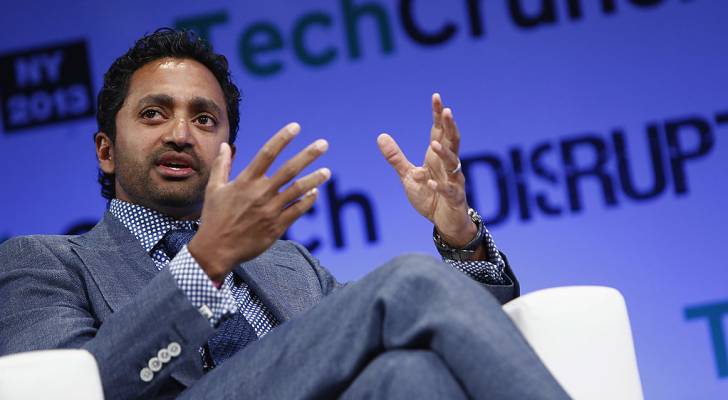

Venture capitalist Chamath Palihapitiya made waves recently when he posted on social media platform X that “tariffs don’t create inflation” in the U.S. [1]

His reasoning? Wholesale inflation prices in August rose 2.6%, which was lower than the 3.3% experts had predicted.

At first glance, this looks like a win for consumers. But dig a little deeper, and the story gets more complicated. Let’s break it down.

Must Read

- Thanks to Jeff Bezos, you can now become a landlord for as little as $100 — and no, you don’t have to deal with tenants or fix freezers. Here’s how

- Dave Ramsey warns nearly 50% of Americans are making 1 big Social Security mistake — here’s what it is and 3 simple steps to fix it ASAP

- Robert Kiyosaki says this 1 asset will surge 400% in a year — and he begs investors not to miss its ‘explosion’

Here’s the real story

It’s true that inflation came in softer than some economists expected, but prices still went up.

The Consumer Price Index shows overall inflation at about 2.9% year-over-year in August, slightly higher than July’s pace [2]. Core inflation, which strips out food and energy, stayed at 3.1%. Meanwhile, according to Reuters, the jobs market cooled noticeably, with payroll growth shrinking to just 22,000 new jobs and unemployment ticking up to 4.3% [3].

Slower job growth means tighter household budgets, which makes even small price increases sting more.

Why does Palihapitiya’s claim feel off? Because tariffs do affect prices, though it may not be immediate or obvious. When the government slaps taxes on imported goods, businesses often absorb the cost for a while, but sooner or later, most pass it on to customers. Studies from Yale’s Budget Lab estimate that tariffs enacted this year alone have already raised consumer prices by around 2.3%, hitting lower-income households hardest [4].

Researchers at the Peterson Institute for International Economics have also found that even though tariffs can generate revenue over time, they come with negative consequences on the economy, such as slower growth and lower production [5].

And tariffs aren’t the only factor at play.

Rising costs across housing, food, energy and even global shipping disruptions keep pushing prices higher. That’s why one month of tamer inflation doesn’t undo the broader trend. Analysts may guess too high or too low when it comes to inflation, but that doesn’t change the fact that real forces are still pushing prices up and that this has real-time consequences for the purchasing power of Americans.

Read more: I’m almost 50 and have nothing saved for retirement — what now? Don’t panic. These 6 easy steps can help you turn things around

A cautious approach

For everyday consumers, the takeaway is simple: be cautious. Inflation hasn’t gone away, and tariffs are likely to add more heat in the months ahead. With wages and job growth softening, families should be proactive. Here’s what you can do to make smart moves with your money:

Budget proactively: Track which categories are rising fastest (food, housing, durable goods). Be prepared to make changes to your spending or look for cheaper alternatives where you can.

Protect savings and income streams: Inflation hurts purchasing power. Investing in inflation-protected assets, such as gold or oil, can help you hedge.

Watch for policy changes: The Federal Reserve is caught between cooling the labor market and avoiding further price gains. Keep your eyes on any policy changes, since interest rate moves or more tariffs could mean rapid changes.

Don’t dismiss inflation warnings: Just because the forecast fell short this time, it doesn’t mean that inflation isn’t creeping up under the surface and waiting to pop.

Palihapitiya isn’t wrong — inflation in August was lower than many expected. But that doesn’t mean tariffs don’t sting. They’re still one of several things pushing prices up, and you can already see the impact in consumer data and how businesses are reacting. So if you’re keeping a close eye on your budget or feeling wary about what’s next, you’re right to be careful.

What to read next

- Are you richer than you think? 5 clear signs you’re punching way above the average American’s wealth

- Dave Ramsey says this 7-step plan ‘works every single time’ to kill debt, get rich — and ‘anyone’ can do it

- This tiny hot Costco item has skyrocketed 74% in price in under 2 years — but now the retail giant is restricting purchase. Here’s how to buy the coveted asset in bulk

- 22 US states are now in a recession or close to it — protect your savings with these 5 essential money moves ASAP

Join 200,000+ readers and get Moneywise’s best stories and exclusive interviews first — clear insights curated and delivered weekly. Subscribe now.

Article sources

We rely only on vetted sources and credible third-party reporting. For details, see our editorial ethics and guidelines.

[1]. X.com. “Chamath Palihapitiya”

[2]. US Bureau of Labor Statistics. “Consumer Price Index summary”

[3]. Reuters. “US unemployment rate near 4-year high as labor market hits stall speed”

[4]. The Budget Lab. “Where we stand: the fiscal, economic, and distributional effects of all U.S. tariffs enacted in 2025 through April 2”

[5]. Peterson Institute for International Economics. “The US revenue implications of President Trump’s 2025 tariffs”

This article originally appeared on Moneywise.com under the title: Chamath Palihapitiya says ‘tariffs don’t create inflation,’ as August numbers smash expectations — but does that add up?

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.