Are you seeking a secure and profitable way to diversify your retirement savings? Look no further; investing in IRA approved silver coins and bars is a smart choice.

In this comprehensive guide, we will explore the ins and outs of IRA approved silver investments, their benefits, the most popular coins and bars, and how to buy and store them. Let this be your stepping stone towards a more prosperous and stable financial future.

If you're considering investing in silver for retirement, we highly recommend downloading a free silver IRA guide. It contains a wealth of valuable information, including the benefits and potential pitfalls of silver investments.

IRA Approved Silver as a Retirement Investment

IRA approved silver investments are a powerful way to diversify your retirement portfolio and protect your wealth from market fluctuations and inflation. By investing in precious metals such as silver, gold, platinum, and palladium, you can hedge your investments and secure your retirement savings.

Silver IRAs, a type of individual retirement account, enable investors to hold physical silver bullion and coins in their portfolio, providing long-term investment benefits and stability.

Related read: Best Silver IRA Companies 2023: Reviews, Comparison, Fees & Rollover Info

Eligibility Criteria

When considering IRA approved silver investments, it's crucial to ensure the silver products meet the eligibility criteria set by the Internal Revenue Service (IRS). For silver to be eligible, it must meet certain fineness levels, typically .995 percent for silver coins and bars.

Moreover, the coins or bars must be sourced from a reputable mint or manufacturer. Choosing a reliable custodian or broker is essential for any investor. They can provide valuable guidance throughout the whole process and most importantly make sure that all the IRS regulations are followed.

Benefits of Investing in Precious Metals

The benefits of investing in IRA approved silver coins and bars are numerous. Silver, as a tangible asset, offers diversification advantages and acts as a safeguard against inflation. Additionally, silver has numerous industrial uses, which can stimulate demand and lead to price appreciation in the long run.

By including IRA approved silver in your retirement portfolio, you can protect your savings against market fluctuations and secure your wealth for the future.

Popular IRA Approved Silver Coins & Bars

Here are some popular IRA approved silver coins and bars, including certain foreign coins. Each of these coins and bars has its unique features and benefits, making them valuable additions to your self-directed IRA.

American Eagle Silver Bullion Coins

American Eagle Silver Bullion Coins are one of the most popular IRA approved silver investments. Produced by the United States Mint, these coins are available in four sizes: one ounce, one-half ounce, one-quarter ounce, and one-tenth. Guaranteed to contain one troy ounce of 99.9% fine silver bullion, they have a face value of one United States Dollar.

The reverse of the coin features the US Eagle and Shield emblem with 13 stars, making them a symbol of American pride and a valuable addition to your portfolio.

American Eagle Silver Proof Coins

The American Eagle Silver Proof Coins, also known as American Silver Eagles, are collector versions of the official United States bullion coins, minted at the national government mint, the U.S. Mint at West Point, with the "W" mint mark. These coins weigh 1.000 troy oz (31.103 grams) and are composed of 99.9% silver.

The proof coins, often found in brilliant uncirculated condition, display a higher level of craftsmanship than their bullion counterparts, making them an attractive investment option for collectors and investors alike.

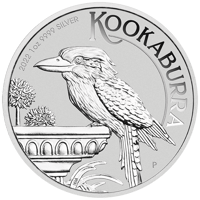

Australian Kookaburra Silver Coins

Australian Kookaburra Silver Coins are a unique IRA approved silver investment produced by the Perth Mint in Australia. These coins feature the portrait of Queen Elizabeth II on the reverse and a kookaburra, a native bird from Australia, on the reverse. The design of the kookaburra varies from year to year, adding to their collectible value.

Composed of pure silver, these coins are a beautiful and valuable addition to your precious metals IRA.

Austrian Silver Philharmonic Coins

Austrian Silver Philharmonic Coins are another popular IRA approved silver investment option. Minted by the Austrian Mint, these coins are composed of fine silver and feature an array of musical instruments on the reverse side, including the cello, violin, harp, French horn, and bassoon.

Their unique design and high silver purity make them an attractive investment for those looking to diversify their precious metals IRA.

Canadian Silver Maple Leaf Coins

Canadian Silver Maple Leaf Coins, also known as Canadian Silver Maple Leafs, are renowned for their pure silver composition and unique design. Produced by the Royal Canadian Mint, these coins feature a sugar maple leaf on the reverse, which is the national symbol of Canada, and boast a radial line finish.

As an added security measure, they also feature a micro-engraved laser privy mark on the reverse side. Their high silver purity and distinctive design make them a valuable and secure investment for your IRA, especially when preserved in their original mint packaging.

Mexican Silver Libertad Coins

Mexican Silver Libertad Coins, produced by the Mexican Mint in Mexico City, are a desirable option for investors due to their limited mintages and attractive design. Composed of.999 pure silver, these coins feature the Mexican National Seal on the obverse, including the Mexican coat of arms with an eagle perched atop a cactus holding a snake in its beak.

Their unique design and high silver purity make them a valuable addition to your precious metal IRA, complementing your existing precious metals IRA.

Royal Canadian Silver Mint Bars

Royal Canadian Silver Mint Bars are 10 oz bars made with pure silver, produced by the esteemed Royal Canadian Mint. These bars possess reeded edges, a distinctive bullion finish, and an individual serial number, ensuring their authenticity.

Their superior purity compared to other 10 oz silver bars makes them a highly sought-after investment option for those looking to diversify their precious metals IRA.

Johnson Matthey Silver Bars

Johnson Matthey Silver Bars are silver bars produced by the globally-renowned precious metals refiner Johnson Matthey. Made of 99.9% pure silver, these bars are celebrated for their world-class quality and prestige. Though slightly pricier than other silver bars of the same weight, their value is maintained due to the esteemed reputation of the mint, making them a worthwhile investment for your precious metals IRA.

These bars are a great way to diversify your portfolio and add a touch of luxury to your investments. They are also a great way to add a tangible asset to your retirement savings. With their high standards.

Choosing the Right IRA Approved Silver Products

Selecting the right IRA approved silver products requires careful consideration of your investment goals and a comparison of silver coins and bars. By assessing your personal financial objectives, risk tolerance, and investment timeframe, you can make an informed decision on which silver products will best suit your needs.

Additionally, understanding the differences between silver coins and bars, such as size, weight, design, and cost, will help you make the most suitable choice for your precious metals IRA.

Assessing Your Investment Goals

Evaluating your investment goals is a crucial step in choosing the right IRA approved silver products. Consider factors such as your risk tolerance, time horizon, and financial objectives, as well as the purpose of your investment.

Creating a document or journal detailing each investment goal and method of monitoring progress can help you stay on track and ensure the silver products you choose align with your overall investment strategy.

Comparing Silver Coins and Bars

When comparing silver coins and bars, consider factors such as divisibility, production costs, premiums, resale value, collectible value, rarity, protection against counterfeiting, and purity. Silver coins and bars can be subdivided into smaller entities, facilitating trading and exchanging.

Production costs may differ depending on the type of coin or bar, the minting process, and the quality of the metal. By taking these factors into account, you can make an informed decision on which IRA approved silver products will best suit your investment goals.

How to Buy and Store IRA Approved Silver

The process of buying and storing IRA approved silver involves finding a silver IRA company you trust, cooperating with them to purchase silver products, and sending the approved silver to a storage facility.

By selecting a reliable silver IRA company and following their guidance, you can ensure the silver products you purchase are eligible for inclusion in your IRA and secure in storage.

Find a Silver IRA Company You Trust

Selecting a reliable silver IRA company is essential for a smooth and secure investment process. Consider factors such as fees, storage options, customer service, and reputation. Research online reviews, request referrals from acquaintances and relatives, and verify the dealer's credentials to ensure you choose a trustworthy precious metals IRA company.

A reputable company will provide guidance throughout the process and ensure compliance with IRS regulations.

Cooperate With a Silver IRA Company to Purchase Silver Products

Collaborating with a silver IRA company to purchase eligible silver products is a crucial step in the investment process. Contact the silver IRA company to discuss your investment goals and the most suitable options for purchasing silver products.

They will guide you through the process and ensure the silver products you purchase meet the exact weight specifications required for IRA eligibility.

Send IRA Approved Silver to a Storage

Once your IRA approved silver products are purchased, it's essential to send them to a secure storage facility. Locate an IRS-approved depository that provides secure storage and complete the necessary paperwork, such as a transfer form and a storage agreement.

The silver IRA company you work with can help facilitate the transfer of your approved silver to the storage facility, ensuring your investment is safely stored.

Diversifying Your Precious Metals IRA

Diversifying your precious metals IRA is an important strategy to protect your wealth and maximize your investment returns. In addition to silver, consider investing in gold coins and bullion, platinum, and palladium.

These precious metals can provide additional diversification benefits and help safeguard your portfolio against market fluctuations and inflation.

Gold Coins and Bullion

Investing in gold coins and gold bullion is a popular choice for diversifying a self-directed IRA. Gold coins are typically minted by government mints and have a face value, while gold bullion is manufactured by private mints and is appraised based on its mass and purity.

Both gold coins and foreign coins can provide a hedge against inflation and a means to diversify your portfolio, offering additional security for your retirement savings.

Platinum and Palladium

Platinum and palladium are other precious metals that can be included in your precious metals IRA. These naturally white metals possess a high resistance to corrosion and tarnishing, making them an attractive investment option. With high densities and melting points, platinum and palladium demonstrate malleability and ductility, making them suitable for various industrial and medical applications.

Including these metals in your IRA can further diversify your portfolio and protect your wealth.

Common Mistakes to Avoid in Silver IRA Investing

To ensure the success of your silver IRA investment, it's crucial to avoid common mistakes, such as buying ineligible silver products or overpaying for silver.

By understanding the requirements set by the IRS and working with a trusted silver IRA company, you can ensure your investment is both secure and profitable.

Ineligible Silver Products

Purchasing ineligible silver products for your IRA can lead to complications and potential penalties. Ensure the silver coins and bars you invest in meet the minimum fineness requirements set by the IRS, typically .999 for silver coins and bars.

Working with a reliable silver IRA company can help you navigate the eligibility criteria and ensure your investment complies with IRS regulations.

Overpaying for Silver

Overpaying for silver can significantly impact your investment returns. To avoid this mistake, research the current market value of silver and compare prices from various vendors. Additionally, purchase your silver from a reliable dealer to ensure you are not paying an excessive amount for your investment.

By taking these precautions, you can maximize your returns and protect your retirement savings.

Frequently Asked Questions

What does IRA approved silver mean?

IRA approved silver means that a certain silver product (coin or bar) is accepted and allowed to be held in an individual retirement account by the IRS. It typically must meet certain purity levels and fineness requirements, and must be produced by a reputable bullion mint.

Thinking about investing in silver for your retirement? We strongly advise downloading a free silver IRA guide. This resource is packed with crucial information, covering the advantages and potential risks associated with silver investments.

As a result, it can provide investors with a safe way to save for retirement while diversifying their investment portfolio.

What silver bars are IRA approved?

The Internal Revenue Service (IRS) approves the investment of silver bars in Individual Retirement Accounts (IRAs) as long as the silver meets the fineness standards of .999+.

Is silver allowed in IRA?

Yes, silver is permitted in IRAs. The IRS now allows for a variety of precious metals to be held within an IRA including gold, silver, palladium and platinum coins and bullion.

What are the IRA approved precious metals?

Investors are able to hold a variety of precious metals within an IRA, including gold, silver, palladium and platinum coins and bullion. These investments are all IRS approved and provide the potential for financial security in retirement.

How does an IRA in silver work?

Investing in silver through an IRA is an effective way to diversify your retirement portfolio and take advantage of the long-term stability that precious metals can provide. With a Silver IRA, you can buy physical silver coins or bars, purchase silver ETFs and mutual funds, or invest in silver mining stocks.

Overall, investing in silver through an IRA is an excellent way to ensure financial security during retirement.

Summary

In conclusion, investing in IRA approved silver coins and bars is a smart strategy to diversify your retirement portfolio and protect your wealth. By understanding eligibility criteria, selecting popular silver products, and working with a trusted silver IRA company, you can ensure your investment is both secure and profitable. Don't miss out on the opportunity to enhance your retirement savings with precious metals – start your journey towards a more prosperous and stable financial future today.