Have you ever considered adding gold to your retirement portfolio? A Gold Roth IRA might be the perfect solution for you. In this comprehensive guide, we will explore the world of gold Roth IRAs, their similarities and differences with traditional IRAs, and how they can help you achieve financial security and diversification in your retirement savings.

Get ready to discover how investing in precious metals can unlock new opportunities for growth and wealth preservation.

Key Takeaways

-

Gold Roth IRAs offer potential long-term growth and tax benefits, such as tax-free withdrawals in retirement.

-

If you're looking to purchase gold with your Roth IRA funds, Goldco is the best Gold IRA company to choose.

-

Investors should be aware of the contribution limits, fees associated with storage and early withdrawal penalties when considering a gold Roth IRA.

How Does a Gold Roth IRA Work?

A gold Roth IRA is a self-directed IRA that allows you to invest in tangible assets, such as gold, silver, platinum, and palladium. To set up a gold Roth IRA, you'll need to work with a self-directed IRA custodian, who will help you open the account, acquire the metals, and complete all IRS reporting requirements.

If you're interested in understanding the potential benefits as well as the pitfalls of investing in gold, we suggest downloading a free wealth protection guide. This resource will aid you in navigating the world of gold investments.

Investing in a gold Roth IRA can be a smart strategy to safeguard against inflation, expand your retirement account, and diversify your overall portfolio. By holding physical precious metals, you can enjoy potential long-term growth and tax benefits that come with a Roth IRA.

Tax Benefits of Gold Roth IRAs

One of the primary advantages of a gold Roth IRA is tax-free withdrawals in retirement. This means that any gains you make on your investments will not be subject to taxes when you withdraw the funds during your retirement years.

Moreover, a gold Roth IRA offers the opportunity to rollover funds from other retirement accounts without incurring taxes or penalties. This can be especially beneficial if you're looking to consolidate multiple retirement accounts or want to diversify your portfolio with precious metals.

Diversification with Precious Metals

Diversifying your retirement portfolio with precious metals can offer several benefits. For instance, investing in gold, silver, platinum, and palladium can provide a hedge against inflation, as their value often increases when paper currencies lose purchasing power.

Moreover, precious metals have a low correlation with other assets, such as stocks and bonds. This means that they can potentially increase returns and reduce risk in your overall investment portfolio. However, it is essential to be aware of the risks, including market volatility and the possibility of fraud, and conduct thorough research before investing.

Top Gold IRA Companies for 2023

When it comes to choosing the best gold IRA companies for 2023, Goldco, Augusta Precious Metals, and American Hartford Gold stand out as top choices. These companies offer excellent customer support, competitive pricing, and a wide range of services to help you navigate the world of gold investing.

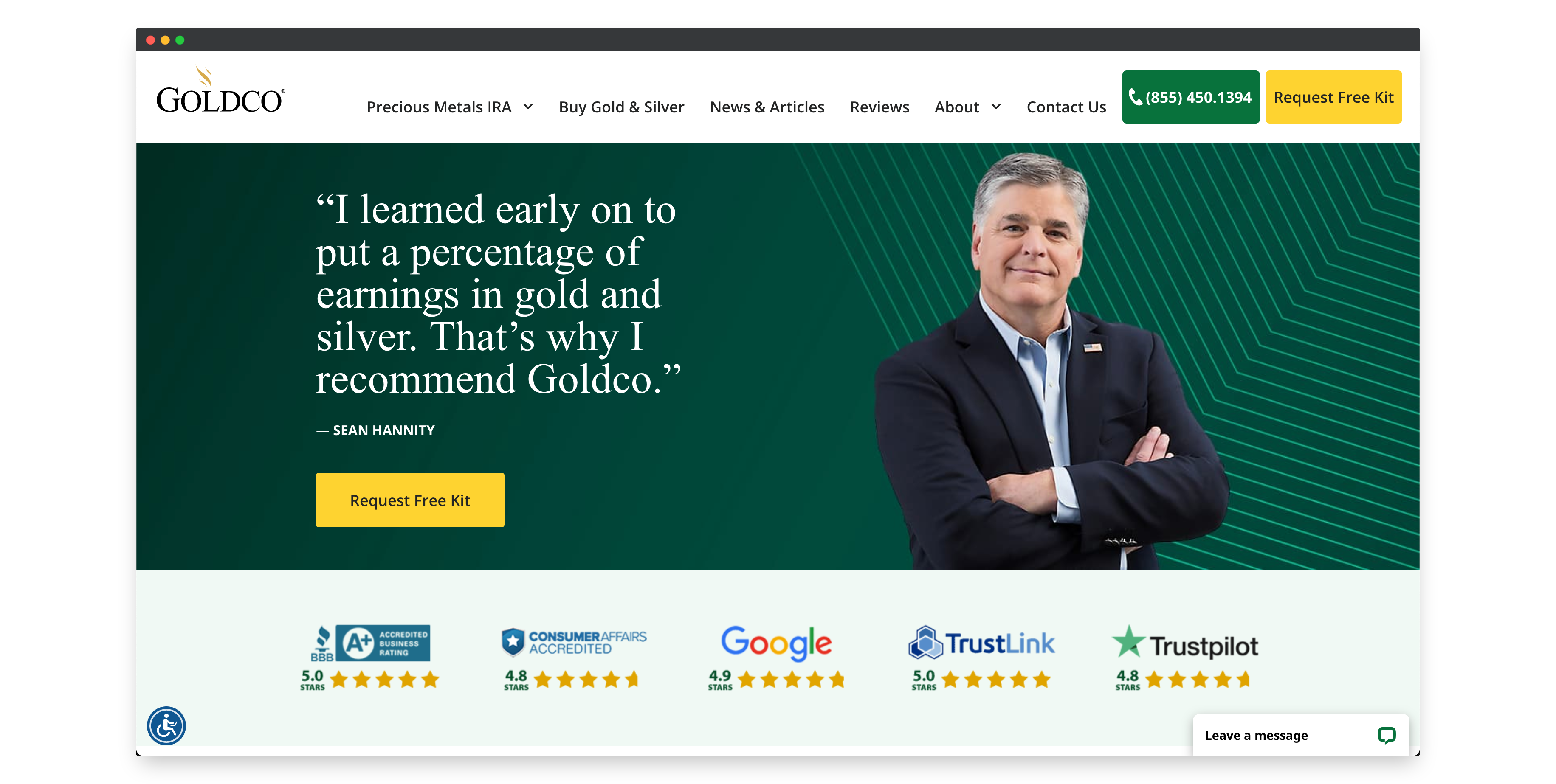

1. Goldco

Goldco is a highly acclaimed gold IRA company with a 4.8 out of 5 stars rating on Trustpilot. They provide a wide range of resources and educational content to help you understand gold and precious metals investing. With their A+ grade from the Better Business Bureau (BBB), you can trust Goldco to provide excellent service and support throughout your investment journey.

Goldco offers a variety of gold and precious metals IRA options, including gold, silver, platinum, and palladium. They also provide a secure storage solution for your metals, so you can rest assured that your metals are safe.

2. Augusta Precious Metals

Augusta Precious Metals is a California-based company offering gold IRAs and various precious metals, coins, and bullion. With a minimum purchase requirement of $50,000 for an account and an A+ rating from the Better Business Bureau, Augusta Precious Metals is a reliable choice for investors looking to secure their retirement with precious metals investments. They also utilize Delaware Depository to store customer assets safely.

3. American Hartford Gold

American Hartford Gold is a self-directed account provider that enables investment in precious metals. They offer tax benefits similar to standard IRA options, a minimum purchase requirement of $10,000 for a gold IRA, and a selection of IRA-eligible gold and silver products.

This makes American Hartford Gold a top choice for investors looking to diversify their retirement portfolio with gold and silver investments.

Gold Roth IRA Guidelines

When considering a gold Roth IRA, it's important to familiarize yourself with the guidelines. These include an annual contribution limit of $6,000 or $7,000, depending on the investor's age, and the fact that contributions are not tax-deductible.

Additionally, early withdrawals from a gold Roth IRA before age 59 12 may be subject to a 10% penalty and considered taxable income. However, there are exemptions, such as a first-time home purchase or the birth of a child, which may help to avoid the penalty.

Setting Up Your Gold Roth IRA

To set up a gold Roth IRA, you'll need to research and choose a reputable Gold IRA company to help you establish and fund the account. This can be done via a rollover from another IRA with no negative tax consequences.

Once your account is set up, you can begin investing in precious metals like gold, silver, platinum, and palladium.

Choosing a Reputable Custodian

Working with a reliable gold IRA custodian is essential for the success of your investment. A reputable custodian will not only ensure that your account remains compliant with IRS regulations, but also provide secure storage for your precious metals and offer a range of services and expertise.

Two of the most popular gold IRA custodians are Equity Trust Company and STRATA Trust Company. Depending on the gold IRA, you may be able to select your own custodian, or the IRA may recommend or require that you use a specific custodian.

Funding Your Account

There are several methods to fund your gold Roth IRA, such as obtaining physical gold coins or bars, or investing in gold ETFs. Both options offer tax-free growth and withdrawals, making them attractive choices for long-term investors.

Alternatively, you can fund your gold Roth IRA through cash, rollover, or transfer from another retirement account. This can be particularly helpful if you're looking to consolidate multiple retirement accounts or diversify your portfolio with precious metals.

Related article: 401(k) to Gold IRA Rollover Guide

Investing in Other Precious Metals

In addition to gold, you can also invest in other precious metals such as silver, platinum, and palladium through a gold Roth IRA. These alternative investments can offer additional diversification benefits and potential growth opportunities, making them a valuable addition to your retirement portfolio.

Silver IRA

A silver IRA can provide diversification to your retirement portfolio, guard your assets against inflation, and present long-term growth opportunities. Additionally, it can act as a safeguard against economic downturns and stock market instability.

A silver IRA operates in a similar fashion to a traditional IRA, except investments are made in silver rather than stocks, bonds, and mutual funds. Silver coins, bars, and rounds can be purchased and stored in a secure depository. Like a gold Roth IRA, a silver IRA offers the same tax benefits, such as tax-deferred growth and tax-free withdrawals when retired.

Platinum and Palladium

Platinum and palladium are two precious metals that are widely employed in various industries, such as the automotive industry. They are both scarce metals, and their prices can be subject to fluctuations. Investing in platinum and palladium can offer potential for higher returns, however with greater volatility.

Investing in platinum and palladium may be a viable option for portfolio diversification and potential higher returns. It is essential to consider the associated risks, such as market volatility, liquidity risk, and storage costs, before investing.

Comparing Gold Roth IRAs to Other Retirement Accounts

Gold Roth IRAs share many similarities with other retirement accounts like traditional IRAs, SEP IRAs, and 401(k)s, as they are all tax-advantaged accounts designed to facilitate saving for retirement. However, gold Roth IRAs possess certain unique qualities, such as the capacity to invest in physical precious metals and the ability to withdraw contributions tax-free.

When comparing gold Roth IRAs to other retirement accounts, it's important to consider factors such as fees, investment options, and tax implications. While gold Roth IRAs typically incur higher fees than conventional retirement accounts, they offer unique benefits like portfolio diversification and protection against inflation.

Risks and Considerations

When investing in a gold Roth IRA, it's crucial to be aware of the potential risks and considerations involved. One of the primary risks is market volatility, as the prices of precious metals can fluctuate in response to various factors, such as economic conditions, geopolitical events, and supply and demand.

Storage fees and taxes are also important considerations when investing in a gold Roth IRA. While many gold IRA companies offer storage solutions for your precious metals, these services often come with additional fees that should be factored into your investment decision. Moreover, you may need to liquidate some of your precious metals to pay taxes on required minimum distributions (RMDs) if you do not have the necessary funds available at the time of distribution.

Lastly, be cautious of potential scams and fraudulent activities in the precious metals market. It's essential to conduct thorough research and work with a reputable gold IRA company to ensure the safety and security of your investments.

Gold Roth IRAs: FAQ

Should you hold gold in Roth IRA?

Given the potential benefits, it can be a good idea to hold gold in your Roth IRA. However, it is important to consider all of the associated risks and costs before deciding whether this is the best option for you.

Ultimately, each investor must make their own informed decision about how to structure their retirement savings portfolio.

What is the difference between a gold IRA and a gold Roth IRA?

The key difference between a gold IRA and a gold Roth IRA is that contributions to a traditional gold IRA are tax-deductible, whereas contributions to a Roth gold IRA are not. Withdrawals from a traditional gold IRA are taxed, but withdrawals from a Roth gold IRA are not.

Therefore, if your goal is to avoid taxation on retirement funds, then the gold Roth IRA may be a better option.

Are gold backed IRAs a good idea?

Investing in gold-backed IRAs can be a great option for those who want to diversify their portfolio, benefit from tax advantages, and hedge against inflation. However, these types of investments should be carefully considered due to contribution limits and limited returns.

Ultimately, it is up to the individual investor to decide if a gold-backed IRA is the right choice for them.

How is gold taxed in Roth IRA?

Roth gold IRAs offer a tax-efficient way to save for retirement as taxes on withdrawals are not applicable. Contributions made to a Roth gold IRA are also not tax-deductible.

Therefore, gold is taxed in a Roth IRA at your income tax rate when making a withdrawal.

What is a Roth gold IRA?

A Roth Gold IRA is an investment account that allows individuals to save for retirement with gold and other precious metals. This type of account offers tax advantages, such as allowing the investor to access their money tax-free upon withdrawal.

Furthermore, assets within this account are insulated from many market fluctuations and risks.

Bottom Line: Is a Roth gold IRA Worth It?

The answer ultimately depends on your individual investment goals and risk tolerance. A gold Roth IRA can be a great way to diversify your retirement portfolio and protect against inflation, but it's important to do your research and understand the risks before investing.

In conclusion, a gold Roth IRA can offer several benefits, including portfolio diversification, protection against inflation, and tax advantages. However, it's crucial to consider the potential risks, such as market volatility, storage fees, and taxes, before making an investment decision. By thoroughly researching and understanding the risks and benefits of a gold Roth IRA, you can make an informed decision and secure a brighter financial future.