricing. Although locating the pricing details for most Gold IRAs requires some searching, Augusta's pricing information is available online.

Since its establishment in 2012, Augusta has gained a reputation for transparency and integrity. The company bolsters customer trust by offering a 100% money-back guarantee for new clients, guaranteed fair pricing, and a seven-day price protection policy. Augusta also provides a clear disclosure of their profit margin on gold and silver sales, with surprisingly honest figures (up to 10% for standard bullion and 66% or more for premium items). This level of openness sets Augusta apart from many gold IRAs that are hesitant to disclose their markups.

To learn about setup, yearly, storage, and other fees, customers are advised to contact Augusta directly. However, a sample fee guide reveals a total setup fee of $250 for the first year, followed by a recurring annual fee of $200, which includes the custodian maintenance fee ($100) and the storage facility fee ($100). Furthermore, Augusta offers an exceptional buy-back program and, despite having the option, has not rejected a buyback request to date.

Augusta partners with the reputable Delaware Depository for its clients' storage needs, featuring vault locations across the U.S. Since accounts are self-directed, there are no management fees. Similar to other gold IRA companies, Augusta primarily serves as a dealer, and separate custodian fees may apply depending on the selected custodian.

Augusta's customer service is exceptional, as evidenced by high consumer ratings. The company's onboarding and transaction procedures are seamless, with specialists guiding customers through all required paperwork. However, online purchases are not available.

The two main limitations of Augusta are its restricted selection of metals and high minimum order requirement for adding gold or silver to a self-directed IRA. Customers interested in platinum or palladium must look elsewhere, as Augusta specializes in gold and silver bullion and coins.

2. Goldco

Goldco is one of the best options for precious metals investing. Its representatives make a concerted effort to provide comprehensive information to both potential and current customers, ensuring they can make well-informed decisions. This dedication to customer support is why we consider Goldco the top gold IRA company in this regard.

With a focus on delivering precious metals market investment knowledge in a structured and unbiased manner, Goldco works to earn the complete trust of its clientele. The company is also backed by the endorsement of television host Sean Hannity. Goldco is a reputable company that has been in business for over a decade. It distinguishes itself in various aspects, but its commitment to superior customer service is particularly noteworthy.

Customers receive Goldco Precious Metals' top-notch customer service from the moment they open an account to their most recent transaction. This includes direct access to a specialist who guides them throughout the entire process. While the company encourages customers to utilize the educational resources available on its website, the content primarily consists of articles relating current events to the benefits of gold ownership. Investors are advised to revisit the disclaimer at the bottom of the page each time they read a blog post.

If you need any other details on fees, account minimums, custodians, and storage options, you will need to get in touch with Goldco. The company also provides a complimentary gold investment guide upon submitting your name, email, and phone number. Account creation is a swift and simple process, primarily conducted online. Additionally, Goldco facilitates gold IRA rollovers for transferring existing retirement funds.

Advantages of Gold IRAs

There are three solid reasons why you as an investor may want to convert Roth IRA to gold:

Retirement Portfolio Diversification

Numerous Americans with tax-advantaged retirement account plans like 401(k) or Roth IRA accounts might be unaware of the existence of gold IRAs, assuming that their investment choices are restricted to the options provided by their employer-sponsored 401(k) plans or IRA custodians.

However, self-directed IRAs grant investors the ability to broaden their portfolios with assets like precious metals, which are not included in their current plans. This diversification can offer a safeguard during times of market instability and economic unpredictability.

Risk Mitigation or Adjustment

In addition, a gold IRA can serve as a valuable instrument for modifying the risk associated with your investments. Gold is generally considered a stable asset with lower volatility compared to other investment options, which is why it has long been regarded as a reliable refuge and a means of preserving wealth during turbulent times.

Asset Protection

Lastly, due to its status as a safe haven, gold is often the first choice for investors seeking protection during periods of market turmoil. For instance, gold's value increased by 25% during the 2008 financial crisis, while markets lost over 50% of their value. Gold's worth continued to rise even as markets faced challenges in recovering.

Is Investing in Gold Suitable for You?

Ultimately, the choice of whether to invest in gold depends on your individual situation, objectives, and financial plans. Seeking guidance from a financial advisor is always advisable.

An increasing number of Americans are considering gold as a means of securing their savings, given the mounting concerns about rising interest rates, escalating inflation, and the growing risk of recession impacting market growth. With a multitude of gold purchasing options, the opportunities are virtually limitless.

If you're concerned about the future and want to preserve your hard-earned wealth, perhaps it's time to contemplate a gold IRA or a gold Roth IRA. No one wants to experience another 2008 financial crisis or a return to the 1970s' persistent stagflation, but these scenarios are genuine threats that could significantly impact your savings.

Countless Americans have attained peace of mind by investing in gold, and they consider it the most reliable means of preserving their wealth. With over ten years of experience, thousands of content customers, and over $1 billion in precious metals transactions, Augusta Precious Metals' specialists possess the expertise to guide you in safeguarding your assets with gold.

Advantages of Having Gold in Your IRA

Gold has long been valued for its ability to offer security and benefits to those who save and invest in it. The following are four key reasons why people choose to hold physical gold.

Diversifying Your Investments

Even those who may not typically favor gold can acknowledge its potential for contributing to a well-rounded investment portfolio. Gold is often seen as a counter-cyclical asset, meaning it tends to perform well when other markets falter. As a result, it is commonly held as a way to safeguard wealth during times of crisis or economic downturn.

The suggested allocation of gold in a portfolio varies widely, ranging from a small percentage to a significant portion. It's crucial to consult with a financial advisor to determine the right amount of gold for your financial objectives.

Protection Against Inflation

Many investors turn to gold as a defense against inflation. As gold typically retains or increases its purchasing power over time, it can help ensure that your assets maintain their value even when inflation erodes your wealth.

Since the end of the gold standard in 1971, gold's value has risen by almost 5,000%, whereas the US dollar has seen an 86% reduction in its purchasing power. During the 1970s, a period of high inflation in the US, gold experienced annualized gains of over 30% throughout the decade. With inflation once again on the rise, many are seeking refuge in gold.

Tax-Efficient Growth

Gold investments, just like any precious metals investment, can also offer tax-efficient growth opportunities, especially when held in a gold IRA. By owning gold within a gold IRA, you can accumulate gains tax-free and only pay taxes when you withdraw the funds.

Building Wealth

Gold is not only a safeguard for uncertain times but also has the potential to yield significant growth even during seemingly prosperous market conditions.

Since 2001, gold has seen an annualized growth rate of nearly 9%, an impressive performance over an extended period. Given the current economic challenges, gold's potential for future growth remains promising.

What Portion of an IRA Can You Allocate to Gold?

You can transfer or roll over all or part of your retirement funds from one account to another. Using the transferred or rolled-over funds, the custodian acquires gold or other eligible precious metals on your behalf in the form of IRS-approved bullion bars or specific coins. The custodian will make the purchase from a precious metals dealer, such as Augusta Precious Metals.

It's important to note that if you own gold through an IRA, you won't have physical possession of the gold bars or proof coins. Instead, the gold will be securely stored in an IRS-approved depository. Although separate from the depository, your custodian can assist in arranging storage at an approved facility.