Canadians are rethinking their alcohol purchases as trade tensions with the U.S. spill onto liquor store shelves. New survey data shows that more than half of Canadians have changed how they shop for booze since tariffs took effect — with many opting to support Canadian producers or cutting back altogether.

Trade tensions prompt buy-Canadian at the liquor store

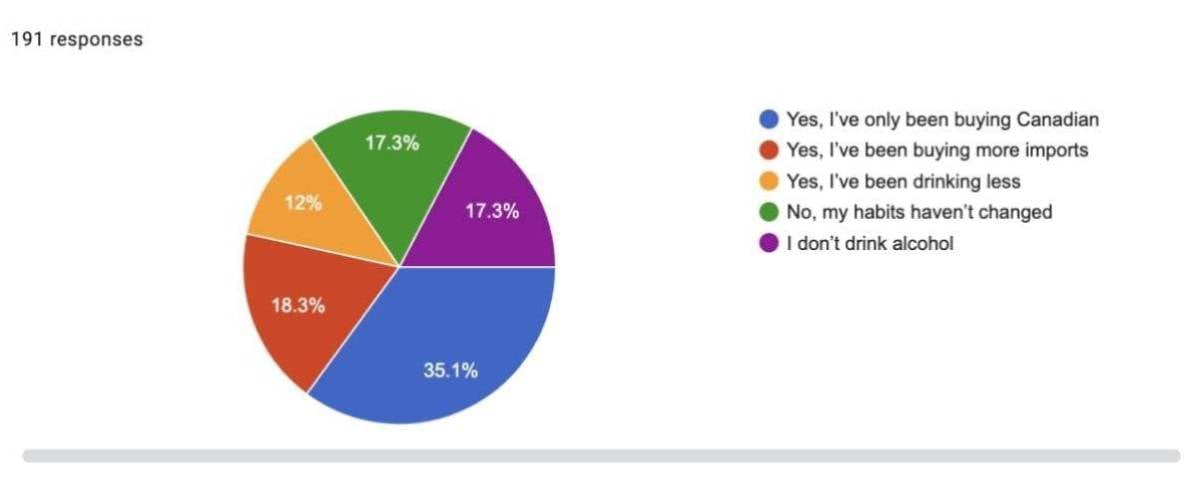

A recent survey of 191 respondents reveals that more than half (53.1%) have changed their alcohol consumption habits since the tariffs were introduced. Of those, 35.1% say they’re now only buying Canadian products, while 12% report drinking less overall. Another 18.3% have doubled down on imports, buying more international options outside the U.S.

But not everyone is convinced that buying Canadian will make a difference. Turns out just under one in five survey respondents (17.3%) admitted they haven’t changed their habits and approximately the same proportion report not drinking alcohol at all.

Change in attitude seems to have an impact

In early 2024, U.S. wines represented about a third of Canada’s wine imports and 20% of sales at the Liquor Control Board of Ontario (LCBO) — Ontario’s provincially run licensed liquor store. Early 2025 sales figures show sales have plummeted. Specifically, U.S. wine exports to Canada dropped by 92.2% in April 2025 compared to the previous year, and imports into Ontario fell to just 15% of LCBO sales.

Turns out the Canadian market is crucial for U.S. wine exports, with retail sales exceeding $1.1 billion annually. The current decline in sales in 2025 means that American vintners are facing a significant decline in sales. According to the Wine Enthusiast, U.S. wine exports to Canada dropped to $2.73 million in April 2025, a significant decrease from the $49.5 million monthly average in 2024. This situation highlights the impact of trade tensions and the growing preference for locally sourced products in the Canadian market.

Read More: Wine sales dry up at the LCBO as Ontario’s trade spat leaves California vintners reeling

Canadian brands are seizing the spotlight

Some domestic producers are seizing the moment. VQA wine sales — made from 100% Ontario-grown grapes — have spiked by 60%, and craft wineries are enjoying a rare spotlight. But the patriotic pivot hasn’t fully offset the broader decline. Many consumers are simply drinking less wine or turning to alternatives like ready-to-drink cocktails and craft beer.

As the ban stretches into mid-2025, the lasting impact may not just be economic but cultural — permanently reshaping how and what Canadians choose to drink.

Survey methodology

The Money.ca survey was conducted through email between June 25 to June 30, 2025. Approximately 5,133 email newsletter subsribers, over the age of 18, were surveyed. The estimated margin of error is +/- 6%, 18 times out of 20.

About Money.ca

Money.ca is a leading financial platform committed to providing individuals with comprehensive financial education and resources. As part of Wise Publishing, Money.ca is a trusted source of reliable financial news, expert advice, comparison tools and practical tips. Canadians get insight on a variety of personal financial topics, including investing, retirement planning, real estate, insurance, debt management and business finance.

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.