In a country where grocery bills keep rising and mortgage payments eat into paycheques, Canadians are fighting back — one credit card payment at a time.

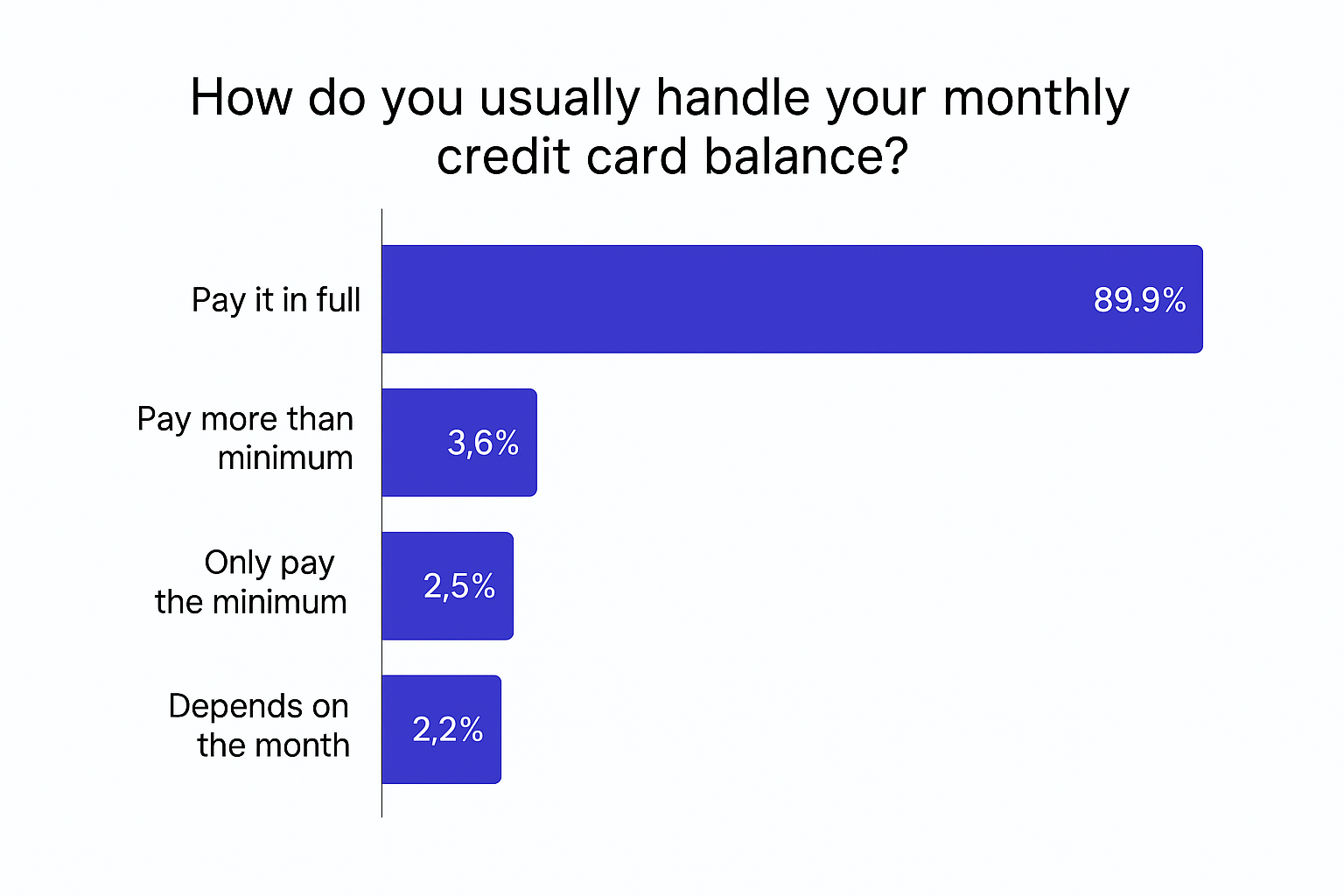

A new Money.ca reader poll shows that nearly 90% of Canadians pay their credit card balances in full every month, proving that even in an age of record debt and stubbornly high interest rates, most people are determined to stay in control of their finances.

Canadians are tightening their belts — and taking control

Even with grocery prices, rent, and gas costs straining household budgets, most Canadians aren’t letting their credit card bills spiral out of control. The survey results suggest a growing awareness of how costly it can be to carry even a small balance using high interest credit.

Financial experts say that this shift reflects more than just budgeting — it’s a mindset change.

"Disposable incomes are under pressure from a cooling labour market and still-elevated inflation. Households are expected to keep spending in check, offering only modest support to growth in the second half of 2025," writes TD Economist, Maria Solovieva, CFA (1).

It appears Canadians have learned the hard way that debt isn’t just a number — it’s a weight that grows heavier each month. After years of cheap credit, people are realizing that carrying balances at these higher interest rates is simply unsustainable.

The high cost of not paying in full

For the small percentage of respondents who only pay the minimum — or skip full payments depending on the month — the stakes are high. Interest on a $3,000 balance at 21% adds up to more than $600 a year, and it can take over a decade to pay off that balance if only minimum payments are made each month.

That kind of math is forcing many Canadians to rethink their spending habits. Some are cutting back on takeout and subscriptions, while others are turning to balance transfer cards or low-rate lines of credit to get breathing room.

A few cracks in the armour

Still, the fact that a small but significant number of Canadians can’t pay in full every month highlights the growing financial strain of the middle class. Inflation may be cooling, but household debt remains near record highs. According to Equifax Canada, consumer debt now exceeds $2.5 trillion (2), and delinquencies are slowly rising — particularly among younger borrowers and renters.

“While the overall delinquency rate appears to be leveling off, the underlying story is far more complex,” explained Vice President of Advanced Analytics at Equifax Canada, Rebecca Oakes in a recent Equifax Canada Market Pulse Quarterly Consumer Credit Trends and Insights report (3). “We continue to see a growing divide between mortgage and non-mortgage consumers — and continued financial strain among younger Canadians, who are facing a slower job market and rising costs.”

How to stay ahead of debt

There are a few practical steps Canadians can take to stay out of the red:

- Automate payments to ensure your full balance is paid on time.

- Track spending weekly using budgeting tools like Monarch Money or Mint to catch bad habits early.

- Negotiate lower interest rates or move balances to a 0% balance transfer card.

- Use cash or debit for everyday purchases to curb impulse spending.

Bottom line

Canadians may be facing high prices and tighter budgets — but they’re also showing remarkable financial grit. With nearly nine in ten paying off their credit cards in full each month, the message is clear: Canadians are determined not to let debt define them.

Staying debt-free isn’t just a financial win — it’s peace of mind in uncertain times.

Survey methodology

The Money.ca survey was conducted through email in August 2025. Approximately 6,750 email newsletter subscribers, over the age of 18, were surveyed with 270 responses. The estimated margin of error is +/- 5%, 18 times out of 20.

About Money.ca

Money.ca is a leading financial platform committed to providing individuals with comprehensive financial education and resources. As part of Wise Publishing, Money.ca is a trusted source of reliable financial news, expert advice, comparison tools and practical tips. Canadians get insight on a variety of personal financial topics, including investing, retirement planning, real estate, insurance, debt management and business finance.

Article sources

We rely only on vetted sources and credible third-party reporting. For details, see our editorial ethics and guidelines.

TD Economics: Canadian Household Balance Sheet (2025 Q2) (1); Equifax: Delinquency Levels Show Signs of Stabilizing, But The Financial Gap Continues To Widen For Some Canadians (2, 3)

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.