Despite financial giants like BlackRock wading into the space, many investors still have trouble taking cryptocurrency seriously. And it’s not just the memes and quirky fans pushing people away.

In 2022, about 8% of U.S. adults called cryptocurrency the best long-term investment around. That number has been cut in half ever since the collapse of crypto exchange FTX wiped out nearly $9 billion in customer funds.

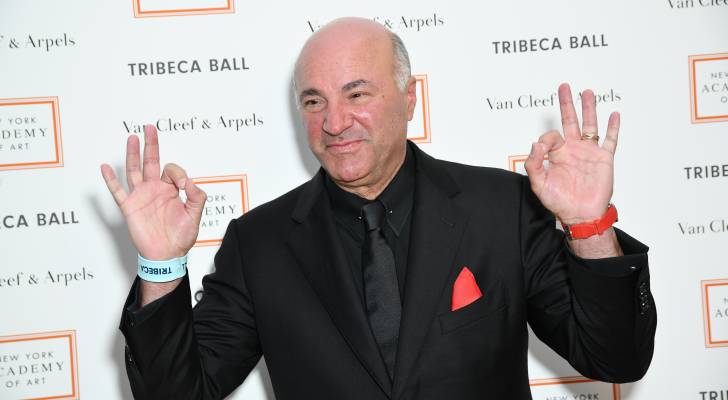

Now, just a few years later, crypto bull Kevin O’Leary says those kinds of debacles are a thing of the past.

Don’t miss

- I’m 49 years old and have nothing saved for retirement — what should I do? Don’t panic. Here are 5 of the easiest ways you can catch up (and fast)

- Robert Kiyosaki warns of a ‘Greater Depression’ coming to the US — with millions of Americans going poor. But he says these 2 ‘easy-money’ assets will bring in ‘great wealth’. How to get in now

- Gain potential quarterly income through this $1B private real estate fund — even if you’re not a millionaire. Here’s how to get started with as little as $10

“All the crypto cowboys are gone. They’re all gone. They’re all in jail, they’re felons, or whatever it is,” he told the press in mid-May at the Consensus cryptocurrency conference in Toronto.

“They were the pioneers (but) they’ve got arrows in their backs … They didn’t play by the rules. And the regulators proved who won that fight.”

Mr. Wonderful says he has reserved nearly 20% of his portfolio for crypto-related assets, including stablecoins, tokens and exchanges. His confidence is infectious, but curious investors still have to ask: Is the sun really setting on the Wild West era?

Is more regulation the answer?

O’Leary is intimately familiar with crypto fraud. He was a paid spokesman for FTX, and he claims the entire fiasco cost him millions.

“Now that that’s over, we can move ahead, and I think everyone understands the potential of this market,” he said.

While O’Leary likely didn’t mean to imply all crypto scams are finished — he seemed to be referring to embezzlement and fraud at trusted firms like FTX — he’s optimistic about the impact of two bills coming before Congress.

One is the GENIUS Act, which would require stablecoin issuers to hold a 1:1 reserve of cash or another liquid asset, amid other protections.

Stablecoins are a type of cryptocurrency that is pegged to another asset, usually the U.S. dollar. That’s why these digital currencies are considered more “stable” than other cryptocurrencies like Bitcoin. Proponents like O’Leary believe they will make global digital payments faster and cheaper.

The other piece of legislation is the market infrastructure bill that would define each individual asset as a security or commodity so that the appropriate regulator — either the Commodity Futures Trading Commission or the Securities and Exchange Commission — can oversee it.

Coinbase CEO Brian Armstrong blamed the FTX debacle on “the lack of regulatory clarity here in the U.S.” forcing American investors to use an exchange based in the Bahamas.

Ripple CEO Brad Garlinghouse agreed: “Brian is right — to protect consumers, we need regulatory guidance for companies that ensures trust and transparency. There’s a reason why most crypto trading is offshore — companies have 0 guidance on how to comply here in the U.S.”

But if Congress’s new regulations don’t end up being strong enough, they may just provide a veneer of legitimacy.

“While a strong stablecoin bill is the best possible outcome, this weak bill is worse than no bill at all,” Sen. Elizabeth Warren said of the GENIUS Act.

Safety also relies on consistent enforcement, and the Trump administration has made a number of turbulent changes as it tries to make the U.S. the “crypto capital of the planet.”

Read more: Want an extra $1,300,000 when you retire? Dave Ramsey says this 7-step plan ‘works every single time’ to kill debt, get rich in America — and that ‘anyone’ can do it

What about less regulation?

On stage at another crypto conference, Vice President JD Vance recently promised, “We fired Gary Gensler — and we’re going to fire everyone like him.”

Gensler was the last chair of the SEC, and in the absence of laws and regulations governing crypto, he strove to make the space safer for investors by suing companies for apparent wrongdoing.

Under new management, the agency reportedly moved its top crypto litigator to the IT department and has dropped cases against several major crypto firms.

The Justice Department has disbanded its National Cryptocurrency Enforcement Team and told prosecutors to only focus crypto investigations on drug cartels and terrorist groups. The Labor Department has told employers that they no longer have to exercise "extreme care” before they consider adding a cryptocurrency option to a 401(k) menu. Other regulators like the Federal Deposit Insurance Corporation and Office of the Comptroller of the Currency have also rescinded crypto guidance.

As advocates for light and heavy regulation compete to push the sector forward in their own ways, critics are pointing out the potential dangers of an unleashed crypto industry on financial stability.

“Stablecoin legislation risks sowing seeds of a financial crisis,” said Alexandra Thornton, the senior director for financial regulation policy at the Center for American Progress, in an op-ed for Fortune.

“Stablecoins were supposed to leverage dollars to stabilize the chaotic universe of crypto. Instead, they seem set to infect the dollar-dominated financial system with the unique combined chaos of crypto and Mr. Trump,” wrote former Bank of England economist Dan Davies and Johns Hopkins professor Henry J. Farrell in an op-ed for The New York Times.

“The GENIUS Act folds stablecoins directly into the traditional financial system, while applying weaker safeguards than banks or investment companies must adhere to,” said Sen. Warren in her speech on the Senate floor. “Make no mistake. We are likely to see another financial crisis in the coming years.”

What to read next

- JPMorgan sees gold soaring to $6,000/ounce — use this 1 simple IRA trick to lock in those potential shiny gains (before it’s too late)

- This is how American car dealers use the ‘4-square method’ to make big profits off you — and how you can ensure you pay a fair price for all your vehicle costs

- Here are 5 ‘must have’ items that Americans (almost) always overpay for — and very quickly regret. How many are hurting you?

- How much cash do you plan to keep on hand after you retire? Here are 3 of the biggest reasons you’ll need a substantial stash of savings in retirement

Like what you read? Join 200,000+ readers and get the best of Moneywise straight to your inbox every week. Subscribe for free.

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.