Despite stubbornly high interest rates and the rising cost of living, Canadians are still prioritizing travel. A recent Deloitte survey found that 67% of Canadians plan to take at least one leisure trip each year up from 62% from the year before.

This rebound in travel spending is not necessarily driven by renewed consumer optimism.

“The demand for sustainable and regenerative travel is gaining momentum, but not all Canadians are willing to pay the price to help leave a place better than they found it,” explained Leslie Peterson, national transportation, hospitality, and services industry leader at Deloitte Canada. “Tourism businesses that can overcome greenwashing-related skepticism and explain the lasting value of sustainable travel by backing up claims with facts will foster trust in eco-friendly tourism offerings and position themselves at the leading edge of this burgeoning trend.”

Overall, Canadians spend an average of $2,405 on transportation and lodging costs for one major annual trip. The good news is there are ways save and spend at the same time, if you can make smart use of your travel and credit card loyalty points. Here’s what you need to know about minimizing costs and maximizing travel rewards.

Know the value of your points

To maximize the value of your loyalty points, you need to figure out the cents per point (CPP) first. To do this, you would use the following formula:

(Ticket price – taxes on redemption) X 100 / points required for a redemption = Costs per point (CPP)

For example, in July 2024, a one-way Air Canada flight from Toronto to Vancouver averaged $368 in cash or 15,000 Aeroplan points plus $47 in fees. That works out to roughly 2.1 CPP — ($368 – $47) X 100 / 15,000 = 2.14 CPP

By knowing the value of one point for each redemption, you can quickly compare the different options you’re considering.

Keep in mind, you to have a base value for each reward program for comparison purposes. Most loyalty sites value Aeroplan at 2 CPP and Marriott Bonvoy at 9 CPP.

So, if you find a CPP redemption worth at least the baseline value of the program then the redemption is a good value. If the redemption falls below that threshold, you might be better off saving your points.

Impact of dynamic pricing on travel costs

This is critical for programs that use dynamic pricing, such as Aeroplan and Marriott Bonvoy.

Dynamic pricing is a system where the price of an item changes based on supply and demand. In the case of points, the number of points required is based on supply and demand. More popular routes will cost you more points, whereas ones that see less demand will cost you fewer points.

What is the best credit card in Canada? It might be the RBC® British Airways Visa Infinite, with a $1,176 first-year value. Compare more than 140 cards in just 5 seconds.

Understand your redemption options

If you collect loyalty points from a financial institution, you’ll have multiple redemption options such as travel rewards, gift cards, merchandise and more. While, travel rewards will usually give you the most value, it’s not always straightforward.

For example, it costs 1,000 Scene+ points to redeem $10 in travel. That’s a value of 1 CPP. With TD Rewards, it costs 200 TD Rewards points to redeem $1 in travel via Expedia.

There are also some programs that allow you to get even more value out of your points.

American Express gives you an option to double the value of your points if you book a flight via their Fixed Points Travel program. For example, you can book a short haul Canada/U.S. flight with a maximum base fare of $300 for 15,000 American Express Membership Rewards points. The 15,000 points are normally worth $150.

As you can see, the best value for your rewards typically lies in travel. Don’t use your points for gift cards, merchandise or a statement credit as they usually won’t be worth as much.

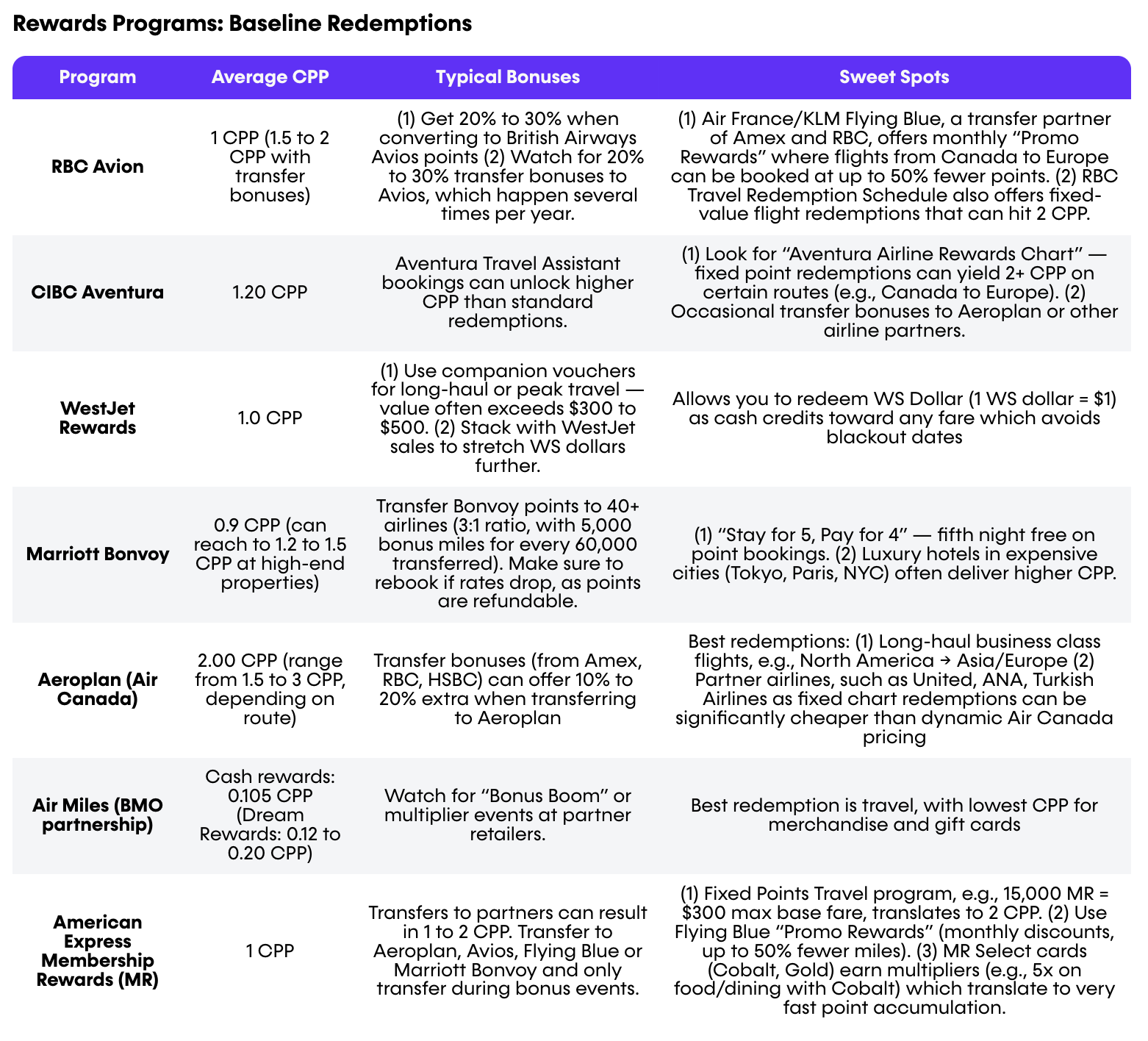

What to expect from each rewards program redemption

Look for the sweet spots

Every loyalty program has some sweet spots that can highly benefit you.

With Marriott Bonvoy, if you book four nights on points, you get the fifth night for free. In addition, Marriott Bonvoy allows you to get a full refund on your points as long as you cancel your room within 24 to 72 hours of your stay. That means you could monitor the price of your room and rebook it if the price drops to get some points back.

As for Aeroplan, the sweet spot comes with partner airlines since they use a fixed points program, as opposed to the dynamic pricing you find with Air Canada flights. If you’re able to find a reward seat on a partner airline, the points difference can be significant. Also, since Aeroplan uses a distance/zone rewards chart, there are a few natural routes that are favourable such as Toronto to New York and Vancouver to Tokyo.

Earn those points fast

Knowing how to maximize your loyalty points is only useful if you have points to burn. Fortunately, there’s an easy way to earn points fast.

Just about every credit card gives a generous welcome bonus when you sign up. This signup offer is often worth much more than the annual fee you’d pay.

For example, the American Express Gold Rewards Card has an annual fee of $250, but it currently has a welcome bonus of 50,000 points when you charge $3,000 to your card in the first three months. In addition, you get an annual $100 travel credit and four Plaza Premium airport lounge passes.

That welcome bonus has a base value of $500, but if you transferred your points to Aeroplan, you could easily get a value of $1,000. The $100 annual travel credit effectively makes your annual fee $150 a year. As for the lounge passes, they have a value of about $40 each ($160 total).

If you are able to charge $3,000 to your card in the first three months, then you can easily recoup the card’s annual fee with the benefits provided.

Burning your points is just as important

Loyalty programs can devalue your points at any time.

For example, many loyalty programs have switched to dynamic pricing instead of a fixed points chart. The more popular a route, the more points it’ll cost you. While some routes may cost you fewer points, the odds are you’ll end up with a lower CPP for many flight and hotel rewards.

Even fixed points programs aren’t safe. In 2021, BMO changed its redemption schedule to 150 BMO Rewards points for $1 travel value, instead of 140 points.

Admittedly, these changes don’t happen frequently, but it’s always in your best interest to burn your points as soon as you can. Even if you can’t find a reward that’s above the base value, getting a free flight or hotel that’s slightly less valuable can still be worth it.

Bottom line

Maximizing your travel points is less about hoarding and more about timing. By knowing the real cash value of your points, understanding transfer bonuses, and redeeming strategically before programs devalue, you can stretch your budget further and travel smarter — even in today’s high-cost environment.

—with files from Romana King

Sources

1. Deloitte: Summer travel spending is on the rise for 2024 (May 22, 2024)

2. Prince of Travel: Changes Coming to BMO Credit Cards in May 2021 (February 8, 2021)

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.