About a year ago, Eric from Houston was facing legal trouble and needed a lawyer. So he turned to his uncle, who works for a law firm. His uncle arranged for a lawyer at a cost of about $10,000.

What Eric didn’t know at the time was that his uncle was allegedly running a fraudulent green card scheme that defrauded families out of $1.4 million — a scheme that has since been shut down by the FBI.

Must Read

- Thanks to Jeff Bezos, you can now become a landlord for as little as $100 — and no, you don’t have to deal with tenants or fix freezers. Here’s how

- Dave Ramsey warns nearly 50% of Americans are making 1 big Social Security mistake — here’s what it is and 3 simple steps to fix it ASAP

- Robert Kiyosaki says this 1 asset will surge 400% in a year — and he begs investors not to miss its ‘explosion’

Now his uncle is “hounding” Eric for the money and “throwing my name under the rug to my whole family,” he told The Ramsey Show. “I’m trying to figure out morally, should I pay him back?” (1)

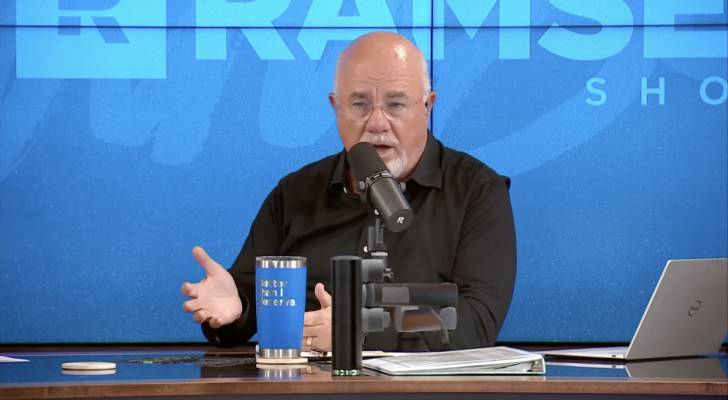

Here’s why Dave Ramsey says Eric still owes his uncle, “but not today.”

Do you still owe money borrowed from someone accused of fraud?

It’s unclear whether Eric’s uncle personally provided him with cash or simply used his position at the law firm to secure the lawyer on Eric’s behalf. Either way, the $10,000 benefited Eric, and that creates a debt — even if it was facilitated through someone now accused of a crime.

However, Ramsey stressed that paying back money is a question of personal integrity — not a judgment on the uncle’s character.

“Regardless of how horrible a person he is or what he said or did, he loans you $10,000 and you owe him $10,000,” said Ramsey. “You paying him back is not about his character. It’s about yours.”

Read more: I’m almost 50 and have nothing saved for retirement — what now? Don’t panic. These 6 easy steps can help you turn things around

Why family loans can get complicated fast

When you need cash fast, borrowing money from a friend or family member can seem easier than applying for credit through a bank — especially if you’re facing legal or emergency expenses. About one in five U.S. adults has received financial help from friends or family, according to the Consumer Financial Protection Bureau (CFPB). (2)

But as Eric’s story shows, informal borrowing can get messy — even without criminal allegations involved. When there’s no written agreement or repayment timeline in place, expectations can quickly diverge, and relationships can be damaged.

That lack of clarity appears to be what happened here. It’s unknown whether Eric had a formal repayment agreement with his uncle; it seems likely he did not. Now that his uncle is facing federal charges, the situation has become even more complicated — not just financially, but legally.

To avoid this kind of fallout, financial experts recommend:

- Putting the terms of any loan in writing, including repayment schedule and interest (if applicable) (3)

- Keeping records of all payments

- Seeking legal advice before accepting money you suspect may have come from questionable or illegal sources

If you’re considering borrowing from someone you know, first ask yourself whether the arrangement will create long-term tension — and whether a personal loan from a bank, credit union or nonprofit lender might provide a safer path.

Because while you may not have an uncle facing federal charges, a lack of structure and transparency in a family loan can turn a financial favor into a lasting financial and emotional burden.

What to read next

- Are you richer than you think? 5 clear signs you’re punching way above the average American’s wealth

- Dave Ramsey says this 7-step plan ‘works every single time’ to kill debt, get rich — and ‘anyone’ can do it

- This tiny hot Costco item has skyrocketed 74% in price in under 2 years — but now the retail giant is restricting purchase. Here’s how to buy the coveted asset in bulk

- 22 US states are now in a recession or close to it — protect your savings with these 5 essential money moves ASAP

Join 200,000+ readers and get Moneywise’s best stories and exclusive interviews first — clear insights curated and delivered weekly. Subscribe now.

Article sources

We rely only on vetted sources and credible third-party reporting. For details, see our editorial ethics and guidelines.

The Ramsey Show Highlights (1); CFPB (2), (3)

This article originally appeared on Moneywise.com under the title: Houston man’s uncle loaned him $10K — but the funds came from fraud. Dave Ramsey says he still owes the money back

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.