Air Canada (TOR:AC.TO) is buying back up to C$500 million worth of its own stock through a substantial issuer bid, a type of buyback that gives shareholders a chance to sell their shares directly back to the company at a premium. The deadline to participate is June 20, 2025.

If you’re a shareholder, you now face a choice: sell some (or all) of your shares back to the company, or hold on and wait to see what happens after the buyback.

Here’s what it means, in simple terms — with real investor input, and a breakdown of risks and strategies.

Air Canada’s share buyback offer

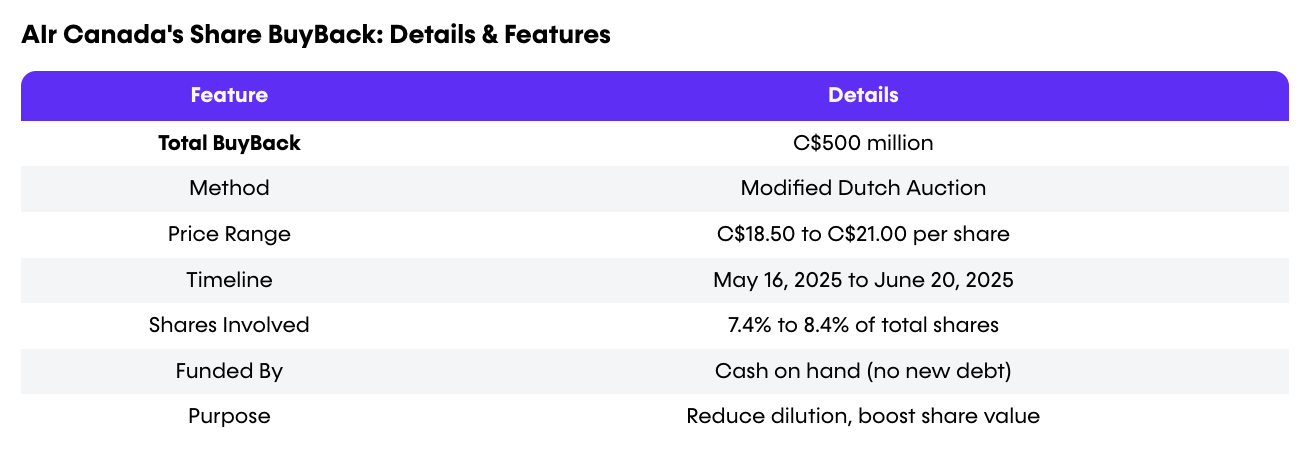

Air Canada (TOR:AC.TO) has launched a substantial issuer bid to repurchase up to C$500 million worth of its own shares, using a modified Dutch auction format. The offer opened on May 16, 2025, and will remain active until June 20, 2025, at 11:59 p.m. ET.

Under the terms of the buyback, shareholders can tender their shares for sale at any price within a specified range of C$18.50 to C$21.00 per share. The final price Air Canada (TOR:AC.TO) will pay will be determined based on the bids received, and all accepted tenders will be paid at that single final price — regardless of the individual bid amounts submitted, so long as they’re at or below the final price.

Why is Air Canada (TOR:AC.TO) doing this? The repurchase could reduce Air Canada’s total outstanding shares by approximately 7.4% to 8.4%, and potentially up to 10%, depending on how many shares are tendered and at what prices. The buyback is fully funded with cash on hand, meaning no additional debt will be used. According to the company, the primary objectives of the offer are to counteract dilution from pandemic-era financing, enhance earnings per share (EPS) by reducing the share count, and signal to the market that management views the current stock price as undervalued.

What is a modified Dutch auction?

A modified Dutch auction is a pricing mechanism where an issuer (like a company) allows investors to indicate how many shares they’re willing to sell and at what price within a specified range. The issuer then determines the lowest price that will allow it to purchase the desired amount of shares (or a smaller amount if not all are tendered). This price is the "clearing price," and all accepted shares are purchased at this price, even if tendered at a lower price within the range. A Dutch auction offers a bidding process to help determine a fair price in a share buyback.

Here’s how it works:

- Shareholders decide what price they’re willing to sell their shares for—within a stated range (here, C$18.50 to C$21.00).

- Air Canada (TOR:AC.TO) reviews all the bids and picks the lowest price that lets them buy back the full C$500 million worth of shares.

- All accepted shares are bought at that one final price—even if you bid lower.

Using this pricing strategy encourages shareholders to offer a realistic price rather than shooting for the top.

Synopsis: What’s happening with Air Canada share buyback

Pros of participating

Sell Above Market Price: Right now, AC shares are trading around C$18.50 to C$19.00. If the final buyback price is higher, you could get a premium.

No Open Market Hassle: This is a direct offer from the company, no need to time the market or use a broker to sell.

Shareholder Value Boost: Buying back shares means fewer outstanding shares. This lifts earnings per share (EPS), which can improve long-term stock performance.

Risks and drawbacks

Proration: If too many people want to sell, not all your shares may be accepted. For example, if you offer 1,000 shares, the company may only buy 400.

You Could Miss Gains: If Air Canada’s stock rises later this year, those who sold might regret selling too early.

Taxable Event: Selling your shares may trigger capital gains tax, depending on your purchase price.

What investors are saying

On Reddit’s r/CanadianInvestor forum, the response to Air Canada’s buyback offer has been mixed, with a range of perspectives from retail investors. Some users are optimistic, noting that the reduction in outstanding shares should lead to an increase in earnings per share (EPS), which could, in turn, support a higher stock price over time. They view the move as a vote of confidence from management and a positive signal that the company sees its shares as undervalued.

Others are more skeptical, questioning the structure and intent of the modified Dutch auction format. One user pointed out that this method is more complex and costly to execute compared to a standard open-market repurchase, and wondered whether it’s primarily being used to artificially create short-term demand for the stock. There’s also a practical, cautionary tone among some investors, who emphasize the importance of bidding carefully. They stress that because the final purchase price will be based on all the offers submitted, shareholders need to strike a balance—bidding too high might price them out, while bidding too low could leave money on the table.

Overall, the conversation reflects a thoughtful divide between those looking for a calculated exit and those considering the long-term benefits of holding onto their shares.

Strategy tips

A. Tender your shares (sell in the auction)

- Best for: Short-term holders or cautious investors wanting a clean exit.

- Tip: Bid closer to C$18.50 to increase chances of being accepted.

- Downside: May get partial fill due to proration.

B. Hold your shares (don’t participate)

- Best for: Long-term investors who believe in the company’s rebound.

- Benefit: Enjoy EPS growth and stock appreciation over time.

- Risk: Short-term volatility could return once the buyback ends.

Deadline: June 20, 2025

- You must decide by 11:59 p.m. ET on June 20, 2025. After that, shares go back to normal trading, and the buyback window closes.

Bottom line

This isn’t just corporate housekeeping — it’s a direct offer to investors. If you’re looking to reduce risk, lock in gains, or exit your position, this buyback provides a structured and potentially profitable way to do so. But if you believe in Air Canada’s longer-term upside, the share reduction could actually work in your favour by boosting per-share performance going forward.

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.