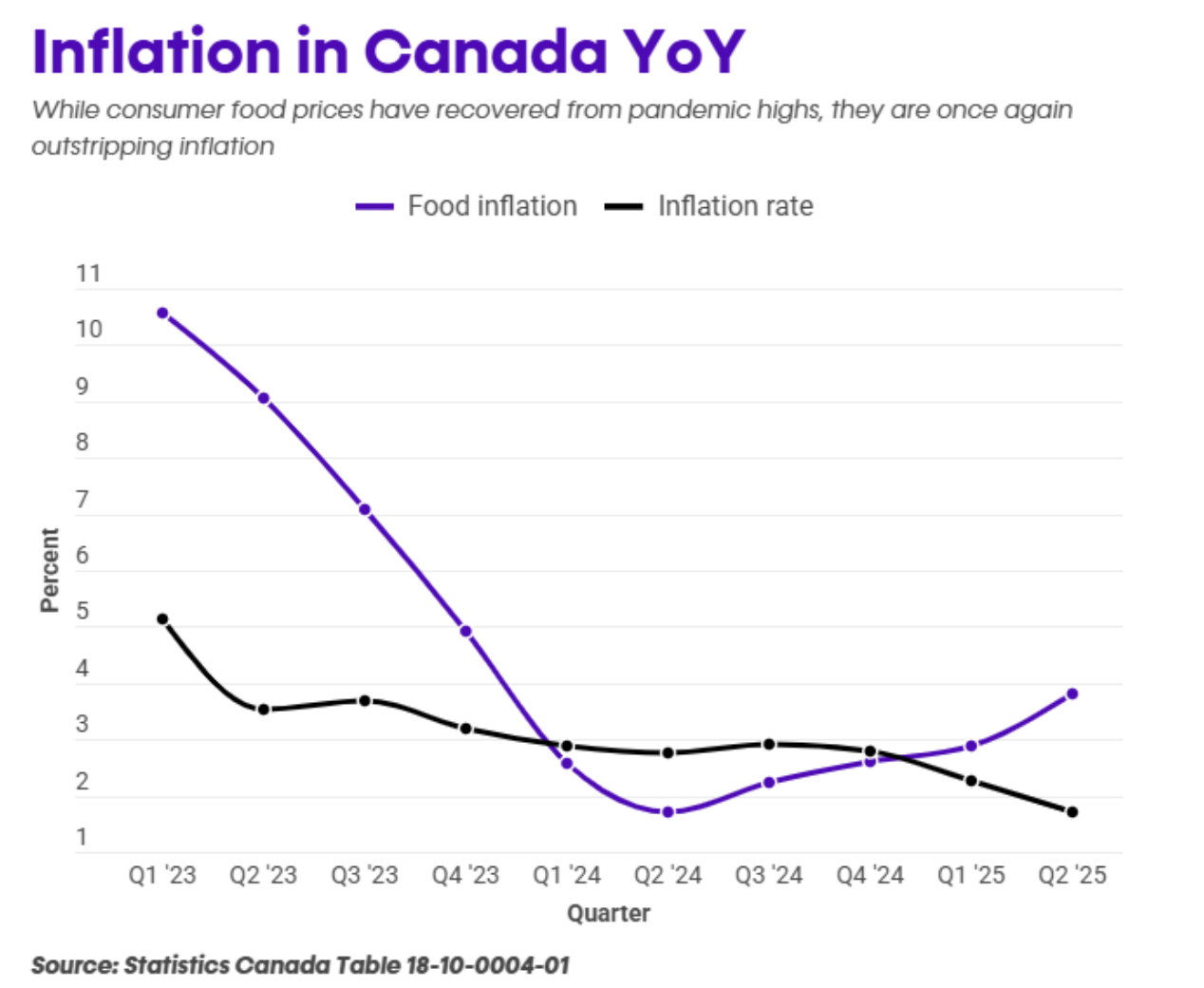

While Canada’s inflation rate has cooled to pre-pandemic levels, food prices continue to soar, and a new report suggests the real culprit might not be inflation at all, but something more opportunistic: Corporate greed and tariff-driven price hikes disguised as necessity.

Food prices keep rising even as overall inflation cools

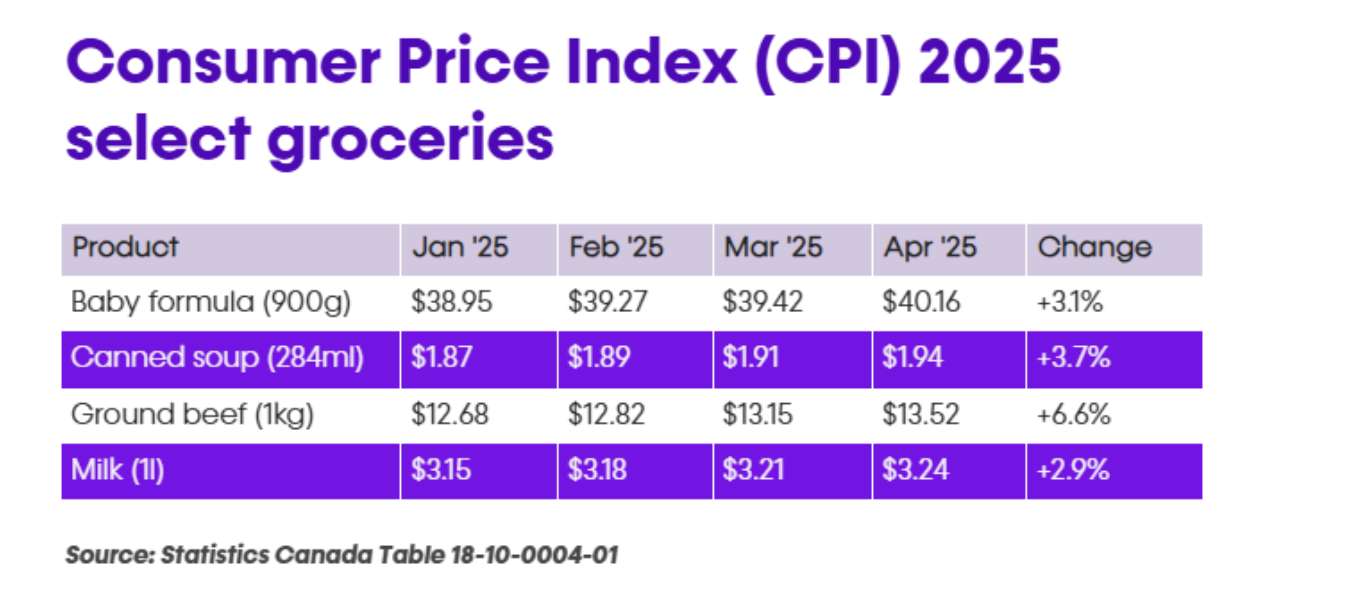

A deep dive by Money.ca uncovers a troubling disconnect: While Canada’s overall Consumer Price Index crept up just 1.7% year-over-year in April, grocery prices jumped a sharp 3.8%. Staples such as beef skyrocketed 16.5%, and bread prices have soared over 50% in just three years. Meanwhile, energy costs, including gasoline, have been falling steadily.

“This isn’t traditional inflation anymore,” said Cory Santos of Money.ca. “What we’re really seeing is corporations exploiting global events — first the pandemic, now Trump’s tariffs — as a cover to boost their profit margins while Canadians struggle to keep food on the table.”

Trump’s tariffs have shifted Canada’s trade balance and widened price pressures

The 2025 Greedflation in Canada report outlines how aggressive U.S. trade tariffs and prolonged corporate profiteering are widening the affordability gap. In January, U.S. President Donald Trump announced new tariffs on Canadian imports, including a 25% levy on most goods and 10% on energy. These policies took effect in March and have already tilted Canada’s merchandise trade balance into a $1.5 billion deficit.

Rural and urban consumers alike are bearing the burden, with more than 80% of rural businesses and 85% of larger Canadian firms planning to raise prices in 2025. “In my conversations with economists, what’s become clear is that these tariffs aren’t just going to hurt consumers directly — they’re likely providing cover for a new wave of opportunistic price hikes that far exceed the actual impact,” Santos explained.

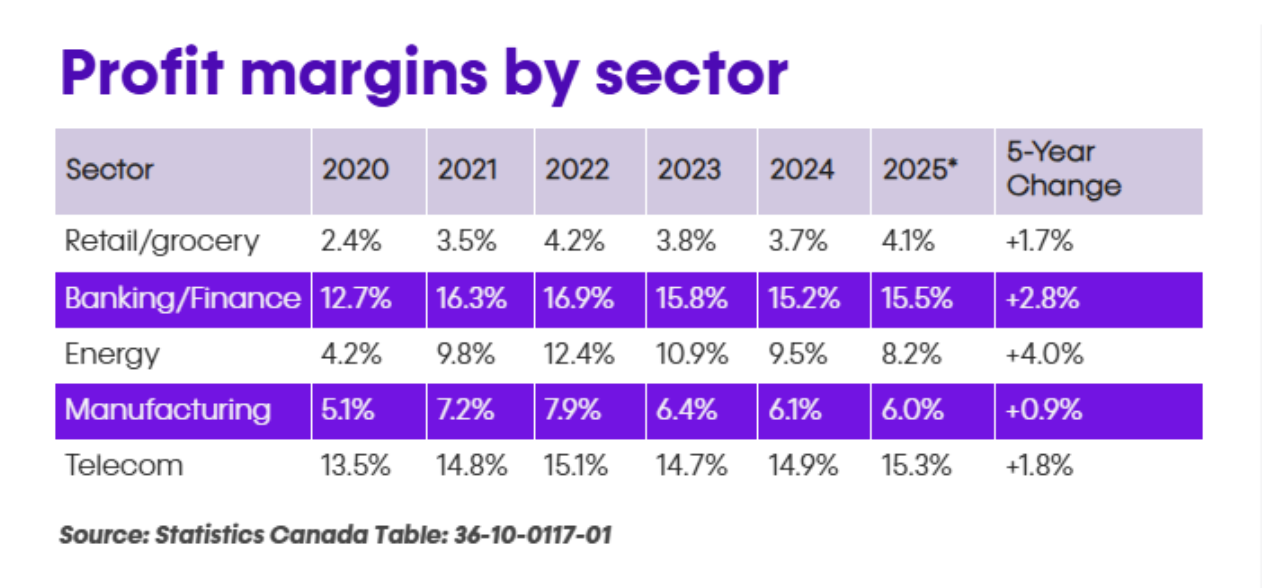

Corporate profits are driving inflation more than before

The term “greedflation” — where corporations use inflationary pressure as an excuse to raise prices beyond necessary levels — was once dismissed as political rhetoric. But evidence shows corporate profits contributed 53% of inflation during the second and third quarters of 2023, up from just 11% before the pandemic — a 381% increase.

Despite economic uncertainty, profit margins remain high across Canada. Eighteen of the 21 largest non-financial industries had margins above pre-pandemic levels in 2023. Energy companies saw margins triple from 4.2 to 12.4% between 2020 and 2022. Banks also posted strong gains, rising from 12.7 to 16.9%.

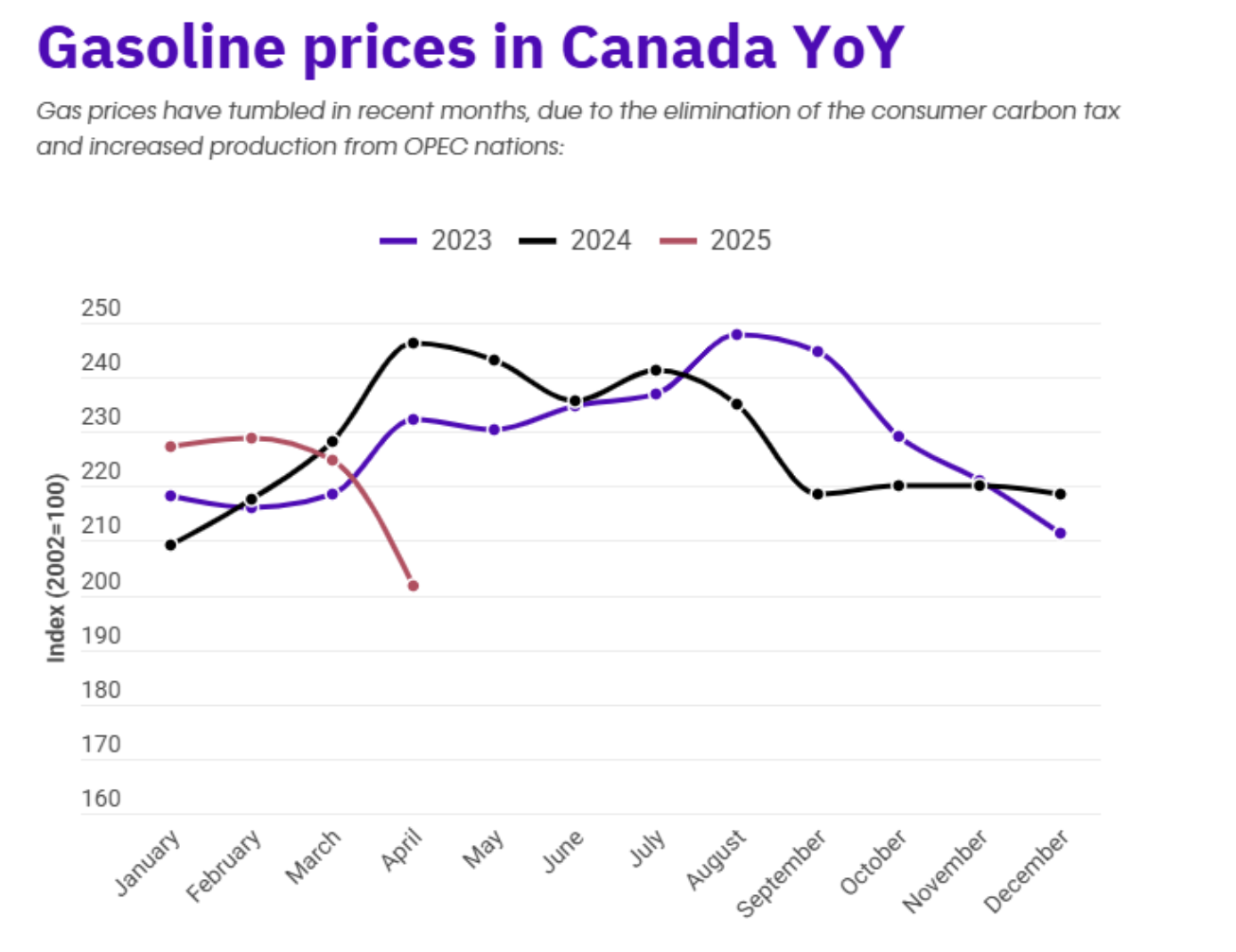

Energy prices fall sharply while food costs continue to climb

Fuel prices have taken a sharp dive thanks to the federal government’s move to scrap the consumer carbon tax on April 1. Gasoline prices have dropped about 22%, settling around $1.42 per litre. On top of that, crude oil costs have fallen to a four-year low near $60 a barrel, as OPEC+ ramps up production and floods the market.

But while fuel costs are easing, food prices keep climbing with no end in sight. According to Dalhousie University’s Canada Food Price Report, the average Canadian family of four is expected to shell out $16,833.67 on groceries in 2025 — up nearly $800 from last year. The grocery bill just keeps getting heavier.

The United States’ tariffs are driving grocery price increases

The United States supplies 55% of Canada’s agri-food imports, including 75% of baked goods, making tariffs a major factor in grocery prices. Retailers such as Loblaw have already identified 6,000 products that could see price increases of 25% or more due to U.S. tariffs.

The report warns that some retailers may be using tariffs as cover for disproportionate price hikes. Loblaw, which controls nearly 28% of the Canadian grocery market, was involved in a bread price-fixing scandal resulting in a $500 million class-action settlement.

Even on legitimately tariff-affected items, a 10% tariff on a product component that’s only 30% of the total cost should not result in a full 10% price hike, yet consumers often see this inflated pricing on shelves.

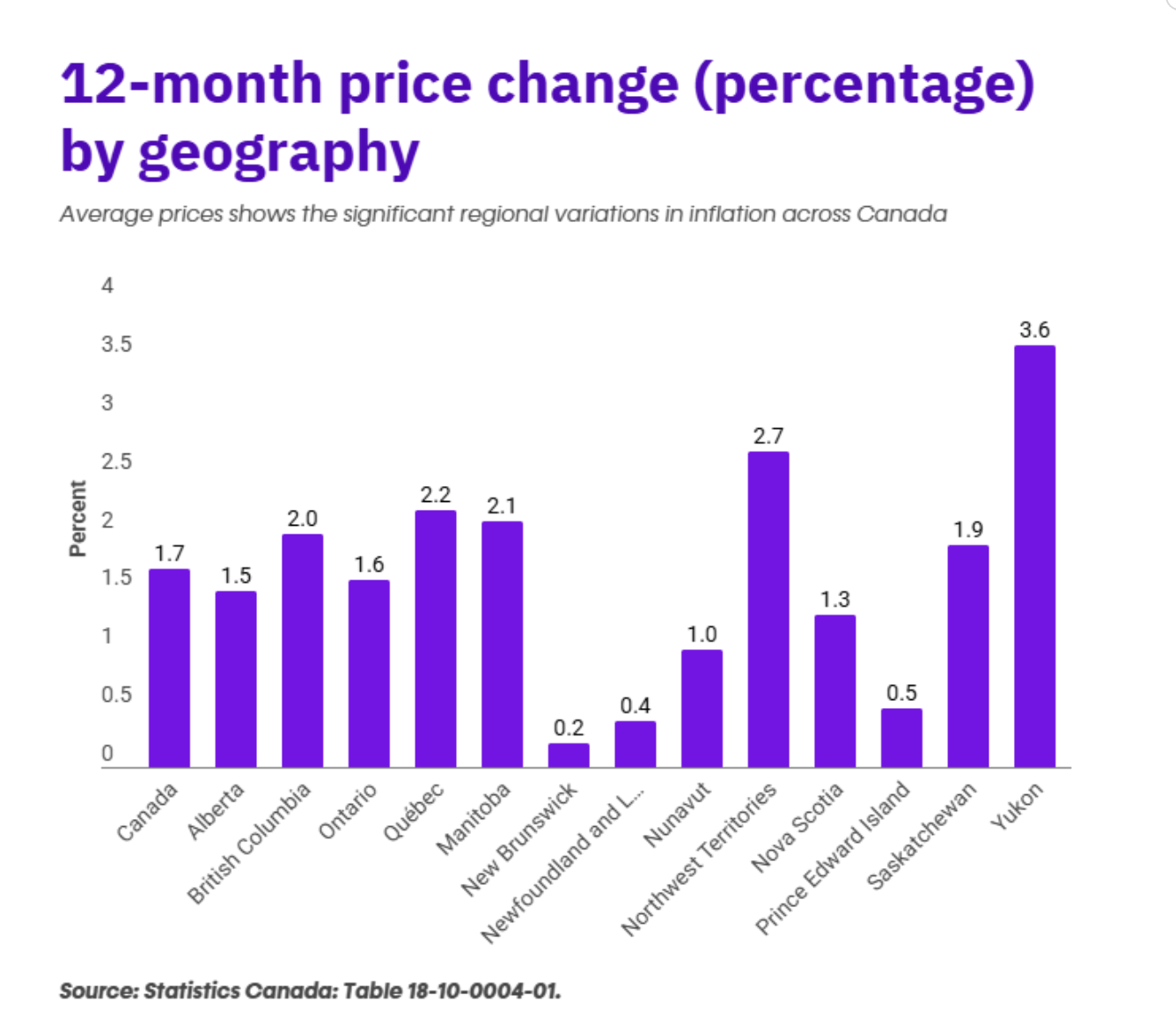

Inflation varies widely across regions and reveals a two-speed economy

Inflation across Canada is far from uniform. Quebec tops the list at 2.2%, with Manitoba close behind at 2.1%, followed by British Columbia at 2.0%, Saskatchewan at 1.9% and Ontario at 1.6%. But the story doesn’t stop there. Even within provinces, prices tell different tales. In British Columbia, for example, Vancouver faces a higher inflation rate of 2.2% compared to Victoria’s 1.9%, highlighting how local factors shape the cost of living.

This split reveals a striking reality: Canada is living with two inflations — one steadily falling, the other stubbornly climbing. As the report explains, “Corporations didn’t just match their higher input costs — they added extra percentage points to expand their profit margins while Canadian households struggled financially.”

Canadians are paying more because companies can charge more

The report makes it clear: Rising food prices aren’t just about higher costs — they’re driven by companies taking advantage of the moment to raise prices and expand profit margins. Even as overall inflation eases, food prices keep climbing, leaving many Canadians to shoulder costs that go beyond what’s justified by supply or tariffs.

With corporate profits remaining high, it’s evident that businesses are charging more simply because they can — a reality that hits household budgets hard.

For anyone looking to understand how greedflation is reshaping the Canadian economy and what it means for your wallet, read the full Greedflation in Canada report, to learn more about the forces behind rising prices and what lies ahead.

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.